Forecast from Several Research Institutions

I plan to spend some time organizing predictions from various research institutions regarding the overall production of the automotive industry this year. Due to chip shortages, uncertain factors have increased, so these predictions may not be accurate at present. However, based on this research data, we can still draw some conclusions.

Predictions from Several Research Institutions

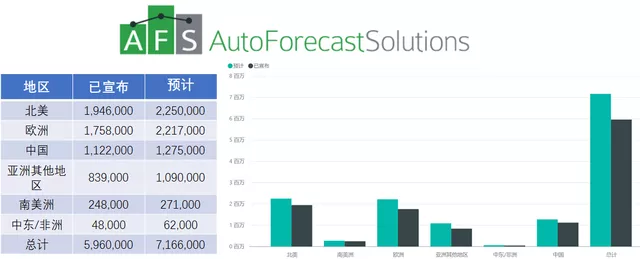

(1) AFS Auto Forecast Solutions

Auto Forecast Solutions mainly uses a method of statistical comparison and estimation based on the reports of auto companies. Therefore, the data can be compared and estimated on a weekly basis. According to the data provided by AFS, global production decreased by 107,000 units in a single week compared to plan (71,300 units in North America). According to AFS’s estimate, the global production reduction due to chip shortages has reached 5.96 million units, and it is expected that the total reduction for this year will be about 7.1 million units.

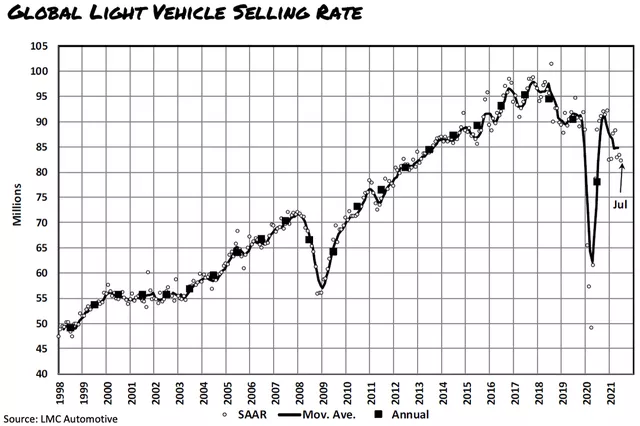

(2) LMC Automotive

LMC’s report is analyzed based on monthly data. In July of this year, global passenger car sales were 6.463 million units, a decrease of 6.3% compared to July 2020 (6.899 million units), which is not a good sign.

Currently, LMC predicts an annual production of 82.1 million units this year. Although global passenger car sales increased by 22% year-on-year in the first half of the year, the predicted annual data has been revised downward several times, as follows:

- January 26: predicted global passenger car sales of 87.82 million units;

- April 26: predicted global passenger car sales of 87 million units, a decrease of 820,000 units. The downward trend was not significant at this time;

- July 26: predicted global passenger car sales of 85.06 million units, a decrease of 1.94 million units, which was 2.84 million units less than in January.

After the sales data for July came out, the annualized data was once again adjusted to 82.1 million units. This is equivalent to the current prediction from AFS. I estimate that LMC will further adjust their prediction on October 26 during Q3. The annual production reduction of 5.72 million units includes a reduction of approximately 1.5 million units in North America.

(3) AlixPartnersThis report was released in mid-June when AlixPartners’ forecast was relatively optimistic, predicting a total global production of 83 million cars in 2021, a decrease of 3.9 million vehicles. Looking at it from an analytical perspective, Alix thought at that time that there would be a decrease of 4.9 million cars in Q1-Q3 and a recovery of 1 million cars in Q4. Based on current conditions, this data needs to be further adjusted. We estimate, as LMC does as well, that global production this year will be around 82 million units.

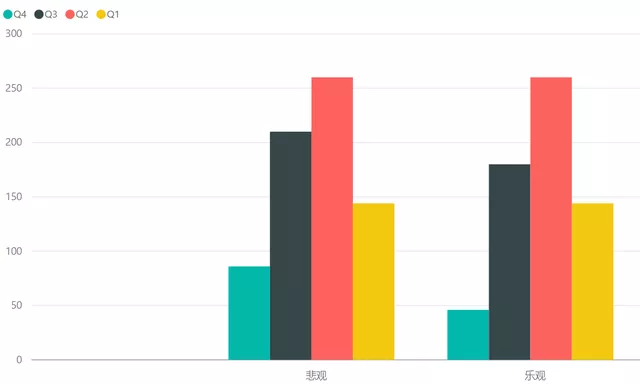

(4) IHS Market’s Forecast

According to IHS Market’s analysis, the expected total global production for the year will be 80.78 million units, with an expected decrease between 6.3 million and 7.1 million units. Due to the disruption of the chip supply chain, global production losses in Q1 were 1.44 million units, while in Q2 this figure increased to 2.6 million units. In Q3, the “visible” production suspension was 1.6 million units, with an estimated actual decrease of 1.8-2.1 million units. In other words, IHS’s forecast is that the semiconductor shortage will continue to occur in Q4 of 2021 and will continue into Q1 of 2022. The second quarter of 2022 is the moment when this consulting company currently believes that chip supply will be relatively stable, and automotive sales will return to a growth trajectory, which will not happen until the second half of 2022.

What are the differences between this round of shortage and the previous ones?

(1) The main problem in the first half of the year was the front-end production capacity

The shortage of semiconductor supply in the first half of 2021 was mainly due to wafer and front-end production capacity constraints. Of course, due to the fire at Renesas Naka Factory and the power outage in Texas, disruptions occurred in the production of NXP, Infineon, and Samsung factories. These rare events may not occur again. Although wafer plant capacity is still tight, it is not as tight as before, so the impact of upstream semiconductors is lower than in the first half of the year.

(2) Packaging and testing (packaging) issuesAfter front-end processing, the silicon wafer needs to be cut, packaged, and tested before being delivered. However, there are also constraints on the related materials such as leadframes, substrates, and resins for the backend’s leadframe framework. Unlike the capacity constraints of the wafer fabs that affected the automotive MCU in the first half of the year, the packaging and testing capacity constraints affect all automotive chips, including sensors, power supplies, and discrete devices. The packaging and testing bases are mainly concentrated in China, South Korea, Japan, Singapore, the Philippines, Indonesia, Thailand, Vietnam, and Malaysia. China has the highest epidemic prevention level among them, while many countries, except for Singapore and Malaysia, have a vaccination rate of less than 6%, and the epidemic has also affected this part of the supply chain.

Currently, it is necessary to expand the capacity of packaging and testing, but it should be noted that the profit margin for these processes is very low, and the delivery time of related equipment is also very long (40 weeks). The magical thing is that the manufacturing bottleneck of these devices is also the lack of chips.

Regarding the price hikes of Infineon, when the automobile industry is in turmoil, Infineon’s management team has begun to show some very frustrating things: on the one hand, Infineon is raising the price of chips, and on the other hand, it says that it is the automakers’ habit of purchasing automotive chips at lower prices that destroys the willingness of automotive chip companies to expand production capacity. Infineon believes that the price of automotive chips is still not high enough, and Chinese chip companies must have something to say about this.

In summary, with the intensification of automotive chip shortages, very discordant voices have emerged in the industry. As the losses of chip, Tier 1, and automotive companies are amplified layer by layer, everyone in the industry chain needs to consider follow-up countermeasures from the perspective of the entire supply chain. The current chip automotive supply chain system is not reliable, and the existing automotive chip manufacturers will inevitably seize the opportunity to raise prices in the long run.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.