Can love be won with a sword?

On July 22, 2021, Magna International and Veoneer announced a merger agreement.

Under the agreement, Magna will acquire all of Veoneer’s issued and outstanding shares for $31.25 per share in cash, with an equity value of $3.8 billion and an enterprise value of $3.3 billion, including Veoneer’s cash, debt, and other debt-related items as of March 31, 2021.

Just when everyone was admiring the world’s strongest automotive contract manufacturer as it transforms into the world’s strongest intelligent automotive complete solution provider, some explosive news came out…

On August 5th, Qualcomm announced that it had submitted a cash offer to acquire Veoneer at a price of $37 per share. The offer, which has been approved by Qualcomm’s board of directors and does not require approval from Qualcomm shareholders or financing conditions, will cost Qualcomm $4.6 billion, half the price Magna was willing to pay for Veoneer’s acquisition.

And on August 8th, Veoneer stated that the board members believe that Qualcomm’s proposal is a “better proposal” as defined in the merger agreement compared to Magna’s offer, and that if Veoneer terminates its merger agreement with Magna as a result, it will have to pay a $110 million fee to Magna. However, even so, Veoneer can still sell itself for an additional $690 million.

However, on August 20th, a new twist emerged. Veoneer submitted PRE 14A, also known as a preliminary proxy statement, to the SEC regarding the Magna acquisition, but strangely, the form is for shareholders to vote on matters unrelated to the controversy or merger/acquisition and will be voted by the registrant or its representative. It seems like another fake-out with no practical results.

So, this acquisition is still uncertain to this day.

So, what exactly is Veoneer? Why are both the top automotive contract manufacturers and the top smartphone chip companies eager to acquire it? And why do Magna and Qualcomm want this Swedish company so badly?

