Author: LYNX

Today is the last day of the National Day holiday. I believe that you, who is reading this article, are packing up your mood and preparing to return to the tense work position. Of course, those little partners who took a year off are happy and can continue to enjoy the leisure and joy of the holiday for a few more days.

Looking back at the past seven days, I don’t know if you have a similar feeling as me – whether you are traveling or “lying down” at home, you don’t want to look at your phone, especially don’t want to click on the green icon of the APP.

Perhaps, this is the “empty” that everyone’s heart most desires in the current information anxiety.

Now the holiday is coming to an end, and the real daily life is about to return. On the last day of the holiday, let’s briefly review the news that was “skipped” during the holiday and look ahead to the fourth quarter that is about to officially begin.

We can probably find that good news and hidden worries coexist, which will be the norms faced by newcomers in the car-making industry, and even the entire automobile industry, at the end of 2021.

Breaking Ten Thousand

The big news that was diluted by the festive atmosphere is still sales.

On the first day of October, the new car-making forces released the delivery volume of the previous month as usual. As if to celebrate the National Day, the delivery numbers of the top new force manufacturers all have a key word – breaking ten thousand.

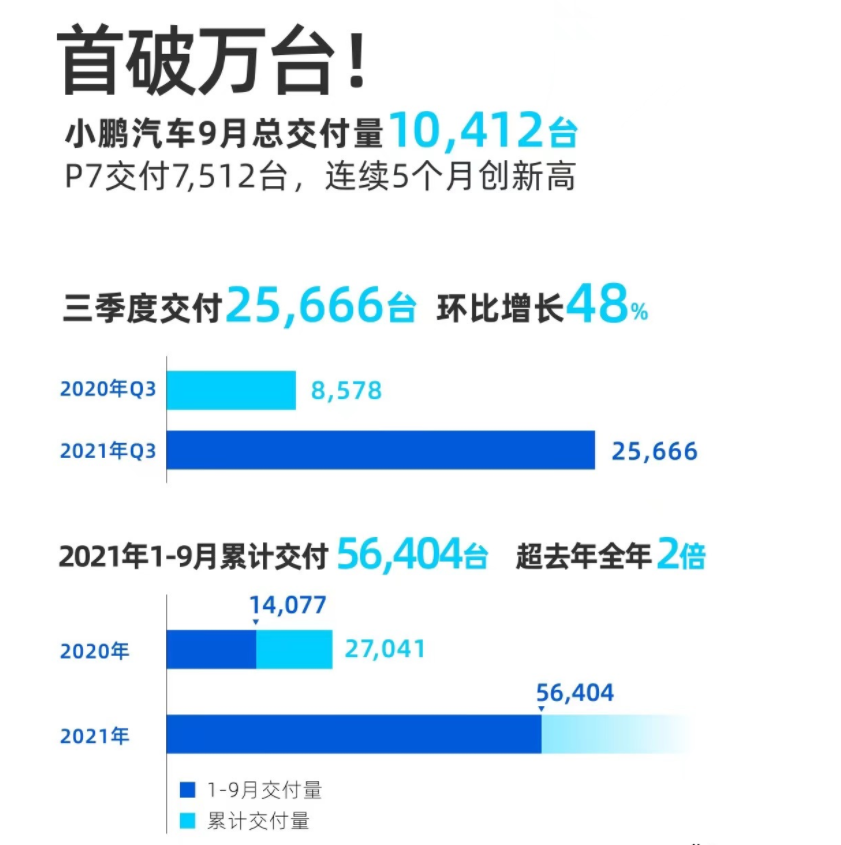

XPeng Motors took the lead in releasing the data: 10,412 new cars were delivered in September, of which XPeng P7, the main sales model, accounted for 7,512.

Currently, XPeng has delivered more than 50,000 vehicles; the cumulative delivery from July to September is 25,666, and the quarterly delivery volume is close to the total delivery volume of 2020; the cumulative delivery from January to September is 56,404, twice the total delivery volume of last year.

Regarding this, XPeng Motors Chairman He XPeng wrote a small article in his WeChat Moments without surprises, expressing his inner feelings and thanking all partners and car owners.

Of course, He XPeng also played a word game in the small article. Specifically, XPeng Motors is the first company among the new forces to come out and say that it has delivered more than ten thousand, rather than the first company to reach this number.

Because NIO also achieved more than ten thousand deliveries in September – delivering 10,628, more than two hundred more cars than XPeng. At the same time, NIO’s cumulative deliveries from January to September this year have exceeded 66,000 units.

