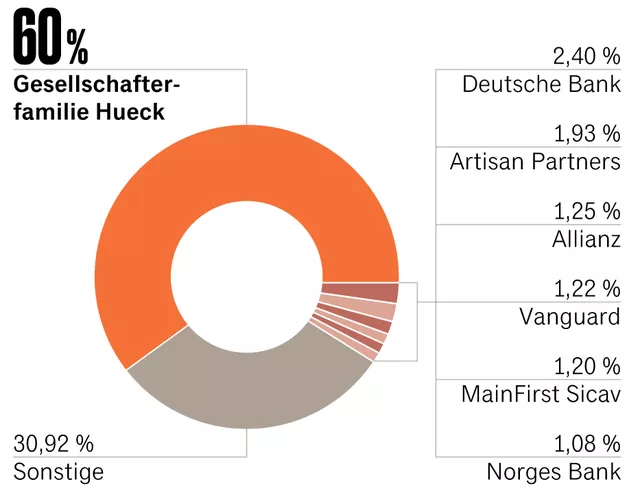

Recently, the automotive parts industry has been particularly lively. Manga, which was ranked fourth globally some time ago, failed to buy Veoneer. Qualcomm suddenly emerged and began to seek integration solutions with Tier 1. Yesterday’s news is that Faurecia and Hella have officially signed a merger agreement. Faurecia is expected to pay a total of 6.7 billion euros, acquire 60% of the shares held by the Hella family, and purchase other shares at 60 euros per share (voluntary public tender offer). After approval by regulatory authorities, the integration is expected to be completed in early 2022.

There will be a detailed disclosure of updates on this acquisition at 10:30 am European time today. Here’s a preview, and we will add detailed content later once the follow-up information is available.

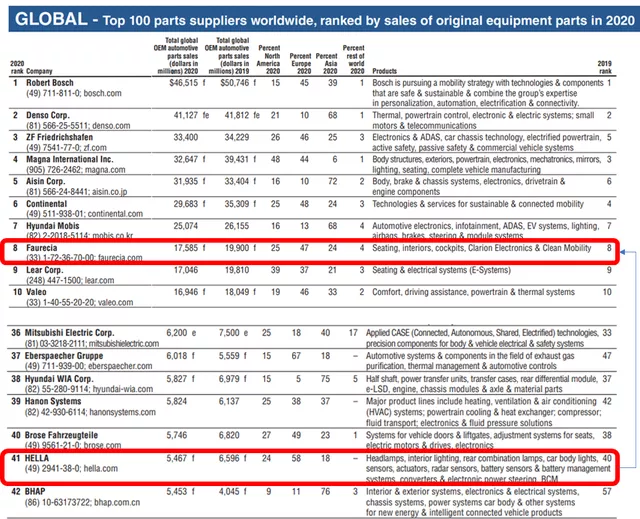

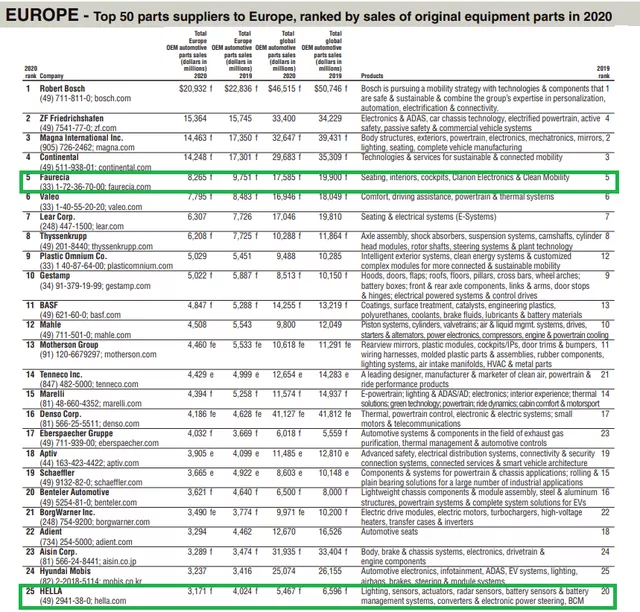

As shown in the following figure, according to the ranking of “Automotive News,” this acquisition of the 41st largest automotive parts supplier by the world’s eighth-largest supplier has revenues of 17.585 billion US dollars and 5.467 billion US dollars, respectively, and a total of 23 billion US dollars, ranking eighth globally.

Of course, this can be understood as the integration of a French automotive parts company with a German automotive parts company. The lion’s share of both companies is in Europe, with 8.265 billion US dollars (47% of its global share) and 3.171 billion US dollars (54.67% of its global share) respectively, and European sales combined amount to 11.436 billion US dollars. Although its ranking has not changed, the gap between them and the top four (Bosch, ZF, Magna, and Continental) has significantly narrowed.

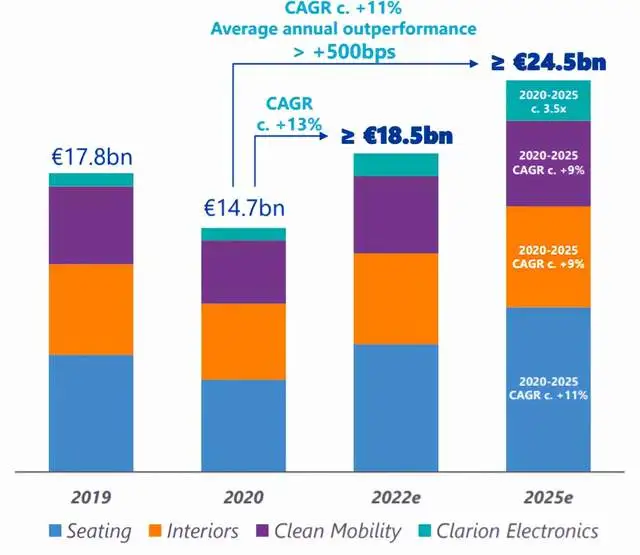

I think the main reason for the merger is that Faurecia’s business lacks explosiveness, but because it mainly focuses on seats and interiors, it is relatively less affected by electrification and intelligence, and has stability in the long-term business. According to the semi-annual report, Faurecia’s sales of electronics in the first half of 2021 were 1.3 billion euros, with a full-year outlook of 2.5 billion euros; hydrogen revenue was 280 million euros, and the target for 2021 was 500 million US dollars. Without the acquisition, it is expected to reach 18.5 billion euros in 2022. Sales outside of seats and interiors need to be driven by electronics and hydrogen.

