The Zero Run C11 was officially launched yesterday with a price range of ¥159,800 to ¥199,800.

This price was announced during the presale at the end of last year and has not been changed.

However, the configurations have been expanded, including front-row double-layer sound-insulating glass, a phone projection function for the copilot, brown interior color scheme, and heated steering wheel, front seat ventilation, rear privacy glass, etc. in the optional package, all of which cost extra.

Zero Run used to call it “surpassing full configuration,” and now it is totally beyond that. With the full config, the C11 is likely to be “the most powerful pure electric SUV under ¥200,000.”

According to the information released by Zero Run, “likely” is a modest description.

Firstly, it adopts a luxury car-level suspension system with a front double wishbone and rear five-link suspension, which is the “top suspension under ¥200,000.” A post by our colleague, Hoo, previously explained why a double wishbone is amazing, pointing out that the suspension is a system engineering, and the structure is only one part. However, it is a foundation. Better than nothing, definitely.

The second crucial factor is the high-power motor. The dual-motor version has a maximum output power of 400 kW, a maximum torque of 720 N·m, and can accelerate from zero to one hundred km/h within four seconds, making it the “acceleration king under ¥200,000”; even the single-motor version still employs the luxurious rear-wheel-drive, establishing a “new standard under ¥200,000.”

Then there is the Leap Pilot 3.0 intelligent driving assistance system, based on 28 sensors, with a dual-chip total computing power of 8.4 TOPS, three to four times better than the MobileyeQ4 chip, and reserving 128 GB of high-precision map storage space for upgrades. It will be online for internal testing by the second quarter of next year.

Last but not least, the C11 has numerous luxurious configurations that are rare or unseen in its class, including frameless doors, front seats with 10-way electric adjustment, ventilation and heating, “the largest NAPPA leather within ¥200,000,” 220V AC power outlet, HIFI-level surround sound system, and a custom 12-speaker digital power amplifier system, plus additional 10 million yuan was spent to fine-tune the sound algorithm by a French team.

All these top-level and king-like factors make other vehicles within ¥200,000 seem like they are squeezing money out of the people without any reasonable purpose, apparently violating advertising laws.

What is particularly impressive is that the LINGPAI cars priced at 150,000 yuan and 190,000 yuan do not have a significant class difference. In general, the coolest configurations only come with the top-end models, while the mid- and low-end models are stripped down and barely considered a car.

The difference between the three models of the C11 is only in three areas: first, the single/dual motor option; second, the lack of a soft green body color for the 150,000-yuan version; and third, the battery size – the low-end version has a 76.6 kWh battery and supports a maximum range of 510 km on the NEDC cycle, while the high-end version has a high-capacity 90-degree battery, which, by the way, has the “highest power in electric vehicles under 200,000 yuan” and supports a maximum range of 610 km on the NEDC cycle.

Everything else is the same across the entire lineup. Even the 150,000-yuan car has 28 sensors and dual chips for OTA assisted driving, without any extra charges. Even optional packages cost only 10,000 yuan across all models.

- Really, I can’t give you any more information, if I do, it might be too sexy.

In LINGPAI’s own words, they are delivering a 500,000-yuan-level experience for less than 200,000 yuan. While this may sound like typical marketing language, the specification sheet backs up their claims.

The outside world has been asking the same question since they first saw the full-option specification sheet: how are they able to offer such a low price?

LINGPAI has also been giving the same answer over and over again: because everything is developed in-house. From high-power motors and autonomous driving chips to the entire vehicle controller, body controller, door controller, Bluetooth key controller, power MCU, battery BMS, ADAS controller, and car dashboard subsystems, all are designed by LINGPAI and Dahua.

For example, almost all of the core chips in the entire ADAS system are domestically sourced, particularly the Lingxing 01 chip, which is a completely domestically-developed AI intelligent driving chip with full intellectual property rights. This means that the company is not held hostage by suppliers and is free to develop its own solutions. On the EV side, it has taken LINGPAI six years to develop oil-cooled EV drives with variable architectures, and in 2022, it will introduce CBC integrated battery solutions, which integrate battery and chassis structure design. As Zhu Jiangming puts it, it will look more like a product rather than a patchwork.

