Author: LYNX

The resurgence of the epidemic and the NOP accident of NIO have made the recent topic of smart electric cars quite dull. In the continuous discussion of the attribution of responsibility for autonomous driving assistance accidents, even a few articles that extended from “NETA’s marketing leveraging” digging up the past due to Wu Yifan’s alleged rape and arrest popped up.

Without hot topics in China, we naturally have to look abroad. However, apart from Tesla’s not-so-painful update on FSD in the United States and AI’s release of a “satellite” with a super chip, overseas is even quieter than China!

It’s so difficult!

Anxiously looking for a topic to write about, I can only look back at last week while playing around with the “decompression tool” in the editorial department in the hope of capturing a little inspiration amidst the sound of popping “bubbles.”

Fortunately, in the corners of the news feed, I found such an old piece of news:

On August 3rd, the Ministry of Commerce released a research report on the development of new energy vehicles in Russia, explicitly pointing out: “Next, Chinese companies can consider seizing the opportunity of market growth in Russia, increasing the export of new energy vehicles to Russia and marketing and promoting them in Russia after sufficient research, gradually expanding their market share in Russia; and discussing cooperation on new energy vehicle infrastructure with Russia, including charging facilities construction, network optimization, scheduling and transportation optimization, intelligent services, and supply in remote areas, to share new opportunities in the new energy vehicle market.”

We all know that apart from energy saving and environmental protection, the country’s support for new energy vehicles has a larger industrial proposition, that is, “overtaking on a curve.”

After the “use the market to exchange for technology” approach was proven unsuccessful in the era of fuel vehicles, new energy vehicles have become the “biggest hope of the village” for domestic enterprises to break the market monopoly of joint venture brands.

As product competitiveness continues to improve and the domestic industrial chain becomes more mature, new energy vehicles carry the shared dream of several generations of Chinese automotive professionals: to go abroad and “shake hands” with international giants in the global passenger car market.

Therefore, since the end of last year, there have been continuous news of Chinese new energy vehicles going overseas and entering foreign markets, including independent brands such as BYD, as well as emerging car-making forces such as XPeng and NIO.

These companies’ first stop in going abroad coincidentally chose Norway, where electric cars are most popular in Europe.

# Norway Looks Cold And Is Supposed To Be The Place With The Most Battery Decay And Least Practical Electric Cars. However, It Became “Electric Car Paradise.” Many Discussions And Analyses Have Pointed Out That There Are Several Reasons For This: Wealthy People, Love For The Environment, Complete Charging Facilities, And Government Support.

# Norway Looks Cold And Is Supposed To Be The Place With The Most Battery Decay And Least Practical Electric Cars. However, It Became “Electric Car Paradise.” Many Discussions And Analyses Have Pointed Out That There Are Several Reasons For This: Wealthy People, Love For The Environment, Complete Charging Facilities, And Government Support.

With This Question In Mind, I Did Some Research On The Russian Electric Car Market And Found Some Interesting Things.

China’s Yesterday, Russia’s Today?

First, We Need To Make One Thing Clear: Russia Is Not Norway. The New Energy Market Is In Its Infancy. If We Have To Make A Comparison, It Resembles China Several Years Ago In Terms Of The Market Environment And Consumer Awareness.

This Was Clearly Stated In A Survey By The Ministry Of Commerce: “Affected By The Cold Climate, The Sales Of Electric Vehicles In Russia Are Limited, And They Are Mainly Focused On Exhibiting New Products And Promoting Innovation And Environmental Protection Concepts.“

So, How Many Electric Cars Are On The Russian Land?

According To The Ministry Of Commerce Survey Report, The Number Of Electric Cars In Russia Was 6,300 In 2020, And The Market Penetration Rate Was Only 0.01%.

Russian Media Reported That The Number Of Registered Electric Vehicles In The Country, Including New And Used Vehicles, Was 10,800 As Of January 1, 2021, A 71% Increase From 2019.

Overall, Compared With Russia’s 45 Million Passenger Car Ownership, Whether It’s 6,000 Or 10,000, It’s A Drop In The Bucket.

