This article is reproduced from the Autocarweekly WeChat Official Account.

Author: Finance Street Lao Li

“Chip shortage” is not only an industrial problem, but also a financial problem, and is also a hot topic in the automotive sector before the holiday.

Before and after the long holiday, it is the most difficult time for practitioners in the secondary market. The left side has to face the uncertainty of the external environment, and the right side has to face the lock-in of industry information. Before the holiday, they should stabilize the morale facing the market’s rise or fall, while after the holiday, they should maintain stability facing the market’s collapse or surge. While the people across the country are celebrating the holiday, practitioners are struggling to cope with work from all sides, which is quite uncomfortable.

During the long holiday, Lao Li reorganized two emerging industry chains, smart energy and smart transportation, and will share them with everyone after the holiday. Some sellers have been promoting the car market and “chip shortage” topic before the holiday, and Lao Li and many researchers have made relevant discussions as assigned by the boss.

Today, let’s talk about the topic of “chip shortage” together. When it comes to “chip shortage”, it may feel like “reheating leftovers”, and many friends may not want to read it. Instead of starting from the industry approach, Lao Li will discuss the impact of the “chip shortage” issue on the market and its possible future trends from the perspective of the secondary market automotive sector and share with everyone.

Where are the hidden worries in the automotive sector?

In September, the automotive sector had a very bad performance. A-share’s Great Wall Motors fell by 20%, Changan Automobile fell by 19%, and BYD fell by nearly 10%; H-share situation was not optimistic either, with typical representative Geely Automobile falling by 20%, and the market was once close to the March performance.

Before the National Day holiday, some institutions were also conducting roadshows and discussing their views on the automotive sector. Lao Li also participated in some of them. Overall, investors have hidden concerns about the automotive sector, not only the traditional automotive sector, but also the new energy vehicle sector.

The hidden concern of the traditional automotive sector comes from supply and demand, and the “chip shortage” has caused doubts about the market’s expectation of supply and demand. To put it simply, what problems has the chip shortage brought to the market? From the perspective of the big market, the traditional car market in September showed a “Davis Double Kill” effect:

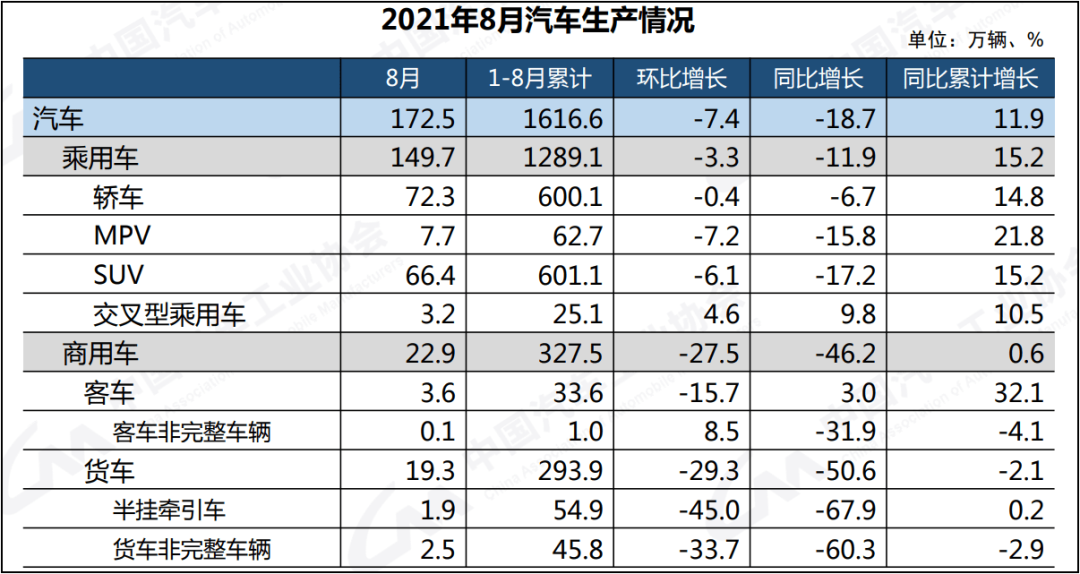

The first wave of price cuts in September was in the first ten days. The China Association of Automobile Manufacturers released the operating data for August, which was surprising. In August, China’s automobile sales were 1.799 million units, a year-on-year decrease of 17.8%, and the overall trend of automobile production and sales continued to decline, with the year-on-year decline increasing compared to the previous month.Below is the translation of the Markdown Chinese text into English Markdown text. HTML tags have been retained.