The protagonists of this love triangle

ADAS company from Sweden

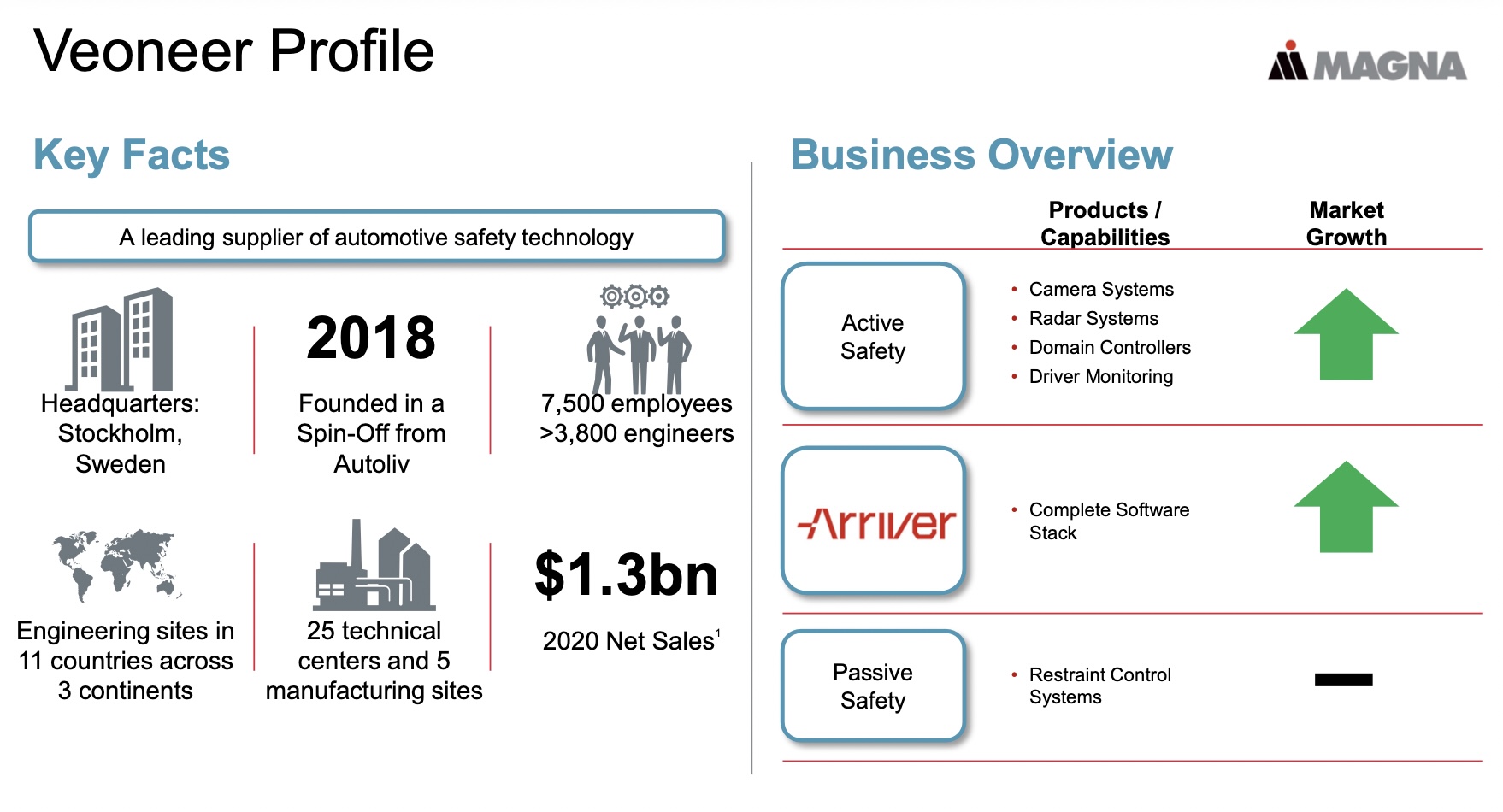

Veoneer, from Sweden, is not a well-known company, but it originates from Autoliv, the world’s largest safety airbag company. Especially after Takata’s various airbag scandals and apologies in recent years and its acquisition by Joyson Electronics, Autoliv is essentially the global airbag leader.

Veoneer, from Sweden, is not a well-known company, but it originates from Autoliv, the world’s largest safety airbag company. Especially after Takata’s various airbag scandals and apologies in recent years and its acquisition by Joyson Electronics, Autoliv is essentially the global airbag leader.

For any company, making money is a top priority. For Autoliv, capturing the booming ADAS business in recent years from the traditional automotive safety hardware field is a reasonable way to create new business growth points and further deepen the existing customer base.

If Autoliv is the boss of traditional passive safety hardware suppliers, then in the spirit of “a tiger father has no dogs”, it hopes to breed a leading Tier 1 in active safety and autonomous driving. And in order to operate capital more efficiently, Autoliv split its electric control field, including driving assistance, into Veoneer, an independent company.

