Author: Zi Li from Tiexi District

On August 12th, Li Xiang, the founder, chairman and CEO of Li Auto made a short speech and rang the bell during the online listing ceremony due to the pandemic. The co-founder and president, Shen Yanan, was also interviewed. Li Auto issued 100 million shares for its listing on the Hong Kong Stock Exchange, with an issue price of HKD 118 per share, which was lowered from the previously announced HKD 150 per share, possibly due to recent turbulence in the automobile industry. On the day that Li Auto confirmed its issue price, XPeng’s stock fell nearly 5%, and on July 30th, when the market was at its worst, it dropped nearly 20% to HKD 131.20 per share.

On the day Li Auto was listed in Hong Kong, the automotive sector continued to be volatile, and XPeng dropped 6.5 HKD per share compared to the previous day’s closing price. Li Auto’s first day on the market was below the issue price, closing at HKD 117 per share.

As expected, Shen Yanan took preventive measures in the interview, “We are not particularly concerned about short-term stock prices, but more about opening up effective and efficient financing channels and effectively entering the next stage of competition.”

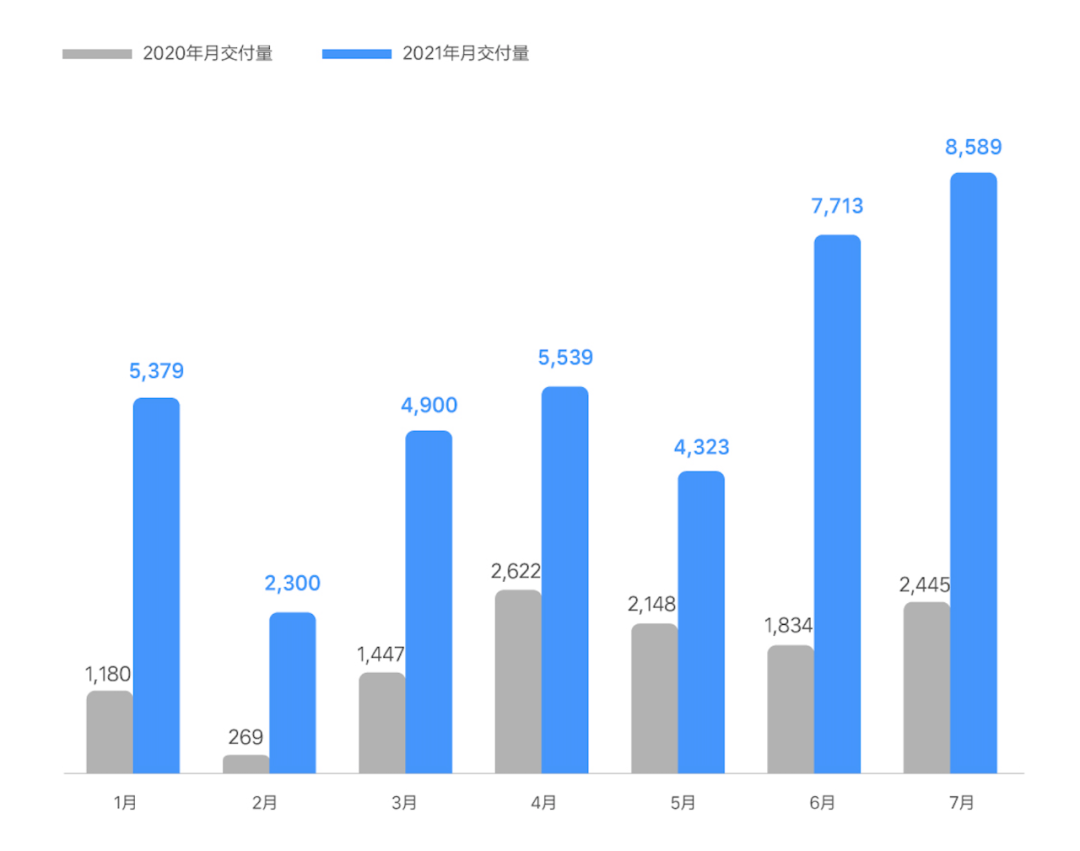

This remark also set the tone for the listing in Hong Kong: everything is focused on the next stage of competition, not the present. In fact, Li Auto’s market performance is currently very strong. Shen Yanan revealed that the number of ONE orders has exceeded 10,000, and it is estimated that delivery will exceed 10,000 in September. “According to previous estimates, our overall gross profit this year will reach 19-20%… Our operating cash flow has been positive since the second quarter of last year.”

Translated, this means that if we do not increase investment in the future, we would have already been profitable.

So what will happen in the future, and why is there such urgency to raise capital and increase investment?

The Domestic War is About to Begin

In the interview stage of the bell-ringing ceremony, Shen Yanan made a very important statement: “We have invested more money in research and development, so from the perspective of net profit, we will be in a state of no profit for a relatively long period of time.”

In a company internal letter published by Li Xiang at the beginning of this year, the tone was already set for the current situation:

“By 2025, China will sell more than 8 million smart electric vehicles. Obtaining more than 20% of the market share is a necessary condition for becoming a head enterprise. At that time, Li Auto will have 20% of the market share and become China’s top smart EV enterprise.”It is precisely in the first quarter of this year that Ideanomics suddenly turned from a small profit in the fourth quarter of last year to a loss, followed by the news that Wei Xiaoli would go public in Hong Kong. Even so, the listing of Ideal in Hong Kong does not mean that the capital reserve is complete – “there is no exclusion of the possibility of returning to the A-share, and the internal exploration has been carried out.” Shen Yanan said.

It seems that the competitive situation of Ideal in the automotive industry has suddenly become extremely severe, and they have to seize every opportunity to raise funds. What happened exactly?

