Li Zi from Tiexi District:

The XPeng P5 was launched last night, with a price:

P5 stands for Page 5, and in many novels it refers to the page after the contents and preface, where the story officially begins.

So what story does XPeng P5 want to tell?

-

Story One: The tale of a young shepherd defeating the giant Goliath – the seven-year-old XPeng wants to overturn a century-old tradition of Volkswagen and Toyota family cars;

-

Story Two: The story of redefining products – by mining the needs of home travel scenes, they redefine family car products, aiming to provide RV experiences in the B-class cars;

-

Story Three: The story of disruptive innovation – through electrification and intelligence, they aim to create a product with stronger performance, more functions, and better experience than traditional fuel-based cars, and bring down the upper-level players such as Passat, Camry, and Accord.

These “stories” may seem like tall tales. However, whether the protagonist is XPeng and its P5 or not, such stories are happening.

Facing Passat and Camry head-on

The specific product information about P5 has been released in the last few rounds of preheat exposure, and this article focuses on P5’s market strategy and prospects. If you are in a hurry to see the product information, please scroll down to the third section.

This time, the XPeng P5 can be said to be “going for the top”, directly challenging the two world’s largest carmakers Volkswagen and Toyota’s main fuel-based models – Passat and Camry.

For a newborn like XPeng to challenge older counterparts may seem unusual, but on closer inspection, it is understandable. P5 is targeting the joint venture brand’s core market priced between 150,000 to 200,000 yuan, with representative A+ class sedans such as Sagitar, and compact SUVs such as Rongfu as well as B-class sedans such as Passat and Camry.

P5 says it is directly competing with Passat and Camry, but everyone can see that its price is only half that of them. When facing the Passat, the price overlap is relatively high, as the various regions have more than 10,000, 20,000 terminal discounts. When facing relatively weak B-class cars like the Buick, the degree of price overlap is very high. The Buick has a terminal discount of around 40,000 yuan throughout the country. The pricing of P5 challenges to provide the best cost performance that Camry cannot match. (Japanese brands have always been arrogant and never expand production when demand is high, only enjoying higher prices.)

15.79-22.39 million RMB actually follows the new car manufacturer’s usual strategy of “finding the gap” – similar to the Sonata, which is priced 20,000 RMB lower than other cars in its competition. Furthermore, the pricing for P5, which targets intelligent and EV acceleration, is more like that of an A+ level sedan. Since it differs so much from traditional fuel cars, it doesn’t have true direct competitors. As long as the price is right, consumers of fuel-based sedans and compact SUVs in the A, A+ and B classes might decide to switch to it.

15.79-22.39 million RMB actually follows the new car manufacturer’s usual strategy of “finding the gap” – similar to the Sonata, which is priced 20,000 RMB lower than other cars in its competition. Furthermore, the pricing for P5, which targets intelligent and EV acceleration, is more like that of an A+ level sedan. Since it differs so much from traditional fuel cars, it doesn’t have true direct competitors. As long as the price is right, consumers of fuel-based sedans and compact SUVs in the A, A+ and B classes might decide to switch to it.

So why do we need to consider Passat and Camry as competitors? It’s because they are from the fuel car market. Take another Hyundai car model, the Mingtu, for example. This car was marketed as a B-class car, with B-class cars as its competitors, when in reality it was just priced as an A+ car, aiming for higher value for the money.

New car manufacturers have become very savvy at this, such as with the ES8. NIO has always emphasized its luxury brand, yet its ES8 is 200,000 RMB cheaper than the Q7 of the same class. After building up enough capital, the prices of the ES6 and EC6 finally reached the levels of BBA’s same standards.

If G3 can’t make it, why can P5?

Leaving Tesla aside, all the previously successful examples of new car models were targeting mid-range prices. For example, P7 and the Han entered the 200,000 RMB+ sedan market, which was the joint area of joint venture brands and luxury brands, both without hot selling products. Furthermore, the ONE entered the 330,000 RMB seven-seat SUV market, which is too high-end for luxury brands and too expensive for joint venture brands. The Highlander, with the highest sales among joint ventures, still sold less than 10,000 units. Although joint venture brands such as Passat and Camry have coverage in the 200,000 RMB+ car market, their best-selling vehicle types are priced at just over 200,000 RMB, plus many brands have terminal discounts, which means that the competition in this price range is not so intense. The 150,000-200,000 RMB car market is actually the A+ level car market, a market that joint venture brands also struggle with. Despite Toyota’s strength, the Asia Lion still hasn’t sold over 10,000 units. Although Sagitar has high sales, it has around RMB 20,000 in terminal discounts and technically belongs to the market below 150,000 RMB.

However, it has to be said that the 150,000-200,000 RMB sedan market is not as simple as the 200,000 RMB+ sedan and 330,000 RMB SUV markets. In the 200,000 RMB+ sedan market, joint venture SUVs are also not strong; it’s simply a market for spacious cars. The 330,000 RMB seven-seat SUV market also has C-class, 3-series, and A4L models, but ONE has seven or six seats, which makes it more distinct.## The Complex 150k-200k Market

This market is much more complicated. Not only are there A+ sedans and terminal B-class sedans after discounts, but also the most powerful joint-venture SUVs, which is the high-end market that joint-venture brands attach the most importance to, with fierce competition.

