Last week, I was discussing DM-i batteries with my friends and noticed that a significant portion of DM-i users prefer the 110km version over the 50km version. I tried to explore the reasons behind this phenomenon:

(1) The Qin, Song, and Tang DM-i are all equipped with 18.3kWh or 21.5kWh range extenders, providing pure electric range of 110-120km for commuting. They also have a fast-charging design that can charge up to 50% SOC in 30 minutes. This higher configuration accounts for a large proportion of sales and validates the strategy of developing range extenders, which can help new energy vehicles penetrate the market quickly.

(2) Compared to the 55km plug-in version, the 110-120km range extender version is significantly more expensive, with a price difference of around 24,000 yuan, making the range extender version the clear winner in terms of price.

(3) The range extender version also has direct current (DC) charging capabilities. If accompanied by the promotion of small DC charging stations (around 20kW), users will be able to easily charge their cars while on the go, potentially guiding consumers towards electric vehicle usage habits.

(4) With Huawei’s possible strong push in promoting the range extender version with fast charging in the SF5 in 2022, there is still much potential to explore.

In this sense, my previous assumption that the DM-i 50km version would sell better (because of its lower price) was wrong. The development of range extenders is likely to be the main force in replacing traditional fossil fuel vehicles.

Table 1: DM-i vs. new version of SF5 supported by Huawei:

Features of BYD’s Plug-in Hybrid Electric Vehicle Sales

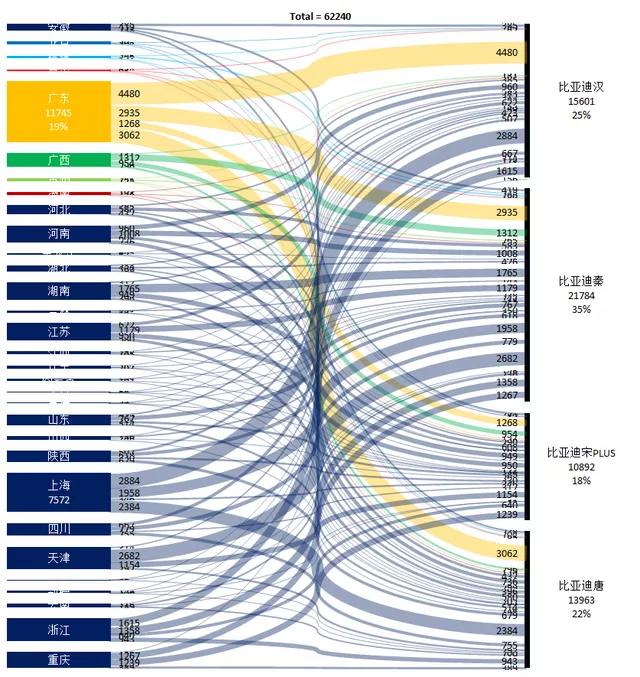

I analyzed BYD’s four vehicles – Han DM, Qin DM-i, Song DM-i, and Tang (DM+DM-i) – geographically and found the following features (consistent with previous analysis of sales data):

Han DM and Tang DM basically follow the concept of plug-in hybrid electric vehicles (PHEVs). Their sales heavily depend on the limitation policies in the four cities, Guangdong, Shenzhen, Shanghai, and Hangzhou.

Figure 1: Deliveries of Tang DM+DM-i are concentrated in a few regions.

Figure 2: Deliveries of Han DM are also concentrated in a few regions.

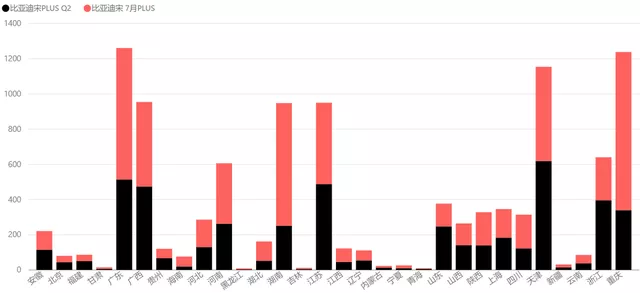

In addition to dominating in areas such as Guangxi, Henan, Hunan, Chongqing, even in areas like Jiangsu, the Qin DM-i and Song DM-i, both of which were delivered starting in April, showed outstanding sales performance surpassing Q2 monthly sales in key regions. Once supply is met, sales could increase significantly.

