Joy’s English Translation:

The strategy played by the brands under Geely is quite interesting now. First of all, Polestar announced that it will merge and list through SPAC and Gores Guggenheim, with a post-merger valuation of approximately $20 billion.

Next, Volvo is also going to IPO on the Stockholm Stock Exchange in Sweden, with a valuation slightly higher than Polestar, possibly reaching $25 billion.

These two companies bring a market value of $45 billion at once. I want to take a look at the plans and technical content of Polestar and Volvo through the “Polestar Investor Presentation” released at the end of September.

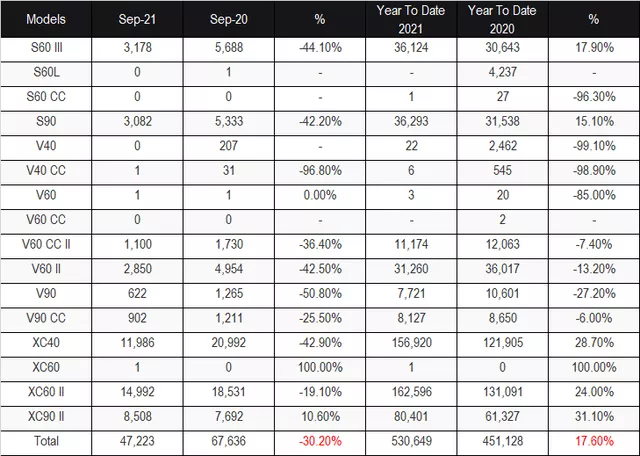

Volvo has done very well in the new energy field. In 2021, the proportion of new energy vehicles in all models reached 24.9%, which is 132,100 vehicles. The penetration rate of new energy vehicles exceeded one quarter in September, reaching 26.9%, and monthly sales reached 12,496 vehicles.

How to view Polestar?

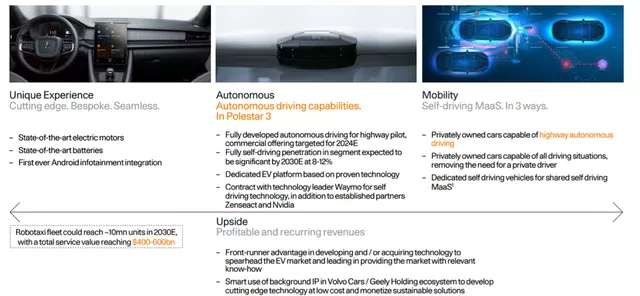

As an independent financing electric vehicle brand, Polestar focuses on defining the design, user product experience, performance, and digital experience of purely electric vehicle products, and attempts to adopt a direct sales model at the sales end. It is also based on Volvo’s design and development of electric vehicle platforms, engineering release, system testing and verification, customer service centers, manufacturing capabilities, and logistics. At the same time, it borrowed Geely’s procurement and supply chain capabilities. In fact, Geely has done a very good job with this brand.

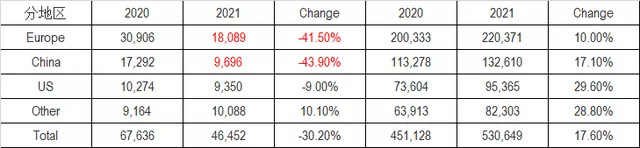

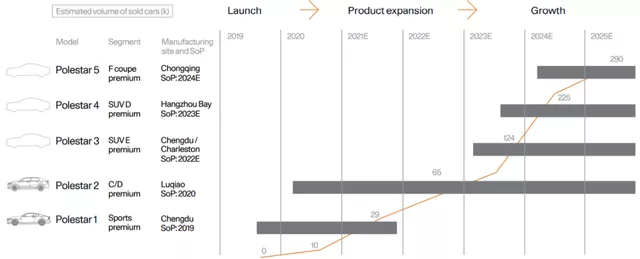

In terms of overall sales, Polestar delivered around 10,000 vehicles globally in 2020, and it is estimated to deliver 29,000 vehicles globally in 2021. The first Polestar1 is completely an image car, sold at a high price of 1.45 million RMB. The Polestar2 launched in 2020 is particularly strange. The following few cars of Polestar (Polestar 3, Polestar 4, and Polestar 5) are aimed at Porsche’s fuel vehicles, with the competing products being Cayenne, Macan, and Panamera, respectively.

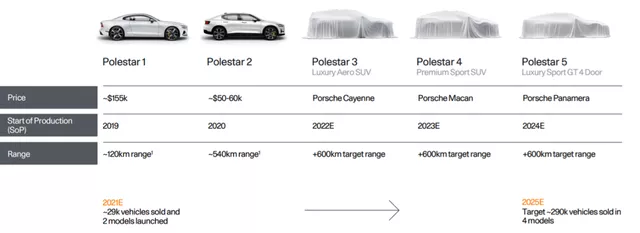

Polestar aims to increase sales from this year’s 29,000 to 290,000 by 2025. From the current perspective, its biggest competitor should be the PPE of the Volkswagen Group, and it is in direct competition with NIO in China.

Note: Does Polestar’s market planning not consider other electric vehicles?

The core controversy of this matter is whether or not Polestar, as a new brand, can take over Porsche’s special position given Porsche’s Taycan, a particularly expensive, purely electric sports car, has already achieved impressive sales numbers.

