Author: Wang Lingfang

In the period from January to July 2021, the penetration rate of new energy vehicles in new car sales has reached 10%.

This is according to data released by the China Association of Automobile Manufacturers (CAAM).

CAAM data shows that from January to July, China sold 14.756 million vehicles, and the sales of new energy vehicles reached 1.478 million, just passing the 10% mark.

If we look at passenger cars, the situation is even more optimistic. According to CAAM data, in the same period, China’s sales of passenger cars reached 11.56 million, of which new energy passenger cars reached 1.398 million, with a penetration rate of 12.1%.

The reason for emphasizing the 10% threshold is that when the penetration rate of a new technology reaches the range of 10%-50%, it will show exponential growth rather than linear growth.

New energy vehicles are at such a turning point, and their penetration rate is expected to increase rapidly in the near future.

However, “Electric Vehicle Observer” analyzes monthly data that leans toward using insured numbers, which can more accurately reflect the terminal situation.

In contrast to the vigorous progress of CAAM and the China Passenger Car Association, the insured number of new energy passenger cars in July showed a slight downward trend, but plug-in hybrid models represented by BYD and Ideal performed outstandingly.

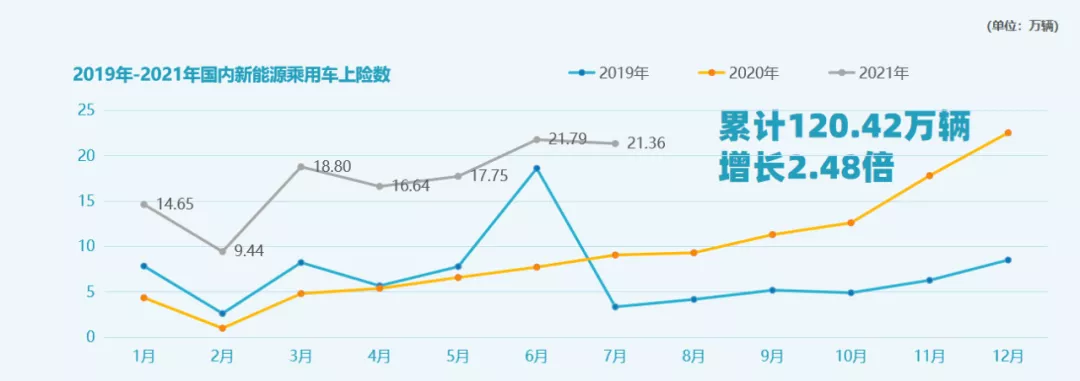

Over 1.2 Million Passenger Cars Insured in the First Seven Months

The insured numbers show that in July, the insured number of China’s domestically produced new energy cars was 213,600, a year-on-year increase of 1.35 times, but a month-on-month decrease of 2.0%. The insured number of pure electric passenger cars was 169,800, a year-on-year increase of 1.35 times, and a month-on-month decrease of 5.3%.

