Last September, due to the pandemic, Tesla combined its annual shareholder meeting with Battery Day, during which it announced several improvements related to cost reduction, efficiency enhancement, and production increase of batteries. The 4680 battery cell, integrated casting body, and CTC battery pack were also showcased at the event.

This year, Cybertruck and Roadster 2 were delayed again, and the FSD Beta was not officially released, indicating that the status of major projects is still ongoing.

After a year, Tesla held a more traditional shareholder meeting on October 7th, where we could see the current progress of the planned projects.

Growth under the Increase

The first part of the shareholder meeting was a summary of recent developments, including delivery data, factory capacity, and planning. These data are the most direct manifestations of Tesla’s growth and a window for predicting Tesla’s future growth.

Sales Volume of Models that Break Through Descriptors

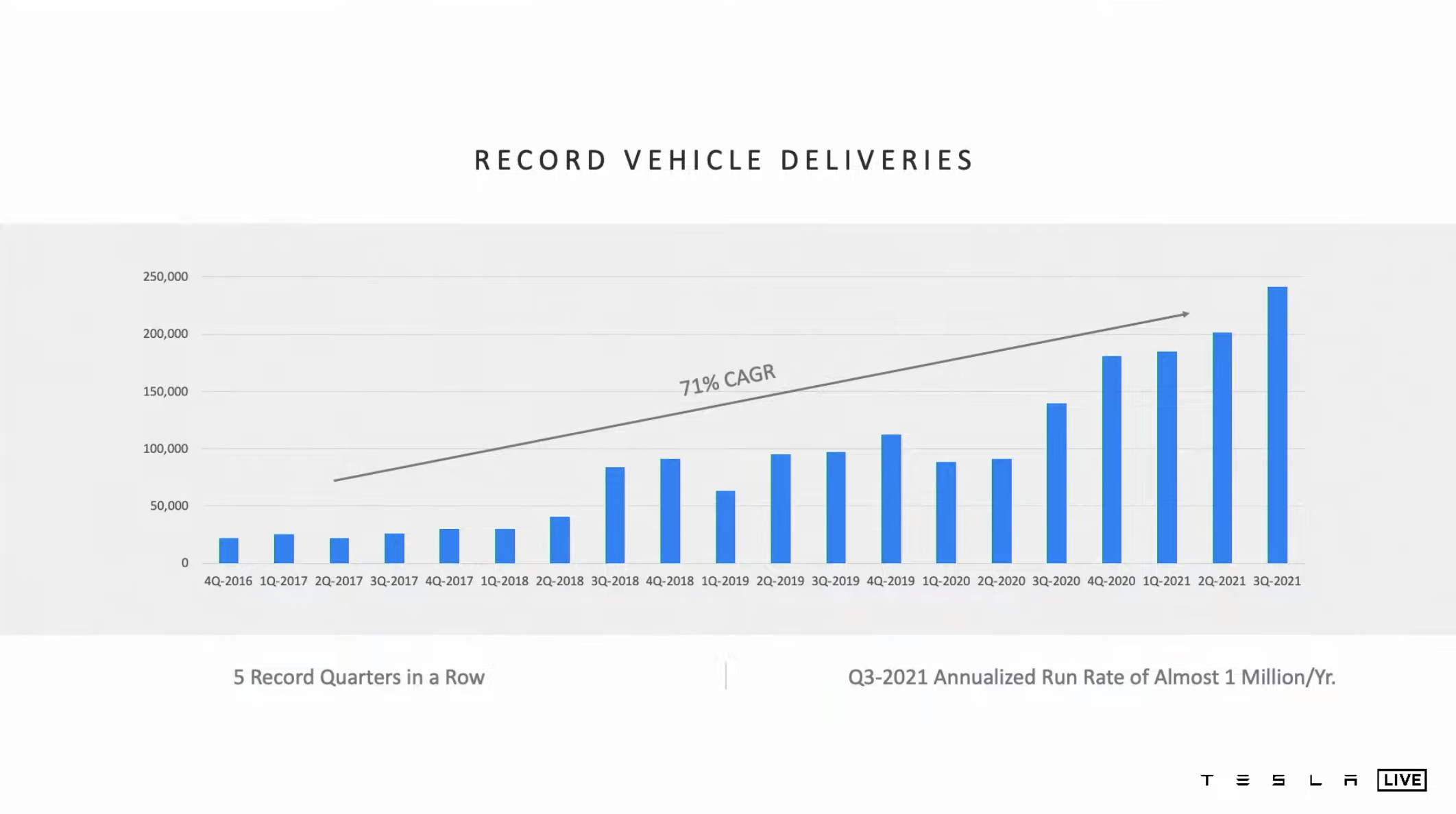

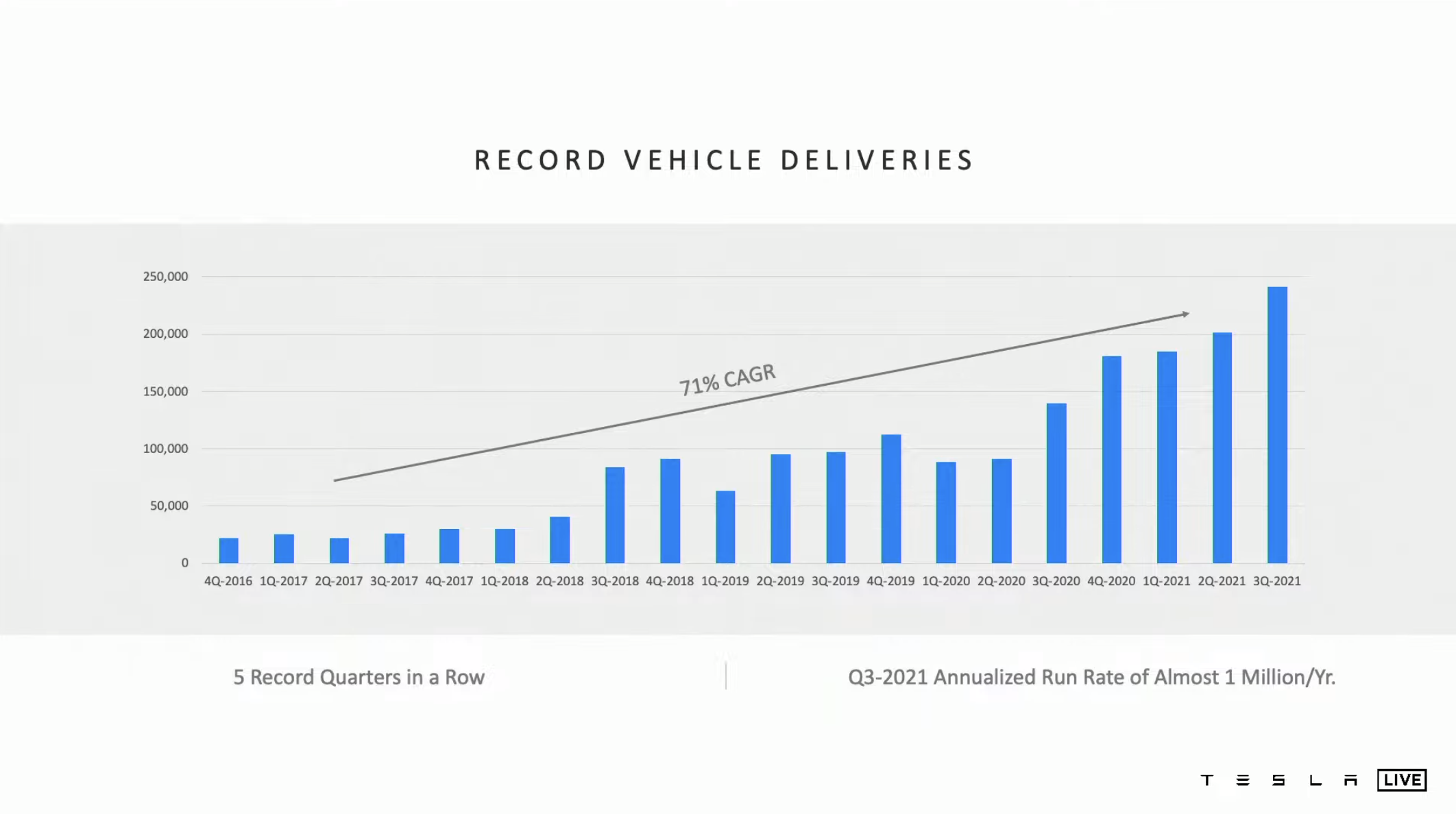

Since last September, Tesla has delivered over 800,000 vehicles in the past 12 months. In the just-ended 2021Q3, Tesla delivered over 240,000 vehicles.

