This article is reproduced from the autocarweekly WeChat official account

Author: Financial Street Lao Li

The domestic secondary market has always had a neutral and cautious attitude towards NIO.

In the past two years, the industry and capital have had very different opinions on NIO, and after passing the crisis at the beginning of 2020, with the increase in delivery volume and the diffusion of Tesla’s negative impact, industry friends have become increasingly concerned about NIO, the leader of the domestic new car-making force. After observing it for a while, Lao Li found that there was a lot of positive coverage after the Q2 financial report was released.

Lao Li had the opportunity to become a NIO employee several years ago, and in recent years, his attention to NIO has surpassed that of Tesla. However, in work, colleagues’ attention to NIO is far less than that of Tesla. Besides the routine attention to NIO’s monthly sales, they also pay attention to XPeng and Ideal. I can’t think of any other special research.

Today, Lao Li will objectively discuss with everyone from the perspective of industry and capital, what level is NIO’s Q2 financial report? Is it worth chasing NIO in the secondary market? Does NIO, which has a new brand, have no future?

Q2 financial report, what level is it?

The NIO Q2 financial report can be described as average, neither exceeding nor falling below expectations.

In the past two years, Wall Street investors have conducted very in-depth research on NIO, and many research data have also been circulated in the market, from large Morgan Stanley to unknown funds, overseas peers’ judgement is very accurate: in the past two quarters, they have given NIO relatively conservative expectations, but after NIO announced a new brand, some institutions have also raised their expectations for NIO.

How do domestic institutions view NIO? Lao Li and many friends discussed, and the basic idea of everyone’s thinking is like this: NIO’s valuation password is its growth, as long as NIO’s various financial indicators maintain high growth rate, the secondary market will have confidence. However, it is easier said than done. Everyone has confidence in Ningde times because as long as Ningde ensures a 50% market share, the industry will have high growth, and Ningde times will also have high growth; NIO is different. As a high-priced C-end product, its growth rate has great uncertainty.

After NIO’s Q2 financial report was released, the secondary market has been discussing. From now until Q2 next year, NIO’s growth rate may not be as exciting as it has been in the past year. Financial reports should be viewed in the context of a timeline. Financial report numbers without comparative cycles have no meaning. Let’s first take a look at some of NIO’s main financial indicators:

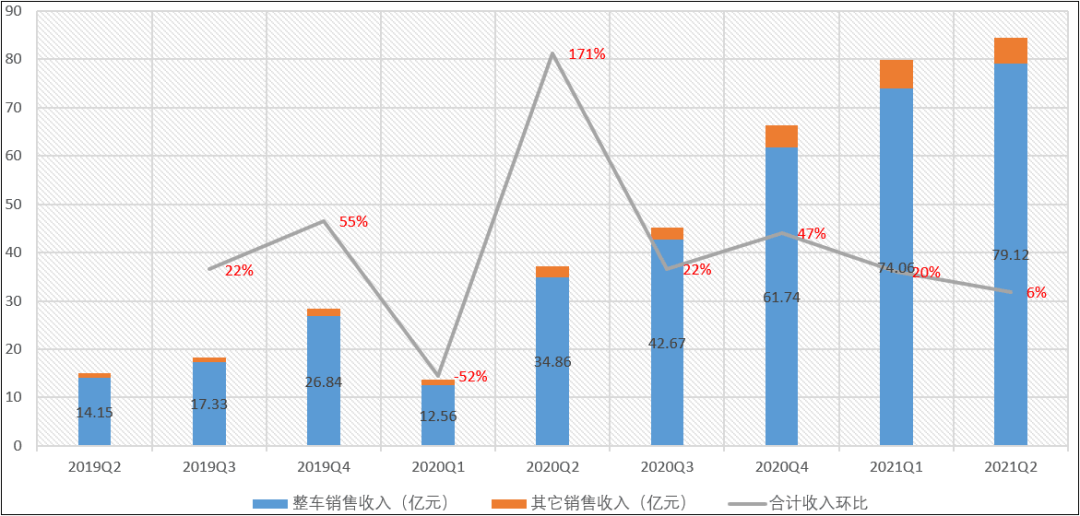

Revenue indicators: In Q2 of 2021, NIO achieved revenue of RMB 8.448 billion, a year-on-year increase of 127% and a month-on-month increase of 5.8%.