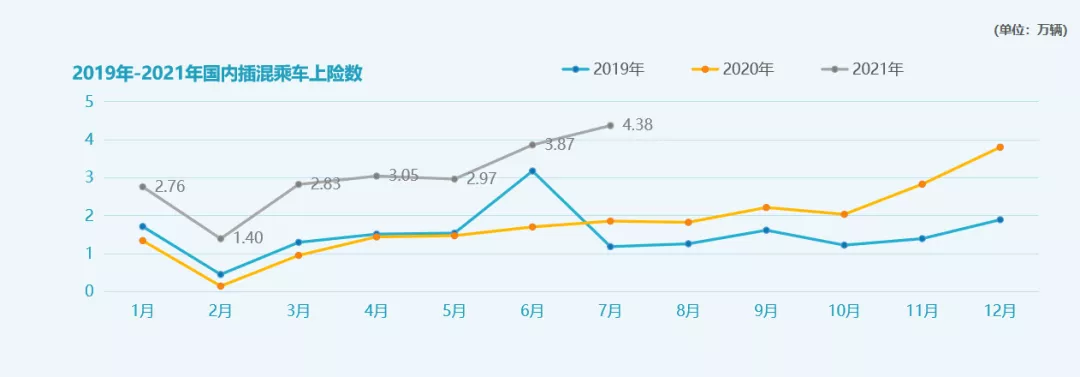

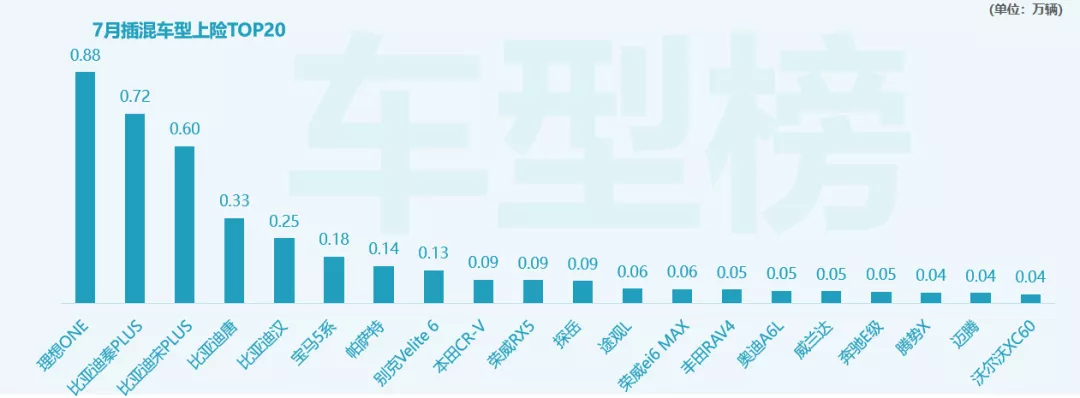

However, with the drive of BYD and Ideal, plug-in hybrid models have recently shown a more obvious upward trend: in July, the insured number of plug-in hybrid passenger cars was 43,800, a year-on-year increase of 1.35 times, and a month-on-month increase of 13%.

In July, new energy vehicles showed a slight decline due to the drag of pure electric vehicles, but plug-in hybrid vehicles had a more obvious upward trend.

Looking at the cumulative data, the growth of new energy passenger cars is very significant. From January to July, insured numbers of new energy passenger cars reached 1.2042 million, a cumulative year-on-year increase of 2.48 times; the insured numbers of pure electric passenger cars reached 991,900, a year-on-year increase of 2.3 times; and the insured numbers of plug-in hybrid passenger cars reached 212,500, a cumulative year-on-year increase of 1.37 times.The executive vice chairman of the China Automobile Dealers Association and chairman of the New Energy Vehicles Branch, Li Jinyong, predicts that the sales volume of plug-in hybrid electric vehicles may reach 400,000 this year.

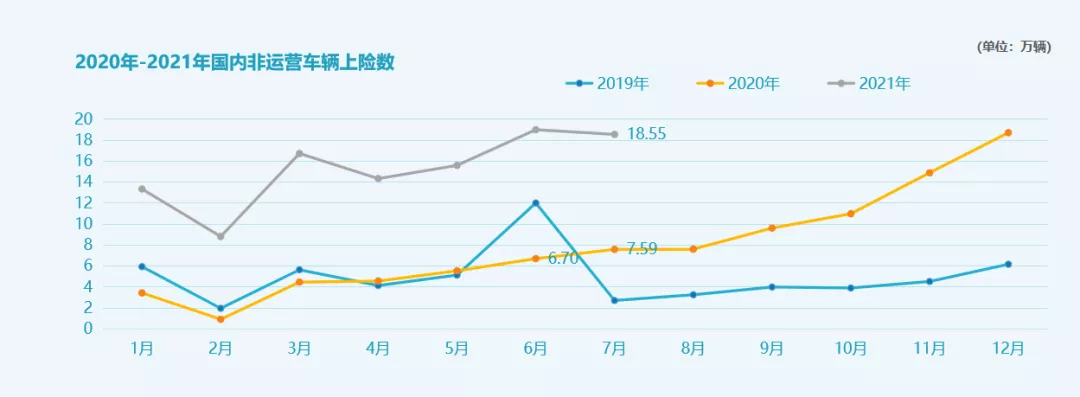

In terms of usage, the growth rate of non-operational vehicles is far higher than that of operational vehicles, which is the main driving force for the growth of new energy vehicles.

