Author: Zi Li from Tiexi District

Editor’s note:

According to the data from China Association of Automobile Manufacturers, the total sales of new energy vehicles from January to July this year reached 1.478 million, with a market share exceeding the critical point of 10%. This means that for every 10 cars sold in China, one is a new energy vehicle.

This number did not cause much of a stir— the momentum of new energy vehicles is still strong and surpassing 10% was only a matter of time. However, the fact that the market share of new energy vehicles has exceeded 10% is much earlier than expected by most people. From this point in time, new energy vehicles will enter a faster period of popularity, the pattern of competition among car companies is changing dramatically, old and new forces are transferring power, the supply chain is trying to catch up with the pace, and the infrastructure for charging and swapping is finally facing a challenge of scale…

As a result, “EV Observer” will launch a series of reports entitled “New Energy Vehicle Market Share Exceeds 10%”, with this article being the first.

Some numbers need to be looked back to feel their impact:

- In 2009, the production of new energy vehicles in China was less than 300.

- After the “Ten Cities and Thousand Vehicles” demonstration project and the continuation of the promotion and application of new energy vehicles, with subsidies from the government for five years, the production and sales both exceeded 300,000 in 2015.

- From 2016 to 2018, under strong subsidies, the production and sales of new energy vehicles continued to rise, reaching 1.256 million in 2018.

- In 2019, due to the withdrawal of subsidies and then the pandemic, the sales of new energy vehicles fell for the first time in history, reaching 1.206 million.

- In 2020, the sales of new energy vehicles rebounded and reached 1.367 million, with a market share of 5.4%.

- The sales of new energy vehicles from January to July 2021 has reached 1.478 million, with a market share exceeding 10%.

It took 11 years to go from 0 to 5.4%, with 9 years of heavy subsidies. It only took 7 months to go from 5.4% to 10%, and by this time, there were hardly any subsidies left. New energy vehicles are accelerating their market popularity.

When the China Society of Automotive Engineers released the “Roadmap of Energy-saving and New Energy Vehicles 2.0” last year, it predicted that the market share of new energy vehicles will reach 20% by 2025.The leaders in the new car industry have different views regarding the penetration rate of new energy vehicles’ sales in China by 2025. Li Bin from NIO thinks that “the number is still slightly conservative”. He XPeng from XPeng believes that “the penetration rate of new energy vehicles’ sales in new cars in 2025 will reach 35%, and it may reach around 60% in first-tier cities”. Li Xiang from Li Auto predicts that “over eight million intelligent electric cars will be sold in China by 2025” (if calculated on an annual sales of 20 million, eight million means a market share of 40%). Additionally, considering that traditional car companies are speeding up their transformation, the speed of the future arrival will be faster than expected.

At the same time, the “New Car Makers VS Traditional Car Companies” is rapidly approaching, what will be the trend of the confrontation? The answer has already been revealed slowly, and the market topic system is changing – traditional car companies can no longer define cars alone, and new car makers have comprehensively seized the discourse power.

Tesla is rapidly advancing globally, and Li Xiang from Li Auto is becoming popular in China. Chinese local brands have long bet on new energy vehicles, and some new brands have emerged. There are also active participants in the traditional international car companies camp, with Ford and Volkswagen being the most aggressive, and BMW and Porsche are also responding in the higher-end market. It is their existence that still leaves the battle between new and old in suspense. And those conservative, indecisive, and powerless traditional car companies have even lost their value for discussion.

Example: Traditional brands’ failure in the headphone market

The most intuitive difference between traditional car companies and new car makers is their product concepts:

Traditional car companies say that “our EVs are professional cars”; new car makers say, “our EVs are technological products.”

