After finishing yesterday’s article, many friends told me that there were different interpretations about issues such as recalls and battery quality levels, and different people (only) saw what they wanted to see. Therefore, I wanted to write another article to clarify my viewpoint.

This is what I think:

About the Collaboration Between LG and US Automakers

In the short term, there is room for discussion between GM and LG on the allocation of the $1.8 billion cost responsibility. If this issue is not resolved, it will have an impact on the subsequent two joint venture factories and the Ultium battery collaboration. However, this issue will not affect the overall framework of the collaboration.

Fortunately, Ford is relatively fortunate. Of course, Ford may also need to pay attention to the battery status, input parameters, and usage data of the North American Mustang BEV. The main American automakers’ batteries are primarily soft-pack solutions, and the next U.S. battery factory’s strategic direction may be to update more finely at the process level.

After experiencing these incidents, automakers will be more clear that the batteries used in the United States in the future should be produced in the United States. The battery production layout originally in Korea will be largely relocated to the United States and will be supervised by automakers nearby.

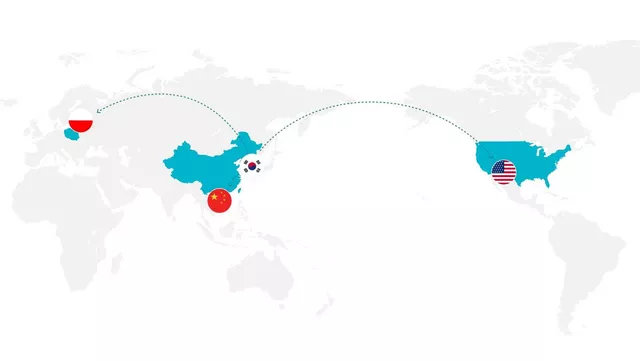

By the way, for readers who are not familiar with LG’s situation, LG’s main supply areas currently cover South Korea, Europe, and the United States, including:

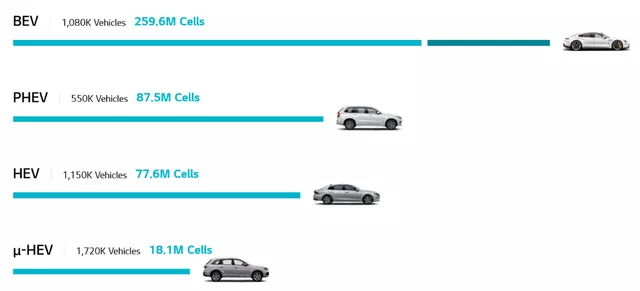

BEV: 1.08 million vehicles, 259.6 million battery cells. (Currently, there have been more than 10 fire accidents of Hyundai KONA, more than 10 fire accidents of GM’s Bolt EV, 1 each for Volkswagen and Jaguar Land Rover, and the approximate calculation may be more than 30. The probability of fire is 1/30,000. This data is higher than Tesla’s 21700.)

PHEV: 550,000 vehicles, 87.5 million battery cells, mainly including GM, Volvo, Audi, and Geely’s plug-in hybrid. I have no impression that the P1.1 and P2.6 series have had any fire accidents.

HEV: 1.15 million vehicles, a total of 77.6 million battery cells, mainly supplied to Hyundai, etc.

48V: 172,000 cars, 18.1 million battery cells, mainly providing 48V batteries for companies such as BMW and Volvo.

By investigating the models and battery cell models behind the fire accidents in China from 2015 to 2020, the differences between the two can be clearly compared.

What I am more concerned about is the subsequent battery cell design of LG’s N2.1 series. So far, there have been no problems with its high-power 390 battery cell series.

The Choice of European Automakers

For European automakers, Volkswagen, Renault, Volvo, and Jaguar have used a large number of Korean soft pack batteries for their BEVs, which will not have particularly big problems in the short to medium term. However, in the long term, Volkswagen and Volvo have already selected pouch cells as their main technology route, while Renault and Nissan continue to expand AESC. AESC has maintained a long record of no fire, and overall, I think there is no need to do more safety interpretation on this route of soft pack technology. The root cause of the accident is currently explained by the two automakers, and it is difficult to explain it clearly in a short time.