I think the main reason for the merger is that Faurecia’s business lacks explosiveness, but because it mainly focuses on seats and interiors, it is relatively less affected by electrification and intelligence, and has stability in the long-term business. According to the semi-annual report, Faurecia’s sales of electronics in the first half of 2021 were 1.3 billion euros, with a full-year outlook of 2.5 billion euros; hydrogen revenue was 280 million euros, and the target for 2021 was 500 million US dollars. Without the acquisition, it is expected to reach 18.5 billion euros in 2022. Sales outside of seats and interiors need to be driven by electronics and hydrogen.

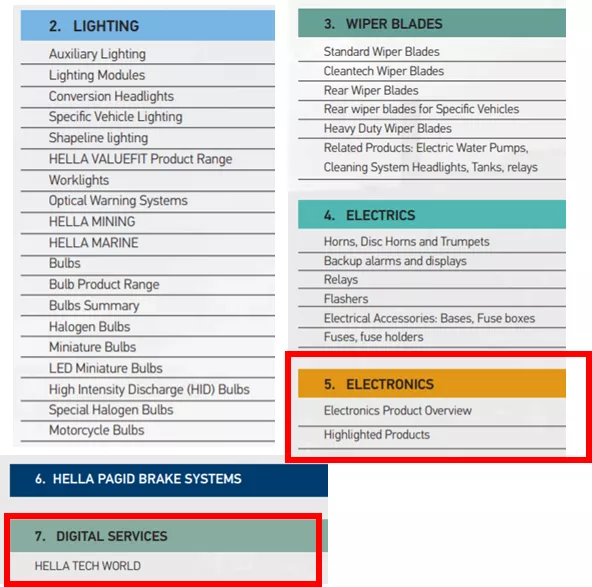

In contrast, Hella’s overall product line includes car lights, wipers, electrical and electronic parts. However, it is currently facing continuous challenges from global suppliers in car lights and electricity, and there are constantly more cost-effective suppliers to replace Hella’s business.

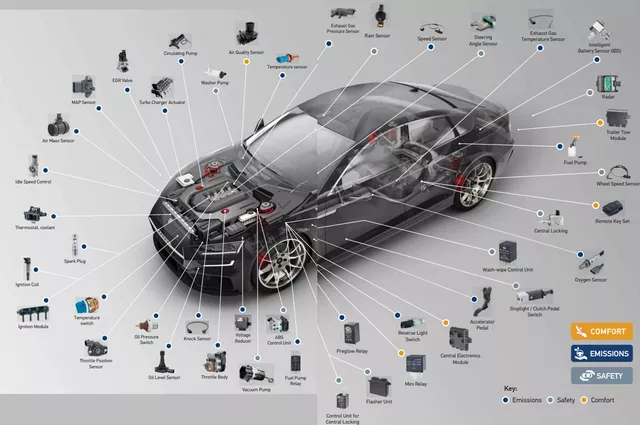

After the merger, Hella’s main product lines will include energy management (IBS), sensors (including millimeter wave radar), and ECU control modules (Hella can also make ABS controllers, LED controllers and central gateway controllers) and other product lines, which is still good in combination, especially Hella’s more complete sensor product line.

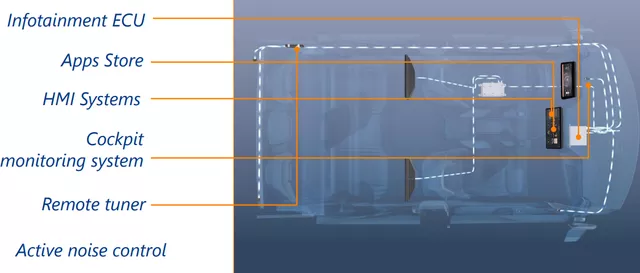

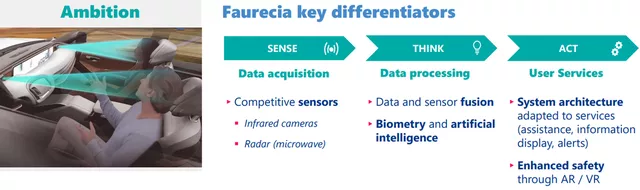

These products, combined with Faurecia’s original cockpit electronics, display systems, and ADAS systems, will have better effects, especially the integration of these sensors and electronic capabilities. The synergy between the two suppliers will still have some positive effects.

Originally, Faurecia may have done fairly well in the cockpit domain controller, and after adding the perception part, the system architecture can be more complete and competitive.

Regarding ADAS, Faurecia has relatively done less, but with the integration of Hera’s accumulated experience, there may be new growth points.

In conclusion, as mentioned in previous articles, there is a high possibility of further integration of small automotive parts (with revenue less than 5 billion US dollars). Due to the accelerated introduction of electric vehicles around the world, many parts companies based on traditional businesses have lost opportunities for growth, and the new choice is either by splitting or through mergers and acquisitions. With so much money invested globally, there will inevitably be people who cash out and others who take over.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.