Author: Nie Yiyao

A mysterious member of SAIC Volkswagen’s ID. family, “Pangtou Yu,” which has been hyped up in the circle of friends for a long time, the ID.3, known as the “king of electric cars” in the European market, has finally arrived.

Not long ago, the ID.3 was officially released at the SAIC Volkswagen booth at the Chengdu Auto Show, announcing its entry into the domestic market. Unlike the ID.4 and ID.6, which are shared by FAW-Volkswagen and SAIC Volkswagen, the ID.3 will only be produced and sold by SAIC Volkswagen in China, so it will not need the suffix X as a distinguishing feature, and will be called the SAIC Volkswagen ID.3 instead.

The reason why the ID.3 is a mysterious member of the SAIC Volkswagen ID. family is due to the following reasons.

Firstly, the ID.3 is the first electric vehicle model built by Volkswagen on its pure electric platform MEB, which is not only of strategic significance but should have been released and put on the market in the domestic market before the ID.4 and ID.6, just like in the European market. However, Volkswagen Group changed its strategy, giving the ID.3 a sense of mystery.

Secondly, just two months after the ID.3 was launched in the European market, in October last year, it sold 10,475 units, winning the title of the “king of electric cars” in the European market. What kind of vehicle is this that can so easily defeat Tesla Model 3 in the European market? The ID.3 is inevitably thought-provoking and more curious to consumers.

With the release of SAIC Volkswagen ID.3 and its expected launch at the end of the year, the mystery of the ID.3 will be gradually unveiled, and its performance in the domestic market will have both suspense and highlights. This is a story for later. For now, for the ID.3, this timing of entering the Chinese market is not too late but just right.

The market is no longer “one size fits all”, and user needs are more diverse

One sign of the maturity of China’s new energy vehicle market is that manufacturers are no longer looking up to Tesla and new forces, and users are no longer treating a small number of brands as the only standard; manufacturers are beginning to innovate and tap into leading aesthetic trends, and users are beginning to focus on personalized consumption expression. A mature market should be rich and diverse in both brands and categories, rather than singular.

Although it has only just begun, with increasing market competition and development, the domestic new energy vehicle market is becoming more vibrant.

The most obvious manifestation of this is when the Wuling Hongguang MINI EV emerged a year ago, breaking the shackles of defining the attributes of pure electric vehicles under the context of “technology” and “intelligence” defined by Tesla. And what was the result? Perhaps no one had anticipated it at the time, but the Wuling Hongguang MINI EV opened up a new market, known as the “people’s commuter car” and the “Wuling girl,” waves upon waves.

Inspired by this, Great Wall Motors quickly mastered the strategy of exploring segmented demand in the field of new energy vehicles, and Euler various “cats” mined female culture and women’s economy thoroughly. Even the new force, XPeng Motors, launched the lovely and hanging XPeng P5.

Today, the domestic new energy vehicle market is becoming more and more promising, with increasingly diverse brands and models, no longer based solely on brand and model size, nor on brand and model singularity. As long as manufacturers can explore segmented areas of the market, create distinctive features for their brands or models, and establish their own labels, they can successfully push a product to market.

Just as there are a plethora of followers for those targeting tech-savvy people, those catering to elite crowds, those specially designed for dads, those that are affordable and practical for ordinary people, and those that are delicate, cute, and unique for women… the list goes on.

The level of tolerance in the market is also rising, as the bias that “traditional carmakers cannot build pure electric cars” is disappearing, as evidenced by the popularity of Wuling Hongguang MINI EV and Great Wall Euler.

The market is no longer “one-size-fits-all,” and the trend of increasingly diverse user needs is favorable for the entry of SAIC Volkswagen ID.3. Compared to ID.4 and ID.6, which entered the domestic market ahead of time, ID.3 has gained more market acceptance and user expectations through time difference.

Individual “Small Car” ID.3, Creating New Choices for Families

ID.3 is the smallest member of the SAIC Volkswagen ID. family (ID.3, ID.4X, ID.6X), and SAIC Volkswagen has positioned the ID. series for family users. However, while ID.4X caters to the travel upgrade needs of young families, and ID.6X is targeted at the family-multi-person travel scenario, ID.3 is more personalized and is a pure electric two-door A-class car that can be suitable for small families, and will also be a favorite of young women.

