*This article is reproduced from the autocarweekly WeChat account.

Text: Li, Financial Street

Two days ago, Geely Automobile released its financial report for the first half of 2021, with revenue of RMB 45 billion, a year-on-year increase of 22%, shareholder profit of RMB 2.38 billion, and a net profit of RMB 2.41 billion. Considering the external environment, financial data, and future expectations, this is a neutral-to-optimistic report.

At the beginning of the year, many researchers asked Li when Geely would perform well in the secondary market, and Li said it would be in the second half of the year. From Q1 to Q2, many securities firms have been quietly studying Geely, including Geely brand, Lynk & Co brand, and Ecarx. Many funds are also quietly laying out Geely. For institutions, this is a layout for the whole year.

Therefore, after BYD, Geely is the next object of attention in the secondary market.

It has to be admitted that the ability of institutional funds to grasp the trend is very strong. Everyone thinks that Geely will definitely have an expected financial report. The fact is also true. On the occasion of the financial report, Li and everyone talked about whether Geely’s financial report has any substance? Why has the secondary market been buying Geely all the time? How long can Geely’s second wave rise last?

Meeting expectations is exceeding expectations

There is a certain regularity in the cycle of the platform and products of the automobile industry. The overseas car companies have a product offensive cycle of about seven years, and the domestic independent brands often have a cycle of three to four years. According to incomplete statistics, BBA’s three companies often lead the way for six or seven years, while domestic independent brands often need three to four years. Geely is trying to break this rule.

Geely’s first take-off in the secondary market was in 2016, when many domestic securities firms became famous by promoting Geely. Later, for a long time, although Geely had a callback, its reasonable market value was maintained. At the beginning of the year, many friends thought that Geely might have a second wave of valuation from the second half of the year, and Li held the same view. The driving force of this wave is Geely’s industrial layout, and the pushing force is the secondary market’s confidence in Geely.

In the industry, Geely’s financial report is considered neutral-to-optimistic, but Li’s personal view is that Geely’s financial report is within expectations, and some data exceeds expectations. Let’s briefly analyze Geely’s half-year report:

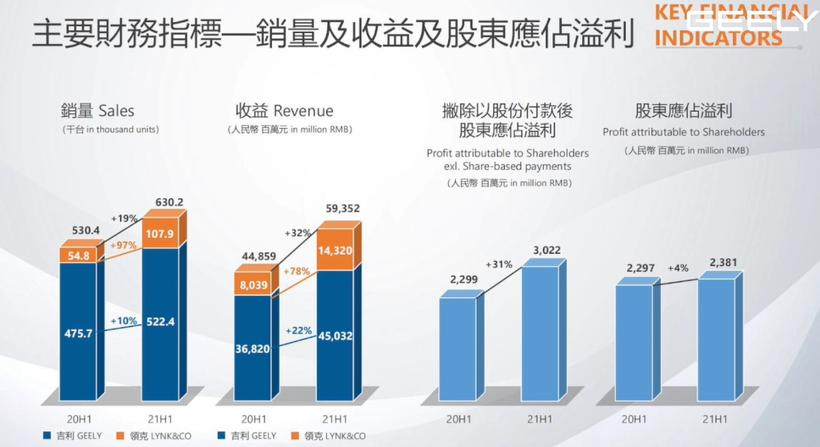

Sales: Sales of 630,000 vehicles in the first half of the year, a year-on-year increase of 19%, completing 41% of the target of 1.53 million vehicles for the whole year. The cumulative ranking of China’s passenger vehicle market rose one place compared with the same period last year to third place, with a market share of 6.3%. It is worth noting that Lynk & Co brand sold more than 100,000 vehicles in the first half of the year, a year-on-year increase of 97%.

Revenue and Profit: In the first half of the year, the revenue was RMB 45 billion, a year-on-year increase of 22%. Excluding the share-based payment, the profit attributable to shareholders was RMB 3.02 billion, a year-on-year increase of 31%. The profit attributable to shareholders was RMB 2.38 billion, and the net profit was RMB 2.41 billion, a year-on-year increase of 4%.