There is a clear main line for traditional car companies’ transformation – when Porsche launched Taycan, they said that it is a car that can make the driver feel it’s a Porsche; when Ford launched Mach-E, the feedback from the first batch of test drives was full of praise for the driving experience, such as “unique driving experience” and “makes people want to drive”; and when Volkswagen planned the ID series, it repeatedly emphasized that this EV series should continue the glory of Beetle, Golf, and classic minivans, and is a continuation of Volkswagen’s quality.

Undoubtedly, although Porsche and Ford are emphasizing the driving experience, and Volkswagen is emphasizing German quality, at a deeper level, their contexts and attitudes are completely consistent: we have a far deeper history, more mature engineering technology, and better driving tuning, and we are professional carmakers.

When Tesla’s Model S became popular, people discussed its enormous central touch screen, the EV’s rapid acceleration, and unconventional design features such as the hidden door handle.

When Tesla’s Model S became popular, people discussed its enormous central touch screen, the EV’s rapid acceleration, and unconventional design features such as the hidden door handle.

This way of thinking naturally inspired and extended to the new car camps represented by Xiaoli Wei. New cars always have larger, more convenient central touch screens or multiple screens, and they also come up with strange functions such as imperial concubine chairs and vehicle photography.

New car makers don’t think of cars as just cars, at least not entirely, but often brainstorm about what else cars can do.

The decline of Nokia and Motorola is legendary, which is why the mobile phone industry is frequently compared to the automobile industry. However, compared to the relatively low user experience threshold of mobile phones, the changes in the headphone market are more suitable for reflecting the automobile industry.

They are both industries with a higher threshold: to become a professional driver, you have to drive dozens, hundreds, and even thousands of cars. To develop a “golden ear,” you have to listen to dozens, hundreds, and even thousands of headphones, and then compare and cooperate with different professional front-end devices.

They are also both industries with long-term stable patterns: Sennheiser, AKG, and Audio-Technica are well-known brands in the professional headphone market, and there are also excellent products from professional audio equipment suppliers such as B&O, Denon, Bower Wilkins, Bose, and JBL. These brands define what “noise reduction,” “sound field,” and “high, medium, and low frequencies” mean.

But now, the headphone industry is completely different, and the changes began with Beats. For professional enthusiasts, Beats’ sound quality is no match for professional brands. It has blurred details, nothing except bass, and its noise reduction is not outstanding. However, Beats’ advantage is equally special. It has fashionable design, convenient connection with mobile intelligent devices, and its heavy bass is more suitable for young people to listen to rock and HipHop music. Beats has become a phenomenon in the headphone industry. According to Slice Intelligence data, Beats, which ranked first in the headphone market in 2016, accounted for 24.1%, more than double that of second-place Bose (10.5%).

Later, Apple joined, and the TWS (True Wireless Stereo) earphone market took shape. The entire industry has undergone irreversible changes, and AirPods have become the undisputed market leader, with TWS becoming the most potential electronic consumer goods market after mobile phones, pads, and watches.The sound quality of Apple products is not outstanding, and they don’t even care so much about it. The ACC coding Bluetooth connection they use itself causes great loss of sound quality. After the cancellation of the 3.5mm interface, even professional wired headphones are excluded (unless you pay extra for a professional adapter cable, otherwise plugging in HIFI headphones is pointless). HomePod is even monophonic.

What makes professional headphone and sound equipment vendors feel frustrated is that users don’t care so much about sound quality. What users want are beautiful and easy-to-use products, and having significant shortcomings in sound quality is acceptable. As a result, Apple’s non-professional AirPods are defining the market. Although TWS penetration is still not high, its sales have far outstripped those of professional brands.

In May of this year, Sennheiser sold its consumer business and announced its withdrawal from the C-end market of headphones and sound equipment. In the late stage of the traditional headphone market, it was already struggling to keep up. When the era of TWS arrived, it couldn’t even enter the mainstream brand sales rankings.

The dilemmas that traditional car companies will face are so similar to those of Sennheiser and other traditional headphone and sound equipment vendors. In an industry with significant barriers, consumers have a very weak perception of sound quality and driving experience, but they can clearly perceive the technology and design selling points of electronic consumer products such as Apple, Tesla, and Xpeng.