The market panic was caused by lower-than-expected data. From the demand side, people had doubts about the market’s new demand. Currently, the trend is “policy advances, economy retreats”, and no one can see the true demand of end users clearly. From the supply side, most people are uncertain about the real impact of the “chip shortage” on product delivery. Some companies are truly “chip-shortage”, while others are covering up poor sales with “chip shortage,” and even some companies are magnifying orders by claiming “chip shortage”, which has increased market confusion.

The second price reduction in September came from mid-to-late September. An institution released weekly sales data for September, and according to market rules, September should have entered the peak season. However, the traditional fuel car weekly sales fell below expectations, which had an impact on the market. In late September, due to the festive effect, many funds began to buy “safe-haven varieties”, such as medical consumption, which also caused some impact on the automobile sector. After a continuous decline for almost a month, it finally stabilized at the end of the month.

The new energy vehicle sector also has some hidden worries, which is slightly different from traditional fuel vehicles. Its market adjustment is not due to supply and demand but because it “rose too much”. New energy vehicles have risen too much from Q2 to now, and the company fundamentals have not changed, which is a typical technical correction. Every correction is an opportunity to buy in.

The new energy vehicle market has been exceeding the market’s expectations all along. In August, the penetration rate of the new energy vehicle market had increased to 17.8%, and the penetration rate of new energy passenger cars was close to 20%. Even without considering the high penetration rate under the influence of “chip shortage”, the sales data itself showed a solid upward trend: In August, the sales volume of 321,000 vehicles not only broke the production and sales record but also exceeded the monthly sales volume of 300,000 for the first time. The YoY growth rate of 180% also exceeded the market expectations.

Market worries do exist, and the buyers are concerned that “chip shortage” will lead to even more chaotic Q4 automobile market. Recently, many brands have been in high demand, and BBA is even more scarce. Taking Beijing Benz as an example, due to the shortage of chips, Mercedes-Benz’s entire model range has been discounting. There are also many adjustments among independent brands, and the differences between brands are quite significant.

In the normal discount and full-chip-supply scenario, this year’s market is highly likely to have a good “year-end market”, but the problem is that “chip shortage” has disrupted the normal market rhythm. After some brands have reduced their discounts, the Q4 sales volume is presented as a big question mark in front of car companies and analysts, whether it will increase or decrease. As the different funds speculate in different enterprises, divergent performance among the enterprises will cause large uncertainties in the sector.

In the normal discount and full-chip-supply scenario, this year’s market is highly likely to have a good “year-end market”, but the problem is that “chip shortage” has disrupted the normal market rhythm. After some brands have reduced their discounts, the Q4 sales volume is presented as a big question mark in front of car companies and analysts, whether it will increase or decrease. As the different funds speculate in different enterprises, divergent performance among the enterprises will cause large uncertainties in the sector.

When no one knows where the market will go, hedging is the best way.

How to deal with the problem of chip shortage?

The secondary market likes to thoroughly study key issues, but the problem of “chip shortage” seems to be difficult to fully understand. When the chip shortage problem burst out for the first time in the industry in Q3 last year, many experts believed that it could be resolved in Q1 of this year; after new problems emerged in Q1 this year, many experts believed that it could be resolved in Q3, but now it has not been resolved even in Q4, and some experts have suggested it could be solved in Q1 or Q2 next year…

Researchers have long lost confidence in the judgments of others, and as early as the first half of the year, Lao Li pointed out that due to the particularity of the semiconductor supply chain, which is multi-link, highly closed, and highly distributed, it’s possible for people to judge the chip supply situation of a certain company, but impossible to judge the overall situation of the industry.

Therefore, no matter whether it is industry experts or industrial media, after analyzing again and again, none of them can accurately predict the future trend, even Plan A and Plan B are difficult to provide.

