In the chip industry landscape, August matters more for the emergence of Qualcomm’s acquisition of Veoneer at $37 cash per share. This signifies Qualcomm’s transformation from a relatively simplistic automotive chip supplier to a vertically integrated system and solution provider in the autonomous driving field, accelerating the competition among chip manufacturers. Moreover, this milestone event exemplifies how QUALCOMM is not relying on Veoneer’s profits, but rather hoping to expedite the evolution of autonomous driving solutions at a system level, which is critical for future competitiveness. Consequently, the competitive landscape in the cabin sector has entered a new phase. In the mid-to-high end market, Qualcomm has already won the battle on the cabin chip front due to the strong influence of mobile phones. Veoneer’s collaboration with Qualcomm starts at the forefront of future competition in creating an industry-leading ADAS and AD (autonomous driving) solution, laying the foundation for Qualcomm to acquire new clients in the autonomous driving field.Car companies are locking in platforms, making Qualcomm’s chip platform the top choice for the world’s major Tier 1 companies. This means that Qualcomm only needs to focus on its chip iteration, BSP, and toolchain.

Table 1: Selection of seat chip by major Tier 1

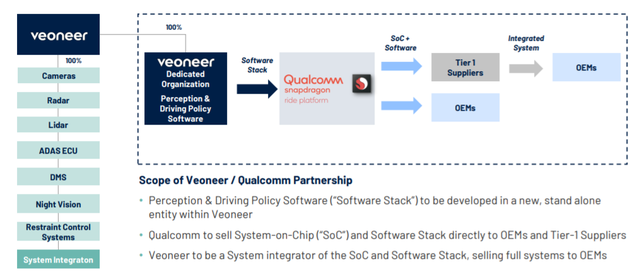

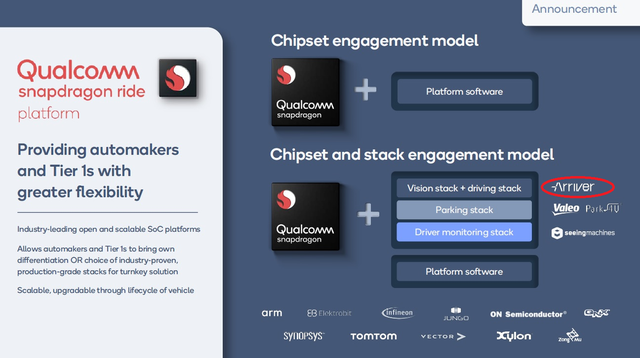

So in terms of autonomous driving, it’s not so much that Qualcomm is acquiring Veoneer, but rather wants to buy its independent software company Arriver™. It is fully owned by Veoneer and has approximately 800 employees worldwide (in Germany, Sweden, the United States, Romania, and China) responsible for developing the next generation of perception and autonomous driving decision-making strategy software stacks – this is the key to making Qualcomm® Snapdragon Ride™ ADAS/AD expandable System-on-Chip (SoC) the mainstream intelligent driving platform.

It should be noted that Qualcomm is currently maintaining growth in the automotive field with two areas, cabin and communication, and has revenue of $10 billion. This time, Qualcomm bought Veoneer directly with cash. Since the failed acquisition of NXP in 2018, Qualcomm’s desire to buy in the automotive semiconductor field is not realistic due to global government suspicions of anti-monopoly issues. Therefore, what Qualcomm values most in Veoneer is its ability to develop autonomous driving domain controllers and software.

Figure 4: Software capabilities are also the core assets of current Tier 1 companies

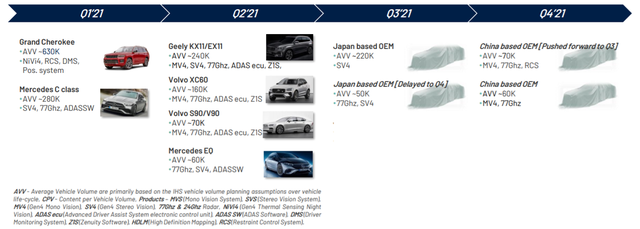

From Veoneer’s disclosed customers, car customers include American brands Stellantis and Jeep, European car manufacturers Mercedes-Benz and Volvo, Japanese brands Honda and Subaru, and Chinese automaker Geely. Although they are currently L2 level ADAS computing platforms, this is an important step forward.

Figure 5: Through Veoneer, Qualcomm can directly touch the needs of automotive OEMs

The next step for Qualcomm is to distinguish between different types of assets:

(1) The highest priority is the software part of Arriver™ which is actually coupled with the domain controller.(2) Other visual sensor components outside of ADAS, including DMS, can be integrated into Qualcomm’s cockpit chip in the future; Qualcomm’s chips can be used for visual aspects.

(3) The traditional constraint system, radar, etc., can be separated into a separate business for packaging and sale.

It is worth noting that due to Veoneer’s previous split with Volvo, the intellectual property of Arriver is mainly focused on L2 assisted driving; its development work mainly deploys software for visual perception and driving planning on the Snapdragon Ride platform, including Lane Support System (LSS), Forward Collision Warning (FCW), and Automatic Emergency Braking (AEB) functions. With these capabilities, we may see Qualcomm becoming a complete “solution provider” in the future, providing a complete set of solutions for sensing, processing, communication, and cloud.

Qualcomm’s Snapdragon Ride platform is currently highly anticipated but overall lags behind Nvidia. Qualcomm believes that this platform meets a series of important requirements such as safety (ASIL-D system design), robustness, energy efficiency, heating and efficiency, and plans to enter mass production in 2023. It integrates an automatic driving accelerator (large-scale neural processor array), high-speed interconnect integrated with SoC, supported by Qualcomm Kryo CPU and Adreno GPU. The software stack includes planning, positioning (Qualcomm Vision Enhanced), perception (cameras, radar, lidar, sensor fusion, C-V2X), SDK, operating system, and security driver support.

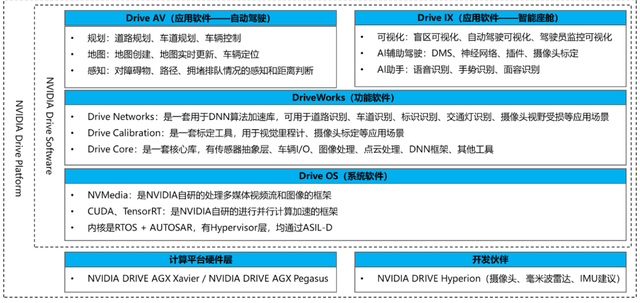

From Qualcomm’s vision, they aim to challenge Nvidia’s overwhelming position in the field of autonomous driving.

Summary: By acquiring Veoneer for $4.6 billion, Qualcomm has acquired Veoneer’s Arriver software team and achievements, while reducing costs by divesting non-software businesses. In this sense, not only can it narrow the gap with Nvidia in the field of autonomous driving, but it can also be in a relatively advantageous position compared to Intel.

Summary: By acquiring Veoneer for $4.6 billion, Qualcomm has acquired Veoneer’s Arriver software team and achievements, while reducing costs by divesting non-software businesses. In this sense, not only can it narrow the gap with Nvidia in the field of autonomous driving, but it can also be in a relatively advantageous position compared to Intel.

In the current field of autonomous driving, companies that start with chips and software are indeed the most core forces in this field. Even car companies and Tier 1 are building their own intelligent driving capabilities based on this foundation.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.