Revenue and Profit: In the first half of the year, the revenue was RMB 45 billion, a year-on-year increase of 22%. Excluding the share-based payment, the profit attributable to shareholders was RMB 3.02 billion, a year-on-year increase of 31%. The profit attributable to shareholders was RMB 2.38 billion, and the net profit was RMB 2.41 billion, a year-on-year increase of 4%.

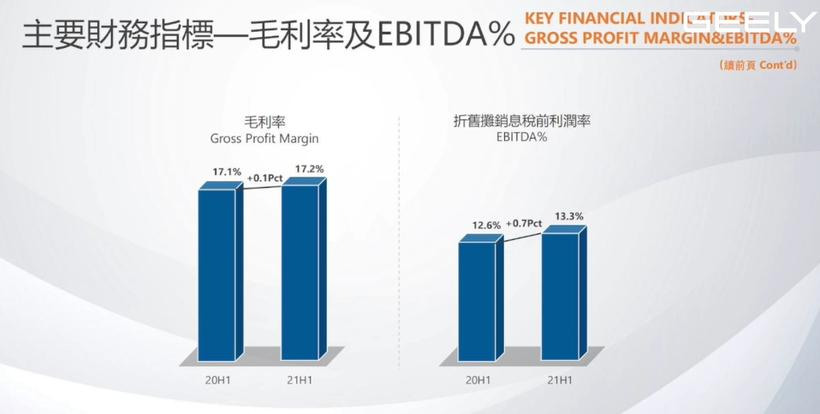

Profit Margin: The gross profit margin in the first half of the year was 17.2%, which was basically the same as the 17.1% in the same period of 2020, and it was at the industry average level. The gap between the gross profit margin of 20% for NIO and the top-tier Tesla’s gross profit margin of over 25% is not significant.

From a financial perspective, Geely’s half-year report is considered average, but a deeper analysis reveals great potential for future growth in related data, which is why people gave a biased optimistic rating.

First, sales volume is the most important. This year’s second half, Geely and Lynk & Co will release several new models, and based on the sales proportion of 4:6 for the first and second half of the year, it should be able to achieve the annual sales target. The industrial insiders are more concerned about sales volume, while the secondary market is more focused on finance.

Second, the existence of a large single product in the car industry is not only to improve sales but also to average costs. The increase in sales of Geely and Lynk & Co’s same-structured models will gradually increase the product gross profit margin. The CMA platform is the most concentrated architecture for Geely and Lynk & Co products. As time goes by, its per-vehicle gross profit margin is worth looking forward to.

Third, diversified profits. In the first half of this year, the net profit of Geely’s two major joint ventures, Lynk & Co and Geely Financial Services, increased by 62%, among which Lynk & Co’s net profit increased by 144% and Geely Financial’s net profit increased by 41%. Diversification means stability and sustainability, which is helpful for ratings.

This year, many securities firms are pointing out that the automobile industry will shift from large single products (such as the Haval H6) to platform single products (such as the MQB platform), and companies with large single products will receive higher valuations. Geely has been developing along this path for years, from the BMA architecture to the CMA architecture, from the SPA architecture to the SEA architecture. Mr. Li’s view is that the CMA architecture represents the future of Geely’s gasoline vehicles, and the SEA architecture represents the future of Geely’s new energy vehicles.

From the perspective of enterprise development and capital investment, long-term development and deployment are often the most advantageous. However, the noise of human nature and society always pushes people to do short-term business. In the past, Mr. Li often recommended investing in Ningde, telling clients to take a long-term view of Ningde’s potential. Earlier this year, Mr. Li recommended investing in Geely, also telling everyone to take a long-term view.## Geely, Another Perspective of BYD

It is difficult to understand Geely without a comprehensive understanding of the automotive industry.

In the secondary market, industry research emphasizes a comprehensive and long-term perspective. Friends in the industry and consumers tend to view car companies from a partial and short-term perspective. Over the past three years, Geely’s many layouts have been based on a global and long-term perspective. Although Mr. Li has been working in the industry and capital market for many years and has been working hard to learn and study, he frankly admits that he has not fully understood many of Geely’s layouts.

