Author: Sun Xiaoshu

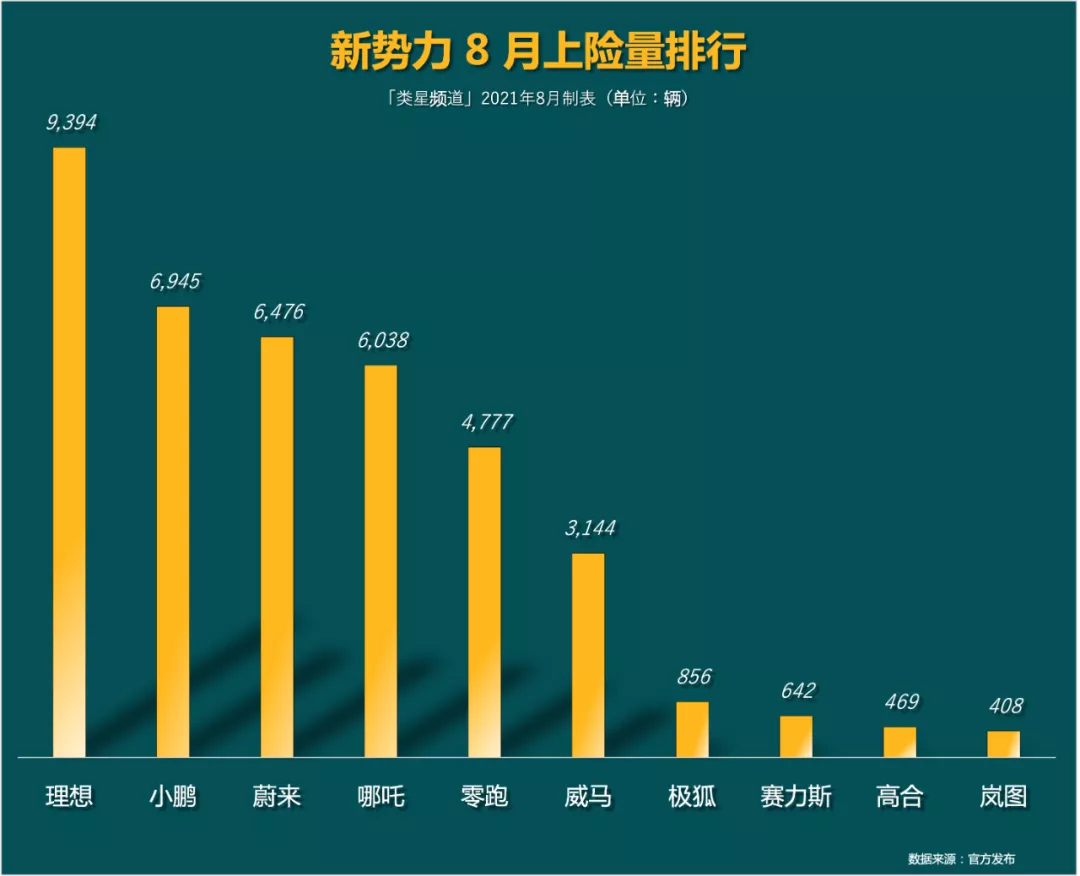

Since the opening of the market-oriented promotion of new energy in 2020, “WEY Xiao Li” has firmly established its position as the top tier of domestic new car manufacturing. However, the final battle of new energy is still ongoing, and the upgrading battle of intelligent driving is also imminent, with opportunities for challengers always available.

Riding on the momentum of the unrelenting trend of intelligent electrification, being a new member of the top tier, no follower is willing to miss the temptation. Liangrun is one of them, and the C11 officially launched on September 28th is an important piece in Liangrun’s entry into the competition.

Surpassing High Configuration

C11 is Liangrun’s third model and the first model of the Liangrun C platform. It is positioned as a medium-sized SUV, with a price of 1.598 million yuan for the luxury version, 1.798 million yuan for the premium version, and 1.998 million yuan for the performance version, with NEDC ranges of 510 km, 610 km, and 550 km respectively.