According to the market forecast by Polestar’s marketing department, the growth rate of sales will follow this curve: 10,000 units in 2020, 29,000 units in 2021, 65,000 units in 2022, 124,000 units in 2023, 225,000 units in 2024, and 290,000 units in 2025.

Note: Except for some Polestar 2 models, all of these cars are produced in China and sold worldwide, and currently, Europe is the main market.

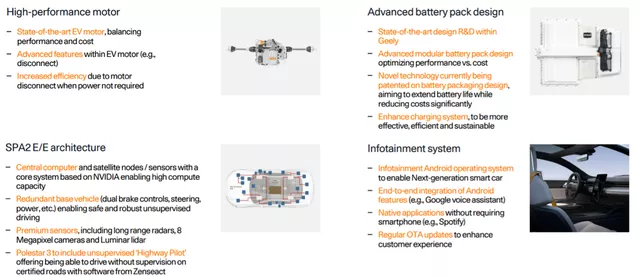

What technologies does Polestar have?

Powertrain Technology

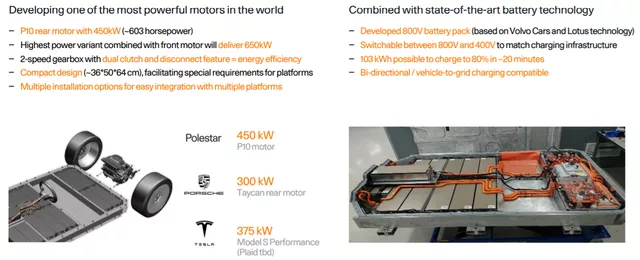

Electric drive system: The rear-wheel-drive P10 has a power output of 450kW, while the four-wheel-drive system has a power output of 650kW and uses a two-speed gearbox. The motors have been miniaturized to approximately 36x50x64 cm, which makes them easier to apply.

Battery system: We won’t go into much detail about the Polestar 2, but the upcoming Polestar 3 will mainly reuse the 800v battery pack developed by Volvo and Lotus. It is said that this component uses a series-parallel structure, which can support both 800V and 400V charging networks. The energy of the battery is 103 kWh, and it only takes 20 minutes to charge up to 80%. The battery system can also support V2G bidirectional charging and discharging.

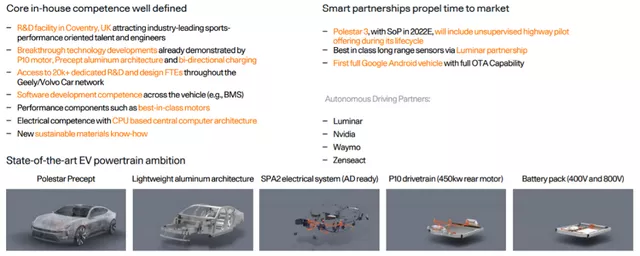

The architecture of Lynk & Co is mainly evolved from SPA2 at Volvo, and the most interesting thing here is the electronic architecture with the concept of central control, which is supported by a Google Android vehicle system that allows OTA upgrades. The autonomous driving supply chain system has Luminar providing radar, NVIDIA providing GPU processors, and Waymo providing engineering integration (Waymo’s effectiveness is still uncertain at present). The autonomous driving software comes from Zenseact.

Looking around, the only thing that stands out is the electronic architecture of SPA2, which relies on a central processing platform for electrical and electronic equipment. It is quite powerful, but other companies can also do it.

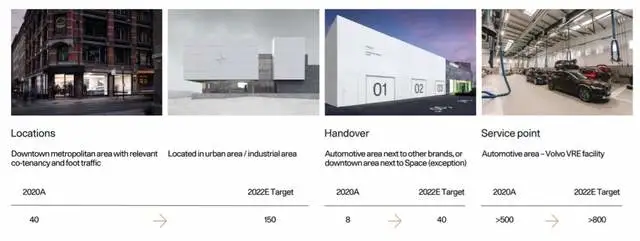

Sales and Service of Lynk & Co

Lynk & Co is learning from the business model of China’s high-end pure EV brands. Its showrooms are located in places with high traffic flow in cities around the world, with warehousing and logistics located in supply parks, and delivery areas are dependent on Volvo City showrooms. After-sales service is backed by Volvo’s after-sales service area.

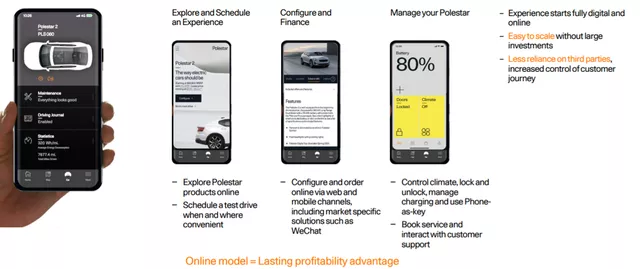

The use of a mobile app to enhance the user experience is already familiar to us, and there’s nothing special about it.

In summary: I feel that European car companies are now copying the homework of Chinese car companies, which is a bit of an ironic reversal. I have always believed that this product, the car, will undergo a very large transformation in the next 3-5 years. Our understanding of the industry structure and industry characteristics will change significantly, and it is important to closely observe this. I believe that Lynk & Co also needs to spend money in China to find effective strategies that suit its own brand.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.