Author: Michelin

The fresh sales figures for new energy vehicles in September are as pleasing as the seasonal harvest – on the rise.

In the wave of new forces breaking the 10,000 units sold barrier, the traditional joint venture brands have finally emerged on the new energy vehicle rankings with the familiar and unfamiliar Volkswagen ID. family, which has sold more than 10,000 units and entered the besieged circle of new forces and independent brands.

Over a month ago, GeekCar’s friends wrote an article called “Volkswagen ID. still has a chance”. At that time, the Volkswagen ID. series, which had gained a strong foothold in the European market, suffered a setback in China, with monthly sales only half of what they are today. In just two months, sales of the ID. series almost doubled, recovering some of its lost dignity from the previous months. If a month ago, the GeekCar thought that the series still had a chance, then the sales in September seemed to say that the show is officially starting.

With the ID.3 officially launched this month, it can be said that the electrification counterattack from traditional car companies has officially begun.

The momentum is starting to show

Looking at the Volkswagen ID. family surpassing 10,000 units in sales, it is hard to ignore the word “family”.

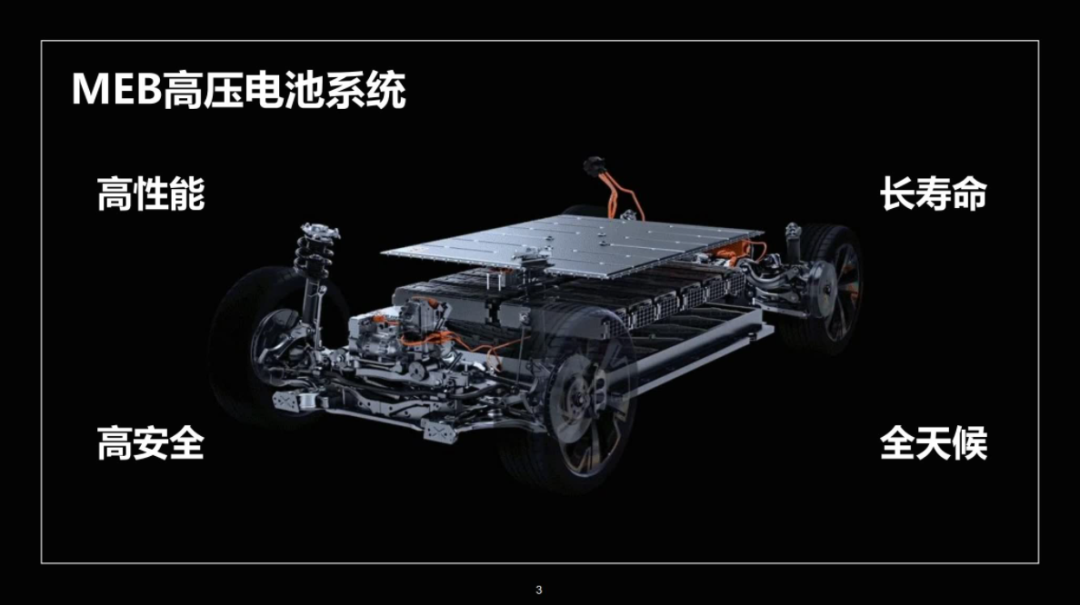

In the eyes of many people, the 10,000 units of sales were contributed jointly by the Northern and Southern Volkswagen in one year, which seems somewhat unsportsmanlike. However, the mass-market tactics are Volkswagen’s specialty, and the company is releasing three pure electric vehicle models within a year. It’s hard to say that this isn’t an attempt to replicate the successful pack tactics in the fuel SUV market to the electric vehicle field. This strategy owes much to the MEB electric platform.

A few years ago, when the MEB platform debuted, opinions were mixed. After all, the market outlook for pure electric vehicles was not yet clear, and the huge investment in developing the electric platform was described as “a huge gamble”. Today, it seems that this “gamble” is finally paying off.

Thanks to the modular nature of the MEB electric platform, Volkswagen can quickly create three different SUV pure electric models, sharing parts, suppliers and some production lines to introduce them to the domestic market within a year and use economies of scale to keep vehicle costs to a minimum. Under the influence of new carmakers, we seem to have become accustomed to the new cycle of pure electric vehicles being introduced on an annual basis. However, who wouldn’t want to introduce their own product matrix soon, unconstrained by platform, new model development costs, and production capacity?

