Smart Connected Cars Report in September!

Smart connected cars have been experiencing rapid development with increasing sales and market share, especially in the New Energy Vehicle (NEV) sector this year.

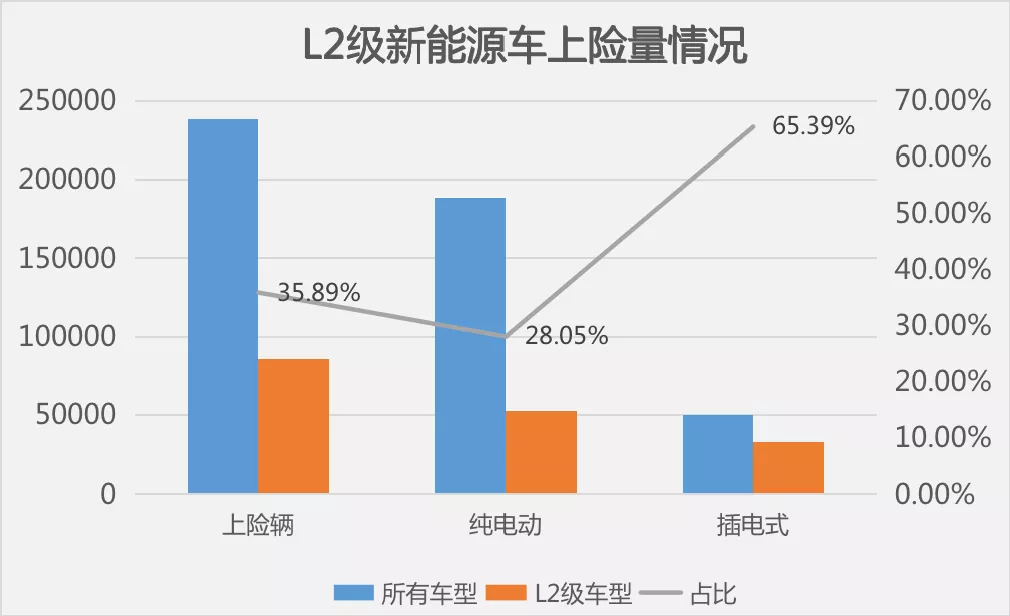

Based on a volume of data, Cyber Motors found that in August 2021, the number of L2 smart connected cars (i.e., equipped with adaptive cruise control or full-speed adaptive cruise control, and lane-keeping assistant systems) sold has increased to 85,616 vehicle collisions compared to July’s 76,200. This includes 52,861 pure electric vehicles and 32,754 plug-in hybrid vehicles.

In terms of market share, the L2 smart connected cars accounted for 35.89% of the new energy passenger vehicle market in August, slightly higher than July’s 35.68%, showing a continuous upward trend. Among them, pure electric vehicles rose from 27.54% to 28.05%, while plug-in hybrids plunged from 67.25% in July.

Battle Among the Three Musketeers: BYD, Tesla, and Ideal

Generally, smart car technologies in various segments are progressing steadily in line with the overall trend.