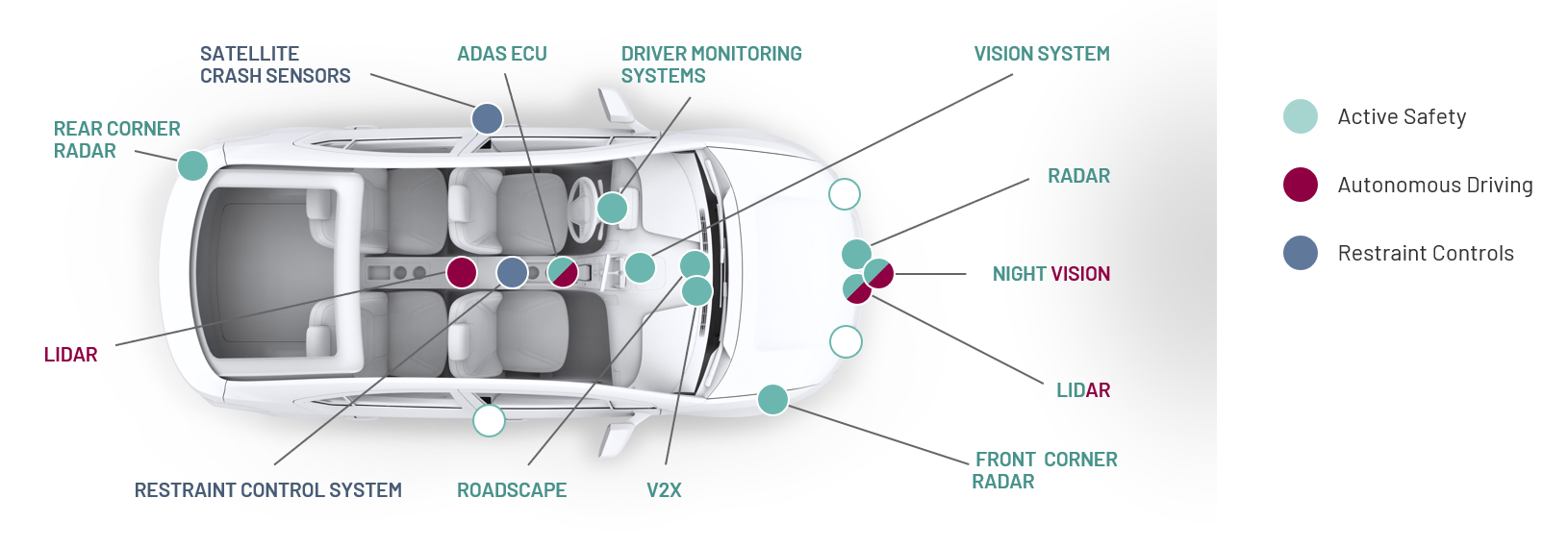

Veoneer’s main business is active safety systems, the Arriver advanced driver assistance software, and restraint control systems (software and hardware to control seatbelt pre-tensioning logic when the collision is detected). Its customers currently include mainstream global automakers such as Mercedes-Benz, Volvo and Subaru.

Veoneer’s fourth-generation binocular ADAS system is already available in the latest S-Class. According to a colleague responsible for 42Mark, the actual experience can reach the first-tier level of products we have tested so far.

OEM Emperor

Magna, headquartered in Canada, is arguably the most diversified automotive component manufacturer in the world. This automotive OEM giant with over 100,000 employees worldwide provides OEMs with advanced technology automotive system products, modules, and parts from design, development to manufacturing.

In addition, Magna also offers vehicle engineering and assembly services, including design, research and development, testing, and manufacturing of product systems such as vehicle interior systems, seating systems, latching systems, body and chassis systems, mirror systems, electronics systems, hybrid and electric vehicle systems, exterior systems, powertrain systems, roof systems, and vehicle engineering and assembly.Translate the following Chinese text in Markdown format to English Markdown, in a professional way, keeping the HTML tags inside the Markdown and showing only the result:

如果上述内容你还是无感,那么麦格纳还可以用作品说话。加价加到起飞的奔驰的大 G、即将搭载华为辅助驾驶全家桶极狐以及非官方复刻版「卫士」 INEOS Grenadier 都是麦格纳参与研发并整车代工。

### 芯片大佬 & 专利流氓

In 1985, as an entrepreneur in his 51's, Irwin M. Jacobs, a veteran, decided, along with some friends, to create a company that provided "high-quality communications," which was named Quality Communications. It began with only 7 people, and their office was next to a cemetery in San Diego.

Now, this company has become Qualcomm, a global leader in smartphone chip distribution. Qualcomm's products can be seen everywhere. The Snapdragon, released in 2007, was Qualcomm's most successful product in the mobile wireless chip field. In just 5 years, it had a worldwide installed base of over 400,000 smartphones and tablets.

As one of Snapdragon's biggest customers, Xiaomi has been adopting Qualcomm's flagship chips without exception since the first generation of digital flagship machines. Qualcomm, through Xiaomi's shipments, has successfully broken through the boundaries and become a well-known brand in the mobile consumer electronics market as a high-end smartphone chip manufacturer.

In fact, Qualcomm's presence is far more than just its Snapdragon series chips. In 2020, Qualcomm's revenue was $235 billion, of which about $5 billion was from patent royalties, accounting for about 21%. However, if calculated by profit, this number far exceeds 21%.

Qualcomm not only charges patents fees to customers who purchase its chips but also collects licensing fees from chip manufacturers that produce chips using its patented technology. This is because the core technology of the chips produced by these manufacturers belongs to Qualcomm. This is known as the "Qualcomm tax."

## Seller's Helplessness, Buyer's Ambition

### Vinheler wants to survive

Veoneer’s packaging and sale clearly shows the gradual squeeze on the survival space of second-tier Tier 1 suppliers in this era of significant top-down effects and flow.

From 2018 to 2020, Veoneer’s sales were $2.228 billion, $1.902 billion, and $1.37 billion, respectively. This continued decline, coupled with the visitation of the epidemic and the chip panic, is obviously difficult to reverse. The corresponding net losses for these three years were -$276 million, -$500 million, and -$545 million, respectively, making it a clear loss-making company. Of course, regardless of the future, the soaring share price brought about by the acquisition is also a kind of appeasement for Veoneer’s shareholders.

Traditional front-loading ADAS giants such as Bosch rely on closer relationships with manufacturers to occupy a huge share. In the main battlefield of autonomous driving technology and driving assistance products in China, Veoneer not only faces competition from European giants, but also needs to guard against autonomous driving solution providers such as Mobileye and rising domestic start-up companies such as Momenta and tech giant Huawei, as well as a series of domestic replacement hardware manufacturers incubated by the trend of overtaking on bends in recent years.