In addition to dominating in areas such as Guangxi, Henan, Hunan, Chongqing, even in areas like Jiangsu, the Qin DM-i and Song DM-i, both of which were delivered starting in April, showed outstanding sales performance surpassing Q2 monthly sales in key regions. Once supply is met, sales could increase significantly.

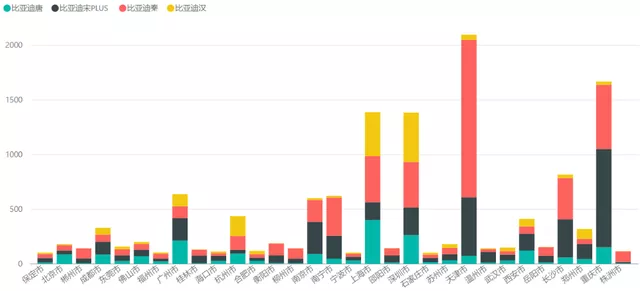

This led to a significant difference between the distribution of PHEVs for the full year of 2021 and July, as shown in the following figure:

If we compare the data for BYD’s PHEV models for the entire year of 2021 and just July, it’s noticeable that the distribution of PHEV models in many areas was quite low for the entire year. However, in July, it was relatively even (see Figure 5), as the two leading PHEVs have different extended-range driving strategies compared to plug-in hybrid models.

In particular, regions such as Tianjin, which had a small sales volume for the full year, are well-known for HEV sales but with the DM-i delivery, it’s evident that the DM-i has significant appeal to Tianjin users.

As such, if we look at data for cities with more than 100 car deliveries in July, we can see the underlying trend: cities such as Tianjin, Chongqing, Changsha, Nanjing, Nanning, and Guangzhou, which were previously unwilling to purchase PHEVs, are now attracted to DM-i’s longer electric driving range and corresponding fuel efficiency.

Extended-Range Driving Predictions

Extended-Range Driving Predictions

From Toyota and Honda’s efforts to promote HEV, as well as other car manufacturers’ experiences in promoting 48V, it’s evident that there are challenges to promoting energy-saving vehicle models in second- and third-tier cities in China. However, whether it’s a simple series or a different mode switching form as BYD has done, the logic of extended-range driving is very sound.The working principle of HEV in series mode: the engine is connected to the generator through the engine shaft, which drives the generator to generate electricity. Then, through the excellent dual electric control performance, the electrical energy is directly output to the driving motor to drive the wheels. When the vehicle is driving at low speed or accelerating and the SOC value is high, the excellent vehicle control strategy will intelligently switch to pure electric mode, and the engine will stop running with zero fuel consumption. If the SOC value is low, the surplus energy will be converted into electricity through the generator and stored in the battery.

The working principle of HEV in parallel mode: the battery provides power to the driving motor when it is appropriate to do so, forming a parallel mode with the direct driving path of the engine. When the vehicle’s power demand is too high and is beyond the economic power of the engine, the vehicle is generally in high-speed overtaking or ultra-high-speed driving.

The working principle of the engine direct drive mode: when cruising at high speed, the engine directly drives the wheels without shifting gears, simplifying the transmission path and reducing fuel consumption. In order to reduce fuel consumption under high-speed working conditions, the vehicle control strategy will intelligently switch to high-speed cruising mode when the speed exceeds a certain threshold, and control the engine to work in the most efficient area, reducing engine fuel consumption. In order to avoid waste of engine energy, surplus engine power is converted into electricity and stored in the battery in a timely manner.

Summary: From this perspective, I understand that with the advancement of Ideal, BYD and Huawei in the next two years, the market for plug-in hybrid vehicles may directly switch from plug-ins with a range of 50 kilometers to a range of 120 kilometers or even higher. Continuing to produce PHEVs with a range of 50-60km may be limited to providing green license plates in Shenzhen, Shanghai and Hangzhou, and sales may plummet after the license plates expire in 2022. However, the vitality of range extension lies in the support of unlimited license plate cities in second- and third-tier cities, as well as power and economic efficiency. Users who purchase range-extended vehicles are reluctant to make charging plans or experience charging anxiety. Therefore, I think that range extension can be put into an observation mode, which is easier to develop than plug-in hybrids with a range of 50 kilometers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.