Introduction:

The combination of high financing and patents represents Ningde Times’ sustainable development strategy for securing its leading position in the power battery industry in the future.

High Financing and Energy Storage Production:

On August 12, Ningde Times announced a new fundraising plan, with a clear announcement that it plans to raise no more than 58.2 billion yuan for lithium-ion battery production and advanced technology research and development and application projects.

There are a total of 6 projects, including the Fuding Times lithium-ion battery production base project, the Guangdong Ruiqing Times lithium-ion battery production project phase I, the Jiangsu Times power and energy storage lithium-ion battery R&D and production project (phase IV), the Ningde Jiaocheng Times lithium-ion power battery production base project (Cheliwan project), the Ningde Times Huxi lithium-ion battery expansion project (phase Ⅱ), and the Ningde Times new energy advanced technology research and development and application project. Including supplemental working capital, the total investment of the Ningde Times project is 69.2 billion yuan, and the planned amount of raised funds is 58.2 billion yuan. In other words, the raised funds contribute 84% of Ningde Times’ investment in new projects.

As of mid-year 2021, Ningde Times had nearly 68.4 billion yuan in monetary funds. A series of operations have enabled Ningde Times to create an abundant capital pool, which can be used abundantly for capacity expansion and technology research and development.

To a large extent, buying power battery stocks is equivalent to buying Ningde Times. Its cash reserves and fundraising capabilities have no rivals in the power battery industry.

Especially given the predicted growth in China’s new energy vehicle market to around 4 million units by 2025, there is limited, yet promising, demand for power batteries. For battery factories, early capacity expansion means predictable economies of scale and early cost reductions. This is a signal of cooperation for host factories that strictly control costs.

Only by grasping the funds daringly can one release their hands. By the middle of this year, Ningde Times’ existing capacity was 65GWh, and there was in-progress capacity expansion of 92.5GWh. Its planned total capacity by 2023 is estimated to be nearly 265GWh, which is conservatively estimated to be almost equal to China’s demand for power batteries in 2025.If there are no unexpected events, the funds and scale of CATL can form a positive cycle, creating a cost gap between OEMs and other battery factories.

Patent Wars

Judging by another development this year, it is obvious that CATL’s strategy against potential competitors is also based on the patent war. Guarding patents is related to the definition of the speaking right of technology that has already been put into production and forward-looking technology in the industry. Whoever sets the rules holds the initiative for future competition.

CATL is best known for two patent lawsuits, respectively, against Tafel and China Aviation Lithium. The patent infringement lawsuit against Tafel is also regarded as the starting point of domestic power battery patent competition and disputes.

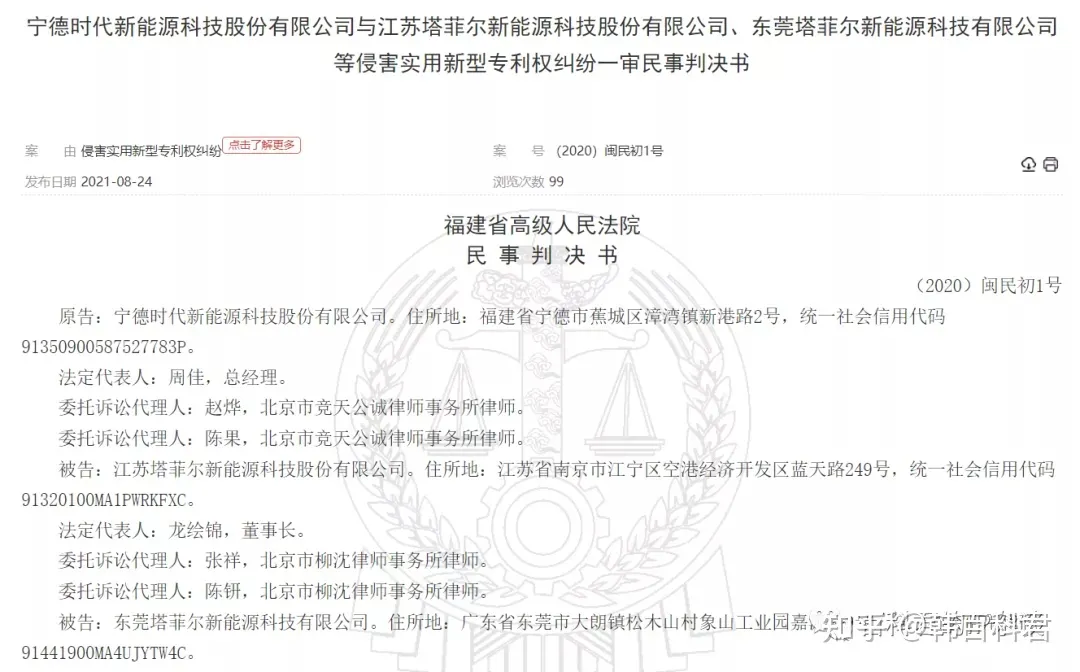

CATL filed the patent infringement lawsuit against Tafel for the explosion-proof valve that balances the internal and external pressures in the charging and discharging process of the balanced battery, which is related to the safety and service life of the battery. On August 26, the judgment of the dispute was published on the website of China’s legal documents: The High People’s Court of Fujian Province recognized that CATL’s utility model patent for the “explosion-proof device” referred to in the indictment is currently valid. Without the permission of the patent owner, both Tafel companies jointly produced and sold infringing products falling within the scope of the patented protection, jointly infringing CATL’s patent rights, and finally, the court ruled that the two Tafel companies shall pay CATL a total of about RMB 23.3 million in various fees.

A month before the judgment against Tafel became effective, CATL officially sued China Aviation Lithium. There is currently no detailed information showing what products and patents are suspected of infringement, but it is understood that the products involved in this lawsuit cover “all products” of China Aviation Lithium.

Many speculate that China Aviation Lithium was sued because of its competition for CATL’s customers. Geely Aien’s battery cells are mostly tilted toward China Aviation Lithium, while some of the supporting cells for JAC and Changan are also given to China Aviation Lithium.

CATL’s customer base and order volume, which are far beyond those of other battery factories, have been talked about and viewed as a legend. But for OEMs, they will support other battery factories in consideration of delivery timeliness and stability, which is why we can see that Volkswagen and Guoxuan High-Tech, Daimler and Funeng, Toyota and Panasonic… have all formed new partnerships. Perhaps all of this makes CATL feel uneasy.

No matter how the story goes, the patent war is not a bad thing. Core technologies that are acquired at great cost should be protected by the market. Taking a copy-only attitude can only lead to disorder and chaos, while competition will stimulate innovation.The competition of cost and scale, as well as technological competition, run through the development and maturation process of an industry. In this fierce and uncompromising competition, the proactive ones always have the upper hand over the reactive ones.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.