There must be a solution to every problem. During the long holiday, Lao Li and many friends exchanged ideas. Everyone believed that since the analytical method of “discerning cause and effect” is not feasible, it is better to directly judge the trend based on the results. If the sales volume meets expectations, the market will naturally be aggressive. If the sales volume does not meet expectations, whether it is due to “chip shortage” or “cold demand”, the market’s aggressiveness will disappear. Therefore, in the next few months, the direct benchmark for judging the automotive industry sector should be “sales data”, not external “chip shortage panic”.

The overall impact of “chip shortage” on the market will not last too long because “chip shortage” is not the most important factor affecting the automotive sector. ACW had been tracking the shortage problem of the industry since last year. Many friends even knew about the chip shortage of Volkswagen in North and South China starting from the end of last year. In the past year, the market for the automotive sector has not been in a steep decline because of “chip shortage”, but instead has generated a structural market with a continuous upward trend, along with the overall market trend.

In the industry, “chip shortage” is often used to hype and its level of attention ranks in the top three in the industry. However, in the secondary market of the automotive sector, the role played by the chip shortage is not that important. From the perspective of impact degree, the chip shortage can be regarded as a marginal effect, ranking behind industrial effects and cyclical effects. From the perspective of impact time, the degree of influence of the chip shortage on the market is about one month.

In the industry, “chip shortage” is often used to hype and its level of attention ranks in the top three in the industry. However, in the secondary market of the automotive sector, the role played by the chip shortage is not that important. From the perspective of impact degree, the chip shortage can be regarded as a marginal effect, ranking behind industrial effects and cyclical effects. From the perspective of impact time, the degree of influence of the chip shortage on the market is about one month.

Some friends in the industry also pointed out that the impact of the chip shortage on companies that can supply their own chips is relatively small, and Li agrees with this view. Before the fermentation of the chip shortage, researchers have proposed this idea. Although there are not many domestic automakers that can supply chips themselves, the concept of chip self-supply has always been suggested. BYD is the fastest reverse in mainstream automakers in September, not only because of the concept of new energy vehicles, but also the superposition of the concept of chip self-supply.

Taking the automotive market as an example, we analyze the effects of industrial effects, cyclical effects, and marginal effects of chip shortages.

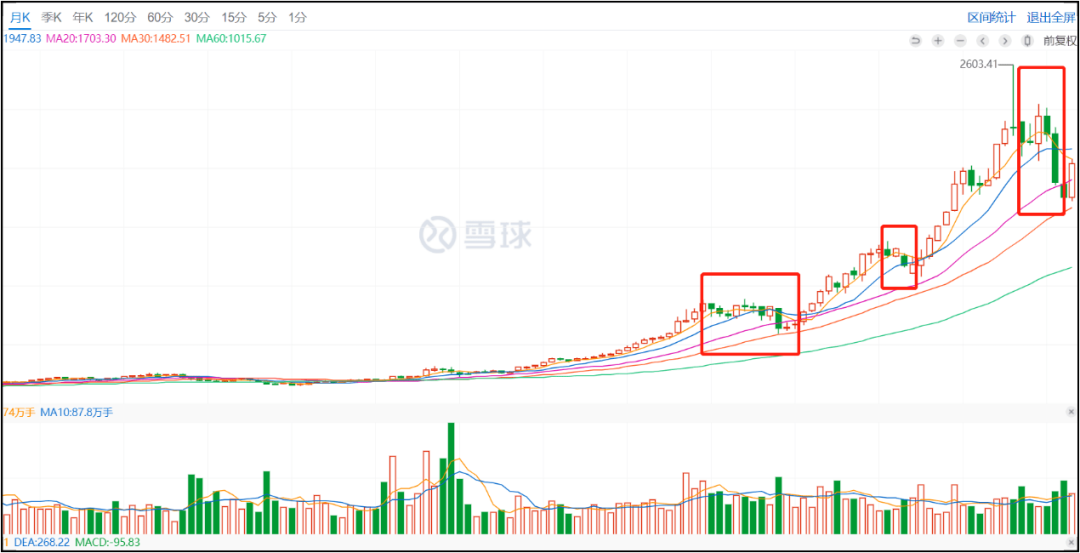

From the end of 2020 to the present, the core driving factor for changes in the automotive industry is industrial transformation. According to the path of industrial evolution, new energy vehicle companies represented by BYD have already entered the explosive period. China’s independent brands represented by Great Wall Motors are also on the rise in the concept of domestic substitution. Similarly, many domestic automakers have overlaid these concepts. Against the background of carbon neutrality, they naturally run fast, and the impact time of industrial effects is basically over five years.

