Recently, two interesting things can be compared:

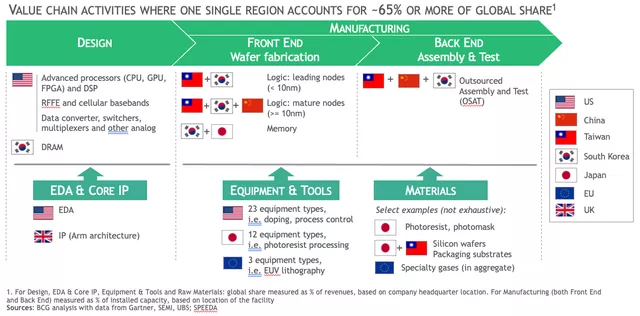

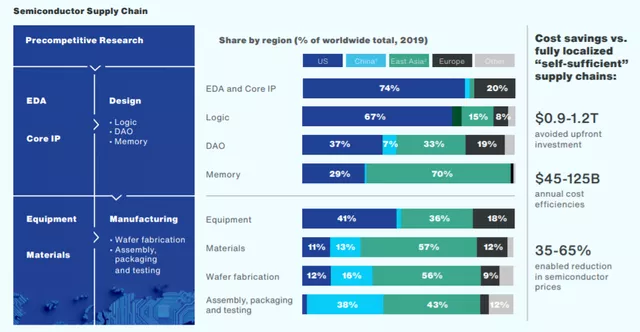

On one hand, the continuous chip shortage has prompted the US government to directly analyze sensitive data on chip orders and inventory by finding various core aspects of the chip supply chain, in order to diagnose bottlenecks in the supply chain and provide data for companies to help them adjust their production processes and adapt to the chip shortage. On the other hand, in September, almost all of the new automobile forces in China began a wave of sales show, making it seem as if China’s automobile industry had already perfectly adapted to the chip shortage.

Reasons for the US chip supply chain investigation

According to US Secretary of Commerce Gina Raimondo, the US government is observing that chips are directly impacting the US economy. This is in contrast to Q2 predictions, such as when automakers announced in May that the chip shortage would be relieved in Q3 2021. The actual situation has worsened, with General Motors and Toyota significantly decreasing production in Q3.

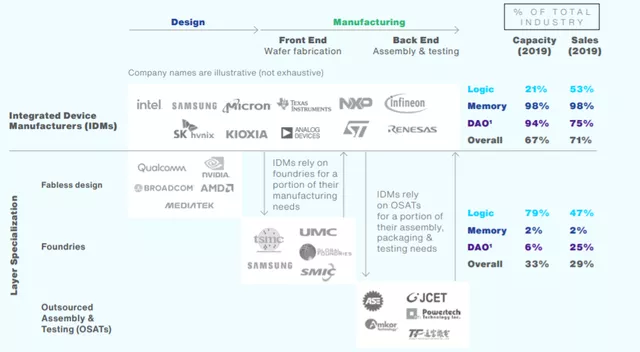

Then the US government created a chip supply chain transparency program, as shown below:

What we need to clarify here is that the ability to recover quickly from unexpected shocks is a sign of enterprise risk resilience and robustness. In supply chain management, three interrelated strategies are usually used to enhance resilience:

Visibility: the ability to monitor the supply chain, usually in real time

Supply buffering: expanding multiple supply sources or holding more inventory

Agility: the ability to quickly shift to alternative processes or products

However, the ability of a single company to adjust quickly when faced with shocks may be limited by collective action issues in the industry, including a lack of communication and trust between companies in the supply chain, and the inability to have clear data on upstream situations to achieve agile responses.The US government believes that it has unique problem-solving capabilities by coordinating various parties in the industry chain and acting as a reliable source of information (even if the data involved is very sensitive). Therefore, the government requires chip suppliers to identify their major customers and disclose annual sales data, including the speed at which they fulfill orders. Downstream chip users in the industry chain are also required to provide detailed explanations on how semiconductor shortages are disrupting production.

Note: At present, the US Department of Commerce is calling on companies to voluntarily share data on chip orders and inventory. However, if this strategy does not receive a response, the US government is considering using national security laws to compel various industries to surrender their data.

In my opinion, this matter is very dangerous and sets a bad precedent. This means that the US government can obtain information on who all the chips in the industry chain are sold to, which companies they are sold to, and the detailed situation of each link involving companies from China, Europe, and other countries. If the use of chips was previously used as a way to restrain China broadly, then future actions will be more targeted.

As shown below, Europeans have already seen this clearly:## Why are new car manufacturers so powerful?