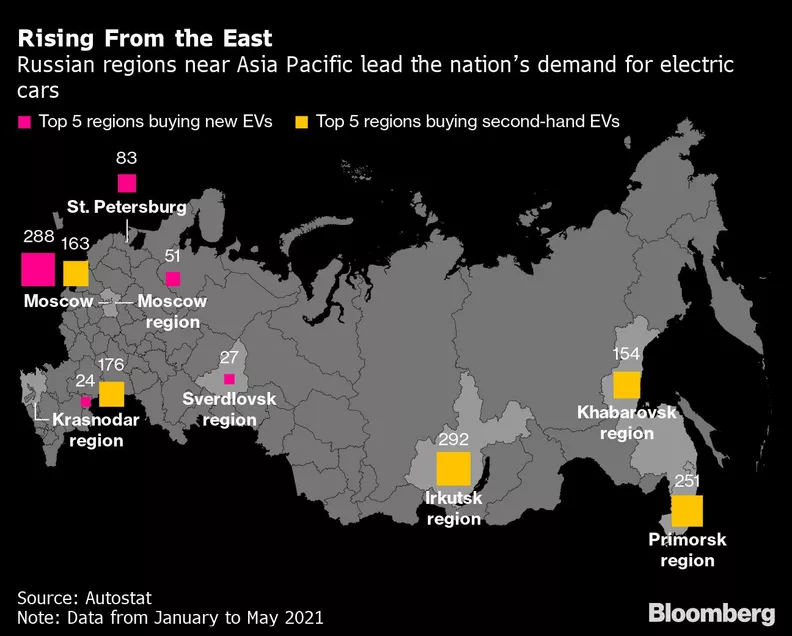

If We Analyze Where Electric Cars Are Sold And To Whom, We Will Find That There Are Several Characteristics: New Car Purchases Are Concentrated In Large Cities, Used Car Sales Are Higher Than New Car Sales, And The Far Eastern Region Of Russia, Close To Asia, Is The Most Enthusiastic About Electric Cars.

New Car Sales Are Easy To Understand: Large Cities Have Higher Economic Levels, And Residents Have More Money, So They Are Naturally Willing To Try New Electric Cars.

In 2020, Moscow And St. Petersburg Were The Two Cities In Russia With The Strongest Purchasing Power For New Pure Electric Cars. Tesla Was The Bestselling Brand, Accounting For 32% Of The Market Share.

Compared With New Cars, Used Electric Cars Sell Better In Russia. Last Year, More Than 5,000 Second-Hand Electric Cars Were Sold In Russia, 93% Of Which Were Imported From Japan, And The Majority Being Right-Hand Drive Models of Nissan Leaf.These second-hand cars were mostly absorbed by the “early birds” in the Russian Far East market. The old Nissan Lingfeng, which has a range of only 300 kilometers, encounters harsh Siberian winds that seriously reduce its endurance. The reason why Russian people still choose it is simply that it is “cheap“.

In the Russian Far East, due to insufficient refinery capacity, fuel prices are much higher than in other parts of the country.

Buying a used Nissan Lingfeng locally only costs 400,000-500,000 rubles (about RMB 35,000-53,000).

Cheaper, obviously, is fuel. It is reported that driving a Lingfeng in these areas costs about 500 rubles (about RMB 44) in electricity bills per month. In comparison, if you drive a Russian “national car” Lada gasoline car, the monthly fuel cost is nearly 10,000 rubles (about RMB 888).

In other words, today, the demand for electric vehicles in Russia is very simple: “Don’t bother with automatic driving and intelligence, just make it drivable, and save money.”

Currently, the population of Russia is about 146 million, but only 25% of the European part of the country concentrated 75% of the population. The popularity of used Lingfengs in the Far East region is obviously not enough to explain that electric vehicles have entered mainstream consumer markets.

In fact, the tall and sturdy Russians have attitudes towards car purchases and doubts about electric vehicles that are quite similar to Chinese consumers:

Russian people love “big cars”, drive big SUVs, and everyone respects you; if you drive a small, compact car…

Russian urban construction is full of strong “Soviet-style grandeur”, except for the densely populated capital Moscow, there is basically no need to worry about the problem of cars being too big and difficult to park. And if you are in Moscow, the most worry-free way of transportation regardless of whether you drive a big or small car is taking the subway…

