These three companies, although all in the autonomous driving industry, have taken three completely different commercialization routes, and this choice of commercialization route indirectly determines their technological route. Let’s talk about the unique features of these three companies below.

Xiaoma Zhixing

Xiaoma Zhixing has two co-founders, CEO Peng Jun and CTO Lou Tiancheng, both of whom have worked in Baidu’s autonomous driving department. Peng Jun previously served as the chief architect of Baidu’s autonomous driving department, responsible for Baidu’s overall strategic planning and technological development of autonomous driving. The prototype of Baidu’s Apollo was built under Peng Jun’s leadership. Lou Tiancheng is the youngest T10 engineer in Baidu’s history and mainly worked on technology research and development.

Baidu’s autonomous driving department initially followed Waymo, and the focus of its technological research and development was mainly on Robotaxi. Therefore, Xiaoma Zhixing inherited Baidu’s mantle after its establishment and chose the most difficult and commercially promising field in the autonomous driving industry, Robotaxi.

Xiaoma Zhixing was established at the end of 2016, and it took only half a year to build its prototype car. After continuous hardware iteration and research and development, Xiaoma Zhixing launched the fifth-generation autonomous driving hardware solution, PonyAlpha X, in the fourth quarter of 2020. This set of hardware has a high degree of standardization and integrated hardware design, which can not only reduce the weight of the assembly but also improve its anti-interference ability against vibration, temperature, humidity, electromagnetic interference, etc. Relying on this integrated hardware and strong software capabilities, Xiaoma Zhixing became the first company in the Chinese market to provide Robotaxi services by launching a normal operation on the public roads of urban areas in Nansha, Guangzhou.

During the middle of this year, I specifically visited Nansha to investigate Xiaoma Zhixing’s Robotaxi technology. The operating conditions mainly involve urban trunk roads and village roads. There are many electric bicycles and tricycles that do not obey traffic rules, which imposes high requirements on the perception and regulation capabilities of autonomous driving. From my actual experience, Xiaoma Zhixing’s Robotaxi has average commuting speed in Nansha, but its performance is very stable. Sitting in the car gives people a reassuring feeling.The technology iteration of Pony.ai’s Robotaxi is quite simple. They first use a few scattered cars to conduct tests in a city, solve the potential problems in that city through a round of testing, and then, when the problems have been solved to a certain extent and the risks are controllable, introduce more test vehicles for larger-scale testing to discover and solve problems. As the current test vehicles are equipped with safety officers, safety can be ensured, and the research and development personnel only need to deal with problems reported by safety officers or reported manually every day. Once there is a long enough operating time without any new problems, it can be open to the public.

In summary, they follow the path of Waymo and, under the pressure of commercialization, have recently entered the relatively easy-to-deploy field of Robotruck.

Most players in the domestic Robotaxi industry are following this approach. However, Momenta is an exception in that they have taken a different path.

Momenta’s founder, Cao Xudong, has previously worked at Microsoft Asia and SenseTime, and many of his partners have backgrounds in Microsoft or SenseTime. Thanks to the influence of SenseTime, a company oriented towards AI technology, Momenta has a deep obsession with data-driven autonomous driving and has invested a huge amount of resources in developing data-driven unmanned driving solutions.

