Over the weekend, I plan to spend some time sorting through data from Shanghai. Shanghai is a pioneer in the new energy vehicle boom this year, as demonstrated by last year’s policy restricting driving in the inner circle which ignited Shanghai’s new energy vehicle market. As shown in the chart below, starting in October, both the number of new energy vehicles insured and registered in Shanghai surged to 30,000. This also triggered a continuous hot sales wave for Tesla in China.

What I want to say is that based on the current registration and insurance data, demand in Shanghai is weakening and is moving back towards the 12,000 unit median line before the policy stimulus. In addition, I always believe that there will be restrictions on the issuing of license plates for new energy vehicles in Shanghai.

Note: This year’s new energy vehicles are too hot and everyone is involved. I am not writing this to affect the market. I am just writing my observations.

Interpretation of August’s registration data in Shanghai

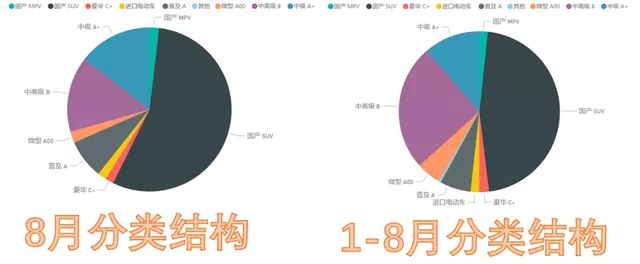

Table 1 is a comparison I made. Last year, Shanghai’s annual registration data was 117,200, while August’s registration data this year was 12,554. From January to August this year, Shanghai has registered 147,000 new energy vehicles, and the total number of registered vehicles in August was 42,595. From the perspective of registration numbers, the penetration rate of new energy vehicles in August in Shanghai was 29.47%, lower than the 34.74% from January to August.

From this trend, Shanghai may have tightened to a certain extent, and there is likely to be a certain degree of decline in new energy vehicle registrations in Q4.

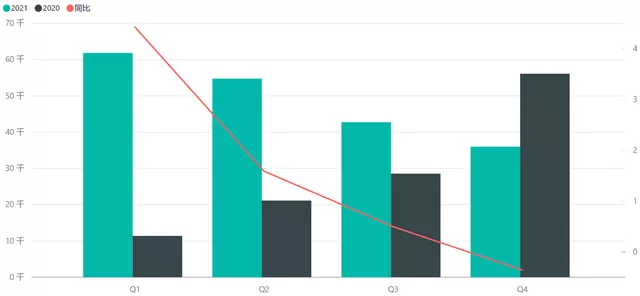

Figure 2 shows the number of new energy vehicles registered in Shanghai in 2021 and 2020. The estimated number of new energy vehicles registered per month in Q3 and Q4 of 2021 is 12,000, which is quite possible. In 2020, data continued to rise due to policy guidance despite the impact of the epidemic. In 2021, demand was squeezed and the number of cars was increased to a level that management did not anticipate. This is a controlled allocation process. I estimate that Shanghai will issue 200,000 new energy vehicle license plates this year, achieving a year-on-year increase of 67%.

Note: Possibly on the basis of 200,000 in 2021, there will be a moderate increase of 10-15% in the future, but there will not be a doubling like in 2020 or such a large increase of 67% like in 2021.

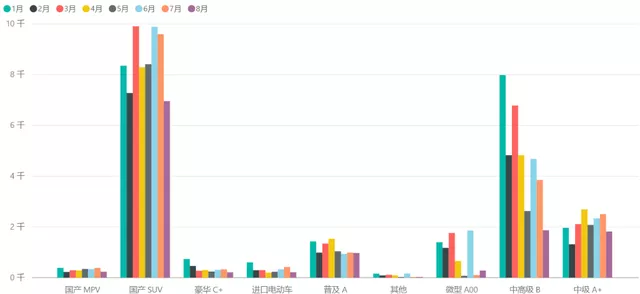

In terms of vehicle types, SUV was the best-selling new energy vehicle in August, with a total of 6,959 units sold. It was followed by mid-to-high-end (B-level) sedans with 1,867 units and A-level sedans with 1,820 units.

The registration amount of Shanghai A00 experienced a significant surge in June, but it was soon constrained. However, there may be a little more leeway for A0. Currently, the market volume of B-level and A-level cars has begun to equalize. This is indeed a reflection of the decline in C-end demand, coupled with the supply of A-level cars to B-end, gradually returning to the normal state of China’s new energy vehicle market before.

I think it is necessary to track the situation in Shanghai, which can serve as a template. The demand of the C-end to some extent emerges with the competition of vehicle models, and is also driven by policies. The impact of policies can be long-term or carry a certain degree of timeliness.

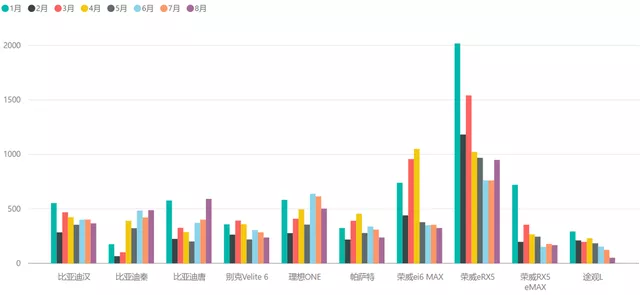

Main vehicle insurance situation of Shanghai in August

Looking at the insurance data, the plug-in hybrid electric vehicles (PHEV) of 2021 were basically stable at around 5.5K, while the newly registered pure electric car data had fluctuated greatly, with Tesla’s data causing significant disturbance.

This is the monthly insurance data of Shanghai’s TOP10 all-electric models, and the cumulative data can help explain the meaning of my “disturbance” statement. I expect that there will also be a significant increase in the amount of pure electric cars registered in September.

“`

“`

The following is the translation of the Chinese Markdown text into English Markdown text, with HTML tags retained:

In summary, I understand that Tesla’s deliveries are relatively late, which has caused significant disturbances to the insurance data in August. The chip shortage has an even greater impact on the entire market, and there is still considerable difficulty in analyzing the market situation.

Additionally, I am curious about the situation in Shanghai for DM-i’s series of models after the license plates are canceled in 2023, considering the low stability of the PHEV market.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.