Previously, new carmakers entering the main market of best-selling fuel cars did not achieve outstanding sales, and NIO ES6 and EC6 have a total monthly sales of around 6,000, which is the ceiling of current new carmakers. XPeng has a deep experience in this regard. Although G3 is still half a level cheaper than joint-venture compact SUVs, it sells only a little over a thousand vehicles per month.

If P5 wants to do what G3 hasn’t done, it must have better conditions. There seem to be two conditions currently:

- P7 has outstanding sales, XPeng has accumulated better brand reputation, which is similar to the case of NIO ES6 and EC6. Meanwhile, the market share of domestic new carmakers continues to expand, and the popularity of the “NIO Li” concept is getting higher and higher, so XPeng’s influence is much higher than that of G3 when it was listed.

- P5 accelerates faster. It is not exaggerated to say that the zero to one hundred km/h acceleration time is more than 7 seconds, but compared with fuel cars, the advantage is obvious enough. G3’s zero to one hundred km/h acceleration takes more than 8 seconds, which is much weaker compared to fuel cars.

As for the focal dual-laser radar, it is actually for 200k and more expensive cars.

The Creation of P5

This time, XPeng has launched a total of 6 new car models: 460G, 460E, 550G, 550E, 550P, and 600P. Numbers represent the range, and 460, 550, and 600 mean ranges of 460 km, 550 km, and 600 km, respectively. It does not seem to have any advantage, as some car models have achieved a range of 600 kilometers at a price of 150k.

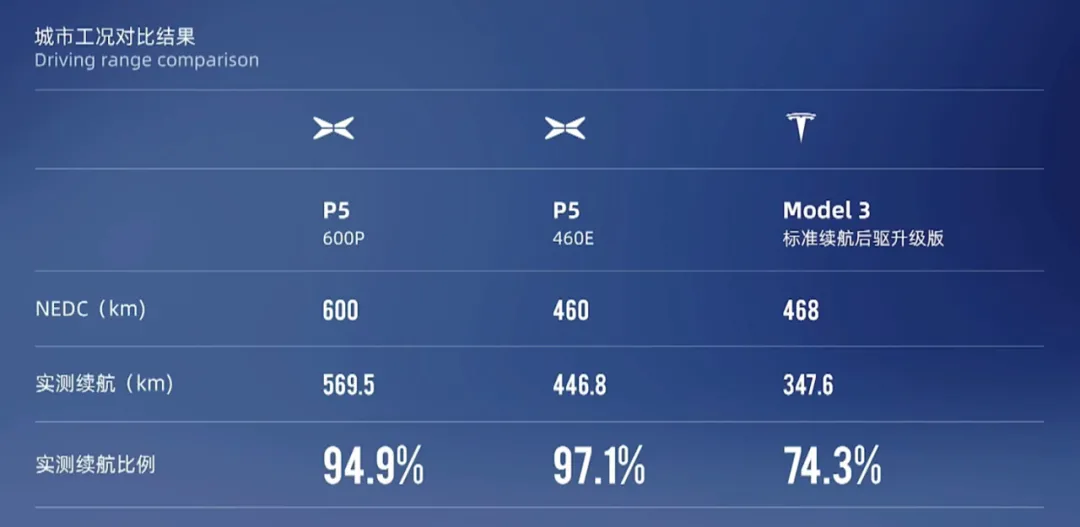

Mr. XPeng seems to have anticipated such questioning, so he presented third-party actual tested range numbers at the press conference to prove that P5’s calibrated range is closer to the actual range.

The letters following the car model names represent the hardware level of intelligent assisted driving. G is the basic version that can only achieve cruise control. E represents hardware support for XPILOT 3.0, which can achieve high-speed intelligent assisted driving (NGP). P represents hardware support for XPILOT 3.5, which can achieve urban intelligent assisted driving (NGP).Two car models with the suffix P are equipped with Lidar, priced at ¥199,900 and ¥233,900 respectively. The cost of purchasing XPILOT 3.5 is ¥45,000 (¥25,000 if purchased before delivery, and customers who pre-order the 600P model can enjoy a half-price discount, which is ¥12,500). The price of purchasing XPILOT 3.0 is ¥36,000 (¥20,000 if purchased before delivery).

In addition, the core selling point of the P5 is its multipurpose space, which is also its most controversial point. Some people think this is a “false demand”, but upon careful consideration, it may not be.

Personally, I have friends who take a nap in their car at noon. Some people will stay in the car for a while when they get home, which is also well-known. Since this is the case, it is necessary for the car to perform better when it plays these roles. After all, in addition to basic needs, all the demands of modern society are created to make ourselves more comfortable.

If we take environmental protection out of the equation, even the production of new cars itself is to create demand. People have been driving non-smart cars for decades, and people have been using non-smart phones for decades. New cars create demand for intelligence, and the P5 creates demand for multipurpose space, which is only natural.

The key is whether it is created well or not, not whether the demand is real or not. In this era of consumerism, any demand can be real.

As for traditional auto giants, the new car forces represented by Wei Xiaoli, who was previously at the helm of the industry, either occupied the high-end market and sold well, but not the core market, or were in the popular price range but had poor sales, so they were not a big threat.

But the challenge that the small Xpeng P5 is facing now is already in the hinterland of traditional auto giants. Facing such a young opponent who is coming to “subvert” and seize power, shouldn’t they pay enough attention?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.