Before the end of August, I would like to summarize and share the status of non-plug-in hybrid electric vehicles (HEVs) in China based on retail data from 1-7 months.

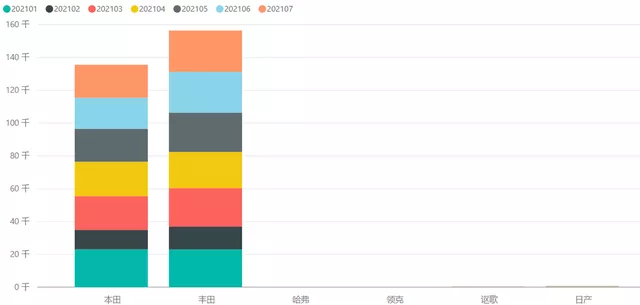

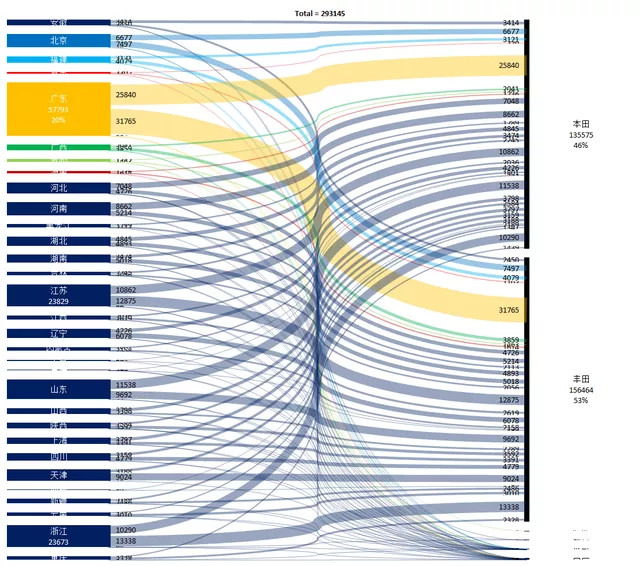

The driving force behind the promotion of hybrid products is the voluntary replacement process of manufacturers for their own fuel vehicles, so it shows strong planning. Currently, Toyota and Honda, the two most determined enterprises, have made good progress, and the retail volume of hybrid vehicles from 1-7 months under their leadership is 293,100.

The next increment of hybrids mainly depends on Nissan. For other brands, it remains to be seen whether Great Wall’s hybrid strategy on the Wey brand is effective; and Lynk & Co’s hybrid strategy seems intermittent and not very determined, which is related to the status of their PHEV.

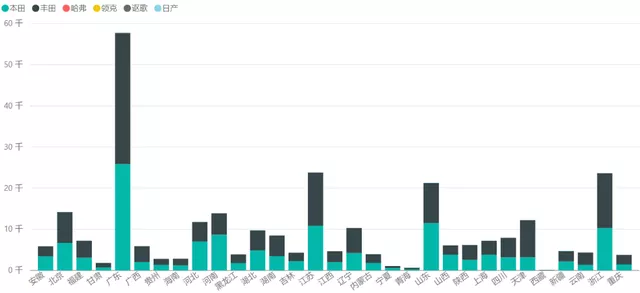

From a regional perspective, hybrids do not have a particularly large advantage in restricted cities, but are closely related to the distribution of Japanese brands in China (brand preference).

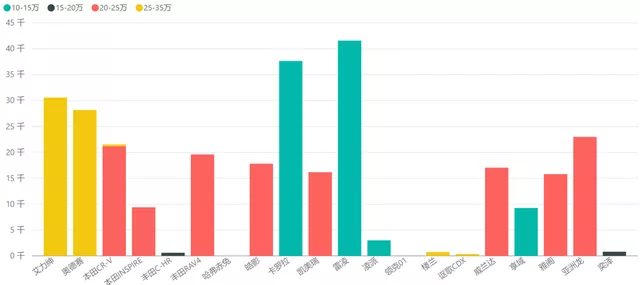

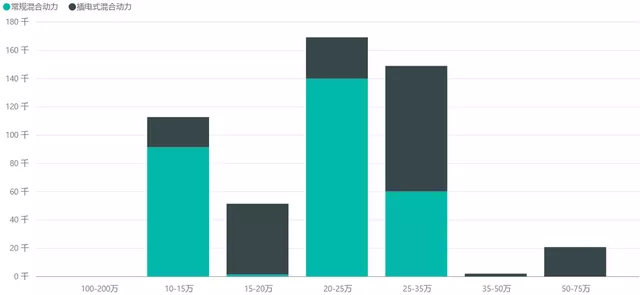

The strategy for selling hybrids is not that consumers choose this type of car for its fuel efficiency, which balances economic benefits, but more like a built-in attribute in the power configuration. Looking at the price range, the sales volume of hybrids priced between 100,000-250,000 RMB is 91,500, and for those priced between 150,000-200,000 RMB it is 1,399, for those priced between 200,000-250,000 RMB it is currently the major sales force with 140,000, and for those priced between 250,000-350,000 RMB it is 60,200. In terms of the development direction of hybrids, after the subsidy is reduced, the battery may be adjusted freely from 0.5 kWh to 2 kWh, then configured upwards to 10 kWh.