This is a mode created by IT people themselves. Starting from scratch feels difficult, with high barriers and long time frames. However, the advantage may lie in the ultimate cost reduction in the later stages.

This is a mode created by IT people themselves. Starting from scratch feels difficult, with high barriers and long time frames. However, the advantage may lie in the ultimate cost reduction in the later stages.

Innovation for traditional non-luxury brands is nothing new. It mainly involves the following three points: benchmarking against higher-level competitors, downsizing of configuration, and cost control. However, Zero Run does not follow this conventional thinking. The C11 project was probably launched in 2017. At that time, it was uncertain how it would compete with 500,000 yuan models. Even with many unexpected competitors appearing today, the C11 parameters still maintain a significant advantage.

This is because the car is not designed to benchmark against others.

The idea of Zero Run is to determine the market range first. They believe that the market range of 150,000 to 200,000 yuan is about to explode, and they want to become the benchmark in this main market. Rather than defining themselves through the competition, they use the upper limit of the cost to define themselves, which is a very different strategic thinking.

It’s even somewhat uncommercial. So, no matter how hard-core it is, it doesn’t answer our confusion. Is self-researching not costing anything? Is there no amortization? Is this pricing intended to be spread out until the next century?

At the post-conference interview last night, Wu Baojun, the president of Zero Run, explained the issue of gross margin, “First of all, we pursue the best cost performance and let customers have a clear perception. In fact, we believe that the pursuit of stickiness between us and customers is more important for Zero Run now.”

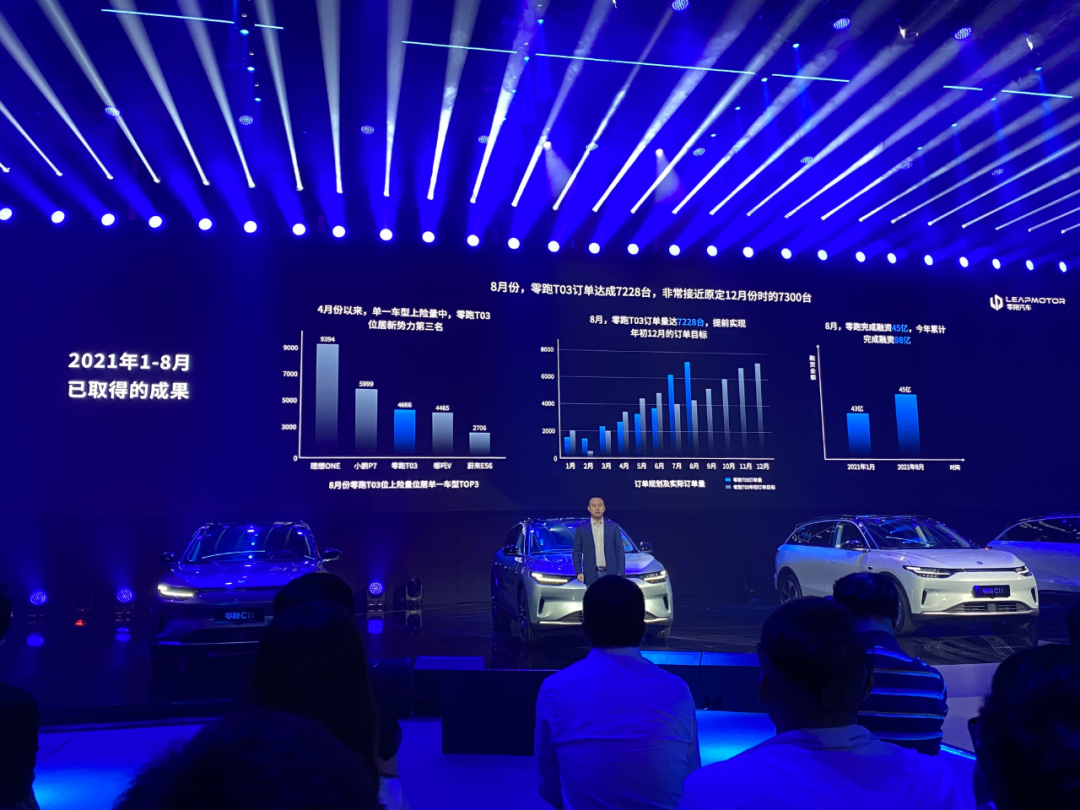

This means to shock sales with low prices first. After all, Zero Run may not lack money in the short term. They just raised 4.5 billion yuan in August.