Magna Needs New Core Competencies

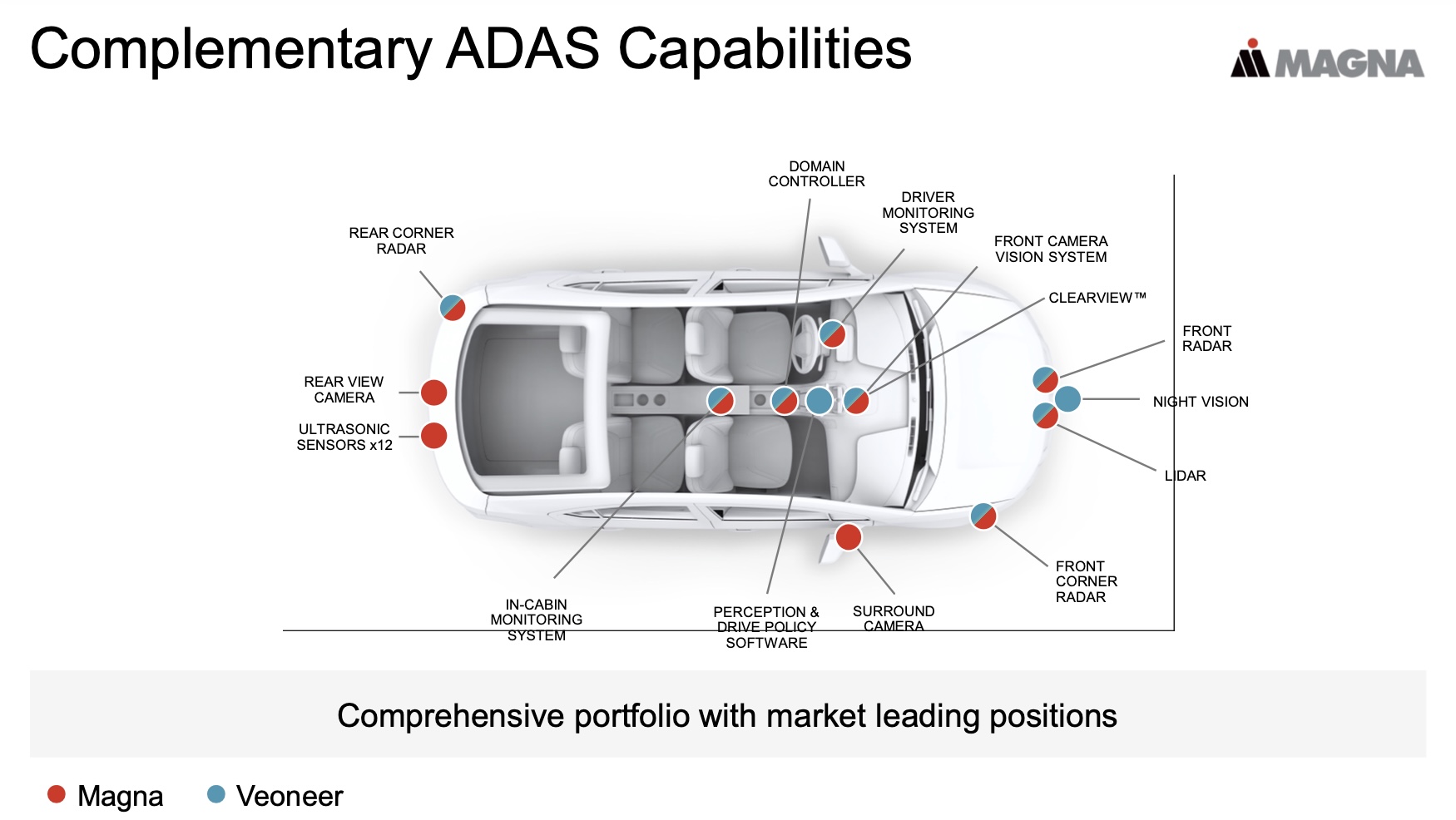

Magna is eyeing Veoneer’s Arriver sensor perception and driving strategy software platform. According to Magna, the Arriver software division will continue to operate as an independent business, which is consistent with Veoneer’s current practice. In addition, Magna will gain Veoneer’s global leadership in constraint control systems.

Magna CEO Swamy Kotagiri said:

The complementary technological products, customer base and geographical distribution of Veoneer are very consistent with our ADAS business, and this acquisition expands Magna’s global engineering and software development talent base. We look forward to becoming the industry leader in active safety solutions after the merger, strengthening our industry position in the entire set of ADAS systems, and preparing for the transition to higher levels of autonomous driving. This acquisition also fits the company’s strategy of accelerating investment in high-growth areas.

