The Prosperous Development Prospects of China’s Automobile Industry Rest on New Energy Vehicles

In recent years, if we talk about the prosperous development prospects of China’s automobile industry, none can surpass new energy vehicles. Compared with other industries, the new energy vehicle sector has shown a particularly strong combat capability. The concept index of the new energy vehicle industry rose nearly 30% this year, and the stock prices of upstream and downstream related enterprises have also risen. Currently, insiders believe that China’s new energy vehicle industry chain is gradually maturing, and there is great potential for expanding overseas market share in the future.

Similarly, with the rapid development of the global new energy vehicle industry, it is increasingly important to match good horses with good saddles. This year, China’s new energy vehicle production and sales volume, penetration rate, and the popularity of power battery vehicles and charging piles are all increasing rapidly. For consumers, the biggest obstacle to purchasing an electric car is the anxiety caused by range. The key to solving this problem is to either increase battery capacity or increase energy density and make charging as convenient and fast as refueling.

On August 30th this year, GAC Aion officially released the Super Flash Battery Technology and the A480 Super Charging Pile, which can effectively solve the slow charging speed of electric vehicles and also address consumer concerns about range. Through a live broadcast event, a challenge car with Super Flash Battery technology completed its journey by relay, achieving the result of “charging for five minutes and traveling 207 kilometers”. This result was also certified by the World Record Certification Agency (WRCA).

New Energy Vehicle Companies and Charging Pile Companies Go Hand in Hand

It is definitely a positive trend for the development of new energy vehicles. According to the latest statistics from the China Association of Automobile Manufacturers, although the current global chip supply and demand structure has affected the current automobile market, the domestic new energy vehicle market has remained a bright spot in the market from January to August this year. The development of charging piles has also entered an accelerated phase.

In 2006, BYD built the first electric vehicle charging station in Shenzhen, which was the first charging station in China. This was an important reason why BYD, a “battery factory” born automaker, was able to stand out in the fiercely competitive new energy vehicle market and lay a good foundation.

In 2008, during the Beijing Olympic Games, the first centralized charging station in China was built, which could meet the power battery charging needs of 50 pure electric buses.In October 2009, Shanghai Electric Power Company invested in and built the first commercial electric vehicle charging station in China, the Shanghai Caoxi Electric Vehicle Charging Station. At the end of the same year, Beijing First Automotive Works Group completed the construction of the first demonstration electric vehicle charging station with a complete intelligent microgrid in China at Jianxiangqiao. Southern Power Grid put into operation the first batch of electric vehicle charging stations in Shenzhen, with a scale of two charging stations and 134 charging piles.

In 2010, State Grid Tangshan Nanhu Charging Station was put into operation, which was the first typical design charging station of State Grid in China. It could charge 10 electric vehicles at the same time by both fast and slow charging methods.

This period was also the starting stage of the charging and swapping industry, and the charging and swapping industry abroad was just starting as well. Before 2012, the development model mainly based on battery replacement proposed by State Grid and Southern Power Grid had emerged. The “Development Plan for Energy-saving and New Energy Vehicles Industry (2012-2020)” issued by the State Council mentioned adapting to local conditions to build charging piles and public rapid swapping facilities, and established the operation mode of “swapping as the main operation, plug charging as the supplement, centralized charging, and unified power distribution”.

In January 2014, State Grid held a work conference and proposed to optimize the planning and layout of charging and swapping service networks according to the principles of leading fast charging, considering slow charging, guiding swapping, and being economical and practical. This to some extent established the development direction of charging mode and set a good precedent for the development of the charging pile industry.

At the end of 2015, the General Administration of Quality Supervision, Inspection, and Quarantine, the National Standards Committee, the National Energy Administration, the Ministry of Industry and Information Technology, and the Ministry of Science and Technology jointly issued five national standards for the revision of electric vehicle charging interfaces and communication protocols in Beijing, which will be implemented from January 1, 2016.