Volkswagen’s changes in this field are the most radical. Originally, Diess planned to invest 3.5 billion euros by 2020 for digital transformation, and restructured the organization to establish the Car.Software software department. As the plan progressed, Volkswagen announced the investment of 7 billion euros to recruit IT talents, expanding the Car.Software team to 2,000 people. As of March last year, the team already had 3,000 employees.

However, the software storm caused by Volkswagen’s ID.3 has shown that change is not easy. Traditional car companies almost have no concept of the workflow and response mechanisms of technology companies. From a more fundamental level, even forming a software team is already a significant challenge:

The powerful radiation effect of car companies means that the places where their headquarters are located are highly likely to be industrial cities, while software talent often lives in technology cities. The salary level of car companies is industrialized, while the salary level of software talent is more like that of technology companies, which is obviously higher. Even after software engineers join car companies, they have to face the incomprehension, even contempt or hostility of industrialized employees.

Variables:

The advertising approach of new car manufacturers is one of the components of their electronic consumer product-style selling points. In comparison, new car manufacturers will be more proactive and bold in promoting ADAS functions, and intentionally or unintentionally call them “autonomous driving.”The recent fatal accident caused by NIO’s assisted driving system has once again brought this controversial issue to the forefront. Following this, Tesla is facing an investigation by the National Highway Traffic Safety Administration (NHTSA) on its Autopilot assisted driving system, covering 765,000 vehicles delivered from 2014 to 2021, including Model Y, Model X, Model S and Model 3.

Whether accidents caused by excessive promotion will affect their progress is unknown, but we have all heard the saying “a thousand-mile dike can be destroyed by an ant-hole,” and this can indeed become a safety hazard that can be completely avoided.

When promoting and aggressively exploring new technologies, equal attention should be paid to consumer education and cultivation. This is a must.

Channel: New Car Makers Establish Service Standards

If there are differences between new car makers and traditional car companies in terms of product concepts, in terms of channel services, the new car makers completely crush the traditional car makers in terms of transparency, standards, and modernization; while traditional car makers symbolize insider dealing, chaos, and pre-modernization.

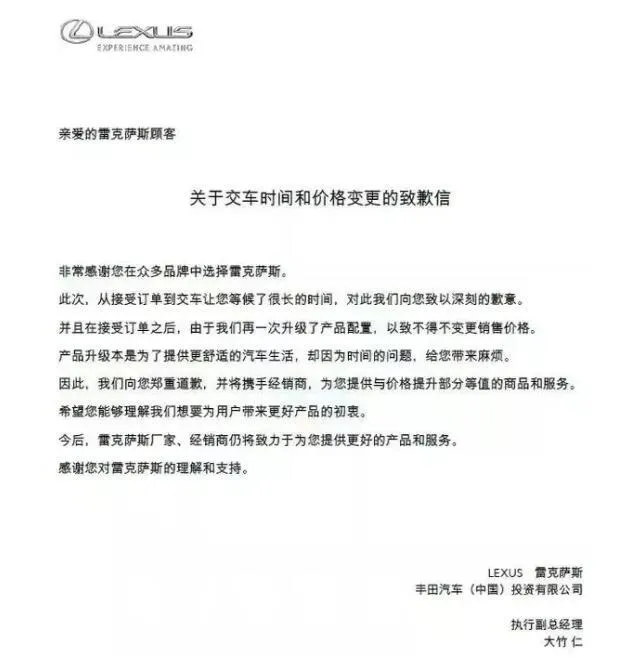

In September 2019, Lexus raised prices for its three models, with increases ranging from 6,000 to 15,000 yuan. Afterwards, some consumers reported that after the official price increase, they received calls from dealers saying that the orders placed before the price increase were not valid, and they needed to pay the price difference before they could pick up their cars. The official price increase has evolved into official price markups.