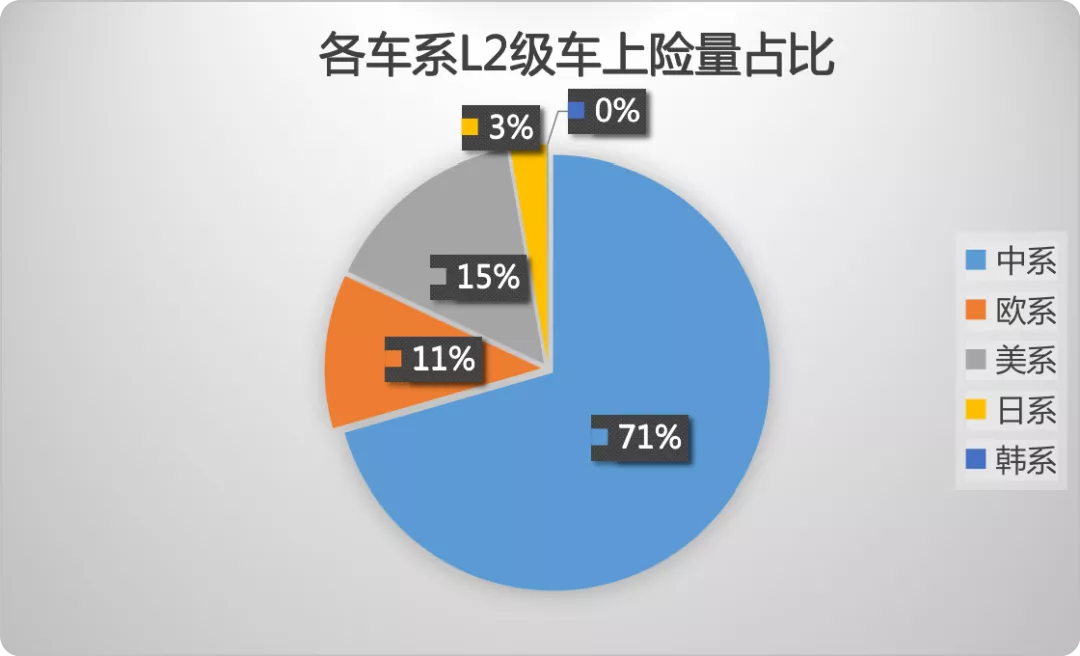

In terms of car models, domestic-made cars have the largest market share, accounting for 71%, which is lower than the overall 85% proportion of new energy vehicles, while American and European cars show an increasing trend in the field of intelligent technology, both higher than new energy vehicles with 7% and 7% respectively. Japanese cars are slightly higher than new energy, with a proportion of 1%, while Korean cars are lagging behind.

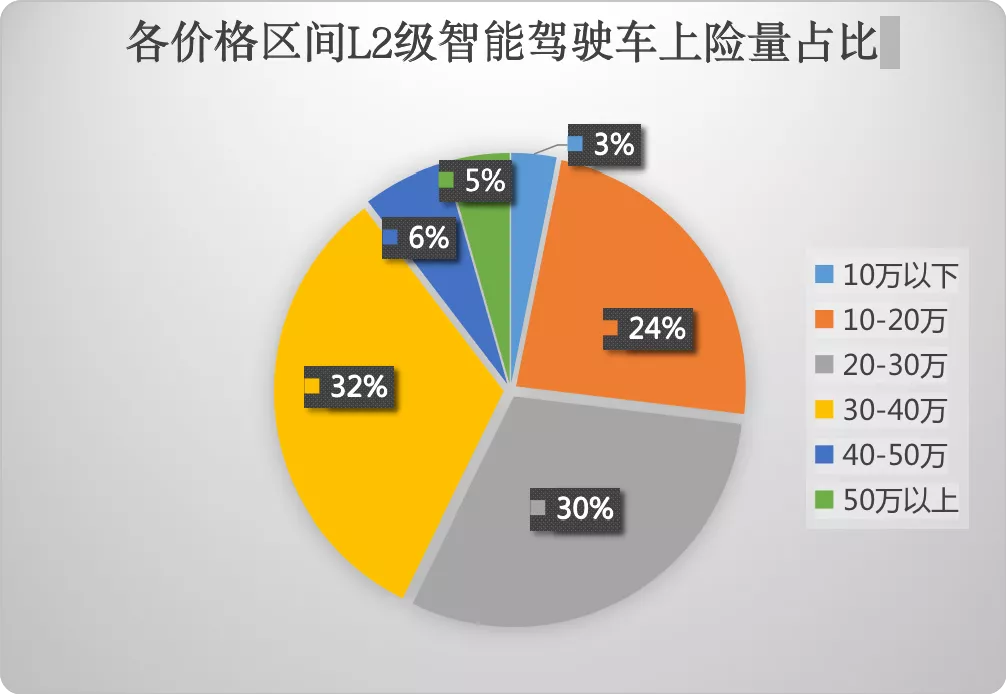

In terms of price, generally, the higher the price, the higher the proportion of L2 smart driving cars in car insurance. In August, 30-40 thousand yuan price zone had the most insured L2 driving cars than the 20-30 thousand yuan bracket, accounting for 32%, topping the list for the first time, which differs from July. It can be seen that users who buy cars worth 300,000 to 400,000 yuan have stronger demand for L2-level autonomous driving.