At a price of less than 200,000 yuan, C11 offers:

- A wheelbase of 2,930 mm (the largest among electric cars below 2 million yuan)

- Front double-wishbone and rear five-link independent suspension

- Two battery packs with capacities of 76.6 kWh and 90 kWh (developed by CATL)

- A self-developed “Heracles” three-in-one oil-cooled motor (performance version)

- Two self-developed Lingxun 01 intelligent driving chips (with a computing power of up to 8.4 TOPS, supporting L2-L3 level automatic driving)

- And the Qualcomm Snapdragon 8155 intelligent cockpit chip:

User-friendly configurations include borderless windows, double-layer glass in the front row, etc.

It can be seen that “surpassing size” and “superior configuration” are the two most prominent labels of Liangrun C11. Regarding the survival of Liangrun C11, “surpassing” and “high configuration” are particularly important.

CEO and founder of Liangrun Motors, Zhu Jiangming, once stated at the Liangrun 2.0 strategy conference that “sales volume will reach 800,000 units by 2025”.

The current T03 and A0-level market are not enough to support the ambition of “2025” of Leapmotor. On the way to expanding towards new horizons, Leapmotor chose to enter the 10-20 million yuan passenger car market with the C11 as their first move. Although this is the largest-scale, it is also the most difficult segment of the electric car market to penetrate, with high risks but also high expected returns. Potential customers in the 10-20 million yuan market are particularly concerned with the practicality and price-performance ratio, so the mileage anxiety and excessive prices of electric cars are a perfect deterrent. The “dumbbell-shaped” structure of the current electric car market objectively reflects this problem. Even Wei Ma, who has been working in this market for a long time, has not been able to free themselves from relying on the B-side market for travel. However, in the process of intelligent electrification, the 10-20 million yuan market is not a monolithic block. It requires manufacturers to combine their deep strategic layout, for example, the P5 of XPeng Motors chooses to use a focus on intelligentization as a differentiation advantage to side step into the market. Leapmotor chooses to directly improve the weaknesses of electric cars and provide higher-end models with super configurations. The C11 is already proven to be effective on the T03. After the MINI EV of Wuling Hongguang successfully mined the potential demand of the A00-level electric car market, the T03 of Leapmotor, with a higher price of 5.99-7.69 million yuan than the MINI EV, provides consumers with a larger four-door electric car and finds a new land in the electric car market. Leapmotor’s cars can confidently rank second among new car manufacturers by surpassing its competitors such as NETA V and Euler Black Cat with their high configurations. After benefiting from the 5-8 million yuan market dividend with the T03, Leapmotor’s natural next move is to replicate the winning key on the C11. The C11 is even more extreme with the addition of user-perceived front double-layer glass, frameless windows, and other configurations.

The current T03 and A0-level market are not enough to support the ambition of “2025” of Leapmotor. On the way to expanding towards new horizons, Leapmotor chose to enter the 10-20 million yuan passenger car market with the C11 as their first move. Although this is the largest-scale, it is also the most difficult segment of the electric car market to penetrate, with high risks but also high expected returns. Potential customers in the 10-20 million yuan market are particularly concerned with the practicality and price-performance ratio, so the mileage anxiety and excessive prices of electric cars are a perfect deterrent. The “dumbbell-shaped” structure of the current electric car market objectively reflects this problem. Even Wei Ma, who has been working in this market for a long time, has not been able to free themselves from relying on the B-side market for travel. However, in the process of intelligent electrification, the 10-20 million yuan market is not a monolithic block. It requires manufacturers to combine their deep strategic layout, for example, the P5 of XPeng Motors chooses to use a focus on intelligentization as a differentiation advantage to side step into the market. Leapmotor chooses to directly improve the weaknesses of electric cars and provide higher-end models with super configurations. The C11 is already proven to be effective on the T03. After the MINI EV of Wuling Hongguang successfully mined the potential demand of the A00-level electric car market, the T03 of Leapmotor, with a higher price of 5.99-7.69 million yuan than the MINI EV, provides consumers with a larger four-door electric car and finds a new land in the electric car market. Leapmotor’s cars can confidently rank second among new car manufacturers by surpassing its competitors such as NETA V and Euler Black Cat with their high configurations. After benefiting from the 5-8 million yuan market dividend with the T03, Leapmotor’s natural next move is to replicate the winning key on the C11. The C11 is even more extreme with the addition of user-perceived front double-layer glass, frameless windows, and other configurations.

