We have observed a trend.

Since mid-2021, in the media activities of automotive companies, Tier 1 suppliers, and startup technology vendors, the questions that peers like to ask manufacturers’ executives have shifted from data privacy and information security to responding to the “chip shortage” in the industry.

Compared with the struggle of automotive and Tier 1 companies in the semiconductor supply crisis, semiconductor manufacturers are also opening up new battlefields through their expertise.

Not long ago, Arm held an online media sharing event, announcing the launch of a new software architecture and reference implementation – Scalable Open Architecture for Embedded Edge (SOAFEE), an open and scalable architecture for embedded edge devices, as well as two new reference hardware platforms designed to accelerate the realization of software-defined future in the automotive industry.

This software architecture has three parts:

-

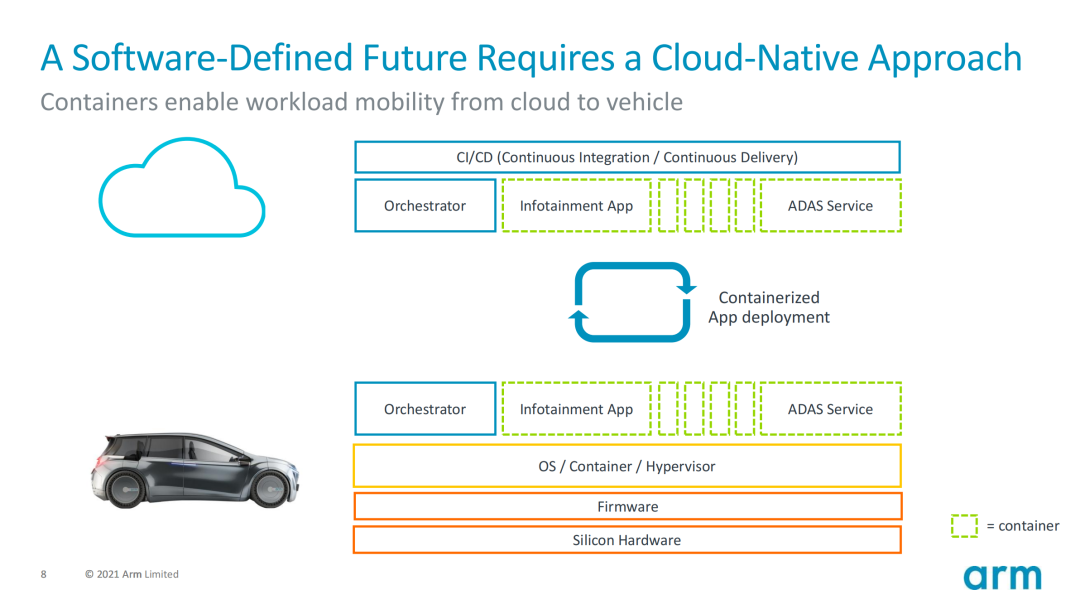

First, SOAFEE – Scalable Open Architecture for Embedded Edge, an open and scalable architecture for embedded edge devices that is a new software architecture and open-source reference implementation that meets both the real-time and security needs of automobiles and fully leverages the advantages of cloud-native development.

-

Second, a hardware reference platform that can execute SOAFEE and develop various functions and services.

-

Third, Arm will establish an industry cooperation organization to continuously improve the design of SOAFEE.

Arm’s motivation for launching SOAFEE and a series of plans is not to catch up with others. In fact, the semiconductor IP provider has been in contact with the automotive industry since as early as 1996. From the earliest brake control chips to current in-vehicle networking technologies, entertainment systems, ADAS, and power systems, Arm has been involved.

In other words, this company, which is often mentioned but not leading the pack, has been active in the depths of the automotive industry for many years and has its own observations and reflections.

Deng Zhiwei, Senior Director of Arm’s Automotive and IoT Business Unit and APAC Partnerships, introduced the importance of software-defined from Arm’s perspective to the attending media.For car manufacturers and Tier 1 suppliers, the cost of software development will be greatly reduced. Meanwhile, by continuously launching innovative services in after-sales, new revenue streams can be created for car manufacturers. The report shows that software-defined implementation can create additional profits of up to USD 2,600-7,500 per car for car manufacturers.

For IC designers and software suppliers, they can better achieve product differentiation, and software-defined also allows more cloud application developers to join the ranks of automotive innovation.

In terms of the market, consumers will also be more satisfied with customized car functions and user experience.

To meet the demand for software-defined cars, a standardized framework is essential. This framework can enhance verified cloud-native technologies that can collaborate on a large scale with indispensable real-time and secure functions in automotive applications. Additionally, this framework can also benefit other real-time and security critical applications, such as robots and industrial automation.

According to Deng Zhiwei, SOAFEE is based on the concept of cloud-native and aims to meet the needs of software-defined cars.

The first version of SOAFEE was released on September 16th, Beijing time, and is already available for download. It is understood that this version includes all the basic modules necessary for starting cloud-native, and all relevant information can be found on GitLab (a web-based Git repository management tool developed by GitLab Inc. and licensed under the MIT License).

At the same time, Arm has established a SOAFEE expert group with industry manufacturers as an organization for industry cooperation.

Deng Zhiwei stated that the SOAFEE program has received many responses and participation, including car manufacturers, Tier 1 manufacturers, and hardware and software ecosystem partners.

When asked how Arm balances SOAFEE as a universal standardized software development, and whether car manufacturers are afraid of its technological monopoly, to the extent that they have concerns like “throwing away their souls,” as pointed out by Chen Hong, chairman of SAIC, Deng Zhiwei responded:When Arm first proposed the SOAFEE concept, their main goal was to avoid similar issues in the industry.

First of all, Arm emphasizes the openness of SOAFEE, which means that it must cover and accommodate various technologies from different car and software/hardware manufacturers in order to prevent monopolies.

Secondly, SOAFEE is open source, meaning that it cannot be controlled by any individual, as the entire standard must be shared. Thus, an open-source approach is used to prevent the monopoly of software design.

Thirdly, Arm believes that car manufacturers’ core technology should not be built in areas where differentiation cannot be isolated, such as operating systems or container mechanisms. For car manufacturers, differentiation lies in applications and services. Arm is happy to see that car manufacturers’ applications and services do not need to be open source. Car manufacturers should create differentiation by focusing on their own applications and services, such as the design of automated or assisted driving systems and services, which can avoid conflicts and contradictions with the entire open-source system.

In conclusion, nearly two years ago, in CES 2020, GeekCar interviewed Chet Babla, Vice President of Arm Automotive and IoT Business. At that time, Babla stated that 7% of the models sold in the Chinese market were electric and hybrid cars, while the global level at that time was only 2-3%. China will be a leading market in automotive electrification and a vital market for Arm.

After two years, we have witnessed the entry of many new players and the crossover of old ones into the market, including ADAS players entering the cockpit field; drone giants becoming part of the automotive supply chain; Internet of Things hardware manufacturers joining the vehicle manufacturing industry and even top car manufacturers preparing to “invade” the mobile phone market.

Through this release, we are even more certain that Arm’s actions in the automotive field are still its strong suit: establishing standards, building ecosystems, and empowering the industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.