Car Companies Competing for China’s 2025 Plan and the First Place

From an unknown time, two keywords became the objectives that many Chinese car companies are competing for: one is “2025,” and the other is “China’s first.”

2025 has become a miraculous time node, and many car companies have set a “reform” flag for themselves by 2025.

Becoming China’s first has also become the glory that many car companies compete for openly.

Those Competing Car Companies

This month, taking advantage of the opportunity to announce their financial reports, Geely officially announced its 2025 plan: to have the highest market share among Chinese brands by 2025 and “sell over 3.65 million units” (including Zeekr vehicles). Among them, the “sales proportion of intelligent electric vehicles will exceed 30%,” which is 10% higher than the 20% set by China’s “New Energy Automobile Industry Development Plan (2021-2035).”

Geely’s total sales target for this year is 1.53 million units, which means that by 2025, its sales will be more than twice that of now. Moreover, 3.65 million units, simply calculated, means that Geely needs to sell 10,000 units per day, which is quite exciting. And among these 3.65 million units sold, the sales of intelligent electric vehicles account for roughly 1.095 million units.

Do you think this target is too ambitious?

We’re just getting started.

Let’s take a look at another car company: Great Wall Motor.

Although Great Wall didn’t explicitly say they want to be China’s first, their 2025 sales target is 4 million units, which is more than Geely’s 3.65 million units. Moreover, “80% of these 4 million units will be new energy vehicles, which is 3.2 million units.”

Not only that, Great Wall will accumulate R&D investments of 100 billion yuan in the next five years, which is 20 billion yuan per year. What does this mean? NIO plans to invest 5 billion yuan in R&D this year (last year’s number was 2.4878 billion yuan), Lei Jun’s investment in Xiaomi’s car project is a 10-year investment of 10 billion US dollars (approximately 70 billion yuan), averaging 7 billion yuan per year. Adding another figure, Great Wall’s R&D investment in 2020 was 5.1 billion yuan.

This is truly investing heavily.

Not only Great Wall, but Changan, GAC, FAW, and Dongfeng have also successively launched similar visions and plans. Instead of reviewing them one by one, let’s look at an overview.Changan Automobile: By 2030, the sales volume of Changan Automobile will reach 5 million units, of which the sales volume of Changan brand will reach 3.5 million units. At the same time, it plans to invest a total of CNY 150 billion.

GAC Group: Striving to achieve an annual production and sales volume of 3.5 million units and a compound annual growth rate of over 10% by 2025, with a market share of over 12% and new energy vehicles accounting for 20% (about 700,000 units), becoming an international first-class high-end intelligent electric vehicle brand. By 2035, it aims to achieve a total production and sales volume of 5 million units, with new energy vehicles accounting for 50%, and becoming a global leader in high-end intelligent electric vehicles.

FAW: Announced the “14th Five-Year Plan” target of “11245”. Income will exceed CNY 1 trillion, with sales volume of 6.5 million units and profit exceeding CNY 68 billion. The sales volume of the Hongqi brand will exceed 1 million units, striving to enter the world’s leading ranks. The sales volume of self-owned brands will exceed 2 million units, striving to enter the world’s leading ranks. The proportion of Hongqi new energy intelligent vehicles will exceed 40%, striving to reach the world’s advanced level (the proportion of the entire group exceeds 20%, and the proportion of self-owned passenger cars exceeds 30%). By 2030, it aims to achieve the electrification of the vast majority of self-owned passenger cars.

Dongfeng Motor: By 2025, the sales volume of commercial vehicles, self-owned passenger cars, and new energy vehicles will reach 1 million units each. Dongfeng’s self-owned brand scale will enter the top 3 in the industry. In 2024, Dongfeng will achieve 100% electrification of its main passenger car brand’s new models. By 2025, the sales volume of new energy vehicles will account for over 20% of the company’s total sales.

At this point, self-owned brands have already got off to a good start with sales of millions.

However, not only are traditional automakers competing, but new players are also gaining momentum.

In a February internal memo, Li Auto set itself a very ambitious goal: to achieve 20% market share and become China’s number one intelligent electric vehicle enterprise by 2025.

Li Auto expects China to sell more than 8 million intelligent electric vehicles by 2025, of which 20% is about 1.6 million new energy vehicles. Li Auto’s current cumulative delivery volume has exceeded 70,000 (achieving 100,000 this year is not a problem). This is not even in the same league.

However, according to Li Auto’s own statement, Li Auto’s 2025 strategy will be completed in accordance with the strategic analysis method (LSA) in the LBP (Li Auto Working Method).

Do you think this is the end? You are still too young.In 2030, the ideal vision is to become the world’s leading intelligent electric vehicle enterprise.

Although NIO has not made similar statements, its actions are honest.

