“Churideer” Media, Under Outward Bound of Xuexin Group, Pays Close Attention to the Evolution of the Automotive Transportation Industry

By Zheng Wen

In the 19th century, a man named Sam Brannan arrived in San Francisco, waving a bottle and shouting: “Gold! Gold! This is gold from the American river!”

Thus, a gold rush in the American West began to brew and ferment, and soon turned into a frenzy. People immediately packed up and left their jobs to rush to the American River to pan for gold. A few months later, the New York Herald, announced the discovery of gold, and the world was set ablaze, with countless people traveling thousands of miles to the desolate California.

Farmers left their land, workers left their factories, soldiers left their barracks, civil servants left their offices…

Later on, it’s impossible to trace what proportion of those gold miners became overnight millionaires, but it is certain that the economy of the gold rush area skyrocketed overnight, gradually prospering, and many mixed stories kept happening here.

Over a century later, another story about the “American River” was born under the rampancy of a new automobile brand called Tesla. This wealth password is more tempting and fuller than the lure of the “gold rush”.

Real estate developers, internet companies, people from the original automotive industry, as well as tech companies, packed their bags and hit the road, not knowing what would happen…

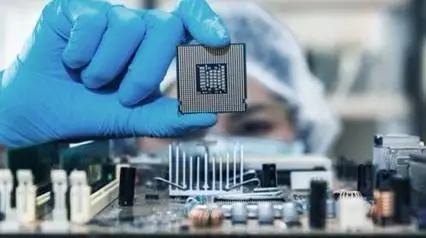

As if to add a little more depth to this “trillion-dollar market space”, problems such as the epidemic, chip shortages, insufficient battery production capacity, and talent shortages cropped up one after another, plus some “blowing” catalysts, one concrete example after another took turns to play out.

Without a doubt, the chip shortage has directly cut off the hope of automakers to “recover losses as soon as possible after the epidemic” in the post-epidemic era.

A new forecast by IHS Markit shows that chip supply will stabilize in the second half of 2022, and the automotive industry will not enter the recovery phase until the first half of 2023. This still means a possible one year of inventory shortage and high procurement costs.

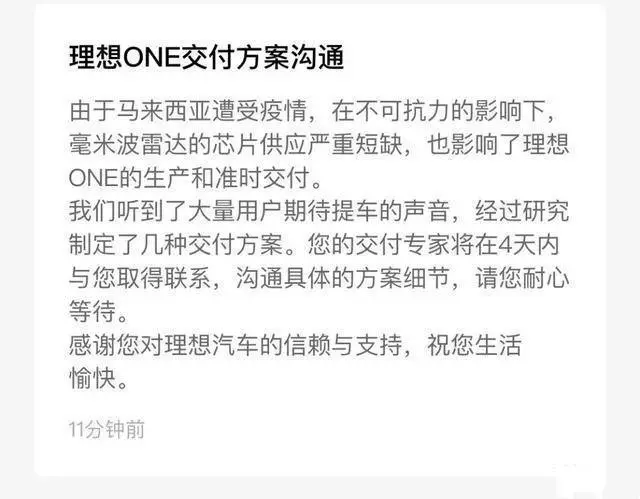

In order to cope with the impact of “chip shortage” on the delivery of new cars, Ideal released a “Plan for Ideal ONE Delivery Communication.” Due to the impact of the epidemic in Malaysia, ideal’s millimeter-wave radar chip supply is severely short, affecting the production and delivery of the Ideal ONE.

Ideal Automotive states that they have opened a special delivery program of “delivering first and installing radar later” after extensive research. They will shorten the delivery time of new cars by splitting the delivery process.According to the delivery plan, vehicles originally scheduled to be delivered in October and November this year will only be equipped with one forward-facing millimeter-wave radar and two rear-corner millimeter-wave radars. The remaining two millimeter-wave radars are planned to be installed before the Chinese New Year in December of this year. Vehicles with only 3 millimeter-wave radars installed will not have the automatic lane-changing and forward-crossing vehicle warning functions.