If calculated on a per-five-quarter basis, Tesla’s deliveries achieved a compound annual growth rate of 71% in the period from 2016Q4 to 2021Q3.

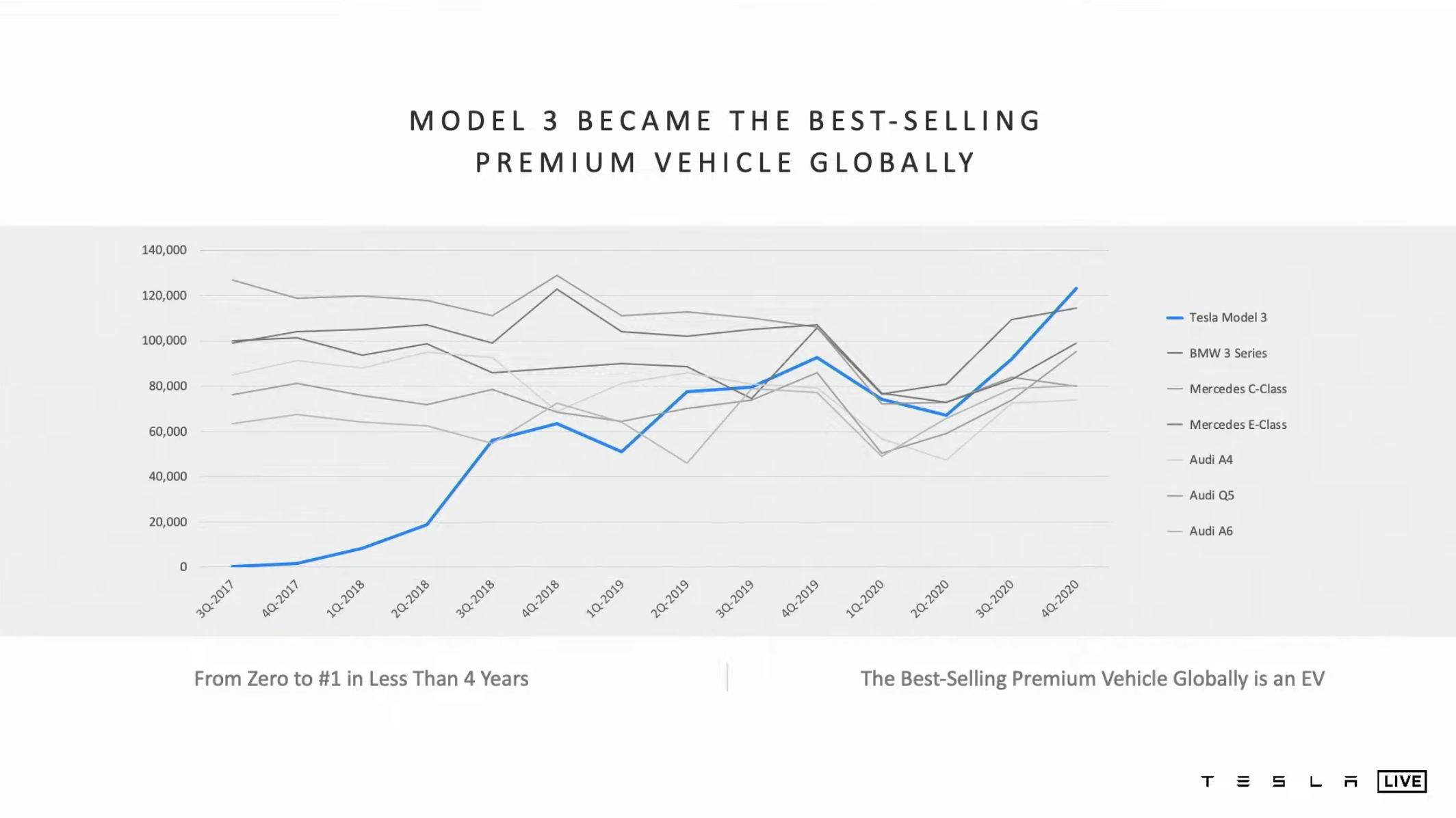

As Tesla’s first mass-produced vehicle, the Model 3 has surpassed many popular products such as the BMW 3 Series and the Mercedes-Benz C-Class to become the best-selling single luxury car model in the global market. It took less than four years for the Model 3 to achieve this goal since its launch.

