According to an article on WeChat entitled “Electric Drive: The Next Trillion-Dollar Long Slope and Thick Snow Track” excerpted from a China Securities report, it has sparked a lot of discussion. The opening of this article mentions that “the single value of the electric drive system for new energy vehicles exceeds ten thousand yuan, the global market space exceeds trillions of yuan, and it is expected to become the second long slope and thick snow track after the power battery system. The optimization and integration of individual components of the electric drive system is the direction of development, and we are optimistic about the rapid rise of independent third-party electric drive system suppliers.” Can this viewpoint hold water?

My question is: if China Securities is correct, the final outcome of this hypothetical deduction assumes that global car companies will largely not have the advantage of their own powertrain assembly. In other words, global automakers will directly purchase the two most expensive components – electric cores for procurement and consider the entire electric drive assembly as not in-house, invest money into third-party companies for growth, and then make external purchases?

I feel that there is a common model, such as BYD producing electric drive systems and then spinning off Fudi Power to go public separately (similarly, there is also Great Wall’s Honeycomb Power). But can this strongly associated model work and where it will go is currently perhaps in a trial phase.

How to decompose the attributes of the electric drive system

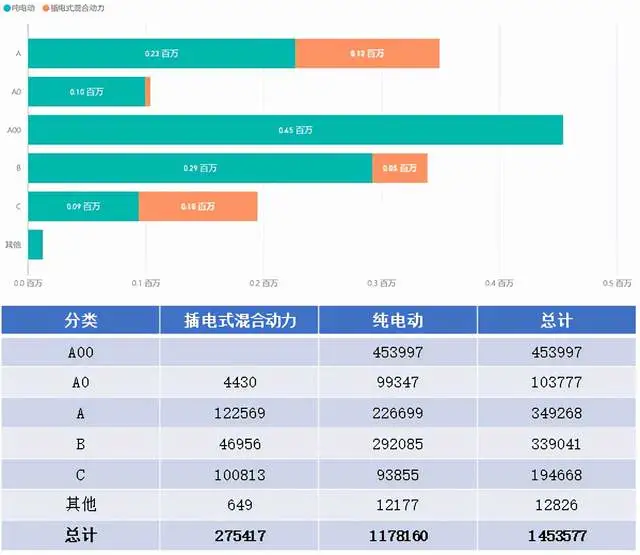

First, let’s look at some data to better understand the complexity of the electric drive system. From January to August 2021, a total of 1.453 million new energy vehicles with plug-in hybrid and pure electric powertrains were insured, which is a basic data point.

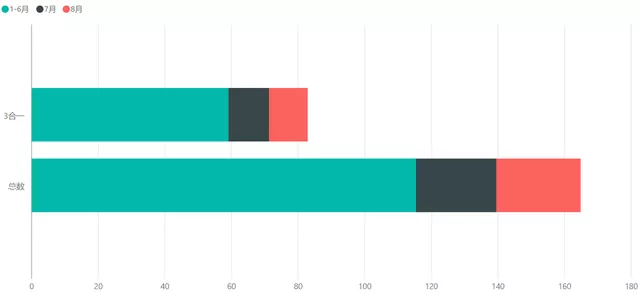

NE Research Institute conducted a three-in-one electric drive statistics. In August, the installed capacity of electric motors for new energy passenger cars reached 253,000 sets, and the installed capacity of three-in-one or above electric drive systems was 116,000 sets, accounting for a 46% share. And this data accumulates the statistics they have done before, the total installed capacity of electric motors is 164.82 sets, which is 113.4% of the insured data, and the overall installation ratio of three-in-one is 50.29%.

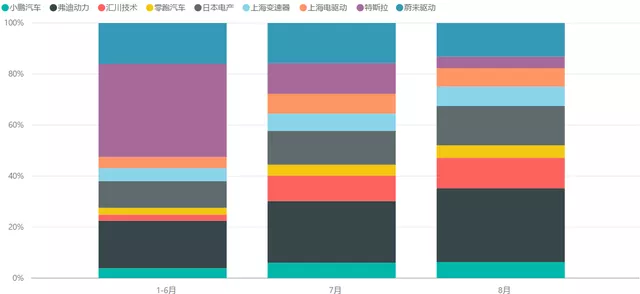

If I further decompose it, we can see that complete vehicle companies represented by Tesla, Nio, SAIC, XPeng, and even Zero Run have a high market share in the three-in-one market.

This is similar to the dismantling done by McKinsey before. While looking at the design from the three-in-one era, it seems that electric drive independence is a trend. However, as we move towards more integration, the electric drivetrain system will integrate more components such as onboard chargers, DC-DC converters, and power distribution units (PDUs), and this integrated design will affect many aspects of manufacturing, making it more suitable for controlled vehicle companies. As the penetration rate continues to increase, the design departments of companies with high integration levels and vehicle companies should have a particularly high degree of association.

This is similar to the dismantling done by McKinsey before. While looking at the design from the three-in-one era, it seems that electric drive independence is a trend. However, as we move towards more integration, the electric drivetrain system will integrate more components such as onboard chargers, DC-DC converters, and power distribution units (PDUs), and this integrated design will affect many aspects of manufacturing, making it more suitable for controlled vehicle companies. As the penetration rate continues to increase, the design departments of companies with high integration levels and vehicle companies should have a particularly high degree of association.

How to view the integration power supplier like Huawei?

In the power field, Huawei has developed an integrated electric drive system, the DriveONE, which directly integrates seven major components including MCU, motor, reducer, DCDC, OBC, PDU, and BCU (battery control unit). On the one hand, it is the deep integration from mechanical components to power components, and on the other hand, it deeply integrates software and background. From my understanding, this approach actually forces the original development of whole vehicle companies and further advances the progress of integration.At this level, due to the integration of things, a control domain of the driving system is naturally formed – fully integrating the overall battery data, electric drive data, charging data, and so on. In my personal opinion, the BYD E3 has also been influenced by this trend, and all car companies are merging the management of the three electric domains. Although it seems like an opportunity for external players to enter with more advanced methods, I think it will actually make car companies build electric drive systems in the same way they build engines.

To put it simply, if Huawei runs through all these things this time, you can also understand that Huawei can complete the entire vehicle and become a parts enterprise that has stepped into the entire vehicle level.

Summary: After thinking about it for a long time, in the A00 and A0 level of low power and low added value, the electric drive system may be outsourced for a long time, and it is not very valuable for car companies to do it themselves. But as the electric drive system is increasingly moving towards the template of combining the gearbox and the engine, I really can’t understand why car companies would hand it over to third-party enterprises instead of doing it themselves, unless NIO (XPT), BYD (Fudi) and Great Wall (Honeycomb) are actually internalized relationships. So is a large part of this trillion-dollar track digested by the valuation of the entire vehicle enterprise? Actually, this is a bit like how much a fuel vehicle enterprise is worth when buying external engines and gearboxes. How much is the value of an entire vehicle enterprise that fully buys electric drive systems and packs and only does automatic driving ecology and cabin?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.