This acquisition is undoubtedly a completion plan for Magna’s “six skills as an OEM emperor”. Magna’s business model makes it impossible for it to compete with major OEMs in the C-end market in a brand-oriented way.

This acquisition is undoubtedly a completion plan for Magna’s “six skills as an OEM emperor”. Magna’s business model makes it impossible for it to compete with major OEMs in the C-end market in a brand-oriented way.

Qualcomm pursues greater dominance

Qualcomm is no stranger to the automotive front-loading market. The most notable are the 820A and 8155 chips in the field of car machines. However, the general consensus about the outbreak of intelligent cabins is only after autonomous driving. Because only when the hands and eyes are freed, the revenue-generating capabilities of the intelligent cabin ecosystem in the mobile space can be fully stimulated.

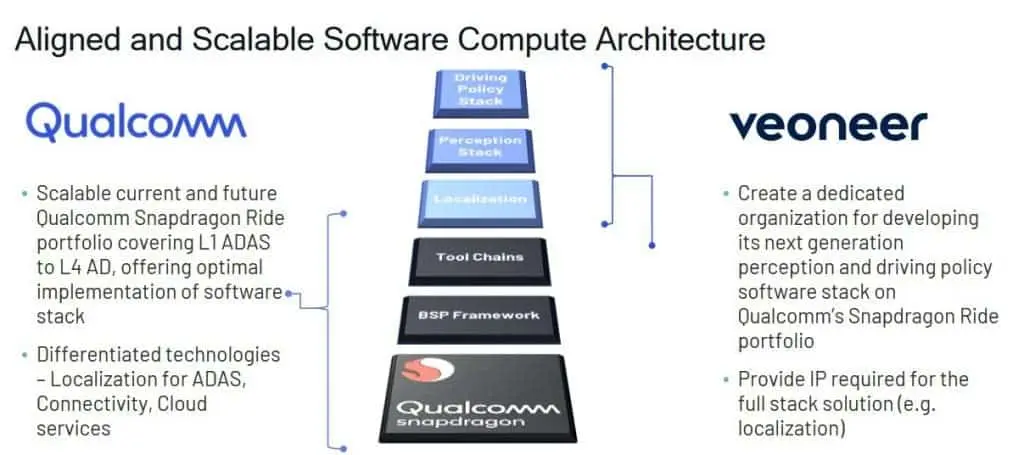

In fact, as early as the beginning of 2020, Qualcomm announced its entry into the ADAS market in a high-profile manner. The goal was to provide OEMs with an extendable platform solution Snapdragon Ride, covering all levels of autonomous driving. General Motors and Great Wall Motors are currently the first batch of public customers and will land in 2023.

In January of this year, Qualcomm and Veoneer also signed a cooperation agreement. Veoneer will become the first Tier 1 to integrate the Snapdragon Ride autonomous driving solution, and sell the autonomous driving domain controller to complete vehicle manufacturers. The software running in this domain controller is Arriver written by Veoneer.

Who will be the final winner?

With the rise of various new energy brands and the entry of new Internet players, the future survival status of OEMs may change. As a brand, they will focus on user operations and product definitions, rather than heavily dependent production and path dependencies in assets. After all, the times have changed, and not all players have the same single product sales and vertical integration capabilities as Tesla. Magna’s customers will inevitably have higher and more flexible requirements for one-stop vehicle solutions.

Arriver was originally a part of the cooperation between Qualcomm and Veoneer, but how to write autonomous driving software was entirely up to Veoneer, and Qualcomm could not intervene, nor did it currently have any property rights. However, it is clear that Arriver is a product that can run on Qualcomm’s hardware platform. Qualcomm’s ultimate goal is to acquire complete and exclusive software control rights and enter the automotive factory with a system-level solution, which may be the ultimate goal of the acquisition.

No matter it is Magna or Qualcomm, their core purpose of acquisition is mainly for the self-driving software called Arriver. From the financial aspect, Magna’s bid is lower than Qualcomm’s.

Motivation-wise, Magna aims to expand their business scope to counteract other European Tier 1 companies’ layout in safety and ADAS. While Qualcomm intends to acquire the software part for their autonomous driving computing platform to create a complete self-driving solution. As a result, although Qualcomm’s bid is higher, they may take more drastic actions for Veoneer’s structural adjustment.

We remain curious and wait silently to see how Veoneer, who definitely wants to survive, will decide on this acquisition…

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.