In other words, the sales performance of the Model 3 in the global market proves that electric cars with strong product power can sell better than the best-performing gasoline cars in the same segment.

However, this is not the end of the story. If familiar with the Model Y, you should know that Tesla expects its sales volume to exceed the sum of the Model S, Model X, and Model 3.

Correspondingly, the goal is to eliminate all descriptors and make the Model Y the best-selling single model in all vehicle categories worldwide.

The globally highest selling single model might not be a familiar concept to everyone. Currently, the Toyota Corolla is the single model with the highest global sales, with an average annual sales volume of 1.194 million units in the past four years.

The globally highest selling single model might not be a familiar concept to everyone. Currently, the Toyota Corolla is the single model with the highest global sales, with an average annual sales volume of 1.194 million units in the past four years.

In fact, Musk talked about this in Tesla’s first quarter earnings call this year and made further predictions on Twitter, stating that Model Y may achieve this goal in 2023, and earlier in 2022, Model Y may become the single model with the highest global revenue.

The reason why this goal is set to be achieved in 2023 is related to Tesla’s current production capacity and factory planning.

Four Up-to-date Factories

Tesla currently has four factories:

- Fremont Factory in California

- Shanghai Factory in China

- Austin Factory in Texas

- Berlin Factory in Germany

Fremont Factory, as the “old factory”, has the most complete product line, and all the currently available Tesla “Sexy” models are produced there. Among the three “new factories”, Shanghai Factory produces Model 3/Y, Berlin Factory only produces Model Y, and Austin Factory produces Cybertruck and Model Y.

It can be seen that all of the above four factories will produce Model Y, but the important issue to note is that the factories currently in production are only Fremont Factory and Shanghai Factory.

Although the Austin and Berlin factories are relatively close to being put into operation, another issue that cannot be ignored is the ramping up of production capacity of the factories.

Shanghai Factory is a typical representative of “speed”, impressive in both construction speed and production capacity improvement speed. However, even Shanghai Factory took more than one year to reach the planned production capacity from production startup.

By extrapolation, the Austin and Berlin factories will also need more than a year for production capacity ramping up after production startup. Mass production will take place in 2022, and it will be in 2023 when Model Y will have sufficient production capacity to challenge Corolla’s throne.

At the shareholder’s meeting, Musk made further comments on factory localization of high-volume models, stating that he believes it is necessary to produce high-volume models locally, if feasible, to enable faster delivery and lower logistics costs.

During the third quarter when Tesla aimed to reach its delivery target, Shanghai Factory not only faced production capacity pressure due to shortage of parts supply, but also faced a shortage of ships transporting cars to Europe. Furthermore, the Panama Canal is a time-consuming option for shipping cars, which are all uncertain factors that exports will face.In the Q&A session, someone asked if Tesla has any plans for new factories, to which Musk replied that there are currently no plans for new factories outside of the four existing ones. However, the four big factories may undergo optimization and expansion, such as a 50% increase in production capacity for the Fremont factory and Nevada battery factory. A new factory may be considered in 2022, and if so, site selection should begin next year.

In fact, there is a lot of information in this answer. Combined with localized production of high-volume models and no plans for new factories, we can infer the following:

-

Tesla’s main market still revolves around China, the US, and Europe, and it may not be worth investing in local factories in other regions like India due to their smaller market size or growth rate.

-

Apart from the Model 3/Y, for other models like the Cybertruck, Tesla might establish production lines in Berlin or Shanghai factories if there are sufficient export orders.

-

Considering current delivery situations, the Fremont factory’s production expansion may involve the Model S/X.

After discussing factories, Musk talked about the production status of other vehicles.