From a provincial perspective, except for Hong Kong, Macau, and Taiwan which are not included, all 31 provincial and municipal administrative zones in China had L2 new energy vehicle sales. Regardless of whether it is the overall insured NEV, or just L2 level insured cars, Guangdong is still far ahead, followed by Shanghai and Zhejiang, with all three accounting for no less than 10%. Compared with the previous month, Guangzhou has increased by one percentage point, Shanghai has decreased by one percentage point, and Zhejiang remains the same.

From the perspective of the automotive industry, 43 brands have sold L2 level new energy vehicles, with BYD, Tesla, and Ideal Auto ranking the top three in terms of the number of L2 level vehicles insured. Among the top 20 selling car manufacturers, Tesla, Ideal Auto, and Jinko New Energy all achieved 100% deployment of L2 function models. In addition, among all car makers, Changan Automobile has the lowest sales proportion of L2 level cars, at only 0.01%, and Chery Automobile, SAIC-GM-Wuling and JAC Motors are all below 1%.

From the perspective of the automotive industry, 43 brands have sold L2 level new energy vehicles, with BYD, Tesla, and Ideal Auto ranking the top three in terms of the number of L2 level vehicles insured. Among the top 20 selling car manufacturers, Tesla, Ideal Auto, and Jinko New Energy all achieved 100% deployment of L2 function models. In addition, among all car makers, Changan Automobile has the lowest sales proportion of L2 level cars, at only 0.01%, and Chery Automobile, SAIC-GM-Wuling and JAC Motors are all below 1%.

In terms of pure electric vehicles, the Tesla Model Y with 11,724 insured vehicles firmly occupies the first place, followed by the BYD Han and the XPeng P7, which had L2 level vehicles insured in August of 6,354 and 5,689 respectively. In terms of plug-in hybrids, the Ideal ONE ranks first with 9,394, followed closely by the BYD family, including the Tang, Song PLUS, Qin PLUS, and Han models.

Slowdown in OTA Upgrade Pace

In September 2021, there were still many new energy vehicle models launched/added, of which there were more than ten new energy vehicle models (including optional ones) with L2 level intelligent driving function. Except for the Mazda CX-30 EV model with a regular LCD screen, all other models are equipped with touch LCD screens, and all except for the Renault Brilliance Yi are equipped with central control displays. Most of them support V2X and OTA upgrades.

Interestingly, possibly due to factors such as chips, XPeng P7 has released two new vehicle models that do not have L2 function. Currently, among the 13 models of XPeng P7, launched in 2020 and 2021, only three do not have L2 function, including the two newly released models.

Relative to this, new energy brands made few moves in OTA upgrades in September. According to incomplete statistics, only three companies, Buick, WmAuto, and Tesla have carried out OTA upgrades for the models in their brand, mainly targeting the on-board system part.Buick has carried out a comprehensive evolution of the voice interaction, multimedia, and system functions and added one-click registration function for the 2020 Buick Velite 6 plug-in hybrid model and the 2021 Buick Velite 6 pure electric vehicle. WM Motor launched the third OTA update for W6, which includes upgrades of the autonomous parking system, voice control system, scene optimization, and the car’s UI. Tesla FSD software has been updated again, and after the OTA software updates for Tesla Model 3 and Model Y, the vehicle will automatically decelerate when an emergency vehicle is detected.

In addition, Ideal has released the OTA 2.2 version, which optimizes natural conversations and sound and adds and optimizes 69 functions in areas such as maps, radio, media control, and car control settings compared to the previous version.

With the acceleration of the intelligentization of cars, there have been continuous financing news in the field of investment and financing this year. In September 2021, China’s intelligent driving industry raised over 10 billion yuan (excluding the entire vehicle) and involved nearly 20 financing events, covering areas such as chips, lidar, and solutions for automatic driving and intelligent cabins. In addition, Xiaomi, JD.com, Tencent, LG Electronics, and Toyota have also made relevant acquisitions.

Xiaomi’s entry into the automotive industry has attracted much attention. On September 1, Xiaomi Corporation announced that Xiaomi Automobile Co., Ltd. had completed the business registration with a registered capital of 10 billion yuan, and Lei Jun became the company’s legal person responsible for leading Xiaomi’s new automotive business.