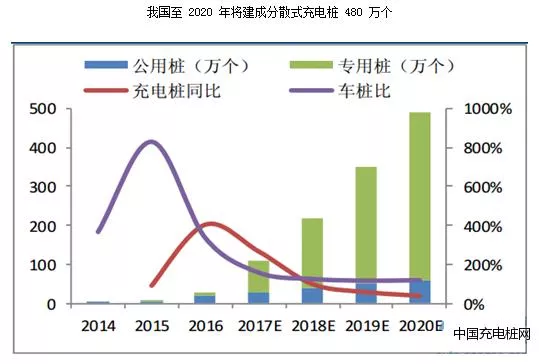

The goal of China’s charging facilities construction in 2020 is shown in the following figure:

Enterprises worked hard, and the government also increased support for the construction and operation of charging facilities. In January 2016, the Ministry of Finance, the Ministry of Industry and Information Technology, the National Development and Reform Commission, and the National Energy Administration jointly issued the “Notice on the Award Policy of New Energy Vehicle Charging Infrastructure during the 13th Five-Year Plan and Strengthening the Promotion and Application of New Energy Vehicles”. Local governments will continue to allocate funds to reward and subsidize the construction and operation of charging infrastructure. It can be said that the support of policies and related financial subsidy policies greatly promoted the development of government and enterprise charging infrastructure construction. Under the opportunity of policy benefits, the charging pile industry will usher in a period of rapid development.At this moment, we have to mention Zong Yi, the first person to connect the “north-south charging road”. As early as March 2014, when Zong Yi learned that his Tesla had been imported into the country but he was in Guangzhou, he decided not only to drive his Tesla back to Guangzhou, but also to purchase 20 Tesla charging piles to build a north-south electric vehicle charging road from Beijing to Guangzhou.

Zong Yi once said, “I not only want to drive electric cars north and south, but also to connect the first electric car charging road in China, and make it into a film. I think this is a very cool thing.”

As we all know, the speed at which Tesla’s superchargers are deployed in China is astonishing. In fact, Tesla was inspired by Zong Yi’s initiative and officially launched the Destination Charging Program. In May 2014, State Grid Corporation of China held a press conference in Beijing to announce the opening of the Distributed Power Generation and Grid Interconnection Project, as well as the market for various types of electric vehicle charging and swapping facilities, including slow charging and fast charging. Combined with the “Guidelines for the Release of Electric Vehicle Charging Infrastructure (2015-2020)” promulgated by our country in 2015, a development goal for the next five years was planned, which further strengthened the determination and foundation for the construction of charging and swapping infrastructure and also allowed more investors to see the rising business opportunities.

First and foremost, it was Tesla. After 2016, Tesla’s vehicles sold domestically have aligned with the new national standard in terms of charging interfaces. By the end of 2020, Tesla had already built over 410 Supercharger stations nationwide. Recently, Tesla released the V3 Supercharger station, which created a record of peak charging power of 250 kW in the world for the first time, which means that Model 3 can cover 120 kilometers in five minutes of charging, equivalent to charging for one hour and covering 1600 kilometers.

Subsequently, NIO quickly followed suit in building charging stations. Li Bin announced in the Q4 2020 financial report conference call that the number of domestic supercharging stations and destination charging piles will reach 600 and 15,000 respectively by the end of 2021. As early as the end of 2019, NIO and XPeng reached a cooperation agreement and shared charging stations. Shortly afterwards, GAC Aion and Porsche also made charging stations.

At the recent 2021 World New Energy Vehicle Congress, Tesla CEO Elon Musk highly recognized the development and growth potential of the new energy market in China, stating, “China is the world’s largest and most dynamic new energy vehicle market. Chinese consumers want cars to have more networked and intelligent features, so Tesla sees the potential for growth in China’s intelligent connected vehicles.”At present, Tesla has built 16 supercharging stations with 104 supercharging piles in 9 cities on Hainan Island. In addition, it has constructed and opened more than 900 super charging stations and 1730 destination charging stations in over 330 cities to better assist in achieving the “double carbon” target. Besides Tesla, which leads other new energy vehicle (NEV) companies, Volkswagen’s latest battery laboratory has been completed in Germany, and its new batteries are planned to be mass-produced in 2025. Volkswagen has also announced its entry into the charging station field. Meanwhile, the Chinese NEV startup, XPeng, has added 16 high-speed supercharging stations, bringing the total number of supercharging stations online to 400. The relationship between NEVs and charging stations is complementary.