When I first entered the public relations industry, I heard a marketing lecturer publicly tell sales consultants during a dealer training session, “We support price hikes at xxxx. If you don’t raise prices, you won’t make money, don’t come to us later.”

Price markups have long been a conspiracy between traditional manufacturers and dealers. For the former, when they don’t want to adjust production capacity, they don’t care about letting dealers make some extra money; for the latter, they have been suffocated by the former’s bundled sales and inventory pressure for a long time, and finally opened up a loophole to make more money. Therefore, the suggested retail price has become a decoration, and consumers are trapped in the middle and suffer losses without knowing why. And they are also taught that “this is a market behavior.”

Car consumers have long suffered from dealers, but in fact, the lives of dealers are not easy either. Because of the buyout model, dealers are very sensitive to the capital chain situation, and they are also squeezed by the inventory pressure and bundled sales of automakers. In this situation, dealers habitually transfer the pressure and injustice they bear to consumers and customers. Selling cars with price markups, inspection fees, delivery fees, financial service fees, false repair reports, only replacing but not repairing, and small repairs with big expenses have been repeatedly exposed, but the rectification has not produced long-term results, and the reason lies here.

The new car industry has abandoned the traditional dealer model in favor of a self-operated, online and agent-based model, where agents do not need to purchase cars but provide sales services. This unified process and cycle provides consumers with a consistent standard from pricing to sales to after-sales service. Traditional automakers have already realized this problem and have made changes. Ford’s change is most radical. In conjunction with the launch of Mach-E in China, Ford announced that it will build city experience stores in 20 core cities nationwide this year. The Mach-E will completely abandon traditional dealerships and only be sold in city experience stores.

The new car industry has abandoned the traditional dealer model in favor of a self-operated, online and agent-based model, where agents do not need to purchase cars but provide sales services. This unified process and cycle provides consumers with a consistent standard from pricing to sales to after-sales service. Traditional automakers have already realized this problem and have made changes. Ford’s change is most radical. In conjunction with the launch of Mach-E in China, Ford announced that it will build city experience stores in 20 core cities nationwide this year. The Mach-E will completely abandon traditional dealerships and only be sold in city experience stores.

Volkswagen has also taken action and has implemented an agent sales model from the ID.4 series onwards, with agents chosen from existing dealerships. However, this has brought new problems. Previously, a media outlet conducted a survey and found that agent dealers had a lack of enthusiasm for the ID.4 series and were more inclined to recommend purchasing traditional fuel cars in the dealership. On the one hand, the latter bears a heavier sales target, and on the other hand, traditional fuel car dealers and sales consultants who have been in the industry for many years have formed a deep subconsciousness that no one really wants to buy an EV and that fuel cars are easier to sell.

Ford will sooner or later face these problems. How to sell the Mach-E in self-operated city experience stores, how to promote this sales model in the future, how to deal with cooperation with existing dealerships?

For traditional automakers, Apple’s self-operated and cooperative dealership model is a successful case that has been proven effective. However, in practice, it is not easy. Dealership groups with long-term agency brands have formed a certain degree of discourse power, and if they want to maintain their current cooperative status, they cannot easily touch their existing interests. Prices can be non-uniform, but how to train dealers to achieve price transparency, how to arrange ownership of after-sales service, and if it is taken back and provided uniformly by itself, how to compensate the dealer… there are a series of problems that need to be solved.

The more common situation is that many traditional automakers still enjoy the dividend of selling cars to dealerships. Too many traditional automakers have not been able to get rid of this capital flow, nor do they have the work methods and related talents needed for self-operated channels, and they do not even consider the dealership model to be a serious problem.

Variables:

WM Motor is an anomaly in the new car industry. After co-founder and former VP of Strategic Planning, Lu Bin, left, the agent-based model he created was overturned and replaced by the traditional dealership model.