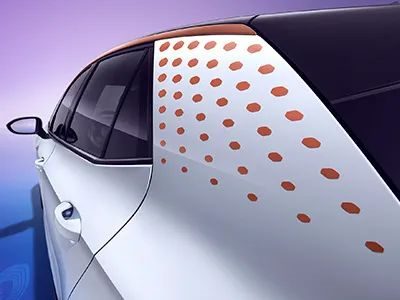

As a result, ID.3 has its own unique features. For example, its appearance is more delicate and cute than ID.4X and ID.6X, with a clean and highly saturated blue-and-white color scheme, together with fierce and cute headlights and starfish petal-shaped wheels. From the tone to the style, it is playful and interesting, with an overall high degree of beauty.

The interior space reflects the advantages of the MEB platform: a long wheelbase with short front and rear overhangs, which makes it about the same length as a Golf, but with a much wider cabin.

The configuration is equipped with a special floating dashboard design, which corresponds to the floating center control screen. The practical and intimate functions include AR-HUD enhanced reality head-up display, IQ.Drive L2 level intelligent auxiliary driving system, etc. The vehicle system does not follow the so-called “more is better” trend, and does not cram a lot of irrelevant applications into it, especially game software.

The configuration is equipped with a special floating dashboard design, which corresponds to the floating center control screen. The practical and intimate functions include AR-HUD enhanced reality head-up display, IQ.Drive L2 level intelligent auxiliary driving system, etc. The vehicle system does not follow the so-called “more is better” trend, and does not cram a lot of irrelevant applications into it, especially game software.

The power battery has two standard sizes of 48 kWh and 62 kWh, with WLTP ranges of 330 km and 420 km respectively. In addition, an optional 82 kWh power battery is available, with a corresponding WLTP range of 550 km. Yes, once again, ID.3 did not follow the so-called long endurance trend, but users are very clear that the endurance range of the ID. series is not exaggerated and is the most accurate.

ID.3 did not follow the zero to one hundred kilometers per hour acceleration trend either. The power of the single motor rear-wheel drive of 125 kW is relatively small, and it takes 6.8 seconds to accelerate from zero to one hundred kilometers per hour. Indeed, it cannot be as fast as 4 seconds or 3 seconds peers. But, why do you need to be that fast? Is it for going on the race track or to have street races at intersections? For a family car, safety and stability are the most important.

The positioning of ID.3 is clear and has its own personality. It does not blindly follow and walks according to its own positioning. This is very Volkswagen, having its own opinions is good.

ID.4X/6X sales continue to grow, benefitting ID.3’s rise

The domestic public opinion environment has always been less optimistic about Volkswagen, the king of fuel vehicles, and its electrification transformation, believing that Volkswagen’s electrification transformation is still somewhat conservative and not thorough enough, and the reaction is also slow.

Especially with the flag set by Volkswagen to “overtake Tesla,” people sneer at it, believing that Volkswagen’s MEB platform models, ID. series, which cost a lot of money to develop, are still like their fuel cars, neither cool in appearance like new forces, nor equipped with intelligent, automatic driving technology like new forces.

Sales are even worse. The sales of the ID. series by Volkswagen in the north and south are always a topic of ridicule for various media outlets. Does the sales of the ID. series by Volkswagen really look that bad? Let’s look at a set of data comparisons first.

SAIC Volkswagen ID.4X was launched in March this year, and the monthly sales have been steadily increasing every month since its launch for five months. Compared with the sales of NIO ES8 and XPeng G3 in the first five months after launch, it is equally impressive. ID.6X was launched on June 17th this year, and achieved sales of 1147 units in July, which is beautiful compared to the start of any new force. It is even better than Tesla’s start back in the day.Tesla launched its first product, the Roadster, in 2008. As of 2012, sales were less than 2,500. After ModelS went into production in 2012, sales for the entire year were only 2,650.

If we put aside our preconceptions, we will find that we cannot simply compare the newly launched Volkswagen ID. series with Tesla and the new forces that have established a solid position and are rapidly developing.

At present, Tesla is like a grown-up who is strong and capable, while Volkswagen ID. is still a young child. It is nonsense to say that a child’s power is far inferior to that of an adult; it is illogical to compare a child’s power with that of an adult.

The most objective comparison is to look at the speed of development of an enterprise or brand, and what heights it can reach at each stage of its development. The achievements of Volkswagen ID. series in the domestic market should be appreciated. The product strength of Volkswagen ID. series is also unique and attractive to consumers.

The addition of ID.3 will further strengthen the ID family of SAIC Volkswagen, forming a “small, medium and large” product pattern of ID.3, ID.4X and ID.6X. This is beneficial to the SAIC Volkswagen ID family to make further efforts and forge ahead in the market. The steady growth of sales of ID.4X and ID.6X also provides a good foundation for ID.3 to enter the market quickly and gain more users, which helps ID.3 rise with momentum.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.