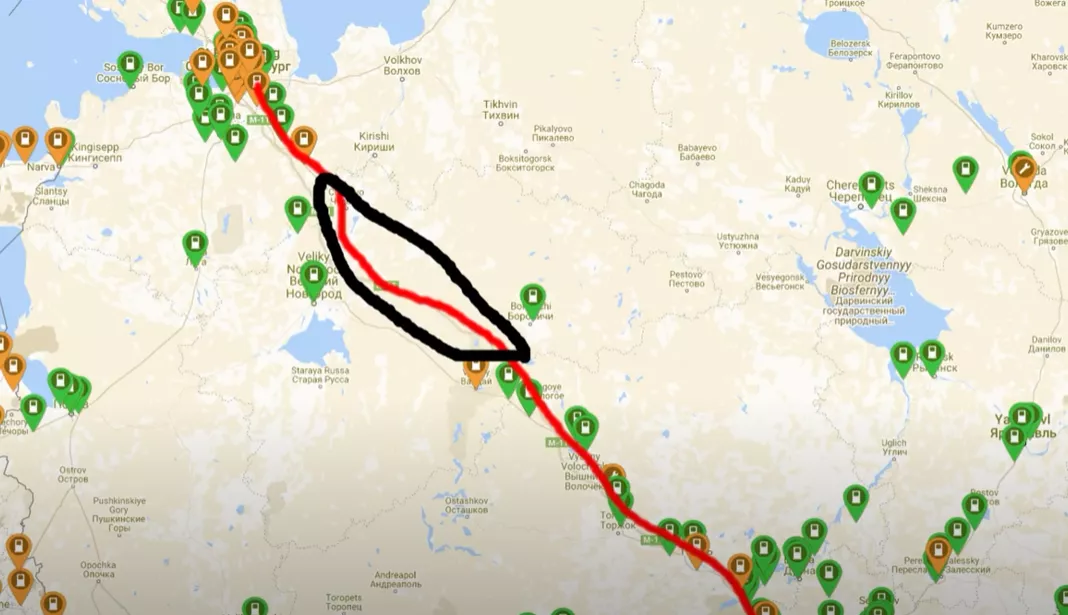

Cold climate causes range anxiety. At the same time, charging facilities are concentrated in big cities like Moscow and St. Petersburg. The distance between these two cities is 700 kilometers, and charging stations along the way are also very rare.

In addition, common concerns of the Russian people about electric cars include: whether the batteries are genuinely environmentally friendly, and whether new electric cars are expensive “toys for the rich”…

In any case, despite the different levels of economic development and income levels of the residents, the people of China and Russia have basically similar doubts about electric cars.

The market is swamped with second-hand electric cars, prompting the Russian government to realize the profound potential of electric cars and begin to learn from China and strengthen policy support:

-

From May of this year until the end of the year, zero tariffs will be imposed on the import of pure electric vehicles.

-

Starting next year, 25% of the purchase price subsidy will be provided to Russian-made new energy vehicles, up to a maximum of 625,000 rubles.

-

Plan to allocate RUB 65 billion (approximately USD 1 billion) annually to develop autonomous driving, hybrid, and electric technologies.

-

Position Moscow as an “electric car pioneer”, plan to build 200 new charging stations every year starting this year, and aim to increase the number of charging piles in the city fivefold to 600 by 2023, while also planning for electric vehicle parking spaces, etc.

-

The goal for 2030 is to achieve that 10% of all automobiles produced in Russia are pure electric vehicles.

From these policies, we can see two layers of implications.

In the short term, the tariff exemption policy that ends at the end of this year is a good time window for global new energy brands, including Chinese manufacturers, to enter the Russian market.

In the long term, Russia, like China, will vigorously support the production of local new energy vehicles and accelerate the construction of supporting facilities such as charging piles.

So, what do electric cars currently produced in Russia look like?

Russian “Magical” Electric Cars

For someone like me who doesn’t understand Russian, it’s not easy to find any clues about Russia’s own electric cars. The earliest one that the world’s media paid attention to looked like this:

This strange-looking electric car is called the Kalashnikov CV-1… Yes, the same Kalashnikov who invented the AK-47 submachine gun.

In 2018, this Russian military giant introduced such an electric concept car: it is claimed to be equipped with a battery pack of up to 90 kilowatt-hours, with an acceleration to 0-100 km/h within 6 seconds, and is expected to compete with Tesla after its mass production. However… its range is only 350 kilometers.With such a large battery pack equipped, but only able to run 350 kilometers, is this an international joke? So I turned to search engines and found this thing below.

The car above is the Irzh brand travel car produced by the former Soviet Union in the 1970s. The designer claimed that the CV-1 “borrowed” its design style and paid homage to classics. In simpler terms, it is a rough and ready “oil-to-electric” conversion.

I can only say that Kalashnikov’s submachine gun is durable and tanks are well-made, but for car manufacturing, please be more careful.

In addition, I also found this sentence in the research report of the Ministry of Commerce: “Independent research and development has begun to show results. Russia’s Lada company has launched the local electric car brand Ellada, and St. Petersburg Polytechnic University has successfully developed urban electric SUV Kama-1, compact electric car platform Zetta, and so on.”

So, with the expectation of seeing what kind of Tesla the nation of warriors has produced, I googled again to see what progress this “initial independent research and development” has made.

Lada Ellada looks like this at first glance-it is still an “oil-to-electric” conversion.

Kama-1 finally has no shadow of a gasoline vehicle, but it doesn’t look like an urban SUV, right?

Regarding the performance of the vehicle, Kama-1 is equipped with a 33 kWh battery pack, and the cruising range is about 250 kilometers. It is worth mentioning that the manufacturer of this car similar to the Wuling Hongguang MINI EV mini car, Kamaz, also counts as a halfway transformation to produce electric vehicles. The company’s current main product is the behemoth below.

