Delivery Progress with Financial Support

The autumn breeze has gradually begun, and it’s the favorite season for some people.

During the period from XPeng’s announcement of the Q2 2021 financial report to the end of the conference call for this quarter, Beijing happened to experience a rainfall. Besides making the sky clear and transparent before sunset, it also brought us the long-lost comfort and coolness of the evening.

I have often heard that autumn is the harvest season, especially for those who have already exceeded their tasks in the first half of the year. It seems that it’s time to settle down comfortably.

In the midst of this lazy and peaceful atmosphere, XPeng dropped an emoji in the group chat.

It reads: “The Horizon is Expanding.”

During this quarter, we witnessed XPeng’s listing on the Hong Kong Stock Exchange. With the strong financial support, XPeng also presented new products such as G3i and P5 in this quarter. These have brought out the following data results in the financial report:

-

The total revenue in Q2 2021 was RMB 3,761.3 million ($582.5 million), a rise of 536.7% from RMB 590.8 million in the same period of 2020, and a rise of 27.5% from RMB 2,950.9 million in Q1 2021.

-

The automobile sales revenue in Q2 2021 was RMB 3,584.4 million ($555.1 million), a rise of 562.4% from RMB 541.1 million in the same period of 2020, and a rise of 27.5% from RMB 2,810.3 million in Q1 2021.

-

The gross profit margin in Q2 2021 was 11.9%, compared to negative 2.7% in the same period of 2020 and 11.2% in Q1 2021.

-

The automobile gross profit margin (i.e., the percentage of gross profit from automobile sales revenue) in Q2 2021 was 11.0%, compared to negative 5.6% in the same period of 2020 and 10.1% in Q1 2021.

A good financial support and a strong sales/delivery performance on the product end are interdependent. Apart from the delivery volume setting a new record repeatedly in a single month during this quarter, XPeng’s data ratio also reflects two characteristics compared to its competitors: a high proportion of high-end models and a high rate of software function selection, among which:- In Q2 2021, the car delivery volume reached a new quarterly high of 17,398 units, up 439% from the same period in 2020 with 3,228 units, and up 30.4% from Q1 2021 with 13,340 units.

-

In Q2 2021, the delivery volume of P7 reached a new quarterly high of 11,522 units, up 44.5% from Q1 2021 with 7,974 units.