Speaking of sales, this raises another long-standing question: Is it appropriate to sell Zero Run cars for 150,000 yuan?

Although it has been hyped for a long time, the value of the product itself and whether consumers perceive it as with value are two different things.

In the past two years, Zero Run has indeed gained a good market position and reputation with the T03, and is now firmly established among the top five new forces. Since April, the T03 has been in the top three of new energy vehicle models for insurance coverage. The monthly delivery volume is around 4,500 units. The order volume in August exceeded 7,000 units, a month-on-month growth of 18%.

However, the T03 is a micro-car worth 70,000 yuan. In the industry’s view, although many small cars do not sell well, it is natural for small cars to sell well.

Due to the low unit price and low purchasing threshold, there is even a trend of rapid digestion of micro cars. Meanwhile, the price of cars below 100,000 yuan is mainly in the realm of domestic brands, and there is not much difference in level between the different domestic brands. Major domestic brands may also have some problems. Domestic consumers are more likely to choose to forgive them because of cost-effectiveness, and this is especially true for micro-cars, where there are few outstanding choices.

The 150,000 to 200,000 yuan range is a much tougher mainstream interval. Currently, there is no successful electric vehicle in this segment. Some say that this segment has not yet exploded, but at the same time it means that traditional gasoline vehicles and mainstream gasoline vehicle brands in this price range have an irresistible market appeal, especially well-established joint venture brands, which still have deep-seated beliefs in consumers’ minds.

Starting from the success of the T03, which is similar to a raid, can the small Xiaomi-gun of the Zhidou brand be powerful enough to encroach into the mainstream market? Especially in the Chinese market, starting from the bottom is a very low-probability thing. Because we always have a very bad impression on the first impression.

In the past 20 years, brands that were based on affordable cars found it very difficult to move up later. We can recall classic old brands like Fukang, Qianlima, Sail, etc., which all had a wide popular base, but are now finding it difficult to move up. Independent brands are relatively easier to make a breakthrough, usually achieved through multiple generations of models or a new brand.

This is accompanied by a bad habit of not buying expensive items and only buying cheap ones. We never want to be cheated, but we also believe that there is no good product that is cheap, making it an unsolvable problem.