In July, the number of insured operational vehicles was 28,100, with a year-on-year increase of 89% and a month-on-month increase of 1%. In terms of quantity, operational vehicles can no longer serve as the main engine to drive the growth of new energy vehicles.

Non-operational vehicles are mainly used by private users. In July, private users accounted for 88.8% of non-operational vehicles. The number of insured non-operational vehicles was 185,500, with a year-on-year increase of 1.45 times and a slight month-on-month decrease of 2%. In terms of absolute quantity, the number of insured non-operational vehicles in July was 6.6 times that of operational vehicles.

In terms of cumulative data, the growth advantage of non-operational vehicles is even more obvious. From January to July, the number of new energy operational vehicles reached 140,500, with a year-on-year increase of 1.45 times; the number of non-operational vehicles reached 1.0638 million, with a year-on-year accumulated growth of 2.2 times, of which private users accounted for 75%. In the first seven months, the number of non-operational vehicles has reached 7.57 times that of operational vehicles.

BYD surpasses SAIC-GM-Wuling

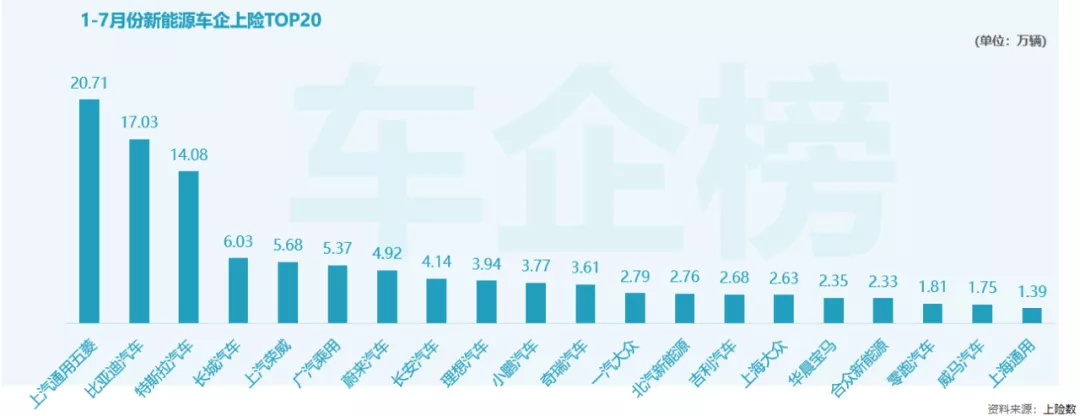

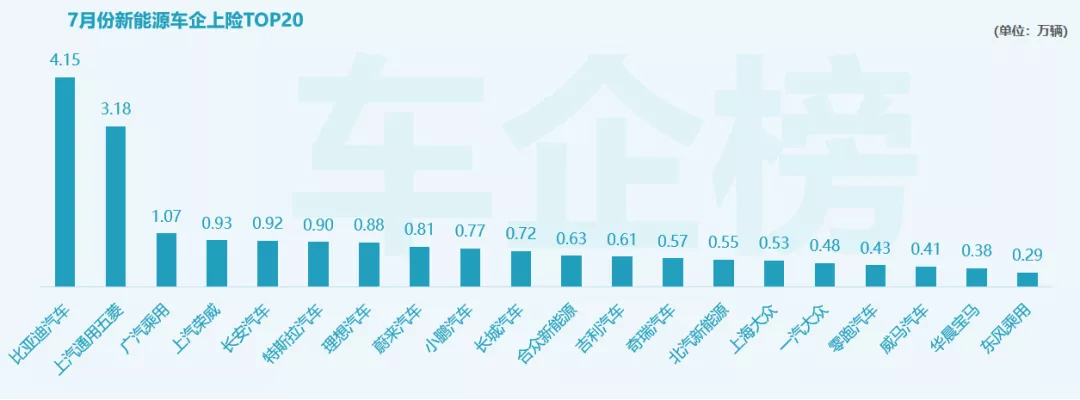

In July, there were two companies whose passenger new energy vehicle insured number exceeded 10,000 units. BYD had 41,500 units and SAIC-GM-Wuling had 31,800 units. BYD has won the monthly championship for the second consecutive month.