In addition to industrial effects, the market is mostly influenced by cyclical effects. There are many driving factors for cyclical effects, such as the general market trend. The collective retreat after the New Year is a cyclical trend of the market. The cyclical trend of the sector, such as last year’s medicine and consumption, which were higher than the valuation center, had a good market, and this year’s valuation was lower than the center, and the market was not good. The cyclical trend of companies, such as the three-year itch mentioned by Li before, these cyclic effects have an impact time of more than one quarter and up to 1-3 years.

Industrial effects and cyclical effects have very strong objective laws, and research can provide a good grasp. However, marginal effects are different from the first two, and are difficult to grasp. The “chip shortage” is a typical marginal effect caused by supply and demand imbalances, characterized by large stock price elasticity, short cycles, and the best way to resist such risks is to wait.

The difficulty in reality is whether we have the confidence to persist when faced with a 30% retreat.

Is it the best time to lay out the automotive industry now?Before the long holiday, friends who have been tracking the automobile sector saw the brokerage’s recommendations for increased positions. Not only the automobile sector but also the entire “dual-carbon” concept is the same. Whenever the market falls, some brokerages see it as an opportunity to lay out their positions. Regarding this issue, I would like to share some thoughts with everyone here.

Partners often remind the team that there are no completely identical market conditions, but there are similar market conditions. Last year was dominated by the healthcare and consumer sectors, and every time the market fell, brokerages always told everyone that the opportunity to buy had come. Sellers screamed from March of last year until March of this year, and each drop during this period was indeed a buying opportunity.

But interestingly, a certain public fund shared its client situation in the first quarter of this year, with a growth rate of more than 30% in new clients, of which only around 5% of the clients had positive returns. This group of data indicates that many users got on board near the end of the market, and most of them were trapped. Numerous images of middle-aged women entering the market “running” appeared in my mind.

This year’s new energy vehicle market has many similarities with last year’s healthcare and consumer market. No sector or stock can rise all the time. As long as you avoid high-entry positions, you can generally get decent returns. As long as you don’t buy the wrong track, even if you enter at a high position, as long as you remain patient, you can survive the cycle.

In my personal opinion, after the tumultuous market at the end of this year, the healthcare and consumer sectors are likely to continue to lead the market next year. The Q4 high prosperity track has an upward trend, and the market believes that there will be a new round of tumultuousness in December, which can be referred to as the “year-end tumultuousness”, corresponding to last year’s “spring tumultuousness.”

Assuming the market trend is confirmed, the automobile sector in Q4 may have two trends. Firstly, many researchers believe that on the premise of unclear supply and demand, the automobile sector (traditional and new energy) is likely to experience a rebound and reach its peak at the end of the year. With the traditional car data exceeding expectations in September and October, a market shakeout may advance.

As for the trend of the automobile sector next year, it is currently difficult to judge, as the market changes every day, and research conclusions are constantly adjusting. The job of researchers is to clarify the facts and give the judgment to operators to win probability. Generally speaking, short-term trends can be predicted through technical analysis. Under the current high-volatility market conditions, fundamental analysis can predict at most one to two quarters. What are the key news worth following in Q4? I believe there are two: one is the third-quarter results announced by various car companies in October, and the other is the sales data of new energy vehicles and fuel vehicles in various months of Q4.# Old Li watched “My Father and Me” during the holiday, and the “Duck Prophet” directed by Teacher Xu Zheng in it tells the story of the first national TV commercial that happened in Shanghai in the early stages of the reform and opening-up. The so-called “Duck Prophet” followed the trend of policy development, and history always repeats itself.

In the new era, “dual-carbon” is bringing mid- to long-term investment opportunities to the market. Although the current market is focusing on the growth industries that “dual-carbon” brings, the investment opportunities of “dual-carbon” in traditional industries are not highly valued. However, in the future, whether it is traditional industries or growth industries, there will be numerous structural opportunities for “dual-carbon”.

Looking at it from afar, the peaks and ridges are tiered differently. During this holiday, the sun is shining in the south while the north is windy and bleak. Only by maintaining an open and ordinary mentality can we transcend time and space and go through the waves.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.