-

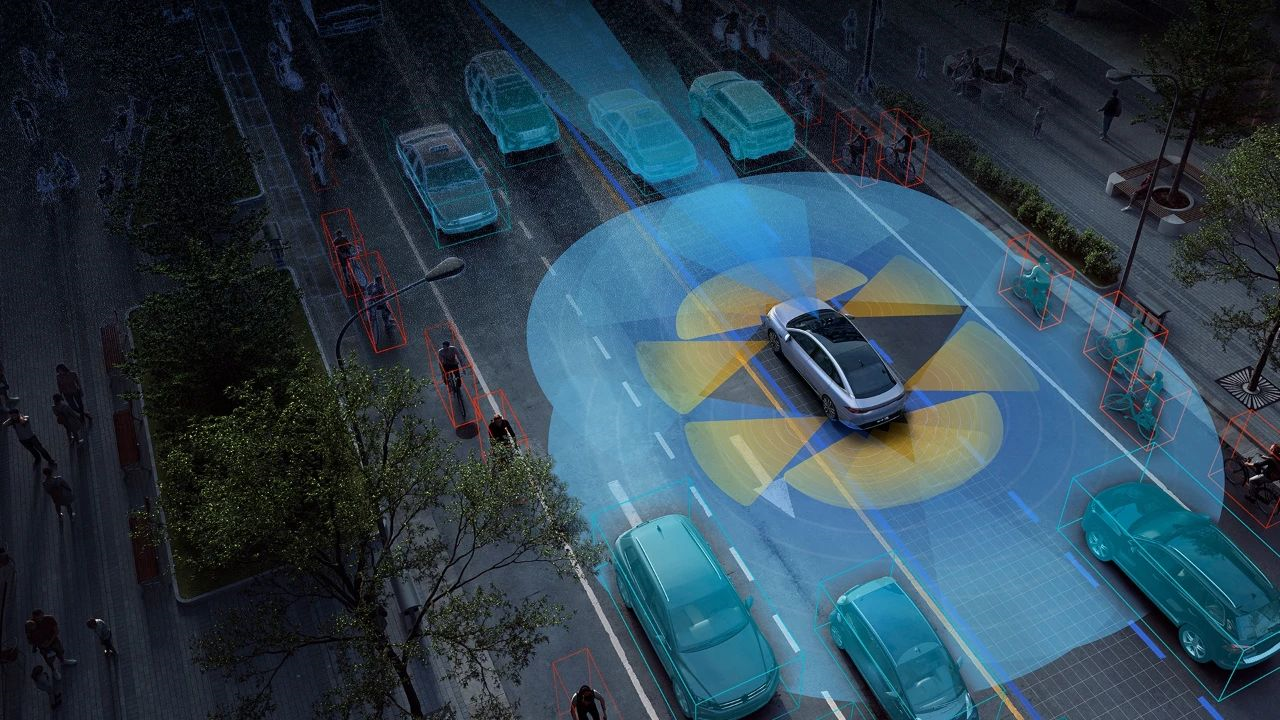

Among the total delivered P7 vehicles in Q2 2021, 97% were equipped with XPILOT 2.5 or 3.0.

-

NGP penetration rate exceeded 60%, and the average monthly usage rate of NGP exceeded 65% in Q2 2021.

2-3 new vehicle models will be launched every year from 2023 onwards.

If creating a new car is like a challenging test paper, then XPENG’s decision at today’s financial report conference is like waving their hand to the teacher in charge and saying, “I want to add two more bonus questions.”

Previously, Xpeng had been building its product line by strictly following the strategy of launching one new vehicle every year. However, at today’s financial report conference, He XPeng doubled that goal:

XPENG PLANS TO LAUNCH AT LEAST 2-3 NEW VEHICLE MODELS EVERY YEAR FROM 2023 ONWARDS.

He XPeng made this decision based on the current phenomenon of strong supply and demand in the intelligent automobile market.

In June of this year, the penetration rate of pure electric cars in China exceeded 10%, indicating that smart cars began to make an impact on the mainstream market.

Representatively, in July, Xpeng delivered more P7 vehicles than Audi A4. More and more traditional car consumers are starting to show interest in intelligence, especially in true high-level assisted driving.

Compared to the past when intelligent automobiles relied on stellar models for quick success, Xpeng predicts that electric vehicles in the 150,000-400,000 RMB range will have significant market share growth.

Therefore, Xpeng has also taken the opportunity to adjust its product range. In the coming years, the Xpeng brand will expand from mainly building cars priced between 150,000-300,000 RMB to 150,000-400,000 RMB, which means that more car models need to be added to the product line.A year ago, at this time, XPeng’s Zhaoqing factory had just started production of the P7. But now, P7, P5, and G3i are all in full production. According to official data from XPeng, they have started to produce in two shifts per day since August, and will break through a monthly peak of 15,000 vehicles in the fourth quarter of this year.

This means that XPeng’s production capacity is also increasing. On August 18th, the second phase of expansion of the Zhaoqing factory was launched, and the annual production capacity will reach 200,000 vehicles in the first half of next year. The Guangzhou factory will also have mass production capacity in the third quarter of next year.

With strong market demand and increased production capacity, designing more cars is a natural result.

Do you remember when XPeng announced that each letter of “Xpeng” would represent a car series? We may witness the appearance of this family portrait within a few years.

It is worth mentioning that designing more car models has also become a tacit choice for new energy top car companies. NIO has already announced that they will deliver three car models next year. Meanwhile, Ideal will provide two new platforms of new cars in 2023. Only the top three car companies will put out nearly 10 new vehicles per year, and the market will become unimaginably prosperous.

High-end and internationalization are equally important.

After listening to so many financial reports, it’s easy to fall into a deja vu loop. It feels like we’ve heard every sentence before.

Like the key words “high-end” and “internationalization,” they seem to come up in every press conference.

But even with the same goal, there will be different paths, and differences in quality and speed will depend on the path chosen.

At this financial report conference, He XPeng stated clearly that they are developing new technology platforms for the fifth and sixth car models after its existing fourth model, and the existing car models will also use the technology of the new platform. They plan to launch a product that costs over 400,000 yuan in 2023.