From January to July, SAIC-GM-Wuling is still the champion of the total insured number, with a market share of 17.2%; BYD accumulated 170,300 units of insured number, with a cumulative sales volume exceeding Tesla’s 140,800 units, and market share of 14.14%. There is a trend of narrowing the gap between the two.

Looking at the monthly data, BYD has become the champion of new energy vehicle insurance volume for two consecutive months, surpassing SAIC-GM-Wuling.

In Li Jinyong’s view, it is not easy for a Volkswagen joint venture company to enter the top 20, but this sales volume is far from sufficient to meet its point requirements.

Therefore, it is foreseeable that Volkswagen will push for greater sales of its own new energy vehicles.

## Tesla CEO Musk Responds to Deterioration in July Sales

## Tesla CEO Musk Responds to Deterioration in July Sales

In response to the sharp decline in sales in July, Tesla CEO Elon Musk commented on Weibo, “Tesla primarily exported the new vehicles produced in the first half of this quarter, and will release more for the domestic market in the latter half.”

As for the types of vehicles sold, the proportion of BYD’s plug-in hybrid models has gradually increased this year, accounting for nearly half of all sales. In particular, the DM-i model saw a significant increase in insured vehicles starting in May.

According to Li Jinyong, BYD’s performance in pure electric vehicles (EVs) has not outperformed the market. Qiu Kaijun, the chief editor of “Electric Vehicle Observer,” also believes that BYD’s pure EVs have not met expectations. As an autonomous battery supplier, BYD is more likely to produce pure EVs priced similarly to gasoline cars. However, currently, the performance of BYD’s pure EVs is somewhat unsatisfactory.

Pure Electric Vehicles: Hongguang MINI is the Most Competitive; Plug-in Hybrids: Ideal ONE is the Best Selling

According to insured vehicle data from January to July, in the pure EV market, Hongguang MINI is the best-selling vehicle, with an insured vehicle volume of 187,100, more than twice the amount of the second-ranked Tesla Model 3.

From the July data, Hongguang MINI remains highly competitive in the pure EV market, with an insured volume 3.85 times that of the second-place Benben.

Li Jinyong believes that Hongguang MINI’s annual sales are expected to reach 300,000 to 400,000 units this year.

Qiu Kaijun also stated that based on information obtained from relevant suppliers, Hongguang MINI may reach 450,000 units this year.

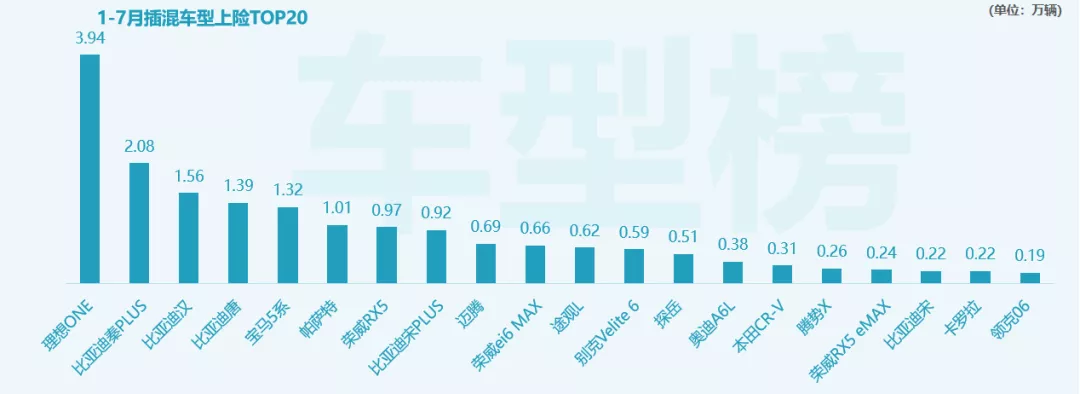

It is noteworthy that due to export supply, the number of insured Tesla vehicles decreased significantly in July.In terms of plug-in hybrid models, from January to July, the Ideal ONE is far ahead, with an insurance amount of 39,400 vehicles, 1.89 times that of the second-ranked BYD Qin PLUS.