Next, let’s take a look at the specific data and some of my own thoughts.

Sales distribution of hybrids in China

(1) Brands

Honda (135,500, accounting for 46%) and Toyota (156,400, accounting for 53%) are still the most successful brands in promoting hybrid technology, which has been the case since 2016. Purely from the perspective of the recognition of hybrids themselves, it is difficult for other brands to have a chance to bring themselves the hybrid gene in this market.

Looking at this year’s expectations, chip shortages will also cause supply problems for hybrids. Based on the current number of over 41,800 per month, it is estimated that it will slow down later, and the annual expectation will be about 450,000, which is less than the previously predicted 500,000.

(2) Price distributionThe only brand that can truly offer cars in the price range of 100,000-150,000 RMB is Toyota, which makes up about half of its total sales. The remaining cars are priced mainly between 200,000 and 250,000 RMB. Honda’s main price range is between 200,000 and 350,000 RMB. Therefore, the strategies of the two Japanese companies are different. Honda is focusing on hybrid technology in large cars to bring these cars up to compliance, which means that their fuel consumption is not particularly good without new energy subsidies. On the other hand, Toyota is able to produce hybrids in small cars and has sustainable means of operation in the field of electric vehicles for the next 5-10 years, so they have not been particularly anxious in this sector.

The Corolla and Ralink priced between 100,000 and 150,000 RMB are still very stable in the market. Honda’s Elysion and Odyssey are focusing on the large car hybrid strategy, which means they can sustain a longer lifespan under fuel consumption limits compared to SGM’s GL8. Japanese car companies aim to gradually increase the proportion of hybrid cars for their cars priced between 200,000-250,000 RMB, indicating they are taking a gradual approach.

Current data shows that hybrid technology depends on the supply model and allows for hybrid configurations to be found mixed in with gasoline vehicles.

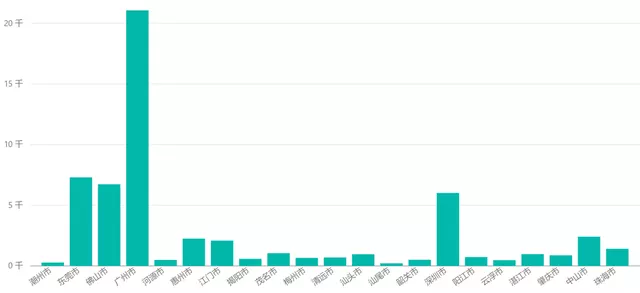

(3) Regional distribution

From a regional perspective, hybrids do not have particularly strong regional preferences. The Guangdong region, which favors Japanese cars, accounts for a very large proportion, indicating that HEVs are distributed in accordance with the supply of fuel vehicles.

From a city-level perspective, there is no particularly high penetration rate in the largest demand area, Guangdong, which can be interpreted as consumers seeing no difference between buying gasoline and hybrid cars.

Development Direction of Hybrids

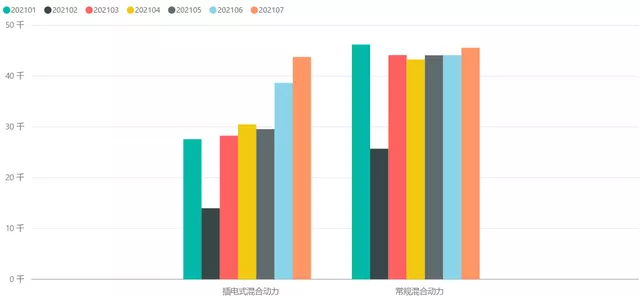

I have pulled out the time and price ranges for HEVs and PHEVs for everyone to take a look at.

Especially when I compare the vehicle data of HEV and PHEV by price range, it reflects the problem more accurately.

Conclusion: Currently, in terms of popular models, the sales strategies for PHEV and hybrids are not the same. The route for PHEVs to extend their range is the way to break through. The route for hybrids around fuel consumption may not necessarily work out. Currently, only by relying on higher cruising range and pure electric driving experience, can users’ usage habits transition to pure electric use of PHEV/EREV, and have sustained value.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.