The revenue total is within everyone’s expectations, but the high growth has been lost. The 5.8% increase from the previous quarter is NIO’s lowest data performance since Q1 2020 (outbreak of the pandemic). The expected total revenue for NIO Q3 is between RMB 8.913 billion and RMB 9.631 billion, an increase of about 96.9% to 112.8% from Q3 2020, and an increase of about 5.5% to 14.0% from Q2 2021.

The revenue total is within everyone’s expectations, but the high growth has been lost. The 5.8% increase from the previous quarter is NIO’s lowest data performance since Q1 2020 (outbreak of the pandemic). The expected total revenue for NIO Q3 is between RMB 8.913 billion and RMB 9.631 billion, an increase of about 96.9% to 112.8% from Q3 2020, and an increase of about 5.5% to 14.0% from Q2 2021.

Generally speaking, as represented by CATL, the emerging growth stock of To B has a reference growth rate of about 30%. NIO belongs to To C high-end products, which can be lowered to around 20%, but this number is still much higher than NIO’s performance in Q2 and Q3.

Some friends may say that Q2 and Q3 are the off-season in the market, and the market will enter the peak season in Q4, so won’t NIO’s data look better? This is cyclical thinking. NIO’s high valuation is based on growth thinking. If the market thinks NIO’s style shifts from growth to cycle, its valuation will continue to be downgraded.

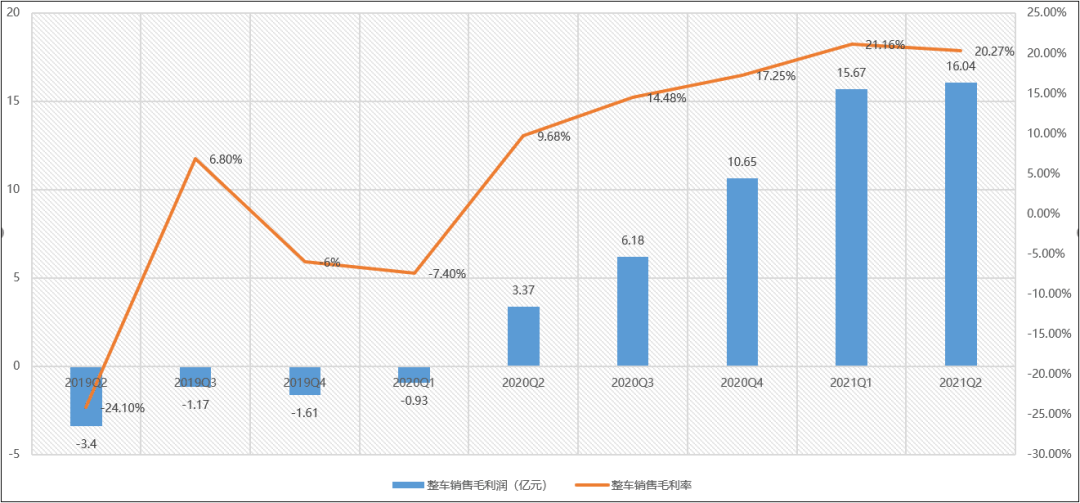

Gross profit indicators: NIO Q2’s gross profit from vehicle sales was RMB 1.604 billion, and the gross profit margin from vehicle sales fell from 21.16% in the previous quarter to 20.27%. In the quarterly reports of the past three years, NIO’s gross profit margin from vehicle sales has been rising. However, the Q2 2021 quarter-on-quarter growth rate not only did not slow down but also decreased. From the data perspective, NIO’s gross profit margin from vehicle sales of around 20% is inferior to that of Tesla. Tesla’s gross profit margin in the same period was as high as 28.4%.

In a previous article (“Guess How Much More Money Tesla Could Cut with a Cost of Less Than RMB 200,000?” – link), Lao Li mentioned that NIO’s cost is high, mainly because of the good quality of the supply chain, including many international luxury suppliers. Looking at it the other way around, the lower gross profit margin has to some extent affected the imagination of the enterprise. Lao Li personally speculated that NIO may have this kind of plan: to keep the gross profit margin at around 20% for a long time to ensure the quality of the NIO brand. As long as the NIO brand can catch up, relying on the current resources and system, profitability can be achieved through a new volume brand.