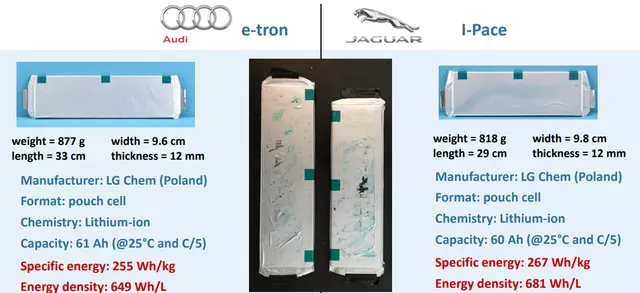

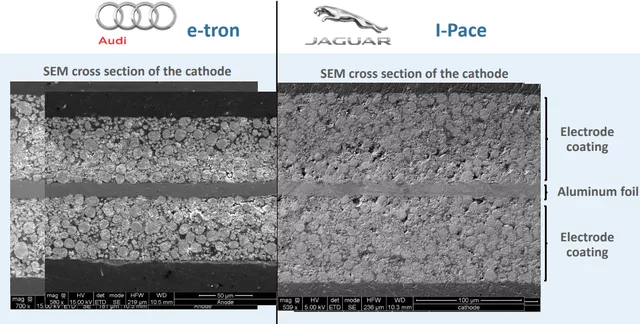

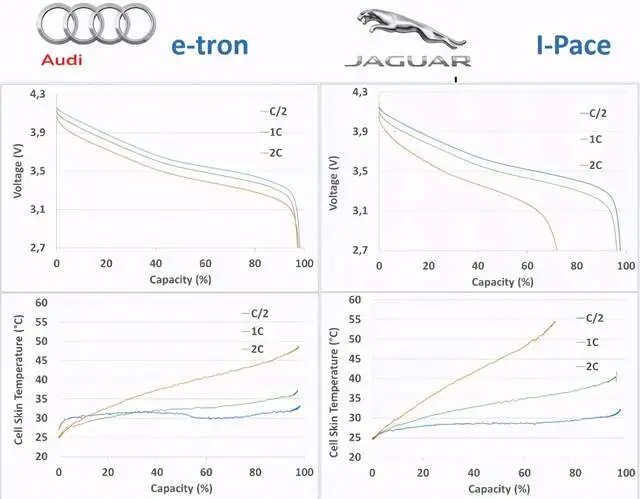

I tend to understand that when N2.1 was launched, LG focused on the parameter of energy density. As can be seen from the above picture, this battery cell has done many challenges in its design, so it can achieve an energy density of 267Wh/kg (1/5 C), but the fast charging speed is average (KONA, Bolt, ZOE, and I-pace’s fast charging ability are not strong), and the discharge rate is not high. From this point of view, this product belongs to the low-cost category, and it was a bold bet for LG in the process of expanding BEVs. Therefore, inevitably, this is quite different from the product quality of LG, especially in the PHEV era, that we previously understood.

Differences in Domestic and Foreign Regulations

Regarding the differences in domestic and foreign regulations, my understanding is as follows:

Based on the main markets: Japan, Korea, the United States, and Europe, their attitudes towards non-collision fires of electric vehicles are strict and cautious because, once accumulated to a certain extent, the brand awareness damage and litigation risk caused by a single vehicle will be very high. Therefore, we can see that AESC from Japan, Panasonic from Japan, and SDI from Korea are very cautious. Especially for SDI, they have been scared by problems with the batteries of mobile phones. When problems with mobile phone batteries occurred, they immediately slowed down on power battery projects and did not dare to move forward until they reached a certain quality level. There is a long-term game process here.

Spatial Issues with Pouch Cells

Currently, worldwide automakers including GM(+Honda), Ford, Daimler, Nissan, Renault, and Volvo all adopt pouch cells to various degrees. Furthermore, BYD’s “blade” also serves as a variant of pouch cells. Despite that pouch cells have not yet become a backbone like prismatic or cylindrical cells, there is still market demand for pouch cells. However, pouch cells’ biggest problem is that it is hard to increase the single-cell capacity significantly without parallel connections. Moreover, it is comparatively difficult to conduct fire isolation in terms of structure. As of now, several domestic pouch cell manufacturers are working on pouch cell CTP, which also faces challenges. The Module in Pack of LG might be feasible, but it takes time.

In my opinion, we don’t need to be pessimistic about this technical path.

Summary: I discussed many recall cases and battery designs, not to make one-sided conclusions on some companies’ battery quality (or lack thereof). Firstly, it is objectively true that manufacturers enjoy advantages in terms of scale and regulatory capacity, but we should not ignore accidents and issues that happened in the past. What I want to say is that the scope of the recall mechanism has expanded globally, causing battery companies to prepare for risks. With the increasing penetration rate of new energy vehicles in China, some historical issues have already begun to be settled. In the United States and Europe, there are collective lawsuits against the practice of limiting the SOC upper limit using OTA.

By adding these explanations, I only want to take a more objective and fair attitude towards the overall development of the industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.