Recently, General Motors has issued a recall on all Bolt EV models including 2017-2018 MY, MY2019 Bolt and 2020-2022 MY Bolt EV and Bolt EUVs. This issue is a huge pitfall but not entirely surprising. One aspect of this problem will be discussed today.

Here are some facts:

General Motors will recall a total of 142,000 Bolt EVs, costing an estimated $1.8 billion for the recall. The specific cost allocation will be determined based on the cause of the accident.

General Motors is currently indefinitely suspending sales of the Bolt EV electric vehicle (sales will resume after the recalled vehicles have been properly handled) and will seek compensation from battery supplier LG.

The recall covers the following quantities:

MY2019 Bolt EV 9,335 units (6,989 in the US, 1,212 in Canada)

MY2020-2022 Bolt EV and Bolt EUV 63,683 units (52,403 in the US, 9,019 in Canada)

Recall Triggered by LG Battery Issue

According to The Verge, the biggest issue in this recall is that the 2020 Bolt caught fire in the United States this week, and a fire video was posted on YouTube. This car was not on the previous recall list, but General Motors made the recall decision through Onstar’s battery data.

The core issue has been identified by General Motors and LG experts. Manufacturing issues exist in other factories besides the Pusan factory in South Korea. The fundamental reason for the Bolt EV fire is the co-existence of two manufacturing defects in the battery (tearing of the negative pole ear and wrinkling of the separation membrane). General Motors currently does not have the ability to confirm the production of qualified battery modules, so two solutions are proposed:

Use Hilltop Reserve mode (applicable to MY 2017-2018 Bolt EV)

Limit charge SOC (applicable to MY 2019-2022 Bolt EV) mode, setting the vehicle to 90% charge limit state.

Note: This statement is similar to that of Hyundai Motor. The current issue still centers on manufacturing issues, and the biggest concern is whether there will be a recall in Europe. If future incidents occur with Renault and Volkswagen, two major BEV customers, LG’s entire BEV business will face significant challenges.

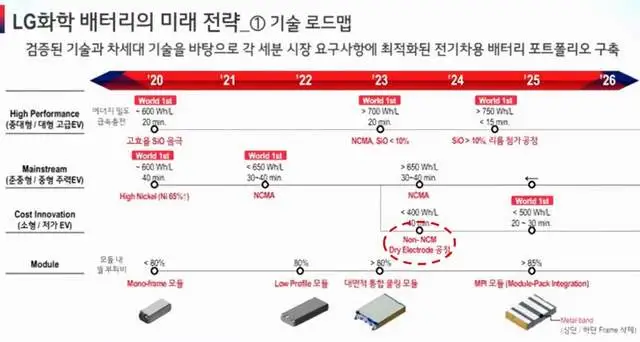

LG Chem’s Technical Roadmap

LG Chem’s previous technical roadmap revolved around soft-pack batteries. In a recent Korean brokerage technical report, there was a roadmap (Figure 3) like this:

High-performance route (ternary): The high-performance route focuses on improving fast charging time. In 2020, it achieved fast charging in 20 minutes and an energy density of 600Wh/L, and in 2023, it plans to iterate to an energy density increased to 700Wh/L while maintaining 20-minute fast charging. In 2024, it slightly improved to 750Wh/L and 15-minute fast charging.

Mainstream route (ternary): In 2020, it was a fast charging of 40 minutes and an energy density of 600Wh/L, and in 2021, it slightly increased to fast charging of 30-40 minutes and an energy density of 650Wh/L.

Low-cost route: In 2023, it introduced a non-ternary technical route, with the goal of fast charging in 40 minutes and an energy density of 400Wh/L, and later it improved to fast charging of 20-30 minutes and an energy density of 500Wh/L.

From the current situation, LG may need to quickly increase the production of cylindrical batteries. Let’s compare LG and SDI in promoting pure electric vehicles. Which one is more stable and reliable?

Compared with the general battery supply strategy, Hyundai has long nurtured two suppliers, LG and SK. After stopping the use of LG batteries in the Kona EV, Hyundai relies on a new generation of EV platform to make up for the loss, which gives SK a great opportunity (although SK’s separator is expensive, this thing may be the key to significant differentiation).

In the long run, this incident has a significant impact on LG’s market share, which is a failure at a critical time.

Summary: We should carefully consider whether there is a possibility that the current cost reduction strategy might have problems. Overseas safety regulations have very low tolerance for electric vehicle fires. Has the safety level of our domestic battery industry reached the point where we have confidence in going abroad? If there are several accidents, companies will easily suffer losses. Each recall is painful for both car manufacturers and suppliers. This industry is really cautious and treading on thin ice.

Summary: We should carefully consider whether there is a possibility that the current cost reduction strategy might have problems. Overseas safety regulations have very low tolerance for electric vehicle fires. Has the safety level of our domestic battery industry reached the point where we have confidence in going abroad? If there are several accidents, companies will easily suffer losses. Each recall is painful for both car manufacturers and suppliers. This industry is really cautious and treading on thin ice.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.