The future of the automotive industry is the new four modernizations. How to layout the new four modernizations is a problem that all car companies are considering. There are three paths to layout the new four modernizations: the first is from the perspective of complete vehicles and experience, represented by NIO, IDEAL, and XPeng; the second is the traditional path of top-tier car companies, focusing on the structure and industrial chain; the third is the combination of the first two, which can do both the complete vehicle and experience and the structure and industrial chain, and this overlapping path is naturally wider, represented by Tesla.

Geely has always been laying out the structure and industrial chain, and now it is concentrating its efforts on complete vehicles and experience. Mr. Li believes that the combination of Geely and BYD can create the most powerful intelligent electric vehicle company in China. BYD is strong in batteries and traditional supply chains, while Geely is strong in architecture and intelligent supply chains. Mr. Li has introduced the SEA architecture in “Why Can Geely Attract the Attention and Respect of Various Forces” and would now like to share more about Geely’s intelligent supply chain.

The core layout of Geely’s intelligent supply chain is Ecarx. Perhaps many friends have not heard of this company, but it is precisely this unknown company that has become the most attentive intelligent company in the secondary market research in the first half of this year. Ecarx is a Tier 1 supplier supported by Geely. From intelligent driving to intelligent cockpit, from software development to hardware integration, from Al algorithm to chip, Ecarx does everything that you can imagine. Ecarx is not just a technical advantage for Geely, but also a supply chain advantage.

Many car companies complain about chip shortages, but few have seen Geely’s chip shortages, which is strongly related to Geely’s supply chain capability in the new four modernizations era. Supply chain capability does not mean being able to obtain the lowest prices from traditional suppliers, but means having a significant say when competing for core resources.

## Geely’s Chip Shortage Strategy

## Geely’s Chip Shortage Strategy

Geely was one of the first automotive industry procurement companies to establish a General Materials Division in response to the chip shortage trend in mid-2020. Since Q3 of last year, Geely has been building chip reserves and developing domestic suppliers as replacements, which has helped the company bypass Tier 1 suppliers like Bosch and directly engage with Tier 2 suppliers. This greatly improves Geely’s say in core resources, as having a strong Tier 1 presence is crucial to supply chain security for any OEM.

Starting early this year, Geely has signed strategic cooperation agreements or established joint ventures with groups like Baidu, Foxconn, and Renault, with Baidu and Geely’s joint venture having achieved considerable progress to date. Many friends have asked Mr. Li why IT giants like Baidu and manufacturing giants like Foxconn would consider Geely as a partner.

Supply chain security is one of the key factors in Geely’s selection as a partner. While the SEA (Smart Electric Architecture) framework is important, supply chain security is even more crucial. Without a reliable supply chain, the value of architecture is virtually nothing. With the help of Ecarx, Geely has essentially ensured the intelligence and networking of its supply chain. The concept of supply chain security used to be stated by companies for their own benefit, but now it must also be communicated to partners.

Compatibility is another important factor in partner selection for Geely. Mobile phone manufacturers such as Apple, Huawei, and Xiaomi are all improving software and hardware compatibility, as well as collaboration between different terminals. Whether it’s Huawei or Xiaomi, only by ensuring the compatibility and collaboration of both can there be a good user experience.

The experience for intelligent electric vehicles is also dependent on the seamless integration of software and hardware and OTA updates. Geely’s SEA framework and Ecarx’s intelligent networking supply chain can achieve deep compatibility and collaboration in the future. Apart from Tesla, no other manufacturer has achieved this level of integration. Geely is working hard to achieve this, and this is why market researchers are focusing on Ecarx.

Geely’s Future in the Eyes of Capital

Many people ask how long the second-phase upward curve of Geely’s development will last. Frankly speaking, Mr. Li doesn’t know either, and many researchers have also pondered this question. The answer could be six months, or even a year or longer. The trend depends on market performance, which includes two aspects: Geely’s performance in the new energy market, and Geely’s performance in overseas markets.