In August of this year, NIO released its Q2 2021 financial report. In this report, NIO stated that it will directly deliver three new models next year (note: not release, but deliver), and will also enter the mass market through a brand new brand.

Prior to this, NIO’s pace has always been one new model per year, steadily advancing. Now, it has gone directly from one model to three, and has reduced the dimension with a brand new brand to face a wider range of users. The production capacity of JAC NIO’s factory will also be expanded from the existing 100,000 to 240,000, clearly aimed at more sales and profits. That’s not it, Li Bin said that there will be more models released in two years.

It is obvious that NIO is sharp in words and decisive in action.

Everyone is eager to take the lead in the Chinese market in 2025.

Why 2025?

Why is the timeline set at 2025? This is a good question.

Some time ago, after a closed-door meeting, the Biden administration officially decided to transform comprehensively to electric vehicles: by 2030, the proportion of zero-emission vehicle sales (pure electric, hybrid, and fuel cell vehicles) should be increased to 40-50%. Traditional giants have responded.

At this point, both China, Europe, and America have confirmed that the “future of the automotive industry is electric”, and the “duty” of accelerating the world’s transition to sustainable development has officially transitioned from voluntary transformation by automakers to policy-driven promotion.

From 2021 to 2030, we will enter the “boiling new decade” of the industry. This decade of change not only represents the revolution of energy forms, but also brings new variables brought by intelligence.

Although the surface change is only the form of power, in fact, it is a top-down reshuffle of the automotive industry, including automakers and suppliers.

Under these two opportunities, traditional giants have already begun their crazy transformations.

German Big Three:Volkswagen: As the giant with the fastest transformation speed, Volkswagen’s goal is to become the leader of the global electric vehicle market no later than 2025, with the target of selling 1 million electric vehicles in the Chinese market in 2022. By 2030, the delivery volume of electric vehicles will account for 50% of the group’s total global delivery volume, and in Europe, the goal is to reach around 60%.

BMW: By 2023, it is expected that pure electric vehicles will cover about 90% of the sub-segments. From now until 2025, the annual sales volume of BMW’s pure electric car models will increase by more than 50% on average. By 2025, BMW will sell more than 10 times the number of pure electric cars sold in 2020, and deliver the 2 millionth pure electric car model. At least 50% of global sales will be pure electric vehicles by 2030, and the company expects to sell approximately 10 million pure electric vehicles globally in the next ten years.

Mercedes-Benz: The goal is to complete the transformation from “electricity first” to “comprehensive electrification”. By 2022, Mercedes-Benz will provide pure electric models for all sub-segments it serves. From 2025 onwards, all newly released vehicle architectures will be pure electric platforms, and each model will offer customers a pure electric version. “By 2025, the sales ratio of plug-in hybrid and pure electric vehicles will reach 50%, and new car sales will have basically transformed into pure electric vehicle models by 2030.”

Detroit Three:

General Motors: Investing $35 billion in electric and autonomous vehicles, and launching 30 pure electric vehicle models globally by 2025. The sales volume of electric vehicles is expected to exceed 1 million units, and by the end of 2025, 40% of vehicles sold in the United States will be electric. By 2035, it will become a fully electric vehicle manufacturer.

Ford: By the end of 2025, it will invest more than $30 billion in electrification, and it is expected that pure electric vehicles will account for 40% of Ford’s global sales by 2030. Currently, its subsidiary Lincoln is accelerating its transformation, and the entire product portfolio will be electrified by 2030, with the first pure electric vehicle model to be launched next year. Lisa Drake, Ford’s North American COO, said that by 2023, Ford’s spending on electric vehicles will surpass that on fuel vehicles.Stellantis Group: By the end of 2025, Stellantis Group plans to invest over €30 billion in the field of group electrification and software development. By 2030, the group’s sales in Europe will have more than 70% and in the United States over 40% from low-emission vehicle types (LEV).

