Recently there are two things that can be directly related. One is the unprecedented importance of automotive chips, which directly affects the production situation of the automotive industry, almost rubbing the supply chain management that the automotive industry has been proud of on the ground; The other thing is Qualcomm’s $4.55 billion acquisition of Veoneer, a Tier 1 automotive electronics company, which has opened up the integration strategy from the midstream, and also represents that chip companies have officially stood in the center of the automotive electronics stage, and even without giving Tier 1 any chance, they have opened up the era of direct access to complete vehicle companies and complete solutions.

I will talk about these two things separately for two days. Let’s talk about the first thing today.

Three stages of automotive chip shortage

The shortage of automotive chips began last year. We can sort out the timeline:

(1) The first stage of chip shortage

In December 2020, Volkswagen Group, Continental, and Bosch first announced the shortage of automotive chips from the perspective of supply chain shortage. The main argument at that time was that due to the impact of the epidemic, the imbalance caused by supply and demand mismatch resulted in a shortage of automotive chips required for the production of automobiles, especially the core components of the engine ECU and ESP, directly affecting the global production of automobiles and auto parts. The epidemic in 2020 had a very large impact on the entire automotive industry chain, leading to a slowdown in automotive production at the beginning of the year. With the gradual recovery of demand growth in China since July and other markets, automotive parts have become in short supply in some places.

(2) The second stage of chip shortage

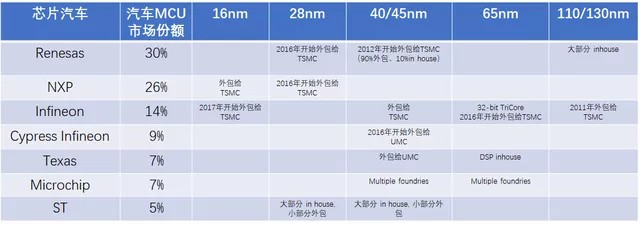

The second stage is actually a shortage of MCUs, reflected in various companies’ research reports in February. In various aspects of automotive electronics, a large number of MCU microcontrollers are used. Due to the requirement for small ICs and high frequencies, MCUs require a process of 40nm and below. Most IDM outsourcing chip production to TSMC and other fabs. TSMC’s production volume accounts for about 70% of the entire automotive MCU market. Since the automotive MCU chip market is also highly concentrated, the top 7 MCU suppliers account for about 98% of demand.

The bottleneck at that time was TSMC. Because the automotive business only accounts for 3% of its total revenue, this bottleneck was not resolved for a while. With the mediation of various governments and car companies, the bottleneck at TSMC has gradually been broken.

Table 1. The major automotive MCU manufacturers and the production relationships with TSMC

Shortage of chips and its causes and subsequent effects

From the perspective of supply chain risk, the shortage of chips extends from AI chips, SoCs, and high-performance GPU chips (currently relying only on three suppliers, Intel, Samsung and TSMC) to MCUs. At present, the supply of these high-demand chips is directly related to the status of TSMC, while the supply of the next level CMOS chips is less affected.

At this stage, automobile manufacturers have even begun to prepare for and switch to cross-MCU platforms. This is not only a business process of transferring from one supplier to another, but also requires the adjustment of software and hardware technologies, which is very difficult. Even so, automakers have overcome these difficulties.

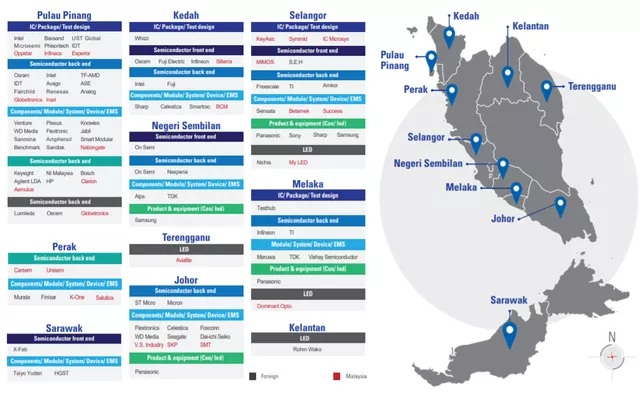

The third stage of chip shortage is the worsening of the epidemic in Southeast Asia. A certain automotive chip supplier centered in Malaysia was required by the local government to close part of its production line until August 21st, after shutting down production for several weeks earlier. This directly led to a deterioration in chip supply, and the shortage expanded from MCUs to core chips.