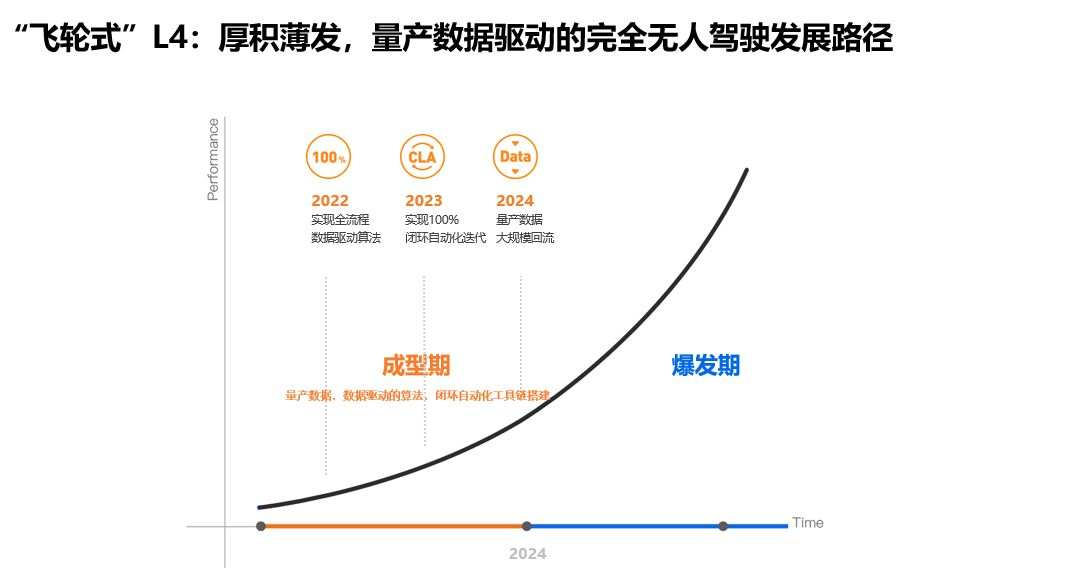

Autonomous driving is a system that requires continuous resolution of long-tail problems, and therefore it must have a mechanism for continuous iteration to drive system improvements. The combination of data, algorithms, and computing power can ensure the closed loop of autonomous driving data, and data can be used to drive the iteration of algorithms. The longer the time, the more data accumulated, and the stronger the algorithm’s ability, achieving a virtuous cycle. A lot of Momenta’s engineers’ efforts are invested in this set of “flywheel” L4: mass-produced data-driven completely unmanned driving solutions.

Although Momenta is aware that data is crucial, their Robotaxi scale is much smaller compared to Pony.ai. The fundamental reason is that large-scale operation of Robotaxi is very expensive. Momenta believes that Pony.ai’s approach of burning money to obtain data for software iteration is not cost-effective. However, currently, relying purely on cameras cannot achieve L4, and launching a fleet of Robotaxi vehicles with a large number of Lidar sensors is too expensive.Translate the Chinese text in Markdown below into English Markdown text, in a professional manner, while retaining the HTML tags inside Markdown, and only output the corrected and improved parts, without writing explanations:

Therefore, they worked with many vehicle manufacturers to provide them with autonomous driving services. This way, the competitiveness of the vehicle manufacturers' car models is increased, and Momenta can rely on production vehicles throughout the country to obtain the data they need. By 2024, when mass production data is returned, it will be a key node for Momenta's mature autonomous driving technology.

From Momenta's layout, it can be seen that their ultimate business model is still Robotaxi, but they chose to cooperate with vehicle manufacturers in order to obtain the iterative autonomous driving system more efficiently and at lower cost.

In addition to Robotaxi and cooperation with vehicle manufacturers, what other commercially recognized business paths are there? It is represented by Robobus, which cuts into the Robotaxi track.

## Qingzhou Zhixiang

Qingzhou Zhixiang's founder Yu Qian was once the Tech Lead of Google Street View, and Google Street View gave birth to Waymo's predecessor, Google X Laboratory. Later, Yu Qian served as the Tech Lead for the perception critical module at Waymo, and was familiar with the research and management of Google's unmanned vehicles. The other three founders, Hou Cong, Da Fang, and Wang Kun, are respectively experts in architecture performance, rule control, and simulation. They had previously worked at Waymo.

To be frank, Qingzhou Zhixiang's entry into the market was quite late. As a latecomer, they cannot compete with Pony.ai in terms of funding, nor with Momenta in terms of personnel.

Their breakthrough was mainly in the landing and technical paths. At present, the taxi-hailing experience of domestic ride-hailing platforms is already good enough. In the short term, Robotaxi's experience and cost-effectiveness are difficult to surpass these ride-hailing platforms. Therefore, Robotaxi does not seem to be a good track for the moment. In addition, in recent years, the development of shared travel has significantly increased the number of operating vehicles in China, exacerbating the congestion of main roads in big cities. As a result, microcirculation buses that provide multi-person travel services for urban capillaries (branch roads) are increasingly favored by urban managers. In addition, Waymo's experience in the Robotaxi field for many years has made Qingzhou Zhixiang recognize the technical difficulty of Robotaxi's large-scale commercialization. Therefore, they chose Robobus, which is easier to land and has clearer commercial prospects.

From a technical perspective, Robobus is essentially the Robotaxi under the current technology status, as all Robotaxis from different companies are fixed-point routes, only with varying numbers of stops. Therefore, in the initial design phase, it can be designed according to the technical architecture of Robotaxi, which means it is easy to transition to the Robotaxi field as Robobus routes increase. At present, Robotaxi cannot be widely implemented in the short term, but with matching customers and user groups on fixed routes, automatic driving can be implemented more quickly, with a little bit of undercutting.