Independent R&D

Leapmotor’s “Cross-segment High Configuration” strategy is enabled by its “Independent R&D and Production” system capability.

Leapmotor made a name for itself in the Chinese EV industry with the emergence of T03 in recent years. In fact, Leapmotor was established in Hangzhou as early as 2015 and is basically a contemporary of “We Xiaoli”.

Behind Leapmotor is Zhejiang Dahua Technology Co., Ltd., a global leader in security technology which provides solutions for security, monitoring, and intelligent transportation.

Leapmotor’s co-founder, Zhu Jiangming, also served as the Chief Technical Officer of Dahua, and must have brought the engineering culture of putting technology first at Dahua into Leapmotor.

In fact, unlike other New Energy Vehicle (NEV) manufacturers in China who initially chose suppliers of intelligent driving chips (NIO, Xpeng, and Mobileye for example, whereas XPeng and NVIDIA later switched to independent R&D after accumulating related technology capabilities), Leapmotor started to conduct independent R&D on intelligent driving-related technology from the hardware to the software level in the initial stage.

For example, the ADAS algorithm and intelligent driving system at the software level, the surroundings-view cameras, and the millimeter-wave radar at the hardware level of Leapmotor’s first mass-produced car, the S01, were all independently developed by Leapmotor. The Lingxin 01 equipped on C11 is also co-developed by Leapmotor and Dahua.

As for Leapmotor’s confidence in full-stack independent R&D, Zhu Jiangming has already provided an answer at the press conference of Lingxin 01, “Leapmotor does not need an integrated supplier like Mobileye, I started with this.”

As the world’s second-largest security technology company, Dahua can provide support to Leapmotor in the development of common and underlying algorithms based on its accumulated expertise in image recognition, while Leapmotor can focus more energy on the development of algorithms in specific scenarios.

For a company, independent R&D is of strategic significance. Although the long investment cycle and high costs may cause a shake-up in the early stage, the ability to respond quickly brought by independent R&D can maintain and improve user experience in a timely manner, and explore the development of differentiated experience.

In addition, independent research and development combined with large-scale production can allow users to experience cutting-edge technology at a relatively low cost.

For example, T03 can provide intelligent driving assistance functions that do not belong to this level at a price of 5.99-7.69 million yuan, and provides a 55 kW motor higher than the Great Wall Euler Black Cat (35 kW) and Chery Qimao Ant (30 kW) in the same level. On the C11, it is a self-developed oil-cooled “Heracles” three-in-one motor.

Because it is self-developed, T03 can be equipped with leading products in the same level. Also because of the self-developed oil cooling and three-in-one motor, these advanced technologies can be integrated into an electric vehicle that costs less than 200,000 yuan.

At the same time, Zhu Jiangming has expressed his recognition of Tesla’s “vertical integration” model more than once, so in the eyes of Zero Run, self-developed and self-manufactured is the complete system capability.

At the end of 2020, Zero Run finally obtained production qualifications through the acquisition of XinFuDa Automotive. In July of this year, Zero Run finally welcomed the first T03 off the production line at its own factory in Jinhua, transforming from Changjiang Zero Run to a real Zero Run.

Regarding the Jinhua factory, Zero Run President Wu Baojun said, “The first vehicle off the Jinhua AI factory has a significant milestone in the company’s history. Zero Run, which has officially entered the era of self-production, fills the last piece of the puzzle in production and manufacturing and forms a complete chain of intelligent and autonomous closed loops.”