The suspension of chip manufacturing caused difficulties in the supply of Bosch’s products such as ESP/IPB, VCU, and TCU. As the world’s largest automotive component supplier, Bosch’s supply gaps in chassis and safety parts have a significant impact on all global automakers.

From the logic of the supply chain, this is an indiscriminate attack on both gasoline and electric vehicles, which is why Elon Musk named Renesas and Bosch on Twitter, believing that these two chip companies are the biggest problems and bottlenecks for Tesla’s supply chain currently. In this sense, things have become severe to a certain extent. Renesas has actually been lying in China for a long time, mainly to ensure supply to overseas and Japanese clients.

From the current perspective, the chip problem has become more complicated than simply hoarding in the circulation field. There are several reasons for this:(1) The new virus has brought enormous challenges to the supply chain in Southeast Asia. Malaysia, in Southeast Asia, is an important manufacturing base for chips worldwide. More than 50 semiconductor companies such as Intel, Infineon Technologies, STMicroelectronics, NXP Semiconductors, Texas Instruments, and ON Semiconductor have set up semiconductor manufacturing bases in Malaysia, where local packaging and testing capacity accounts for a large percentage. Since the virus began to ravage Southeast Asia, automotive chip companies have repeatedly prolonged previously reduced delivery times.

(2) Natural and man-made disasters: According to an irony in a group chat by “Super Brother,” one of the important means for the semiconductor industry to adjust the supply and demand of chips is strange excuses such as fires, power outages, and floods. But in 2021, the number of “reasons” is particularly high, such as the Texas blizzard power outage, TSMC’s water and power shortages, and Renesas Semiconductors’ fire. There are objectively reasonable excuses for not delivering goods, which is hard on the Tier 1 and automakers along the industrial chain. It’s hard to imagine how the Tier 1 will survive this year in China.

(3) Speculation: I heard before that various means are used in semiconductor sales to urge orders and allocate sources by relying on high-low prices and importance. But this year, due to the continuous shortage of chips, the prices of items ranging from $1 to $10 can rise by 10 times, 20 times, or even more. This can be regarded as broadening one’s experiences.

From this event, we can understand that in the future, Japan, South Korea, Europe, and the United States industrial industries (of which the automotive industry is a part) must establish a relatively controllable and complete chip supply system. For the division of labor system, this will require the construction of many redundant links, and everyone’s production capacity utilization rate will decline. This epidemic is an unprecedented situation worldwide, and there is a global consensus that, for some degree of industrial safety, we can tolerate cost increases and efficiency declines, and not be so divided and cooperative.

Of course, China is also deploying chips from various dimensions to improve industrial safety and supply chain integrity. By the third stage, when the chip supply in Malaysia is continuously unstable, it has exceeded the general situation, directly evolving into global companies such as Tesla, the world’s largest electric vehicle company, and not being able to obtain chips. All car companies are scrambling for core chips because this shortage will cause difficulties in global automotive supply in August. In Elon Musk’s way, general chips can be exchanged if possible, but the replacement cycle of these safety components is too long, and rash replacement will lead to endless troubles. This is equivalent to directly hitting the vital interests of automakers.

In summary, after writing the previous article, I don’t know what else to add. The fragility of this world is also evident.I remember a book called “Antifragile” was particularly popular some time ago. Now, chips have become the Achilles’ heel of the automotive industry, and the impact may not completely dissipate until 2022. This is both real and magical.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.