Net profit indicators: NIO Q2 realized a net loss of RMB 587 million, and the net loss ratio expanded from 5.7% in the previous quarter to 7.0%. The start-up period of an auto company must incur losses, and it is far from the time to examine net profit. This indicator has little significance.

## Does NIO have a future for its brand?

## Does NIO have a future for its brand?

In general, there are three elements to consider when looking at financial indicators for startup companies. Firstly, listen to what the company has not said, rather than what they have said. Secondly, look at the MoM (month-over-month) indicators, rather than the YoY (year-over-year) indicators. Thirdly, consider its level of growth, rather than its cyclical nature. Once NIO loses its growth potential, its market value cannot be sustained from any point of view, even with an annual revenue of 30 billion yuan and a gross profit margin of around 20%.

For those who have carefully studied Tesla’s and NIO’s financial reports, it is obvious that Tesla’s financial indicators are very strong. The two main factors supporting Tesla’s financial report are the gross profit margin and sales volume, with the latter having a greater impact. The gap between NIO and Tesla is sales volume. Many people in the secondary market are saying that NIO’s sales have entered a bottleneck. Although NIO delivered a total of 21,896 vehicles in Q2, the MoM growth rate has been slowing down. The MoM growth rate in Q1 was 15.6%, in Q2 it was 9.2%, and Q3’s expected MoM growth rate is 5.0% to 14.2%, which is lower than the minimum expected rate of 20% in the secondary market.

Supply and demand are the main factors affecting sales volume. Li Bin did some research before and believed that NIO’s supply capacity is good. The problem lies in the demand side. Many friends have been discussing how large the high-net-worth population in China is willing to buy high-end electric vehicle brands or how the high-net-worth population willing to pay to buy NIO is.

This is not a mathematical problem, but a social problem. If calculated based on an average bicycle price of 400,000 yuan, Li Bin personally believes that the maximum number of people willing to buy it each year is 100,000. With the slowdown in economic growth, this number will decrease further.

Does this mean that NIO will not make it in the future? The answer is negative. Although the current growth potential of the NIO brand is declining, NIO has found its second growth curve – new brand.

The founders of the new power are all masters of capital control, especially Li Bin, who balances industry and capital just right. To balance them just so, means to accurately predict the capital expectations and know the strengths and weaknesses of the enterprise at various stages, and then to play the limited resources to the best.

Every year, NIO Day and the date of the financial report announcement, NIO can cleverly avoid disadvantages, play to its strengths, and create heat. At NIO Day at the beginning of this year, NIO knew that solid-state batteries were a “long-term future”, but they still marketed them heavily. The media and capital were willing to pay the bill. After the release of the Q2 financial report, NIO knew that the financial report was not spectacular, but still spread the new brand heavily, and the media and capital were once again willing to pay the bill.

True masters always have the pulse of the industry and capital rhythm just right. This time, NIO announced its new brand intentionally created a loophole for capital, and again found a way out for themselves with extreme wisdom.

” NIO has no future,” Li Bin heard this for the first time in 2016. Since then, at least ten people have said similar things, and the arguments are all the same. NIO’s product and service attributes make it difficult to achieve scale, and it will not have marginal effects. This time, NIO announced its new brand, which actually verified this statement: if NIO brand had marginal effects, Li Bin wouldn’t go for the volume model. Considering the positioning of the NIO brand, a new brand is necessary.

Li Bin mentioned in the communication that:

If we make a simple analogy, our (NIO brand and new brand) relationship is more like Audi and Volkswagen or Lexus and Toyota from the perspective of positioning. This is more accurate from the perspective of positioning. Our new brand will not enter the Wuling Hongguang range because they have done very well. What we really see lacking in the Volkswagen market is products that are competitive with (smart electric) products. We hope that there will be products that can provide better products and services at a lower price than Tesla. This is our goal.

Li Bin interpreted Li Bin’s views in his own words: The positioning of NIO brand and new brand can be compared to the relationship between Audi and Volkswagen, but within three to five years, NIO’s attributes and the scale of the domestic market determine that it cannot achieve the sales volume of the Audi brand, nor can it achieve the sales volume of Lexus; the NIO brand is a flag, and its early positioning determines that it will not launch models priced below 250,000 yuan like Tesla, but considering marginal effects, it is necessary to create a new brand.