However, considering the single-month data for July, BYD Qin PLUS is very close to the Ideal ONE in terms of insurance amount. The next four best-selling models are all BYD and the gap is not large.

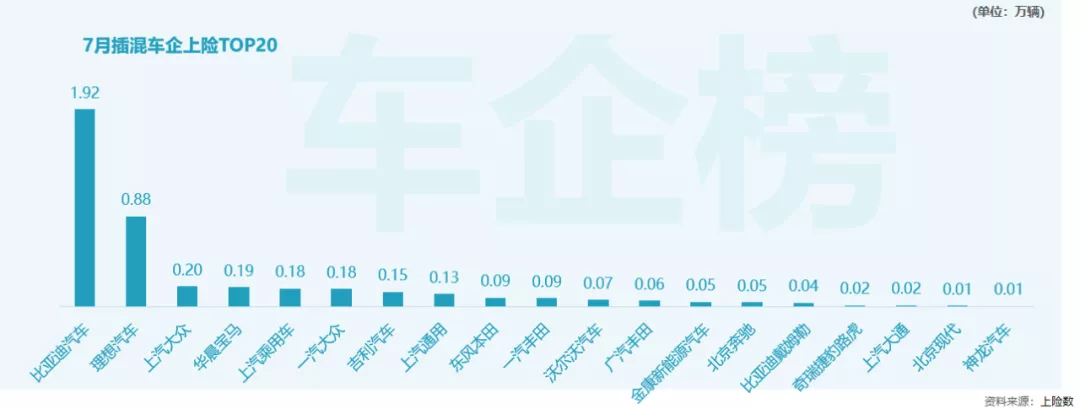

Therefore, from the perspective of automakers, due to BYD’s larger number of plug-in hybrid models, although the sales volume of a single model is not as good as the Ideal ONE, the total sales volume far exceeds that of the Ideal ONE.

As shown in the data, in July, BYD’s plug-in hybrid insurance amount reached 19,200 vehicles, more than twice that of the Ideal ONE.

Qiukaijun believes that BYD’s DM-i plug-in hybrid technology has strong market competitiveness and may capture a portion of the market share of fuel vehicles.