At the same time as the release of its semi-annual report, Geely also released its five-year plan for business development. Let’s take a look at Geely’s vision for the “future” by 2025: Geely aims to maintain a stable position as the number one Chinese brand in the market, with sales of 3.65 million vehicles (including Lynk & Co), of which smart electric vehicles account for more than 30%. Lynk & Co is expected to achieve a top three market share in the high-end electric vehicle market with sales of 650,000 vehicles by 2025.#Geely plans to announce the details of its agenda in the near future, and according to current information, “there are some pragmatic components” in Geely’s plan, as evaluated by the research team headed by Lao Li, the researcher. Perhaps everyone was surprised by this plan, which does not fit the current style of the industry. In an era where everyone likes to talk about annual sales of 4, 5 or even 10 million vehicles, a number of 3.65 million seems out of place.

Lao Li has done some research and found that behind the 3.65 million sales figure, there are brand and model support. It can be understood that the 3.65 million vehicles are not simply conjured up, but are calculated based on architecture and model planning. Among the brand and model decomposition in 2025, the most impressive is Geometry.

The secondary market has always been concerned about Geometry, believing that Geometry is Geely’s future. Regardless of whether Geometry is listed separately, as long as it is within the Geely Holding Group system, it will drive the valuation of the listed company, Geely Auto (HK: 00175).

After the valuation of new emerging forces, the secondary market has been discussing a question: if before 2016, Geely had directly planned Lynk & Co as a pure electric vehicle brand, today, Lynk & Co might be another “WM Motor.” One founder of a new emerging force has also raised a similar question. Lao Li is quite familiar with the Geely system, and at that time, Geely’s layout of Lynk & Co was a correct strategic move. Today, Geely’s layout of Geometry is also the correct strategic move, which the secondary market is looking forward to.

There are similarities and differences between Geometry’s approach and that of new emerging forces. From the perspective of the overall vehicle experience and user operation, Geometry and new emerging forces are becoming more and more similar, that is, in the form of user enterprises, from product innovation, user experience innovation to business model innovation, such as the newly opened experience center, replenishment center and new emerging force experience center.

In addition to these similarities with new emerging forces, the secondary market values Geometry for another important reason – product rhythm. During the earnings conference call, An Conghui reiterated that six models of Geometry will be launched within 3 years of production and listing, which is the strength of the SEA architecture and something new forces cannot achieve within three or five years. Lao Li has mentioned in many articles before that if the second wave of product upswing fails to come, “WM Motor” will enter “the most dangerous time” from “the best time,” but Geometry has a powerful architecture, and there is no need to worry about the company’s life and death problems caused by product discontinuity.The Chinese fuel market has reached a saturation point, and so has the electric market. From a long-term strategic perspective, Chinese enterprises will eventually go global. Just as 20 years ago, numerous joint ventures entered China, now it is time for Chinese car companies to strive to go abroad. Whoever can succeed in going global will be able to achieve an output of 5 million from an output of 1 million.

Most Chinese enterprises, whether they are state-owned or private, choose to expand abroad through exporting or building factories in foreign countries. However, Geely’s approach is more diversified: “from early capital expansion, to mid-term research and development overseas, and now, brand globalization overseas.” Geely has truly realized the “one architecture, multi-region layout, multi-brand volume” situation.

In the first half of this year, Proton Holdings, a subsidiary of Geely, sold 57,900 cars and has achieved a record high market share of 23.5% in Malaysia. Three years ago, Proton was a sleeping lion in Malaysia. In terms of exports, Geely exported about 53,000 cars in the first half of the year, an increase of approximately 173% year-on-year. Who can lay out overseas markets as soon as possible will have more growth space in the increasingly saturated domestic market.

In addition to exploring the third world, Geely is also actively attacking the first world. The Lynk & Co brand has begun global layout and has achieved terminal delivery in countries such as the Netherlands, Germany, Belgium, and Sweden, with exports reaching 3,646 in the first half of the year.

There is a saying in China: “if one does not plan for the whole situation, he is not enough to plan for a corner; if he does not plan for a century, he cannot plan for a moment.” This means that if we cannot plan for the situation as a whole, we cannot plan accordingly for the details. If we do not consider problems from a long-term perspective, then we cannot plan for current affairs. In fact, the research of secondary market industry adheres to this rule, and Geely is the same. To see Geely’s future, we must examine its overall plan and long-term planning.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.