Panasonic has released a video called “Evolution of Battery Technology and Manufacturing at Panasonic”, introducing their battery technology roadmap and manufacturing. The video confirms that Panasonic’s next development stage for power batteries will be towards batteries with higher capacity, such as Tesla’s proposed 4680 cylindrical battery with a diameter of 46mm and a height of 80mm. Currently, the development is in progress and Panasonic will invest significant funds in the future. In terms of positive electrode materials, Panasonic is pursuing two paths towards high nickel. For the negative electrode, they are pursuing both low-cost, high-capacity and low-cost, high-power directions. In terms of technical roadmap, Panasonic is continuing to use their own cobalt-free battery, which performs similarly to NCA.

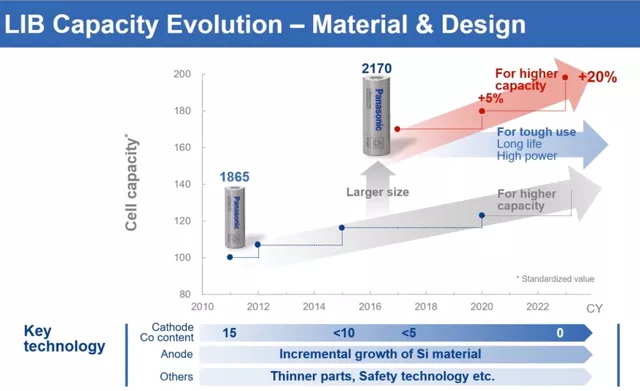

According to the data, Panasonic is still the leader in manufacturing power batteries in terms of quantity. They can produce 5.8 billion cylindrical batteries and 138 million prismatic batteries annually. The data shows a significant increase in the usage of 21700 batteries, catching up with or even surpassing 2170 batteries in 2020.In the MY2021 version, Panasonic upgraded the capacity of its 21700 batteries by 5%, as shown below. In the 2023 plan, there is still room for 20% improvement.

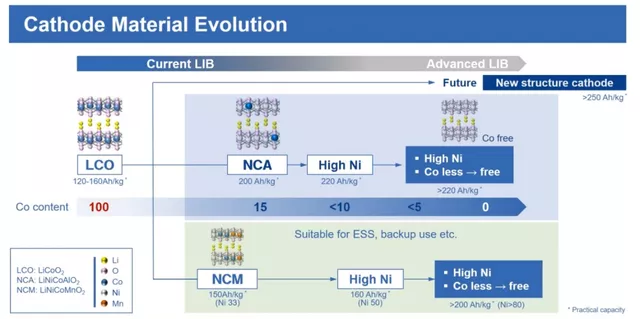

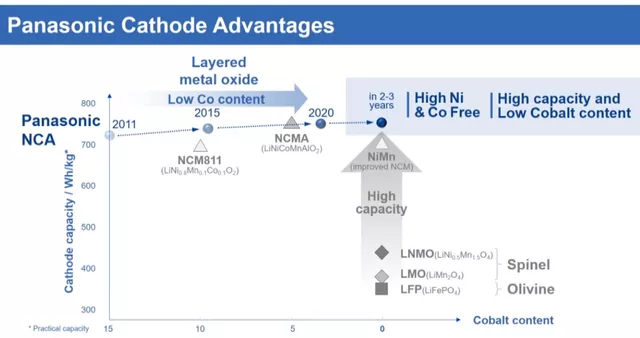

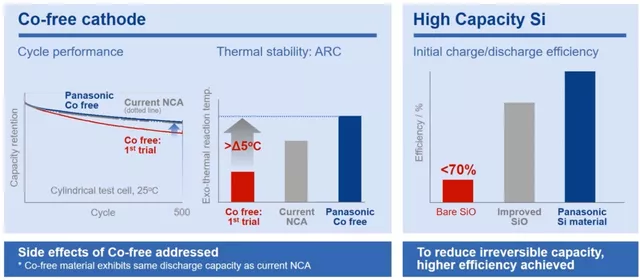

The improvement of battery energy density is not the only goal of Panasonic’s research and development. With the increase in total demand, Panasonic aims to improve the sustainability of power battery materials (reduce the cobalt content in the positive electrode) and reduce costs. Currently, the cobalt content of Panasonic’s NCA battery is less than 5%, and the company is developing a cobalt-free version based on both the existing NCA and NCM routes.

Note: The NCM-based route is suitable for energy storage and UPS applications, and there is a 10% difference in energy density compared with the NCA version.

From the current situation, as the proportion of CATL in Tesla gradually increases, there are differences between the high energy density route insisted by Panasonic and the cost-effective route pursued by Tesla. Therefore, personally, if the true cost of high nickel can be effectively reduced in the future, it can still pose a challenge to lithium iron phosphate.

According to the following statement, Panasonic’s cobalt-free route can come out around 2023. From the positive electrode perspective, it has reached the ceiling in the short term.

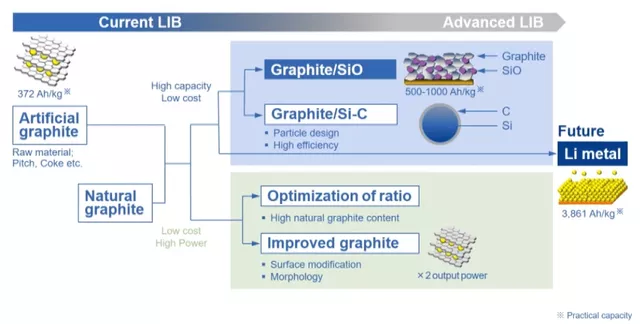

Of course, the next breakthrough direction is to achieve the development of low-cost, high-capacity, and low-cost, high-power negative electrode materials, mainly based on the doping of graphite, including two main products: Silicon/Carbon (Si/C) negative electrode material and Silicon/Oxygen/Carbon (SiO/C) negative electrode material.

Panasonic’s overall technical route is towards the direction of cobalt-free, high-nickel, and silicon-negative electrode.

Panasonic had a highly successful strategy that heavily relied on Tesla in the past. However, with Tesla’s expected cost reduction and demand increase, Panasonic developed a strategy to reduce its dependence on Tesla and focused on its operations in Japan, partnering with Toyota. Despite this, the production volume did not see significant improvement.

Panasonic had a highly successful strategy that heavily relied on Tesla in the past. However, with Tesla’s expected cost reduction and demand increase, Panasonic developed a strategy to reduce its dependence on Tesla and focused on its operations in Japan, partnering with Toyota. Despite this, the production volume did not see significant improvement.

After the new CEO sold off their Tesla stocks and made a profit, Panasonic plans to install equipment for Tesla’s 4860 battery production in Japan during the 2022 fiscal year (April 1, 2021, to the end of March 2022). It is believed that the demand for the 4680 battery will still be significant, considering the upcoming improvements in mileage and pickup truck demands. If this investment is successful, it will effectively increase the supply in the US market and Tesla may once again qualify for the $7,500 subsidy.

In summary, in the short term, lithium iron phosphate may gain a significant market share in China and the global low-end market. However, after the supply of the 4680 battery from 2022 onwards, it will drive the deployment of cylindrical high-nickel batteries in 2023-2024, further improving the product’s flexibility and safety requirements.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.