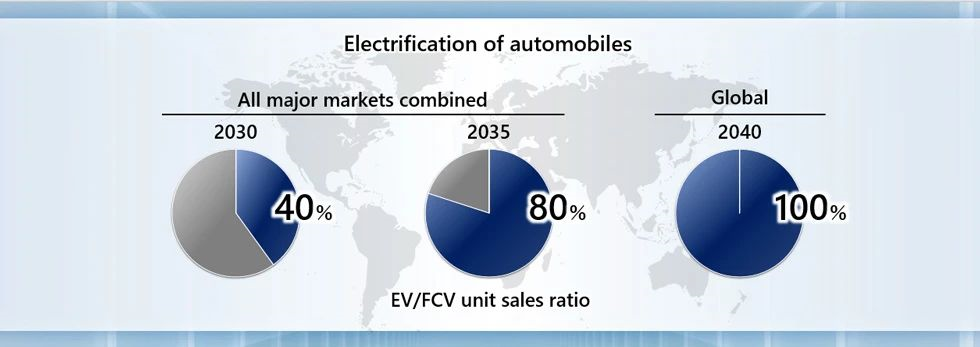

Even Honda, which used to specialize in hydrogen energy, has announced the temporary abandonment of hydrogen fuel cell vehicles and is turning to pure electric vehicles. Honda’s electrification strategy is divided into three steps: by 2030, sales of pure electric (EV) and fuel cell vehicles (FCV) will reach 40% in advanced countries (mainly the United States and China); by 2035, it will rise to 80%; and by 2040, it will reach 100%. At the same time, Honda stated that regardless of how sales revenue fluctuates, it will invest ¥5 trillion (approximately RMB 290 billion) as research and development costs in the next six years.

To put it simply, almost all car manufacturers that you can name are accelerating their transformation.

Moreover, these giants have a very obvious characteristic: it is difficult for a big ship to turn around, but, with a “but”, once they determine the direction, their offensive will be fast and fierce.

Let me give you a very typical example: Volkswagen Group.

In 2018, Volkswagen Group launched the MEB platform and planned 27 models for its four brands. Within the lifespan of the MEB, a production plan of 10 million vehicles was planned. Just for Volkswagen alone, ID.3, ID.4, and ID.6 have been introduced. Just this year, ID.4 and ID.6 have been launched in China, and ID.3 is expected to be launched within the year. The speed is surprising, and this is Volkswagen’s new energy offensive.

Moreover, this move has already achieved initial results. Volkswagen’s electric car market share in Western Europe has reached 25%. Moreover, in the next few years, Volkswagen Group’s momentum will be even more fierce. Its brands will launch more affordable products, which will help Volkswagen capture more market share.## For This Decade Full of Variables, Crisis Awareness is Critical for Chairman of Great Wall Motors

Wei Jianjun, the chairman of Great Wall Motors, is very aware of the crisis at hand with this decade full of variables. In his view, although there are ten years, the true window of opportunity is only three to five years. “If Chinese automotive brands want to truly surpass others, they can only rapidly expand their advantages during this three to five-year period, in order to lead in the new energy and intelligent fields. Moreover, Chinese automotive brands only have one chance.”

Li Xiang, the chairman of Ideal Automotive, has the same feeling. In his opinion, the market competition of intelligent electric vehicles in 2030 is very similar to that of the intelligent mobile phone industry (in 2020, the top five brands of intelligent mobile phones in China accounted for 96.5% of the market share). “The market competition and market share of intelligent electric vehicles in 2030 will be very similar, and only companies with more than 25% of the global market share will have the opportunity to become the leading enterprises in the global intelligent electric vehicle industry.”

Therefore, in order to seize the initiative, independent automakers must act quickly.

Now We Have Set Our Goals, But What About Capability?

Now that we have set grand goals, what about capability? What makes us believe that these independent brands can achieve them?

They need to think about several questions: who are they going to sell the cars to? How are they going to sell them? After all, sales are not as simple as just using words.

This leads us to Volkswagen Group, as mentioned earlier. After the ID series entered the market, Feng Sihan, CEO of Volkswagen Group (China), also has high hopes for the sales of the ID series models in China, stating that “by the end of this year, the sales of the ID family series products are expected to reach 80,000-100,000 units.”

However, the performance of the ID series has always been below expectations, and only gradually picked up in the past month or two. It will probably be difficult to achieve this year’s sales target.

Another typical case is Geely. As early as November 2015, Geely announced the “Blue Geely Action Plan,” which planned to have new energy vehicles account for more than 90% of total sales by 2020, including plug-in hybrid vehicles and hybrid vehicles accounting for 65% of the sales, and pure electric vehicle sales accounting for 35%.

Although equally ambitious, this plan has not been completed as scheduled. In 2020, Geely’s total sales of new cars reached 1.32 million units, of which new energy vehicle sales were only 68,000 units, accounting for only 5.2% of the overall sales scale.

Reality tends to be harsh in contrast to idealism.The determination of independent brands to compete is a good thing. However, it is necessary to formulate relevant plans based on actual conditions.

Nevertheless, we can still see some changes: traditional car companies incubate new car-making capabilities to achieve faster electrification transformation. Great Wall has Salon Smart, BAIC has Xpeng, Geely has Geometry, Dongfeng has Seres, and SAIC has Zhi Ji…… Everyone is moving fast.

However, even if we do all of this, it is still not enough. We still need to develop competitive and high-impact products, such as the domestically produced Model 3/Y by Tesla.

So, who will be China’s number one in 2025? Will it be the traditional car manufacturers or the new players?

It may be too early to talk about this now. Since everyone is determined, let’s set a “small goal” first: which independent brand can outperform Tesla in the domestic market 🙂

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.