As the Chinese charging pile industry continues to grow, according to official media data as of December 14, 2020, there were as many as 89,000 enterprises related to “charging piles” that were operating and surviving in China. From the relevant data, it can be clearly seen that the number of enterprises related to charging piles in China has shown a rapid growth trend in recent years.

In the NEV race, charging pile brands create competitive barriers and brand differentiation, resulting in differences and gaps in charging pile construction among different NEV brands. For example, Tesla has formed a closed loop of car production, sales, and charging facilities. From a commercial competition perspective, this is understandable. However, in the view of the journalist specializing in electromobility, the new energy vehicle industry, including charging piles, is still in the stage of government support and may take some time to transition from policy support to market orientation. As Shanghai announced recently, it will no longer issue license plates for plug-in hybrid vehicles starting from January 2023, and aims to have pure electric vehicles account for more than 50% of newly purchased personal vehicles by 2025, and for new energy vehicles to be used comprehensively in public transport.

The rapid development of public charging piles is mutually reinforcing. On May 12, the China Electric Vehicle Charging Infrastructure Promotion Alliance released the national operation situation of charging and swapping infrastructure, stating that the number of public charging piles increased by 17,600 units in April, up 58.8% year-on-year. As of April 2021, according to official media reports, there were 868,000 public charging piles in China, including 363,000 DC charging piles, 505,000 AC charging piles, and 426 mixed AC/DC charging piles. The cumulative number of charging facilities nationwide has reached 1.827 million, a year-on-year increase of 42%.From the perspective of concentrated construction of public charging infrastructure, the top 10 areas including Guangdong, Shanghai, Beijing, Jiangsu, Zhejiang, Shandong, Anhui, Hubei, Henan, and Hebei have a proportion of public charging infrastructure construction of 72.1%.