Moreover, the MEB platform not only brings economies of scale, but also enables exclusive designs that maximize the advantages of electric vehicles: the design centers on the space planning of the three electric systems, battery, motor, and electronic control unit (ECU), achieving almost 50:50 weight distribution between the front and rear, and shorter front and rear suspensions. Skipping the traditional powertrain centered around the engine, a compact SUV like the ID.4 can offer larger rear and passenger space.

When traditional automakers bid farewell to the “gas-to-electric” switch and transplant their accumulated experience of scale to pure electric vehicles, it is difficult for new car brands to resist the challenge.

How to Maximize the Value of Traditional Brands?

We often use the term “overtake in bends” to describe pure electric vehicles, and new car brands build their brand appeal with a series of labels such as “technology,” “intelligence,” “youthfulness,” and “user experience,” bringing traditional automakers onto the playing field of their own rules. On this playing field, the ID. Family clearly does not intend to compromise entirely, but rather maximize their traditional values while adapting to the new rules.

Volkswagen’s position for the ID. Family in exploiting traditional brand values is clear and does not want to confront the new forces directly. In my opinion, this strategy is to let God be God and let the devil be the devil.

Whether it’s the ID.4, ID.6, or the upcoming ID.3, although they have different positioning, they all have two common themes: family and crossover, crossing from gasoline cars to purely electric vehicles.

The ID. Series targets families with driving experience in gasoline cars, in need of a replacement or a second car. This group has relatively practical needs as a family, habits of using gasoline cars, and is able to accept electric cars, but not so radical in their attitudes toward intelligent cars; we can call them “moderately radical” users.

Therefore, in terms of driving experience, the ID. Series tunes the chassis to have similar driving sensations as gasoline cars, without the dragging and sudden acceleration sensations commonly found in electric vehicles. The aim is to reduce the threshold for accepting electric vehicles through a familiar “old friend” sensation appealing to the target users.

In terms of intelligence, we can already see Volkswagen catching up: MOS system, AR-HUD, upgraded driver assistance functions… are all making ID. look as intelligent as possible. Of course, for users who are used to the new forces, a 12-inch central control screen is not “intelligent” enough, L2 level driver assistance and middle-of-the-road cockpit functions and voice interaction experience still leave room for improvement in the intelligence level of the ID. family.

In terms of intelligence, we can already see Volkswagen catching up: MOS system, AR-HUD, upgraded driver assistance functions… are all making ID. look as intelligent as possible. Of course, for users who are used to the new forces, a 12-inch central control screen is not “intelligent” enough, L2 level driver assistance and middle-of-the-road cockpit functions and voice interaction experience still leave room for improvement in the intelligence level of the ID. family.

However, for the “moderately radical” users that the ID. series targets, is the sense of technology the most important label? Are all users willing to pay for intelligence, as the new forces proclaim? The answer is obviously: no.

This is even more evident in the upcoming ID.3. As the “ace card” that the ID family will finally unveil, the price of the ID.3 has fallen below RMB 200,000. In the traditional fuel vehicle market, 150,000-200,000 RMB can be said to be a large sales base, but the market for electric vehicles in this price range is obviously not as competitive as that for vehicles costing more than RMB 200,000, and is even a bit cold. This is related to the high cost of electric vehicles themselves and the potential cost of intelligent experience. For the range of 150,000-200,000 RMB, apart from the high cost of batteries and other components, the cost of intelligent hardware such as LiDAR and high-performance chips is already limited, not to mention the polishing of user experience. Therefore, whether it’s for users or automakers, they are more willing to invest their limited budget in the “car” itself at this price point.

Of course, intelligence is an indispensable aspect of the future of automobiles. Although the demand from users in the market is not so strong, as new car manufacturers gradually improve their intelligence through iteration and establish their own defensive barriers, Volkswagen may find it difficult to rely on a stable and practical approach to lay out intelligence.

Finally,

In the current automotive industry, we often hear two different voices: when new players continuously introduce new technologies and gameplay, some people praise them for leading the revolution of intelligent cars, while others criticize them for losing the principles of automotive safety and stability; when old players steadily transform, some people question their slow progress and fear that they will be eliminated by the times, while others support them, saying that such cars make people feel at ease. This is because we are in an era of changing technology, market, and even demand.

In this era of change, when we see traditional car companies like Volkswagen establishing an electrification system based on deep technological reserves, changing their positioning based on rich market experience, and gradually getting rid of the “elephant is hard to turn” image, perhaps the counterattack of electrification by traditional car companies has already begun.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.