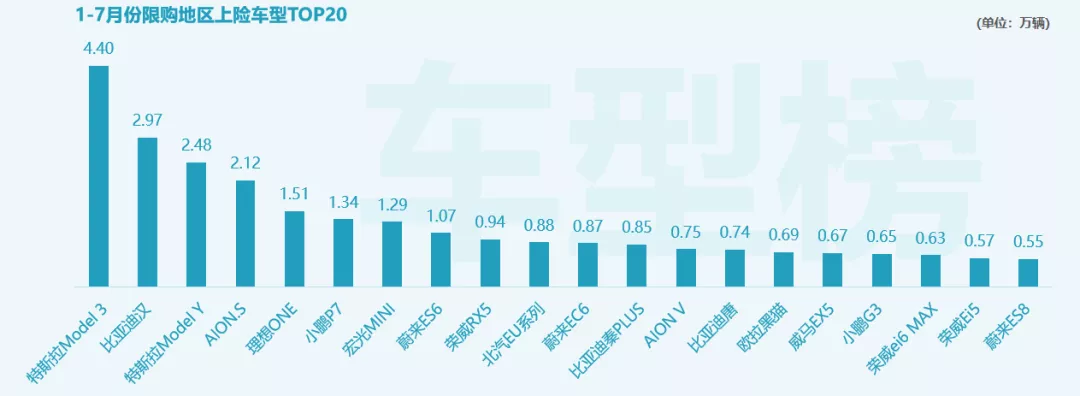

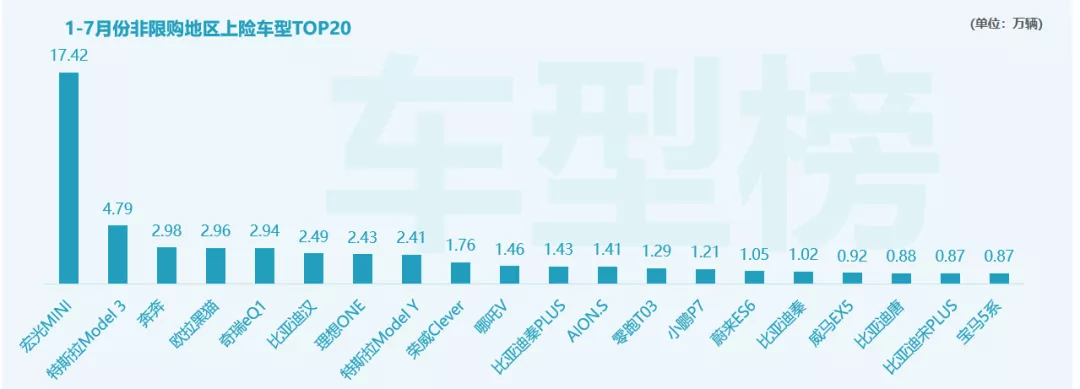

Significant Differences in Model Sales between Restricted and Unrestricted Cities

Restricted cities mainly refer to economically developed areas where consumers have higher purchasing power, leading to differences in sales of hot-selling models.

The hot-selling models in restricted areas tend to be high-priced and highly intelligent, such as Tesla, BYD Han, Ideal ONE, XPeng P7, and NIO ES6.

The models in unrestricted cities are more diversified and the trend of small size is more prominent. For example, the most popular model is the Hongguang MINI, and other small models such as Benben, Hei Ma, and Chery eQ1 rank high.

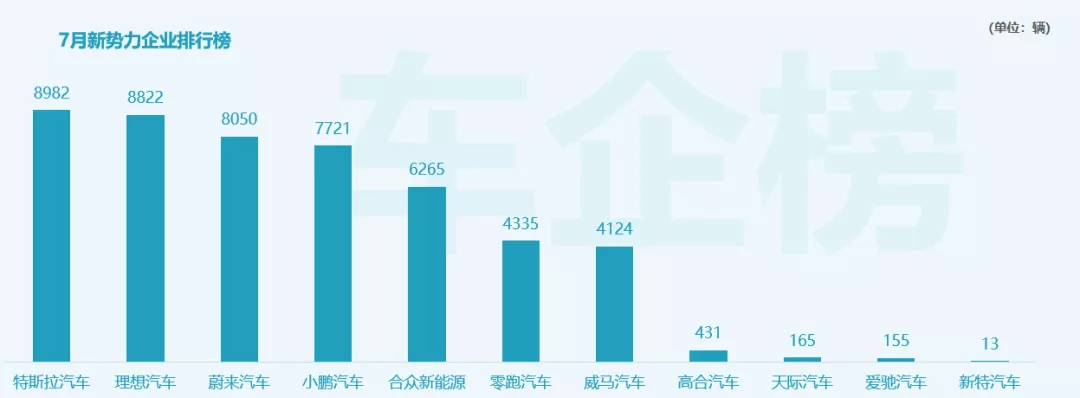

Significant Differentiation of New Automakers

As the pioneer of new automakers, Tesla is an absolute phenomenon and has an insurance amount far higher than that of Chinese new automakers.The differentiation among Chinese new energy vehicle companies is very clear. According to the on-insurance data from January to July, NIO, Xpeng, and Li Auto are the first tier, with the same level of sales; the second tier is composed of Hezhong, Leap Motor, and WM Motor; Aiways, GAC, Enovate, and Seres are in the third tier.

In terms of July sales, due to the decline in Tesla’s sales, it almost equals Li Auto. Li Auto surpassed NIO to become the monthly sales champion of China’s new energy vehicle startups.

In addition to NIO, Xpeng, and Li Auto, the sales data of NIO’s EC6 also shows clear growth, and it’s close to the top three. Moreover, Leap Motor’s T03, an A00 vehicle, drives sales up rapidly, surpassing WM Motor to rank sixth among new energy vehicle startups.

Overall, the ranking of new energy vehicle companies is still fluctuating, such as BYD, which performed poorly last year but has now returned to the top of the single-month sales champion. Tesla’s sales are unstable due to export factors. With more and more companies and capital entering, the ranking of new energy vehicle companies can change at any time, and the overall uncertainty of the ranking has increased.

But what is certain is that the new energy vehicle market has already entered a new turning point and is on the eve of eruption, and the market prospects are promising.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.