Translation

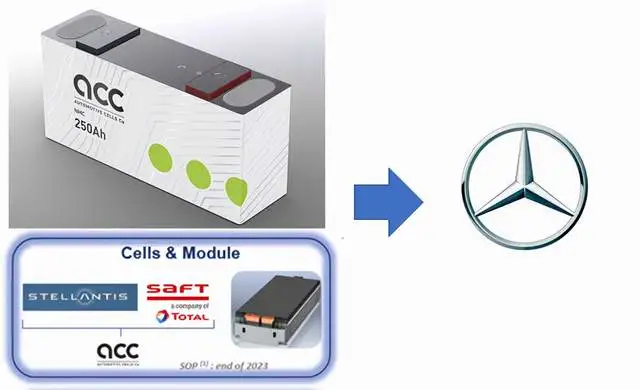

The high penetration rate of electrification and carbon emission policies since 2021 are pressuring European and American car manufacturers to take quick action. After Daimler released its electric vehicle strategy report in July (with 200 GWh and 8 battery factories), the company not only seeks partners to produce battery cells together but also joined ACC, a joint venture between Stellantis and Total, as the third partner in September, obtaining a 1/3 stake.

ACC

The current situation is driving the German and French governments to push their battery enterprises to establish themselves through incentive measures. ACC was established in September 2020 with an original investment target of 5 billion euros to establish two super battery factories with a total annual output of 48 GWh (one in Germany and one in France) by 2030. With Mercedes-Benz joining, ACC has gained confidence and plans to invest more than 7 billion euros, aiming to produce at least 120 GWh of batteries by 2030.

Looking at the timeline, Stellantis originally expected ACC to start mass production by the end of 2023. After this move by Mercedes-Benz, the additional capacity is expected to be reserved for them. It is ultimately a temporary solution for cooperation.

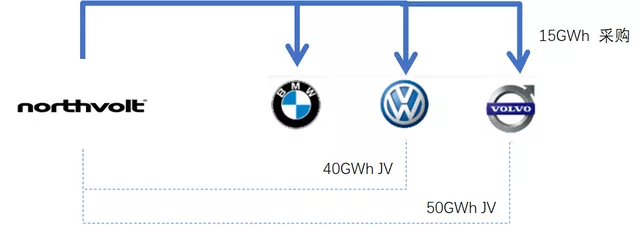

This strategy is similar to what Volkswagen, BMW, and Volvo are doing with Northvolt. As shown in the figure below, European automakers are also working together in this round of electrification. The Northvolt factory began production in 2021 and began delivering to Volkswagen in 2023. Later, Volvo joined and established a joint venture with Northvolt with a future production capacity of 50 GWh per year (Northvolt’s previous factory capacity of 15 GWh was consumed by Volvo’s demand). Coupled with the 2 billion euro battery supply contract signed by Northvolt and BMW, Northvolt has three of the most important customers to support battery production.

Note: I wonder if CATL will claim their patents against Northvolt and ACC. It remains to be seen who will win the global patent competition. China’s leading role hopes to crush Europe’s intellectual property rights.

Europe’s Plan

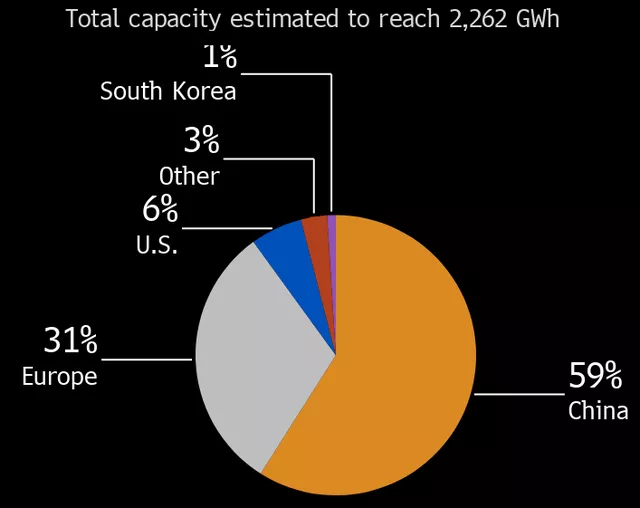

Before Biden’s ZF came out with electric vehicle incentives, Europeans had already started a round of electric power battery promotion —— planning to change their situation by 2030, at least achieve self-sufficiency within Europe, and achieve a 31% global supply range by 2030.

Note: This is estimated to be a global capacity of 2.262TWh, of which 812GWh will be allocated to Europe.

In this plan, it mainly revolves around the quantity that car companies can consume. Of course, there is still a lot of self-talk element here. In my personal opinion, Europe can prevent China’s battery supply chain in a way similar to this round of power shortage, one is to go and find their own mines, the other is to promote European material and process production, then use carbon footprint to trace the battery’s carbon footprint (upstream traceability), and use this as a new generation of trade barriers.

Therefore, as shown in the figure below, we can see that the car companies have already realized that building their own battery supply (by investing and forming joint ventures) is the only way to control raw materials in the future. This has already moved beyond the scope of traditional battery procurement, and there is also a factor of standardizing their own battery cells, which also requires a lever.

Conclusion: Let’s watch and see. I am pessimistic about the direct export of electric vehicles to Europe in the future. This road will definitely be blocked for Tesla or domestic automakers such as MG, XPeng, NIO, and BYD in around 2023-2024.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.