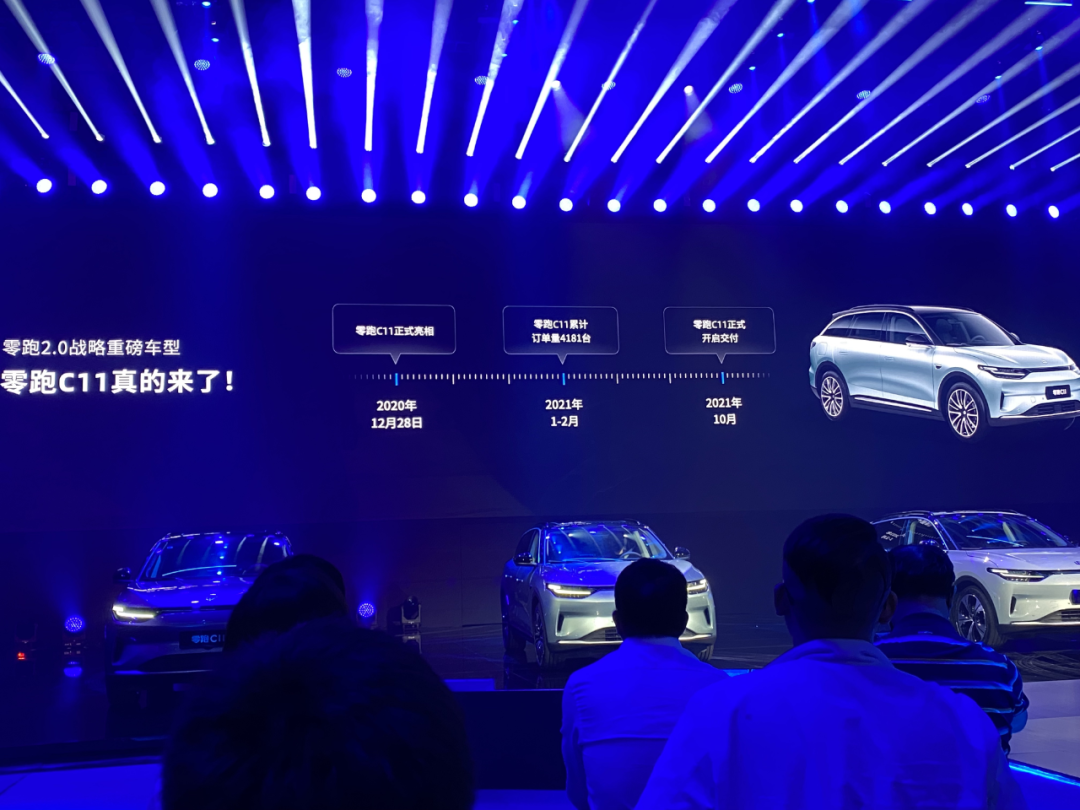

The bottleneck that brands are facing may be reflected in the number of orders. After half a year of presales, as of now, more than 6,000 orders have been received for the C11. This is not bad, but compared with star peers who often have tens of thousands of orders, considering product strength, the C11 is seriously underperforming.

Of the more than 6,000 orders, the vast majority of 4,181 orders were placed in the first two months. This is because of the huge expansion of gold discounts, where a deposit of 20,000 yuan can be used to deduct 40,000 yuan for the vehicle price; the second month can be used to deduct 38,000 yuan; and the third month can be used to deduct 36,000 yuan… and so on. The less discounts offered, the less attractive blind orders become.

We also asked Wu Baojun how he views the “inferior” problem. “I do not think the T03 is inferior,” Wu Baojun said, “the price of the T03 is equivalent to ten thousand dollars, which can already buy many products. We are just in that price range, but the low price does not mean that it is an inferior product. Even for a price of 70,000 yuan, we still provide L2 driving assistance.”

In other words, SMART is also a Mercedes-Benz, and MINI is also a BMW. It depends on who builds it, and how it is built. Zhidou is just affordable, not cheap. You cannot judge a car solely based on its level, just as B-grade movies like horror movies can also produce A-grade directors like Guo Ziren.When it comes to convincing potential customers, there seems to be no easy way for CHJ Automotive, also known as Liangdao (零跑), a new player in the world of electric vehicles. The company’s strategy is to persuade each customer one by one, gaining their trust and commitment to Liangdao’s values. For example, to sell one Liangdao vehicle to a customer, at least four contacts are necessary. The first contact introduces the advantages of electric vehicles, the second highlights the background of Dahua, the third explains what Liangdao is as a brand, and only at the fourth contact is it possible to explain the advantages of Liangdao cars. Only then can the purchase agreement be reached.

To implement this strategy, it is important for Liangdao dealerships to be located in supermarkets. Although this may seem unconventional, it is a necessary approach to maximize customer engagement and increase the company’s exposure. With the changing market position of Liangdao, more large supermarket chains like Wanda are willing to accept Liangdao dealerships. By the end of this year, more than 200 experience stores will be set up in major supermarket chains. With these channels and products, Liangdao’s C11 model aims to reach 5,000 orders by December and 10,000 deliveries by next year.

This ambitious goal is just the beginning for Liangdao, whose long-term plan is to sell 800,000 vehicles annually and surpass Tesla in smart technology within three years. Although not everyone believes in the company’s vision, CHJ’s founder Zhu Jiangming has persevered through doubt and criticism, guided by his belief in the value of his product. And so far, his hard work seems to have paid off, as Liangdao defies expectations and continues to thrive.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.