Car manufacturers have resorted to various strategies to ensure prompt delivery, including offering simplified configurations.

For example, Cadillac has canceled the Super Cruise function on its Escalade model, Audi can no longer provide two remote control keys, and General Motors has announced the production of a batch of 2021 light and full-size pickup trucks without fuel management modules.

The latest forecast from AlixPartners, a US consulting company, shows that the semiconductor shortage will result in a loss of USD 210 billion in revenue for the global automotive industry in 2021, and the total net production of automobiles worldwide will be reduced by 7.7 million units.

The tug-of-war between supply and demand continues, and car manufacturers have to use various tactics to cope with it.

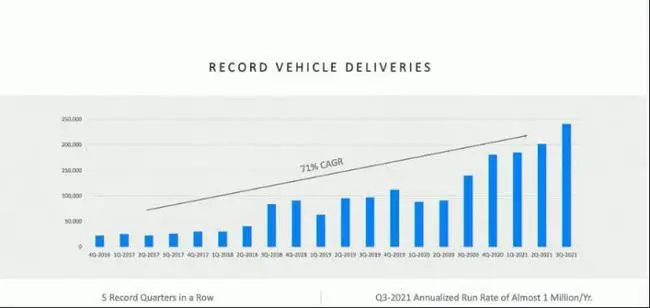

At Tesla’s 2021 Shareholders’ Meeting, Elon Musk, who is known for his tough talk, had to add a precondition to his ambitious goal: the pie is locked with a chain.

Musk said Tesla is confident in maintaining an annual growth rate of almost 50% and achieving annual sales of 20 million vehicles by 2030, but this is based on the premise that chip supply is not a problem. “The current challenge on the supply side is chips. If we have no problem with chip supply, we can achieve our growth expectations.”

Musk is apparently extremely optimistic. What does an annual sales volume of 20 million vehicles mean? It is on the same level as the annual sales of Toyota and Volkswagen combined. Looking back at Tesla’s annual delivery situation since its self-owned sales:

2013 —— 2,650 vehicles;

2014 —— 31,655 vehicles;

2015 —— 50,658 vehicles;

2016 —— 76,295 vehicles;

2017 —— 103,181 vehicles;

2018 —— 245,240 vehicles;

2019 —— 379,247 vehicles;

2020 —— 499,550 vehicles.

Due to the small initial base, the year-on-year growth is astonishingly high each year, but as the base gets larger, the growth rate has gradually slowed down. Is it easy to maintain a growth rate of 50% per year, as Musk casually stated?# Musk’s move to delay is not common in traditional car companies, but at least for now, the chip has to take the blame for Musk.

Despite all the difficulties and troubles, car companies are still actively joining this most primitive pioneering journey, fearing falling behind.

Continuously questioned by the media and already lagging behind “Weixiaoli” by a large margin, WM Motor has recently completed its counterattack against public opinion. WM Motor announced that it is expected to receive over $300 million in D1 round financing, led by PCCW and SDIC, in addition to D2 round financing agreements, with the total financing amount expected to reach approximately $500 million.

The $500 million financing amount is the largest financing amount that domestic automakers have received in nearly a year, and this round of financing may provide crucial support for WM Motor’s continuous research and development of unmanned driving technologies.

So, is this good news enough to allow “lagging behind” WM to hit the road at full speed again?

As one of the first batches of new forces to enter the car-making industry, WM, along with NIO and XPeng, were once known as the “three strong”, with Baidu, Tencent, and Alibaba backing them, but were squeezed out of the top three by the rapidly rising Ideal car in 2020, and the gap in sales between them and the top three gradually widened.

In addition to the sluggish momentum of intuitive sales data, the slow progress in the capital market is also an important dimension. NIO and XPeng have successively listed in the United States, while WM’s plans to list on the Sci-Tech Board have been repeatedly blocked. However, some signs indicate that WM may be building a new equity structure for overseas listings.

