The sales data for European automobiles in August has been released.

Despite the serious shortage of chips, the overall sales of automobiles in major countries in Europe have shown a decline, both month-on-month and year-on-year, but the sales of new energy vehicles remained strong. From the current data, it can also be seen that European car companies are still very committed to entering the era of new energy vehicles.

I have organized some data to analyze with everyone.

Overall sales of new energy vehicles in Europe

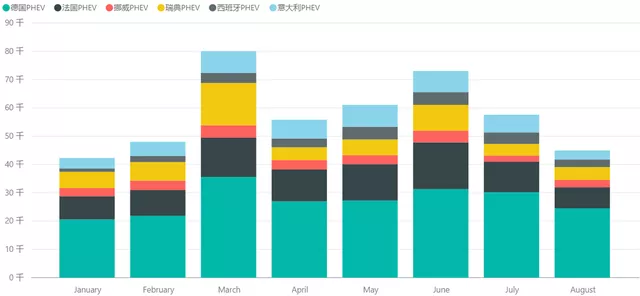

As shown in the following figure, Norway and Sweden have increased month-on-month, with sales of 14,410 and 9,322 respectively. These two sets of data essentially offset the anomalies seen in July, bringing sales back to normal levels.

Germany and France both saw a slight decline, with sales of 53,357 and 17,218 respectively. Italy had a much larger decline, with sales of 6,435, Spain had even fewer sales, with 4,003. Overall, the data for these countries remained similar to that of the previous month, and we look forward to the data in September.

This data for new energy vehicles is relatively precious against the background of a chip shortage in the automobile industry. As shown in the graph below, overall automobile sales in Europe are generally declining. Except for Norway, the main automobile markets in Europe have all experienced a decline of between -15% and -29%, resulting in a new high in the penetration rate of new energy vehicles in Europe. Norway leads the way with a rate of 87.7%, followed by Sweden with 47.1%, Germany with 27.6%, and France with 19.8%. The increase in the penetration rate indicates that the electrification process in Europe is indeed developing rapidly, with only Italy and Spain hovering around 10%.

If we examine Germany’s data separately, we can see the current impact of the shortage of automobile chips in Europe. Germany, the largest market in Europe, is now experiencing a shortage of supply and has fallen to below 200,000, significantly affecting the automobile industry in Europe.

I believe that, similar to the erosion of the Big Three in Detroit during the 2008 financial crisis, the impact of the pandemic and chip crisis in 2020-2021 has broken the original business model of European car companies. In a sense, this round of European car companies’ turn towards electrification was passive and hasty. The nominal increase in the penetration rate of new energy vehicles has strengthened the overall process towards this direction in Europe, but car companies are not really prepared.

Looking at the comparison of BEV and PHEV data in August, overall sales have increased significantly due to the surge in demand in Norway, as shown in the figure below.

However, PHEV sales are still declining and by a considerable margin, as shown in the figure below.

Despite a 20% decline in overall sales, European automakers are doing their best to ensure the supply of new energy vehicles.

Sales figures of different vehicle types in specific countries

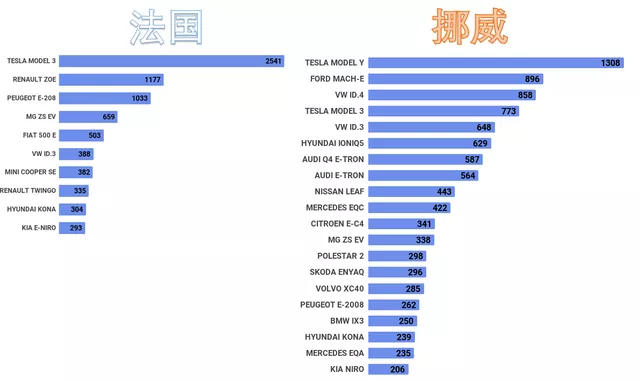

Judging from the data from France and Norway, Model Y and Model 3 exported from China are selling very well:

(1) France

With sales of 2,541 units, Model 3 is currently the best-selling model in the French market. Second place ZOE only sold 1,177 units, and third place E-208 sold 1,033 units. SAIC’s ZS ranked fourth with 659 units and competed with Fiat’s 500e.

(2) Norway

With 1,308 Model Y and 773 Model 3 units sold in August, Tesla delivered more than 2,000 vehicles in Norway that month. This market is also the primary market for Chinese new energy automakers in Europe, although it has not yet been reflected in sales figures.

(3) Germany

Tesla delivered 3,810 vehicles in Germany, another major delivery region for Tesla in Europe.

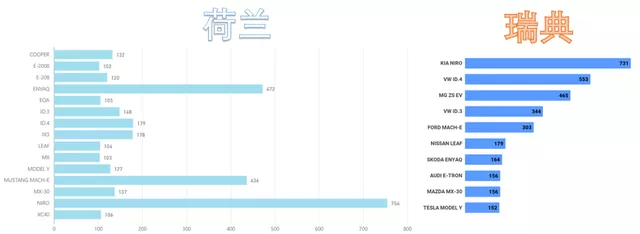

(4) Netherlands and Sweden

As shown in the figure below, Tesla did not choose to concentrate deliveries in the Netherlands and Sweden, so Model Y deliveries in both markets are around 100+, and the best-selling model is Kia’s Niro EV.

Summary: From the data in August, new energy vehicles in Europe can still maintain stability despite the shortage of chips, especially in comparison to traditional vehicles. From this trend, Europe’s automotive industry is indeed undergoing a transformation and integration towards new energy.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.