With this sales result, NIO finally shook off the shadow of slowing sales in July and August, and regained the new forces monthly sales champion throne.

This championship is also a timely “tonic” for NIO itself. It is worth noting that the company has not been doing well in recent months and has encountered a “retrograde”:

On the side of enterprise development, the epidemic in August fluctuated, which affected NIO’s domestic and foreign supply chains, resulting in less than 6,000 deliveries in that month, the lowest since March this year.

Subsequently, on the consumer side, problems with seat design and NoP automated driving assistance accidents have also caused it to be swept into negative public opinion.

As for how NIO sold more than 10,000 new cars, part of it should be attributed to the “catch-up” sales in August after the stable supply of parts, and another part cannot be separated from the efforts of terminal sales.

Just take a look at the Weibo message from NIO executives, which showed that even the showroom display cars were almost sold out. In another way, if you want consumers to pay for display cars, welfare policies are certainly indispensable.

Compared with the joy of selling display cars, the last exclamation sentence seems to be more important. “Chip shortage” is still causing industry pains, and in September, it was particularly evident in Ideal Auto.

After the new version of Ideal ONE was released this year, Ideal Auto set a flag: to achieve sales of over 10,000 in September.

Judging from the sales performance of new cars after they were launched, Ideal was gradually approaching this goal. In August, Ideal ONE set a monthly sales record, winning the monthly sales champion of new forces with a delivery volume of 9,433, only one step away from breaking 10,000 in September.

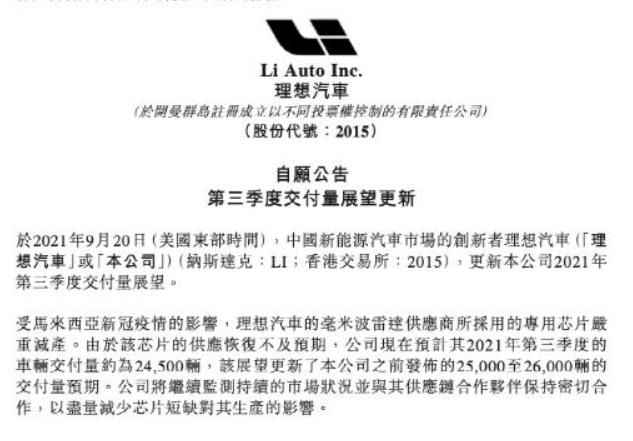

However, things didn’t go as planned. After NIO and XPeng “broke the line” of 10,000 cars in September, Ideal’s deliveries in September fell to 7,094.

# For this result, Ideal had already signaled a lower market expectation. As early as September 20th, Ideal released a notice saying that the dedicated chip used in the millimeter wave radar of its product suffered from serious production cuts due to the new crown epidemic in Malaysia.

# For this result, Ideal had already signaled a lower market expectation. As early as September 20th, Ideal released a notice saying that the dedicated chip used in the millimeter wave radar of its product suffered from serious production cuts due to the new crown epidemic in Malaysia.

After announcing September sales data, Ideal reiterated this reason, indicating that order volume continued to grow but they were unable to deliver cars due to chip shortages.

Apart from “U Xiaoli” in the limelight, the performance of the second-tier players in the new forces of automobile manufacturing in September was also remarkable.

Among them, NIO Automobile delivered 7,699 vehicles, surpassing Ideal to become third in the sales ranking for new forces of automobile manufacturing. In August, NIO had also surpassed NIO, which had encountered supply chain inconveniences.

WM Motor, which has not disclosed its sales data for a long time, also announced its September delivery volume in a surprising move: 5,005 units, and stated that its sales in the first three quarters of the year had exceeded its annual sales of the previous year, reaching 29,043 units.

Lingrao Automobile indicated that it delivered 4,095 new cars in September, a slight decrease compared to August. The reason, not surprisingly, was attributed to insufficient chip supply, and it also stated that the order volume was continuing to increase.

To be honest, the monthly delivery ranking competition among new forces of automobile manufacturing is just a spectacle for us onlookers. If we continue to pay attention to sales data, the three issues to watch out for in the future are probably:

-

Will delivering over ten thousand vehicles become a normal occurrence for the champion or a flash in the pan? Remember, when XPeng He launched the XPeng P5, he boasted a monthly sales volume of 15,000 units in Haikou at the year-end.