During the financial report conference, XPeng did not limit the price range they could reach beyond their main sales figures between 150,000 to 400,000 yuan.

He XPeng said that XPeng’s high-end car model will continue to increase in price based on existing car models (after all, P7’s gull-wing door has already reached 400,000 yuan). The peak will reach 500,000 yuan, and in this price range competition “will not be achieved through high-end service”.

Can support products with prices even twice as high as the current model, “it still mainly lies in product differentiation,” said He XPeng. He has announced that relevant technology research and development has already begun, and in the three-year period from 2023 to 2025, XPeng’s new products will possess typical differentiation, creating a product barrier for XPeng. As this is related to the functionality of the product, “I will share our product logic at that time.”

Thinking even bigger, XPeng also mentioned making a million-dollar product.

“We might enter the 500,000 to 1 million range through flying cars,” he said. But on second thought, maybe it’s still a very cost-effective thing to have a car that can fly for a million dollars…

Aside from these daydreams, there is one thing that can be confirmed.

XPeng stated, “It should be emphasized that the new models will support international markets simultaneously with regard to hardware, software, and services.”

This “software and services,” in fact, presents a bigger challenge than simply sending the car out.

Previously, XPeng had exported nearly 500 G3s to Norway, but comparatively, that only processed transport and sales at the hardware level. Just this month, XPeng announced the delivery of the P7 to Norway, which requires the relevant software capabilities to adapt and follow up locally because P7 has a significant upgrade in intelligent cockpit and advanced driver assistance compared to G3.

If XPeng’s goal to “complete the basic layout of our overseas markets within three years from 2020 to 2022” is to be achieved, it will also be a systematic challenge for XPeng.

At the hardware level, the synchronized development of left-hand drive and right-hand drive models is necessary;

At the software level, XPILOT4.0 must become a global technology architecture;

At the service level, XPeng’s self-operated sales, delivery, and service system must be established locally.

All of this requires people and money.

¥4 billion for research and development

If the previous sections were all about looking at and feeling out the cards, this section is like slamming a pair of kings, three pairs of threes, and four pairs of twos on the table.

Gu Hongdi, Vice Chairman and President of XPeng Motors, said in a financial report meeting that the first sentence he said was quite eye-catching: With the funds raised from the Hong Kong IPO, our XPeng Motors now has cash reserves of 46 billion yuan.

“The raised funds will be mainly used for research and development and market expansion.“

This includes meticulous work in research and development, infrastructure, sales, brand building, and marketing.

At this financial report conference, XPeng Motors (XPeng) for the first time made it clear that R&D expenditures for this year will be further increased, with a total of 4 billion yuan for the year.

In addition to the multi-model R&D mentioned earlier, more importantly, in the face of the current market competition and unprecedented technical complexity, “human resources have become the most basic and hardest to find resources.”

As of the end of the second quarter of 2021, XPeng’s R&D team has exceeded 3,000 people, an increase of about 50% from the beginning of the year. We expect the R&D team to exceed 4,500 people by the end of this year.

Of these, XPeng will significantly increase the number of researchers dedicated to global autonomous driving software, hardware, big data, and mapping, “with the total number of autonomous driving software, hardware, and supporting infrastructure teams expected to exceed 1,500 by the end of this year.”

In addition to R&D investments, basically, all supporting technology investments have made progress over the original targets.

He XPeng also mentioned: “We found that when a city establishes a supercharging network and service system, the conversion rate of single stores will be much higher.”

Therefore, by the end of this year, the goal of establishing 300 new sales stores has been raised to over 350, and plans to reach over 500 XPeng brand supercharging stations by year-end, and further accelerate the layout of charging in non-first-tier and second-tier cities. The high-speed supercharging station will also be improved simultaneously.

Increased scale will improve users’ willingness to try new technologies, and a stronger technical experience will, in turn, drive the expansion of user scale.

Finally, XPeng announced its next “small goal”: “We expect our total delivery for the third quarter of 2021 to be between 21,500 and 22,500 vehicles, with an estimated revenue of RMB 4.8-5 billion.”

After sending the emojis, XPeng quietly exited the group chat.

The cool autumn weather is the perfect season for getting things done.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.