As for the last compact electric car platform Zetta mentioned by the Ministry of Commerce… let’s put it aside for now, and everyone can directly see the picture.

Do you still feel familiar? Let’s welcome the Baojun E200 from SAIC-GM-Wuling.

Do you still feel familiar? Let’s welcome the Baojun E200 from SAIC-GM-Wuling.

In Russian media reports, Zetta was described as “initially claiming that the battery pack was imported from China, and finally admitting that everything from the car doors, dashboard screens, to the software under the screens was purchased from China”.

What’s more interesting is that Zetta is also a “new force in car manufacturing” in Russia. The company announced in 2016 that it would create “Russia’s own pure electric vehicle”, and quickly released 3D renderings of the pure electric platform plan and products.

But in the next five years, Russian media only saw renderings of the car. The release date of this car has been delayed from the originally planned 2019 to this year, and it still cannot be mass-produced.

While the mass-produced car is not yet on the market, Zetta is constantly burning money, having received over 7.5 million U.S. dollars in funding from the Russian government and investment institutions.

For Zetta, which is burning money and constantly releasing product release dates, Russians may have a profound understanding of a magical term called “PPT car-making” by learning Chinese.

Who Can Strike Gold in Russia?

The stories that happened in China’s new energy era seem to be repeating themselves in Russia. So, which Chinese car companies, who have already become quite powerful, can respond to the appeal of the Ministry of Commerce and strike gold in Russia?

It is probably still the independent brands that have a certain scale, rather than new forces in car manufacturing such as “Weilixiao”.

In terms of product forms, China’s new energy vehicles are undoubtedly ahead of Russia in terms of intelligence and other aspects. However, when it comes to selling cars, in addition to strong product power, local production capacity and distribution channels are equally important.

Currently, manufacturers such as Great Wall Motors, Geely, and Chery have already built production bases in Russia or surrounding countries, and have established certain sales channels.

Under such circumstances, the introduction of products such as ORA and Xiaoma ant into the Russian market to strive for the benefits of import tariffs and subsidy policies in Russia seems to be a logical choice.

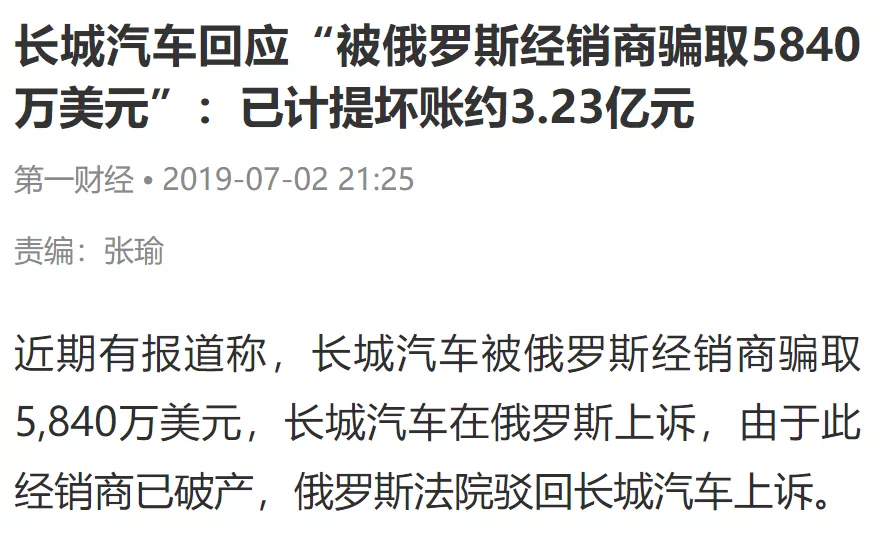

As for the new energy vehicle manufacturers, with the insufficient production capacity in China, it would incur higher trial-error costs to hastily explore the Russian market. Keep in mind that Great Wall Motors suffered from dealership bankruptcies in Russia and lost a painful lesson of RMB 332 million.

Furthermore, for new energy vehicle manufacturers, nowadays, intelligent and automated assisted driving technology serves as their core competitiveness, and achieving localization in Russia would be quite troublesome. Not to mention, adapting to the habits of Russian people in the deep user interaction is a challenge, even translating the UI into Russian is not easy.

However, one thing is certain that the Russian new energy market’s annual growth rate of double digits holds great potential.

For Chinese local manufacturers who have accumulated certain strength, exporting quality and affordable electric vehicles with longer range to Russia is undoubtedly a good opportunity to expand sales and brand influence.

Over a hundred years ago, the October Revolution brought to China the ideas that changed the national destiny. Today, perhaps it’s time to bring excellent Chinese new energy vehicles to Russia and let the Russian people know that advanced electric vehicles are not just Tesla.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.