In fact, WM’s real dilemma needs to be returned to product positioning. WM advocates the brand concept of “Technology for All”, so it is different from other brands that cater to mid-to-high-end customers and has entered the more mainstream consumer market (15,000 to 250,000 yuan market), facing a huge competition in the fossil fuel car market.

Idealism is full, and reality is skinny. This segment of the market is not easy to shake. For a long period of time, the new energy vehicle market maintained a dumbbell shape, with high-end brands breaking through the high brand premium, models such as Wuling Hongguang MINI EV igniting the low-end market, even the NETA brand targeting the 70,000 to 100,000 yuan price range market has also started to show some improvement, but the mainstream market remains quiet.Although recently, Shen Hui, the founder, chairman, and CEO of WM Motor, stated in an interview that the structure of China’s new energy vehicle market will accelerate from a “dumbbell-shaped” structure to a “spindle-shaped” structure in the future. It is expected that electric vehicles priced between 150,000 yuan and 250,000 yuan will occupy 60% of the market share by 2030, and the penetration rate will increase from 3% to 40%.

However, Cui Dongshu, the secretary-general of the China Passenger Car Association, who is engaged in market research, has given another judgment, which is that the “dumbbell-shaped” structure will move toward a “pyramid-shaped” structure. Of course, the time span of structural evolution cannot be ignored in market competition.

When will it be ignited? I don’t know! This is the biggest dilemma for WM.

On the one hand, no one knows when the dawn will come, and on the other hand, second-tier brands have begun to catch up, and WM’s pressure is getting heavier every day. However, everything has not yet reached the final judgment, and WM’s story is still continuing tenaciously.

It is not only new energy vehicle companies but also traditional car companies that are struggling. Volvo Cars recently announced that the company plans to conduct an initial public offering on the Nasdaq Stockholm exchange. The new shares issued by Volvo Cars will raise approximately SEK 25 billion (approximately RMB 1.84 billion) in total.

Volvo’s IPO plan has also had twists and turns, and the key reason is that the valuation did not meet expectations. Insiders said that Geely is currently holding in-depth discussions with banks, and the target valuation is about USD 20 billion. In addition, some media believe that the valuation may be USD 25 billion.

Overall, although the valuation is expected to exceed USD 20 billion, from the perspective of the industry, this valuation is not high. In recent years, Volvo’s profitability has continued to rise, but it does not necessarily mean that it can attract capital markets. “New energy and technology attributes” as an important dimension considered by the capital market, Volvo does not seem to satisfy in this regard.

This also directly points out that Volvo’s transformation is imminent and will be launched after this IPO. Although it is one of the most active car companies in the world to transform into electrification, it is not satisfactory from the perspective of practical progress.

In 2017, Volvo announced a comprehensive electrification strategy, stating that all new models launched since 2019 will be equipped with electric motors, and promised to deliver a total of 1 million new energy vehicles by 2025. The following year, it again announced that pure electric vehicles will account for 50% of the company’s total sales by 2025. This year, it announced again to become a pure electric luxury car company by 2030.The reality is that in 2020, Volvo’s global Recharge series (including pure electric and plug-in hybrid) accounted for 17% of the total sales, and currently the only one available for sale in China is the “gas-to-electric” model, with a mediocre market response. In addition, the important field of intelligentization also needs to catch up.

In the 21st century, another “gold rush” is still ongoing, with shortages of chips, battery production capacity, financing, IPO… all of which will become interludes and stories in this “golden age”.

“I stooped down and picked up that dazzling thing, looked at it carefully, and my heart almost jumped out because I was sure it was gold, about half the size of a pea…”

With the turn of the century and the transformation of identity, the competition and cooperation between enterprises in the current automobile business landscape are no longer as clear-cut as they used to be. However, even though the entanglement is complex, they are still headed in the same direction.

The “prospectors” are rushing to a western world called “new energy vehicles”.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.