-

Which new force of automobile manufacturing will be the first to achieve sales of 100,000 units annually after achieving ten-thousand-unit monthly sales? NIO had a cumulative sales volume of 66,300 units in September, which is closest to this number. However, it’s highly unlikely that we’ll see this milestone achieved this year.

-

When will the monthly sales rankings of new forces of automobile manufacturing be subdivided by vehicle type and price range instead of ranking by companies? After all, comparing NIO and Lingrao, whose main sales cars are priced below 100,000 yuan, with NIO and Ideal, whose main sales cars cost more than 300,000 yuan, does not seem fair upon closer examination.The topic that really deserves attention from every car-buying enthusiast with a real plan, behind the delivery of mere data, may be the Black Swan called “Chip Shortage”.

Black Swan Has Been Flying

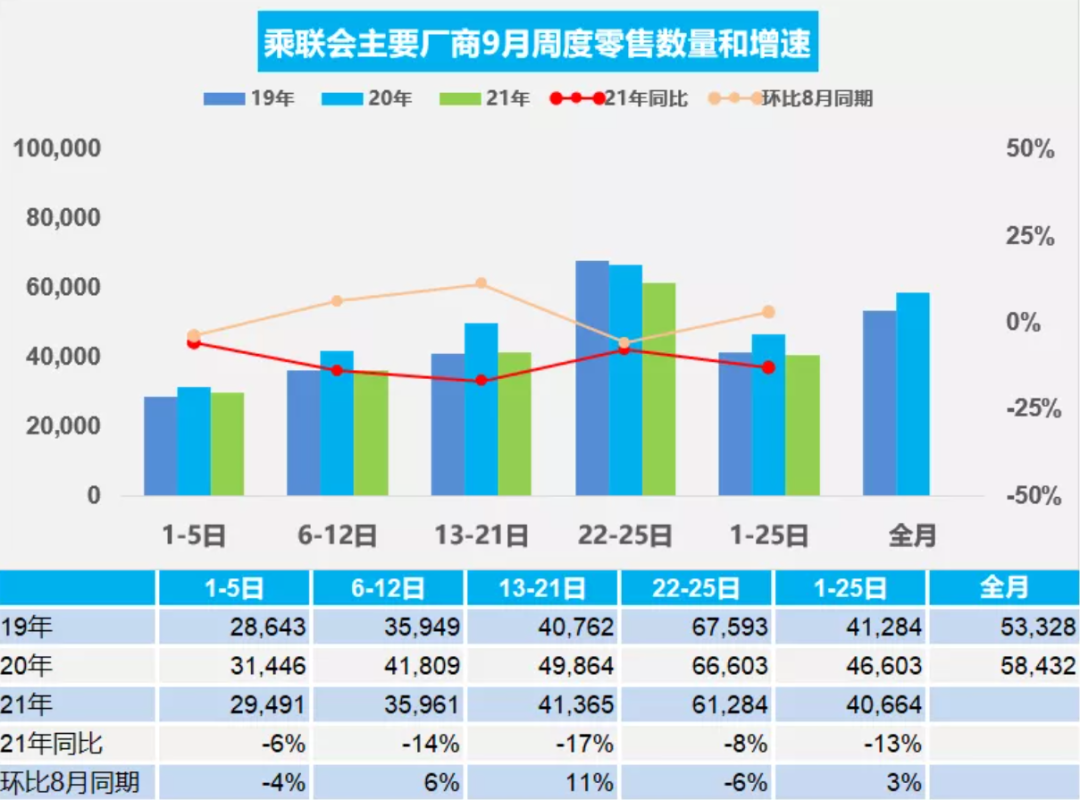

“Chip shortage causes stumbling operation of car industry in August, with many indicators showing a year-on-year decline of two-digit growth, and the market’s dismal situation is completely beyond expectation“, which is a summary of the current problem of shortage of automotive chips in the report of China Passenger Car Association (CPCA).

If we only pay attention to new energy vehicles, the rising market index month by month and the good news announced by new forces every month may create an illusion that the market is thriving.

However, after all, new energy vehicles are still in their infancy. When we extend our focus to the entire automotive industry (primarily gasoline vehicles), it is not difficult to deeply understand the “dismal situation” in the CPCA report.

According to statistics by research institutions, as of August this year, the global automobile production reduction due to the chip shortage has reached 5.85 million units. Among them, China’s market reduced production by 1.122 million units, and it is expected that the global automobile production reduction in 2021 will exceed 7 million units.