The planned annual production capacity of the Jinhua factory in the first phase is 50,000 vehicles, and it can be expanded to an annual production capacity of 200,000 vehicles at most. At the same time, Zero Run’s Jinhua factory is equipped with three powertrain workshops and can achieve a maximum production capacity of 200,000 battery packs and 250,000 motors through transformation in the second half of the year.

With the increasingly mature independent research and development and increased power of self-production, Zero Run’s envisioned system capability has taken shape, so the C11 can achieve “higher-level configuration.”

A smooth journey ahead?# Challenges Ahead for Lynk & Co

Lynk & Co has made great progress, but challenges remain. One of the core capabilities of Lynk & Co is the self-developed Lingxian 01 chip. At the press conference, Zhu Jiangming stated that he is most concerned about chips since he can name every employee in the chip R&D department. However, there are still uncertainties around the Lingxian 01 chip.

Due to the similarity between security monitoring and intelligent driving environment perception in image recognition, Lynk & Co can develop intelligent driving chips on top of the existing Big Dipper chip. In fact, the Lingxian 01 chip can be regarded as a specialized upgraded version of Big Dipper’s security chip.

On the other hand, investing heavily in self-developed chips is a huge challenge because of the similarity in the underlying technology. Currently, Big Dipper can offset a portion of the development costs of the Lingxian 01 through its security field. However, it is foreseeable that the investment in automatic driving technology will only continue to rise in the future. Compared to the automotive industry, the security industry is still limited. Therefore, independent growth is the only way for Lynk & Co to move forward.

However, independent growth for a new automaker is a highly challenging project that requires massive capital investment. Capital support is also a critical issue that Lynk & Co, which has not yet gone public, needs to consider seriously.

William Li, CEO of Nio, once said, “If you don’t have 20 billion, don’t even think about building a car.” According to He XPeng, CEO of XPeng Motors, “If it costs 20 billion to get from 0 to 1 in car manufacturing, then at least another 30 billion is needed for research and development, globalization, and organizational structure expansion.”

Therefore, after successfully going public in the United States, Lynk & Co is actively working towards a listing on the Hong Kong Stock Exchange, which will accumulate firepower for the next stage of competition. In contrast, Lynk & Co has raised nearly ¥3 billion and ¥4.3 billion in round A and B respectively.

In July of this year, Lynk & Co raised ¥4.5 billion in Pre-IPO financing, which is very significant. Firstly, it brought Lynk & Co’s total financing to nearly ¥12 billion, which can promote the launch of new car models such as C11. Secondly, the Hangzhou Municipal Government invested ¥3 billion in this round of financing, which means that Lynk & Co has found a powerful ally.

## Conclusion

## Conclusion

Intelligent electrification is entering its best time. In August, the sales of new energy vehicles in China reached 321,000, an increase of 181.9% year-on-year and 18.6% month-on-month. At the same time, new energy vehicles accounted for 18.6% of total sales in August, and pure electric vehicle models accounted for 14.5% of total sales, with an increasing penetration rate.

For automakers who have planned to launch key vehicle models in 2022-2023, this round of industry dividends of intelligent electrification is beckoning to them. Among the second-tier new car makers, only NIO, Leapmotor, and WM Motor seem to have the potential to succeed.

Out of these three, WM Motor seems to have a more complicated situation, while NIO and Leapmotor are in the stage of gaining momentum. Seizing the chance, WM Motor took the lead and launched a fierce attack on the intelligent electric vehicle market with its high-end model C11. This big game of intelligent electric vehicles is becoming more and more interesting. Meanwhile, there are plans for LI to go public in the second half of 2021, with an IPO application to be submitted. However, LI Technology’s co-founder, director, and president, Wu Baojun, revealed that they are still preparing for the IPO and have no clear timetable, and they are open to “other listing plans”. This means that LI may also consider listing on the US or Hong Kong stock markets.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.