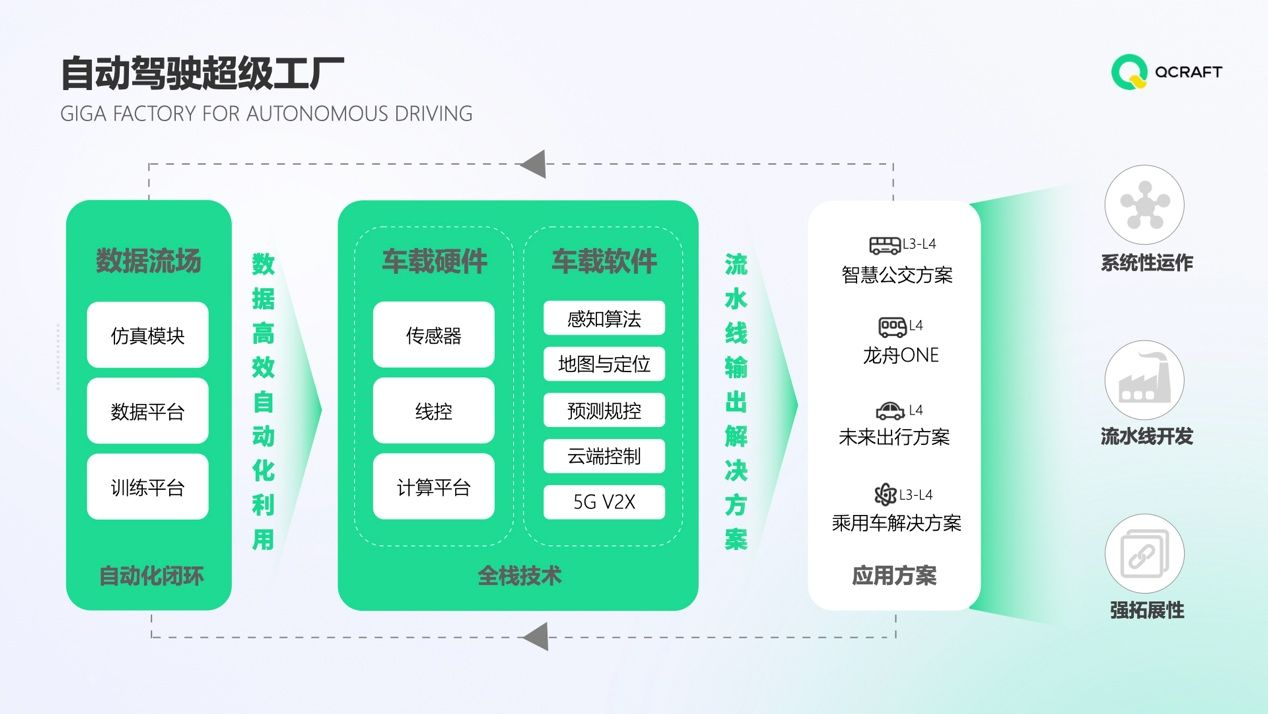

In addition to differences in business models, QZSSR also has some unique understandings in implementing completely autonomous driving routes, which is called the “Autonomous Driving Super Factory” strategy.

They believe that because the sensors and computing platform serving the entire plant are applications of L2 and L3, the difference in data required for L4 Robotaxi is significant. Affected by cost, most L2 and L3 scheme passenger cars mainly use visual and millimeter wave perception, and some are aided by lidars. These scheme’s computing power and data dimensions are relatively low, so it is challenging to achieve intercommunication with L4 data. There are significant challenges in building data loops.

Based on this understanding, QZSSR uses a set of hardware solutions to adapt to multiple car models, ensuring that deployed projects can be quickly and efficiently deployed, and that data can be shared between different car models. Also, the costs of buses and other commercial vehicles are not as rigid, even if they deploy L2 and L3 schemes; redundancy can be achieved on the scheme to improve safety by one order of magnitude through driver monitoring and training.

In addition to hardware considerations, QZSSR also has a unique approach in software design. General autonomous driving companies focus on the development of modules such as maps, positioning, perception, and regulation. After a large number of road tests, they will find that traffic scenes vary greatly, and it is challenging to discover problems entirely through only road tests. This is when they realize the importance of simulation tools and return to building simulation environments.# Automated Driving and Data Accumulation: Insights from Chinese Startups

Zhengzhou Qz Intelligent Technology Co., Ltd. (Qz) was one of the first Chinese startups to build its technical stack around simulation as a core capability. However, this concept was too new for most people to understand, and even some thought that Qz sold simulation software. Nevertheless, from today’s industry consensus, Qz was very forward-looking at the time.

In addition to data accumulation, Qz has consistently emphasized automation, including the use of unsupervised learning in fusion perception to reduce dependence on manual annotation; in its application, Qz focuses on the combination of traditional robotics and machine learning technologies, which enhances the interpretability of artificial intelligence technology and can reduce the need for engineers to manually tune parameters, thus converting engineer time into machine time.

From a commercial perspective, if this toolchain could continue to be offered as a product to automakers, it should be able to solve the urgent problem of mounting Lidars on passenger cars.

Summary

Some companies with strong financial resources can deploy road testing and rely on massive road testing to collect first-hand data to discover problems. Some companies collect data through cooperation with vehicle manufacturers, relying on the production of national cars. Some companies have built their core technologies around simulation from the very beginning, cut into specific scenarios, and used simulation and related toolchains to form an efficient data testing closed loop.

From the business models and technical routes of Chinese autonomous driving startups such as Pony.ai, Momenta and Qz, it can be seen that data accumulation and use have become the consensus of the industry. How to obtain effective data at lower cost and use it in an automated way has become the key to the competition among major companies in the market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.