Shortage of chip supply causes lagging production capacity, which inevitably leads to a decline in market sales volume. CPCA’s data shows that in August, the most popular passenger cars in the market continued to show a downward trend in sales volume. Toyota Corolla and Honda Accord, which people are very familiar with, had a year-on-year decline of about 30% in sales volume that month.

Overall, although car companies and the media shout “Golden September and Silver October” every year, September this year seems to be particularly lackluster. CPCA’s data shows that the overall sales volume of passenger cars in the first four weeks of September this year decreased by 13% year-on-year.

As for what chips are missing in cars, many reports have detailed explanations, so only a brief introduction is given here.

According to their functions, automotive chips can be roughly divided into three categories:

The first category is responsible for computing power and processing, such as AI chips used for autonomous driving perception and fusion, and traditional MCUs (Electronic Control Units) used for engine/chassis/body control.

The second category is responsible for power conversion, such as IGBTs (Insulated Gate Bipolar Transistors) and other power devices.

The third category is sensor chips used for various radar for autonomous driving, as well as airbags, tire pressure detection and so on.

Data from China Association of Automobile Manufacturers shows that the demand for traditional fuel vehicle chips in China is about 934 chips per vehicle, while the demand for chips for new energy vehicles is about 1,459 chips per vehicle.# The Impact of Chip Shortages on the Chinese Auto Industry

These chips have specialized functions that cover everything from tire pressure monitoring and rain sensor controls, to self-driving and in-car entertainment systems. Unfortunately, it is not a single specific chip that is in short supply. Rather, due to the effects of the pandemic, it is impossible to predict which chip will experience supply chain issues next.

During an interview, William Li Bin, the CEO of NIO, made an apt comparison, stating, “In fact, the automotive industry has faced chip shortages every quarter this year. But the chips that are lacking each week are not the same, and we don’t know which one will be next, just like cooking in a kitchen where one week we run out of oil and the next week vinegar. This is a localized effect that continues to exist in different ways.”

As Li Bin points out, Chinese car manufacturers can be thought of as chefs, and different vehicle models correspond to different menus. Chips are like seasoning, and if you run out of salt and vinegar, no matter how brilliant the chef is, they cannot make the dish.

As for the tendency of some domestic manufacturers to tout “self-developed chips” for their ease of promotion… It is advised to take this claim with a grain of salt. While some chefs may have relatives who run salt fields, it doesn’t mean that the chef never has to go to the market to purchase other seasonings.

Some may argue that the Chinese car market entered a state of slow growth in the stock market phase years ago, and a temporary drop in sales volume is not uncommon.

The problem is that in the past, the market had sufficient production capacity and demand was greater than supply. However, chip shortages causing a decrease in production has changed this to a situation where “supply determines demand.” Put simply, it may be difficult to purchase certain popular cars even with ample funds.

According to a report by the China Association of Automotive Manufacturers (CAAM), in September, the average market discount rate in China was about 13.1%, down 0.6% from the end of the previous month. Currently, channel inventory for joint ventures and luxury automakers has reached an extremely low level, and promotional efforts have noticeably decreased.

When it comes to predicting when the chip shortage will be truly resolved, like the end of the COVID-19 pandemic, the answer is difficult to predict. We can only suggest that if one is not in a hurry to purchase a car, they may want to wait.

After all, manufacturers only offer greater discounts when supply is greater than demand.

October Outlook

After discussing the new forces in the automotive sector in September, as we approach the dawn of the first day of work in October, let’s take a brief look at a few major events that will happen in the near future.First of all, it can be expected that the highly-anticipated Xpeng 001 will be officially released soon. What kind of market response it will receive is highly anticipated, and the supercharging stations will also seize the opportunity to provide detailed reviews.

In addition, during the holiday season, WM Motor suddenly announced that it has obtained a new round of financing and also revealed in the press release that it will launch its first pure electric car in mid-October. Whether this car will be the punch product to revitalize WM Motor’s sales, or another “speculative” product, it is worth everyone’s attention.

Of course, we can’t forget the big players in the new energy vehicle industry, such as Tesla and BYD.

Tesla’s news always leaves people guessing, from sales to prices, from lawsuits to Musk’s tweets, everything can be news, and everyone can only wait and see.

As for BYD, the long-rumored high-end brand is highly likely to unveil in the fourth quarter, but it is not known if it will arrive in October.

In conclusion, the wonderful holiday has come to an end. After returning to busy everyday life, everyone should remember to frequently check out the informative and entertaining intelligent car reviews provided by the supercharging stations!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.