Performance of CATL in H1 2021 beyond expectation

On August 25, CATL (300750.SZ) released its H1 2021 financial report, revealing that the company achieved revenue of RMB 44.075 billion, a YoY growth of 134.1%, net profit attributable to shareholders of RMB 4.484 billion, a YoY growth of 131.4%, and adjusted net profit attributable to shareholders of RMB 3.918 billion, a YoY growth of 184.6%. The net cash flow from operating activities was RMB 25.742 billion, a YoY growth of 341.8%.

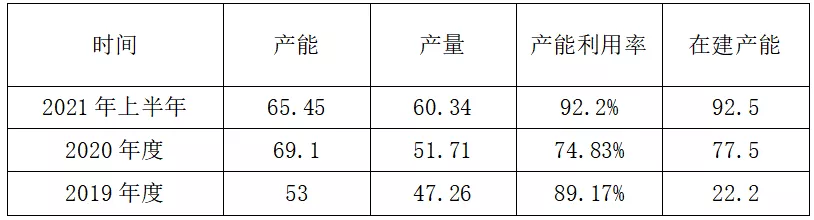

CATL’s overseas and energy storage businesses grew rapidly, and its production capacity not only expanded dramatically but also accelerated in terms of its construction speed. According to the report, the production capacity in H1 2021 was 65.45 GWh, while the total planned production capacity is between 600-650 GWh, which is expected to be achieved within 5 years. This means that the capacity will expand by about 500% in the next 5 years. To support this expansion, CATL has initiated a fundraising plan of RMB 58.2 billion, significantly higher than the valuation of many other battery companies.

In terms of profitability, CATL’s gross profit margin remained stable, at 27.2% in Q2 2021, a slight decrease of 1.8 percentage points YoY, but remained stable QoQ. This indicates that the company has strong economies of scale, bargaining power, and cost control capabilities.

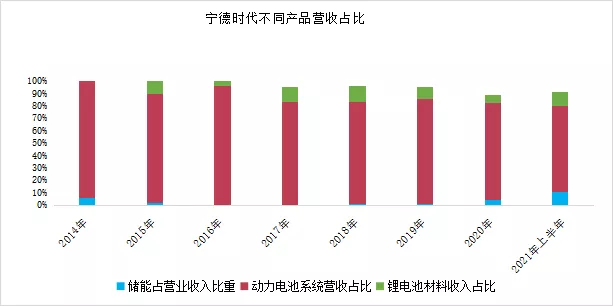

Specifically, in H1 2021, sales revenue of CATL’s power battery systems was RMB 30.451 billion, a YoY growth of 125.94%; sales revenue from lithium battery materials was RMB 4.986 billion, a YoY growth of 303.89%; and sales revenue of energy storage systems was RMB 4.693 billion, a YoY growth of 727.36%. It’s evident that CATL’s energy storage business has achieved significant growth.

CATL achieved 92% of its production capacity utilization rate in H1 2021, indicating strong market demand.

China’s new energy vehicle penetration rate has reached 10% from January to July 2021. According to historical rules, after this inflection point, the growth of new energy vehicles will turn from linear to exponential. At the same time, the revolution to replace fossil energy with clean energy, such as wind power and photovoltaic, is accelerating. However, the instability of renewable energy generation has created huge potential for energy storage in the market.According to GGII data, the global shipments of energy storage lithium-ion batteries reached 27GWh in 2020, a year-on-year increase of 58.8%. China’s energy storage lithium-ion battery shipments reached 16.2GWh, a year-on-year increase of 70.5%.

In July 2021, the National Development and Reform Commission and the National Energy Administration issued the “Guidance on Accelerating the Development of New Energy Storage”, proposing to achieve a new energy storage installed capacity of more than 30 million kilowatts by 2025. Lithium-ion battery energy storage will usher in a period of high growth.

The proportion of Ningde Times’ energy storage business is rapidly increasing. As of June 2021, the revenue share of Ningde Times’ energy storage business has exceeded 10%.

Therefore, whether it is to maintain gross profit margin levels or consolidate its leading position, Ningde Times’ expansion in both power battery and energy storage battery fields is imperative.

Private placement fundraising scheme may be the best option

Expansion is certain, but the source of funds for expansion can be chosen: either using its own funds or financing.

Currently, the price of a single GWh battery equipment is around CNY 200 million. In the first half of 2021, Ningde Times’ net profit attributable to shareholders was CNY 4.484 billion, which is only enough to build a production capacity of around 22GWh if invested entirely.

The planned production capacity under construction already reached 22.2GWh in 2019.

After 2019, Ningde Times’ planned production capacity has increased sharply year by year. By the first half of 2021, its planned production capacity under construction had increased to 92.5GWh.

Overall, Ningde Times already has eight major wholly-owned production bases, including Ningde Zhangwan area (Dongqiao/Hudong/Huxi), Ningde Cheliwan, Ningde Fuding, Liyang base, Sichuan base, Qinghai base, German factory, and Zhaoqing, with a total planned capacity exceeding 500GWh. Considering the current joint venture production capacity, Ningde Times’ planned production capacity is between 600GWh and 650GWh.

Such a large-scale expansion cannot be supported by its own funds alone, so external financing is necessary.

However, Ningde Times’ asset-liability ratio reached 58.84% at the end of the first quarter of 2021, and in the second quarter, it had risen to 63.67%, which is not a low debt ratio in the manufacturing field.

To reduce its asset-liability ratio, equity financing has become the best option for Ningde Times’ production capacity expansion.

Ningde Times’ production capacity (unit: GWh)

On August 12th, CATL (Contemporary Amperex Technology) announced a 58.2 billion yuan private placement project (some projects have already been announced previously) to increase the company’s net asset value, reduce the asset-liability ratio, improve the capital structure, and enhance financial stability.

On August 12th, CATL (Contemporary Amperex Technology) announced a 58.2 billion yuan private placement project (some projects have already been announced previously) to increase the company’s net asset value, reduce the asset-liability ratio, improve the capital structure, and enhance financial stability.

By choosing targeted financing, CATL can obtain a higher amount of financing with minimal equity dilution. Based on the market value as of August 26th, the 58.2 billion yuan placement accounts for less than 5% of the total market value.

Drive the development of the upstream and downstream industry chain

The equipment suppliers are the first to benefit from such large-scale financing.

According to GGII statistics, since October 2020, CATL has accumulated over 16 billion yuan in lithium battery equipment orders.

After this private placement, CATL’s demand for equipment continues to grow. The total investment in the five projects from the private placement is approximately 29.7 billion yuan. This means that more than ten equipment companies such as Pulead Technology and Keheng Technology will benefit from it.

Next, companies in the upstream industry chain will benefit.

From the material side, according to GGII data, the nearly 14GWh of new production capacity from CATL corresponds to a new demand of about 100,000 tons of lithium, which is equivalent to 20% of the global lithium consumption in 2021. The usage of ternary cathode material exceeds 200,000 tons, and the usage of lithium iron phosphate reaches 350,000 tons. The corresponding demand for lithium copper foil reaches 80,000 tons.

Related structural component suppliers such as Keda Lixun and cathode suppliers such as Capchem will also benefit. Negative electrode suppliers such as Pulead and China Baoan (BTR) and diaphragm suppliers such as UBE Group will benefit. Electrolyte suppliers such as Tankeblue, Xingzhongbao, Yongtai Technology and SDSH will also benefit.

It can be foreseen that under the circumstances of large-scale expansion, the relationships between CATL and upstream and downstream companies will be further linked, and a safe and stable supply chain has become the top priority to ensure its stable development.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.