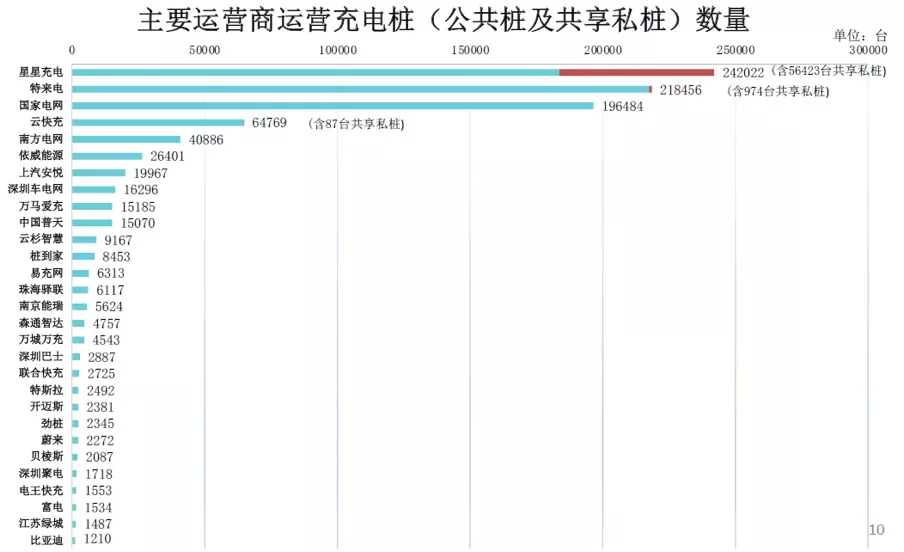

As of April 2021, there are 10 charging operation companies in China that operate more than 10,000 charging piles. They are TELD, which operates 217,000 charging poles, State Grid, which operates 196,000 charging poles, Star Charge, which operates 184,000 charging poles, YKC, which operates 65,000 charging poles, Southern Power Grid, which operates 41,000 charging poles, YIWO, which operates 26,000 charging poles, SAIC Anchi, which operates 20,000 charging poles, Shenzhen Charge Electricity Network, which operates 16,000 charging poles, Wanma Aichong, which operates 15,000 charging poles, and China Putian, which operates 15,000 charging poles. These 10 operators account for 91.7% of the total quantity, while the remaining operators account for 8.3%.

Star Charge, in cooperation with State Grid, Southern Power Grid, TELD, and other charging operators, has achieved interconnection and formed a closed circuit charging network covering the entire country, making it possible to use the same app anywhere in the country. With more public charging stations, electric vehicle owners can recharge their vehicles while at home, shopping, traveling or staying in accommodation.

According to media reports, Star Charge is the leader in public charging supply, covering more than 350 cities nationwide. With the strong promotion by the government and the joint efforts of major charging operators, first-tier and provincial capital cities have basically achieved a public charging network where the radius of charging stations for new energy vehicles in suburban counties does not exceed 5 kilometers, while the radius is 3 kilometers for ring roads and 1 kilometer for urban areas, covering all major city arteries and key highways.

Shanghai encourages the development of battery-swapping mode for taxis. According to Yu Fulins, director of the Shanghai Municipal Transportation Commission, in March 2021, SAIC Group released its first Roewe Ei5 taxi model, which can swap batteries. This marks the beginning of a pilot project for battery-swapping taxis in Shanghai. Shanghai is also exploring a pilot project to gradually upgrade charging stations to fast-charging stations by adding direct current fast-charging piles through sharing of electricity capacity, which aims to solve the problem of insufficient new energy vehicles charging infrastructure.The release of GAC Aion’s ultra-fast battery technology and A480 Super Charge Station not only solved the problems of charging anxiety and range anxiety, but also presented a brand new approach. Technically, “ultra-fast” refers to the high charging rate of batteries. It is known that existing pure electric vehicles can achieve a range of 200km in half an hour. In comparison, the ultra-fast battery technology achieves the fastest 6 times charging rate. “Ultra-fast battery technology can achieve ‘5 minutes charging for 200km range,’ which is the fastest charging battery technology in the world. At the same time, the A480 Super Charge Station also achieves the highest charging rate in the world.” According to the relevant person in charge of GAC Aion, what does this mean? It means that users only need the time to drink a cup of coffee to charge their car, and their range can almost cover the Greater Bay Area of Guangdong, Hong Kong and Macao.

“Our company is accelerating the construction of the A480 Super Charge Station, striving to provide new energy vehicle charging experience that is better than refueling traditional gasoline vehicles.” It is expected that by 2025, the A480 Super Charge Station will cover 300 cities nationwide and 2,000 super charge stations will be built. “The launch of GAC Aion’s ultra-fast battery technology and A480 super charge station has proven that electric vehicles can be charged just as quickly as gasoline vehicles refueling.” In the view of Cui Dongshu, the Secretary General of the Joint Conference of National Passenger Car Market Information, when range anxiety and charging anxiety are no longer the pain points for users, more consumers will actively choose to embrace new energy vehicles. When electric vehicles are approaching the refueling time of traditional gasoline vehicles, the spring of electric vehicles has arrived.

To sum up, with the arrival of the new fast charge standard, electric vehicles will be able to catch up with traditional gasoline vehicles in terms of waiting time for charge, with one charge and one refuel having the same duration. This will accelerate the development of electric vehicles. Now, the development of new energy vehicles has become increasingly mature, and the future prospects are bright. The charging network and technology, which are complementary and enriched, are constantly improving. In the near future, charging will become more convenient, can be more technological and intelligent, and we are looking forward to it.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.