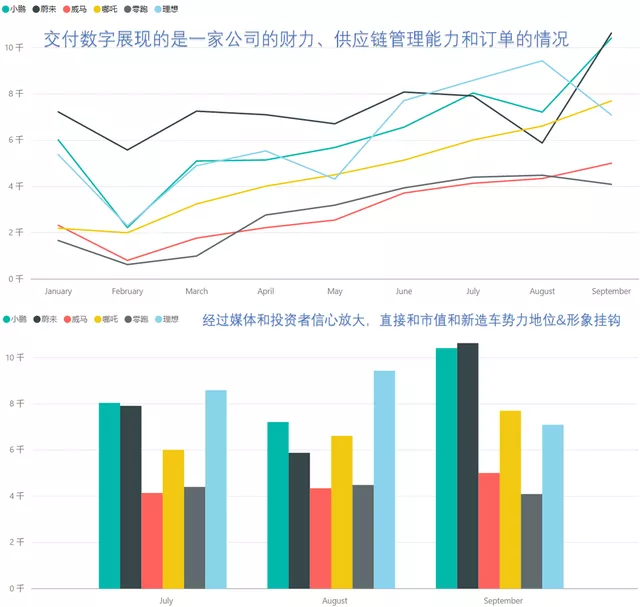

In September, almost all new energy vehicle companies released their sales data, with NIO and Xpeng delivering over 10,000 cars each.

In my personal opinion, this sales data has become a competition. The combined delivery volume of the six major new energy vehicle companies was 44,933 in the previous month and 272,500 units from January to September.

From this, we can still see the impact of chip supply on these companies, and the extent of the impact depends on the OEM’s ability to manage chip scheduling and willingness to bear costs within the supply chain.

1) Ideal Auto’s monthly sales fell compared to the previous month, delivering 7,094 units of Ideal ONE in September, a decrease of 24.8% compared to the previous month. Looking at the third quarter as a whole, the total delivery volume was 25,116 units.2) NIO’s global sales in September broke 10,000, with a total delivery of 10,628 vehicles, including 1,978 ES8s, 5,260 ES6s, and 3,390 EC6s. Among them, the ES6 is the brightest star in NIO’s delivery, with a MoM increase of 124.59%. It can be said that a lot of effort has been put into delivery. From January to September 2021, the cumulative deliveries of NIO totaled 66,396, a YoY increase of 151.7%.

3) XPeng delivered more than 10,000 vehicles for the first time in September (this caused both new forces to break through the 10,000 line at the same time). In September, XPeng delivered 10,412 vehicles, with a MoM increase of 44.33%, among which the P7 became an unquestionable mainstay with 7,512 units, while the younger G3 accounted for 2,900 units. In the third quarter, a total of 25,666 vehicles were delivered, with a cumulative delivery of 56,404 vehicles from January to September, doubling last year’s total.

4) In September, NIO delivered 7,699 vehicles, with a cumulative delivery of 41,427 vehicles from January to September. Leading second-tier competitors, Zero Run delivered 4,095 vehicles in September, with a cumulative delivery of 34,731 vehicles from January to September, while WM Motor delivered 5,005 vehicles in September, with a cumulative delivery of 26,892 vehicles from January to September.

As of now, global automakers have begun to change their supply chain systems and management methods. Simply put, all automakers’ procurement centers go directly to chip manufacturers for centralized management of chip purchases, which is an inevitable trend for the next 2-3 years.

Barra: GM will make’substantial shifts’ in supply chain over chips

“We’re going to make some pretty substantial shifts in our supply chain,” Barra said in an online interview. “We’re already working much deeper into the tiered supply base because generally General Motors doesn’t buy chips (directly) but (our suppliers do). But now we’re building direct relationships with the manufacturers.”And China’s new forces in the automotive industry have also been challenged by chips. However, the total amount is relatively small and a few thousand units can trigger changes in the new forces’ rankings. Being able to set flags such as “Who is the first” and “Who is the first to break 10,000” directly affects media orientation. Meanwhile, it can also amplify investors’ confidence and link market value and the status and image of the new automotive forces. Due to the low demand for chips, yet the ability to raise prices, this further boosts the price of chips.

Note: as long as you are in the new forces, you understand the decision-making mechanism that must be made.

Conclusion: I actually think that the chip crisis will not be relieved until at least mid-2022. The US government can only make the situation worse when interfering. You don’t know what better situation the government can bring to the industry, given its scale. You need to believe that each big player has its own ideas, let alone the strategic tool of chips may further move towards more dangerous usage.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.