Delays and New Cars

First up, some bad news: the production plan for the Cybertruck will be delayed, starting mass production in 2022 and delivering on a large scale in 2023. Semi and Roadster 2, with lower priority, “are expected” to begin mass production in 2023.

Musk explained in more detail the reasons behind the many delays for these models. All Tesla vehicles that have been announced will be produced, but the auto industry’s shortage of components is widespread and not limited to automotive chips.

Tesla always places orders with battery suppliers who offer reasonable prices, “matching supply with demand.” However, the demands for electricity and chips in models like the Semi are enormous, and without enough parts, production is not feasible, making vehicle production purely theoretical.

Regarding battery production capacity, Musk also discussed the progress of the 4680 cells. 4680 cells will not be mass-produced this year, and a 10 GWh 4680 cell production line has been planned next to the Fremont factory, less than a mile away. This capacity is enough before the Texas factory mass-produces the Model Y.## Tesla’s Future

The Q&A session at the shareholder meeting also brought up topics on Tesla’s future business and operational strategies, some of which may involve investors’ implicit growth expectations. Although some of the content was not very specific, it had some forward-looking significance.

Open Authorization for Autonomous Driving

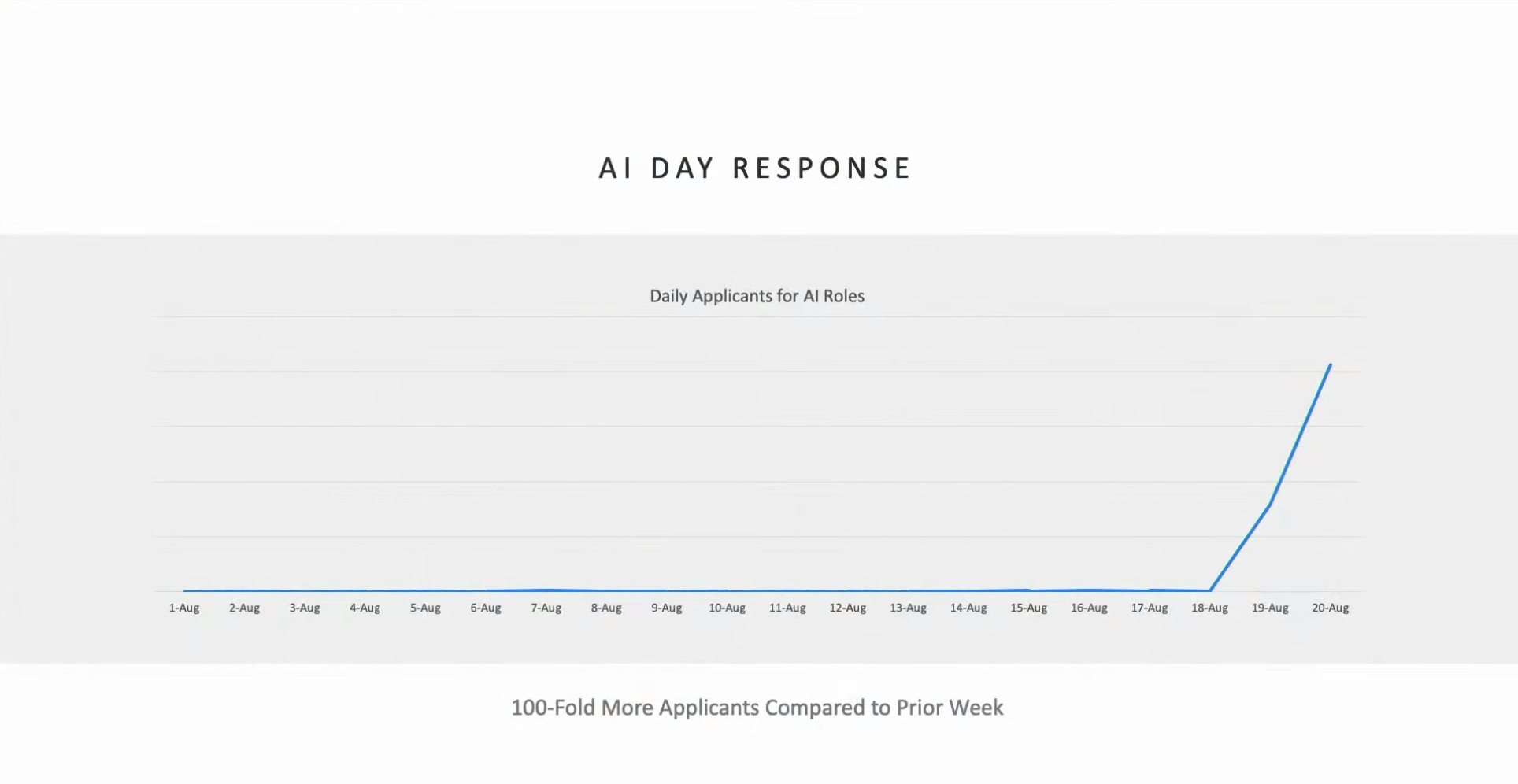

This year’s AI Day has attracted a lot of attention from the tech community due to Tesla’s expertise in developing its own chips and AI technologies, which serve the Autopilot system. At the shareholder meeting, something unexpected happened: Musk announced that Tesla will open authorization of autonomous driving technology to external companies that have a need and willingness to use it.

According to Musk, the reason behind this decision is that autonomous driving is a technology that can improve driving safety and save lives, so Tesla should not keep it to itself.

Musk’s openness and generosity are admirable, but the execution of the authorized autonomous driving business is not so easy at present. Firstly, Tesla has its own specialized perception hardware, computing chips, and software system for autonomous driving. If other companies want to use it, it is not just a matter of buying software authorization. They may also need to purchase supporting hardware and make targeted hardware design changes during vehicle pre-installation.

In addition, the improvement of software capabilities requires the collection and training of data. The ownership of this data and whether training can be achieved without using Tesla servers are also some issues to be considered.

Energy Storage Business Is Worth Paying Attention To