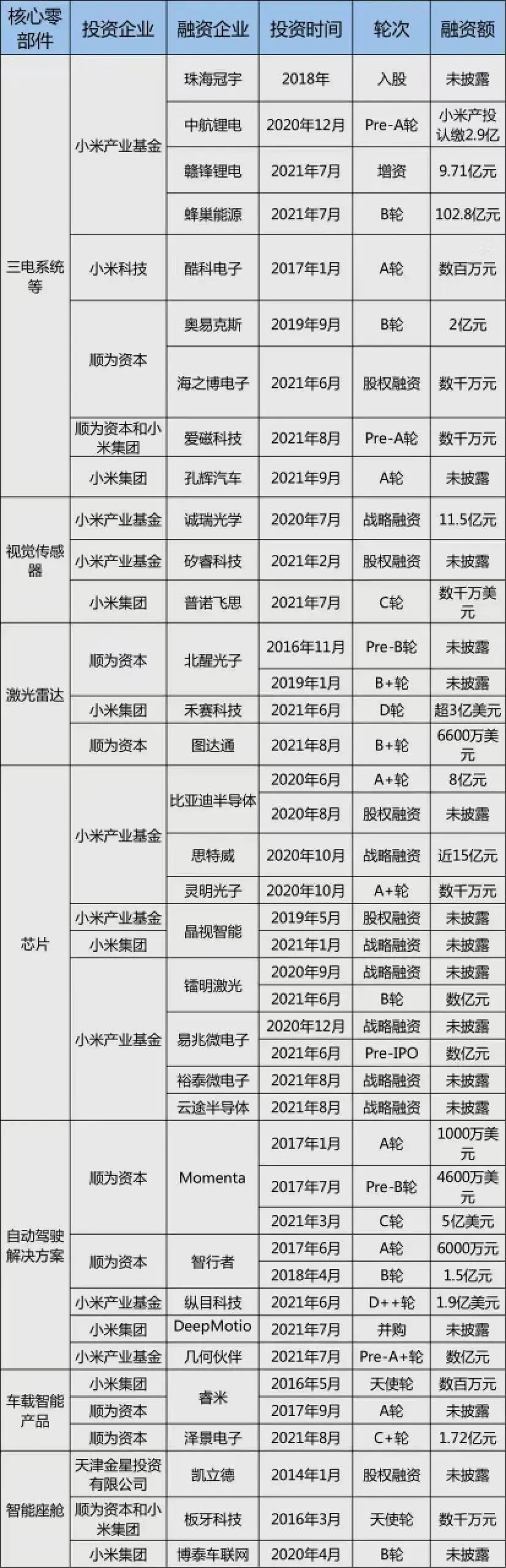

As the company completes its registration, Xiaomi’s investment in the automotive field is also accelerating. In September, Xiaomi Changjiang Industry Fund made new external investments. This time in Zhejiang Konghui Automotive Technology Co., Ltd. and Suzhou Yuntu Semiconductor Co., Ltd. The two companies operate in the fields of electronic control suspension systems and vehicle-grade chips, respectively.

As of now, Xiaomi CEO Lei Jun has begun to lay out investments in the automotive industry through multiple channels such as Shunwei Capital, Xiaomi Corporation, and Xiaomi Changjiang Industry Fund, involving multiple fields including the entire vehicle, three-electric systems, automatic driving, and vehicle networking.

According to incomplete statistics, the Xiaomi system has invested in more than 50 new energy vehicle projects in the entire industrial chain, building an enormous automotive empire that is continuously growing.

另一个不得不提的企业为

另一个不得不提的企业为 Momenta。9 月15 日,中国自动驾驶独角兽 Momenta 宣布完成新一轮融资,具体数额未知,其中 通用汽车 作为领投方投资了 4 亿美金。上汽集团 随即发布通告称,已对 Momenta 追加投资。而仅一个星期左右时间,9 月 23 日,通用汽车 又宣布将向 Momenta 投资 3 亿美元。

新一波的投资热潮正向智能汽车领域涌来。

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.