Will WM Motor have followers? With giants such as Xiaomi and VIVO joining the competition, the new car industry will inevitably require greater investment and bear greater financial pressures, and the traditional dealership model is an obvious way to reduce financial pressure. If any participant cannot resist this temptation, it is not surprising.In the automobile industry, Tesla was the first to operate in a self-operated + network mode on a large scale. In the previous years, it had also made several adjustments and plans regarding channels, and some are being implemented while others have been declared terminated. It seems that it is still too early to assert what the final form will be.

Brand: Time is on the side of new car makers

For traditional automakers, brand is the source of their power, and they have a history. New carmakers face the future, and time is their friend.

The current competitive advantage of traditional automakers is their brand. The current main consumers still remember the dream of luxury cars such as “driving a BMW, sitting in a Benz” when they were young. Their transformation method is the design cycle, and almost every traditional automaker has said that by 20XX, the proportion of pure electric/new energy models will reach…

The current competitive advantage of new car makers is their product development capabilities and public relations capabilities. They know better what technological products today’s consumers need and are better able to communicate with the public. They do not need transformation, and they firmly believe that what they are building now is the car that will travel on the road in the future.

In the transformation process of traditional automakers, there is a fatal injury in terms of time concept:

Today, they still have a brand advantage because the post-90s and post-80s grew up with the awareness that traditional car brands are the best brands. Today, the best brands in the industry are already controversial, and the coolest brands are more considerd to be Tesla and NIO. The brand effect of traditional automakers has been greatly weakened in the post-95s and post-00s generations, and they have no advantage in the post-10s generation.

So, when the post-00s even post-10s become the main purchasing power, how much of the brand advantage of traditional automakers will exist at the 2025 or 2030 time points that are commonly designed in traditional automakers?

Moreover, let’s not forget that the vast majority of traditional automakers now say, “We want to embrace the pure electric future,” while holding onto oil-to-hybrid and oil-to-electric to pass the time. Such behavior consumes the trust of fuel supporters and cannot be recognized by pure electric supporters at all.

In fact, too many people today hear traditional automakers say, “By 20XX, the proportion of pure electric/new energy models will reach…” but they are not interested at all, which are just a bunch of oil-to-electric and oil-to-hybrid.

The vast majority of traditional automakers are still the mortal enemies of time today. As a result, Tesla is increasingly considered to become a company with a market value of over trillion dollars and will become the leader in the future automotive market.

Let’s make a hypothesis now: if traditional automakers today, now, immediately abandon fuel vehicles and only sell EVs, whose sales will be higher in the future between traditional automakers and new carmakers? Will Tesla still be able to maintain its current momentum?

The answer is certainly not absolute, but it will definitely be more advantageous to traditional fuel cars. Unfortunately, they cannot (or are unwilling to do so). Existing employees, organizational structure, corporate culture, revenue structure, capital concepts… All of these are designed around the research and development, production, and sales of fuel cars, and no link allows the automotive industry to produce their own Andy Grove (legendary CEO who led Intel’s transformation from storage devices to microprocessors).

Variables:

Changes are not always good. The 2008 Democratic primaries between Obama and Hillary changed the rules of the US election. Voters hated incumbents and favored fresh faces, becoming a new trend in elections. Eight years later, Trump was elected smoothly under this new trend. His historical achievement was to achieve unprecedented unity between China and the West: he was a terrible US president. So in the 2020 election, the White House welcomed another establishment old white male, Biden.

No one dares to say whether new car-making represents good or bad changes. From Tesla’s handling of the brake gate, at least it cannot be considered good.

Variables always exist, and they exist in too many possibilities. Perhaps the glaciers melting in the Arctic will freeze again overnight, or perhaps the climate of tides and droughts will suddenly stop tomorrow, or perhaps fuel cars will stop emitting any harmful emissions in the next second…

But humans have always done their best to change the status quo instead of waiting for some elusive miracle.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.