During the Q&A session, someone suggested that Tesla’s energy storage business be included in the quarterly financial report. Musk said Tesla will do this next year.When it comes to the topic of energy storage, Musk once again showed his optimism for photovoltaic + energy storage business. In Tesla’s sustainable energy system, solar power and energy storage are very important parts. Solar energy is an inexhaustible energy source, and battery energy storage can smooth out peak demand. Musk said that only one square mile of energy storage batteries could meet all of America’s nighttime power supply needs.

Regarding the growth of this business, Musk said that this year’s auto parts shortage actually affected the energy storage business as many of the components used in energy storage are the same as those used in cars. Therefore, Tesla has allocated limited resources to the automotive business under the premise of parts shortages. When the supply improves in the future, the energy storage business will undergo a big leap forward in growth.

Conclusion

Last year’s Battery Day had a striking data point — By 2030, Tesla’s battery production capacity demand will reach 3 TWh, nearly half of which will be used for energy storage. At the same time, Musk predicted that Tesla’s global deliveries would reach 20 million by 2030. These numbers may seem crazy, but what’s even crazier is Musk’s prediction that global electric vehicle sales will reach 30 million by 2030.

In other words, Musk believes that by 2030, Tesla can capture two-thirds of the global electric vehicle market.

After achieving many seemingly impossible goals, Tesla and Musk’s seemingly incredible goals no longer seem strange. This automaker, which has already sold nearly one million vehicles annually, still breaks many traditional rules. For example, while the sales price per vehicle is decreasing due to hot-selling models, the gross profit margin per vehicle is actually increasing.

When asked about the purpose of holding AI Day, Musk said it was to attract the world’s top AI talent. In fact, Tesla has indeed achieved its wish, receiving hundreds of times more resumes after AI Day.

When it comes to the goal of 20 million vehicles, Musk doesn’t seem too excited. He even said that if you calculate the average lifespan of a car to be 20 years, there will still be many stockpiled gasoline vehicles by 2030, and it will take more than 30 years to replace all of the world’s stockpiled vehicles with electric ones. If the batteries can be fully recycled by then, there will be no need for mining to produce batteries.

When asked about stock splits and shareholder dividends, Musk’s response was an unequivocal “NO”, because Tesla hasn’t reached its peak yet.

This kind of thinking is truly unlike that of a traditional automaker.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.