Li Bin also communicated with some fund managers, most of whom held a positive attitude towards this decision: everyone had lowered their expectations for the NIO brand early on, and the neutral financial report also showed that it was a stable performer, but after the announcement of the new brand, there is likely to be a NIO concept stock in the future, isn’t that great?

In the secondary market, people always rise early in search of profit.

Is the new brand NIO’s future?

When capital abandons you without a goodbye, you can only keep embracing it.

This sentence is most appropriate for the three new forces of China today. From 2015 to the present, the first wave of bullets from NIO, XPENG, and LI Auto has been fired, and the capital market believes that the three new forces have completed the best “nursery period,” and the rest depends on their hematopoietic capacity.The reality is always harsh, whether it is NIO’s E series, XPeng’s D/E platform, or Li Auto’s extended-range electric vehicle, the first wave of products did not fully meet expectations. In terms of unit sales, except for Li ONE, the others are basically satisfactory, and there is a high degree of uncertainty in terms of sales sustainability. Therefore, the three new forces are eagerly launching the second wave of product offensives.

Mr. Li personally believes that the three new forces will quickly differentiate from the second wave of products offensive. From the current information, NIO may have more advantages.

Capital looks at car manufacturers, only looking at revenue and gross margin optimization space. Revenue benefits from unit price and sales volume, while gross margin benefits from the marginal benefits brought by expanding delivery scale. The challenge for new brands is whether NIO can control the product competitiveness and cost of new brands, product competitiveness determines sales volume, and cost determines gross margin.

One undeniable fact is that NIO’s marketing and service levels are world-class, while there is still room for improvement in product competitiveness.

In 2020, the domestic new energy vehicle market was an incremental market, and various companies had good growth rates. However, starting from this year, NIO’s products have encountered greater challenges. Although NIO boasts of its competitors being some super luxury car models, its price range has always been in the BBA interval. If NIO wants to do super luxury, its product competitiveness cannot support it, and if NIO wants to dive into the mass market, it will be a test of cost.

In recent years, NIO has not invested much in research and development. In Q2 of this year, NIO’s R&D expenses were 884 million yuan, and its R&D cost ratio was 10.5%. Li Bin stated that NIO will spend 5 billion yuan on R&D this year, but half a year has passed, and NIO’s R&D expenditure is only 1.57 billion yuan, which is relatively cautious. Tesla’s ability to reduce prices and increase production in the short term is due to its stable domestic supply chain and innovative manufacturing processes, which NIO needs to learn. Once the cost is lowered, the product competitiveness of its new brands is a point of risk.

The launch of a new brand has risks, but more opportunities.

NIO President Qin Lihong stated at Energy Day that “NIO Power” should not be considered a loss concept, this is “investment in child education”, which reflects NIO Power’s financial performance to a certain extent.

Last year, some institutions suggested that NIO Power might become a growth point for NIO, which was endorsed by Mr. Li for two reasons: first, NIO Power’s system is a relatively complete energy replenishment system both domestically and internationally, with a good user experience; second, as the user base of NIO Power increases, its profitability will improve, and the launch of new brands will greatly enhance incremental space.

Last year, some institutions suggested that NIO Power might become a growth point for NIO, which was endorsed by Mr. Li for two reasons: first, NIO Power’s system is a relatively complete energy replenishment system both domestically and internationally, with a good user experience; second, as the user base of NIO Power increases, its profitability will improve, and the launch of new brands will greatly enhance incremental space.

NIO Pilot and 100 Degree Battery are also likely to be integrated into new brands. The value they bring to NIO fundamentally depends on the increase in delivery volume. The application of new technologies, new models, and the launch of new brands will contribute greatly to the increase in NIO’s gross margin and will drive the performance of the secondary market.

“If there is no new brand launch, NIO’s rating will be downgraded significantly, but the launch of a new brand will open up the business model and improve financial expectations, which will naturally lead to an increase in ratings.” This is the conclusion of Mr. Li’s team of researchers after the release of NIO’s Q2 financial report.

For start-ups, external comments are not important, and capital’s long or short positions or media’s bullish or bearish views will not directly affect business operations. What matters is whether the company is on the right track of business development, and NIO has been on this correct track all along.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.