Vivo and Huawei successively spread rumors about car-making, and Xiaomi officially announced its entry into the field. These moves may uncover the mystery: the entrance of the giant players in the industry had already been rumored.

However, with the influx of the giants, the competition will enter the non-rational stage (as explained in the previous article “NIO’s Mobike dilemma”) and the participants in this stage must focus on the goal of “increasing market share” and rush forward. This requires Ideal to enter a more popular market and launch more products.

This also means that Ideanomics must step out of its comfort zone. ONE is currently alone in the market, avoiding almost all EV brands at a price of 300,000 yuan. XPeng is targeting the 200,000 yuan price range, as well as BYD Han. Even the Model Y and NIO ES6, which are priced slightly closer, are positioned lower than ONE, so Ideal is able to directly compete with joint venture fuel cars in this market at this price point and form a differentiated advantage based on its cost performance and new car identity.

The prospectus shows that Ideal plans to launch three range-extended models in 2022 and two EV models every year from 2023. NIO has confirmed that it will enter the low-cost car market with its sub-brand on August 12, and with Ideal’s entry into the economy market and the launch of high-pressure charging EVs, a domestic EV war with NIO, XPeng, BYD, and other domestic EV manufacturers will be fully underway.

At that time, ONE’s performance will no longer count, and Ideal will have to take new steps and make new footprints.

Strategy of the Domestic EV Manufacturers

In the face of a cruel and entirely new situation, Shen Yanan explained Ideanomics’ competitive strategy: “Ideanomics doesn’t compete in the pure EV market, we look at the entire passenger car market. Whether it is range-extended or electric, the goal is to replace gasoline cars more, this is our starting point.”

The focus is not on seizing the share of EV peers, but on seizing the share of fuel cars and taking more than EV peers.

All of this is based on full confidence. Shen Yanan boldly stated: “What is the bottleneck of replacing gasoline cars? Everyone now agrees that whether it is range-extended or pure electric, they are leading in driving experience and intelligence. The reason why more consumers do not choose new energy vehicles is still due to the problem of charging experience.”From Range Extension to High Voltage Charging, the entire technological evolution always adheres to the same idea, “hoping that the charging experience would be as convenient as refueling and equivalent to that of fuel vehicles.” Shen Yanan revealed that Ideal would layout a charging network in advance to ensure that this idea can be truly reflected in the user experience, “Maybe later this year, you will see some of our actions.”

Once the basic logic of competition is determined, specific market selection becomes relatively simple. Ideal looks for regions with a sizable market and weak competitiveness for fuel vehicles. In the prospectus, Ideal has already made clear plans for the 200,000 to 500,000 yuan vehicle range, targeting family cars.

Family cars are relatively easy to understand, as it is an established car buying culture in China and has already been verified by the outstanding sales of Ideal ONE. However, the 200,000 to 500,000 price range selection requires more consideration. If we only talk about scale, the 150,000 to 200,000 yuan market is obviously a larger pie. However, over the long term, mainstream joint venture brands, such as Volkswagen and Toyota, have cultivated this market to a high degree of maturity. On the other hand, the 200,000 yuan market is the relatively vacant area between mainstream joint venture brands and luxury brands. It is a difficult market for Volkswagen and Toyota to penetrate, while BBA (Mercedes-Benz, BMW, and Audi) would find it unappetizing. In addition, upgrading consumer preferences are in effect, making this market a gold mine for EV manufacturers. XPeng P7 and BYD Han have already proven this point.

An interesting detail is that when asked about the recent optimistic policies for low-speed electric vehicles during an interview, whether Ideal is considering resuming SEV (short-range electric vehicles) projects, Shen Yanan firmly responded: “Our focus is on family cars in the 200,000 to 500,000 yuan price range. Therefore, although there are clear policies for low-speed electric vehicles, we will not invest in SEVs.”

The past is over. The so-called plan is something that we must strictly execute.

Get Ready to Charge

Let’s review Ideal’s product launch plan for the next few years: In 2022, release the second generation of range extension platform, X platform, with three models; two EV platforms, Whale and Shark, will be released annually with two EV models starting in 2023.To do a simple statistics: it took 4 years from 2015 to the end of 2019 for ONE to be delivered; from 2019 to 2022, 3 new extended-range vehicles will be delivered (according to the market release), in a total of 3 years; from 2022 to 2023, 2 EVs will be launched, in a total of 1 year; and from 2023 onwards, 2 EVs will be launched every year. To divide it into stages: in the first 4 years, they only aimed to produce one car; in the following 3 years, they aimed to produce 3 cars; and afterwards, they aimed to produce 2 EVs every year.

The faster pace is obvious, and as for the investment size, Shen Yanan revealed in an interview: “The investment in each car is about 2.5 billion yuan.”

As mentioned earlier, Li Xiang predicted in 2025 that the market size would be 8 million vehicles, and the ideal would hold a 20% market share. To support this goal, such a product deployment rate and investment scale are obviously necessary, and also not enough. In fact, we have already seen that NIO has launched a new round of initiatives recently, which is almost a naked statement: “We know how big the market we want is, and we know how big a market we can get.”

On April 29th, NIO’s new Qiao intelligent electric vehicle industrial park in Hefei officially started construction, with an initial investment of 50 billion yuan and a planned capacity of 1 million vehicles.

On July 31st, XPeng’s Wuhan factory project started, with an investment of over 4.7 billion yuan and a capacity of 100,000 vehicles. Together with the Zhaoqing and Guangzhou factories under construction, the total production capacity will reach 300,000 vehicles.

At present, Ideal’s Changzhou factory has a capacity of 100,000 vehicles, which will be expanded to 200,000 vehicles after the new workshop is completed in 2022. At the same time, Shen Yanan confirmed the news that they are in contact with the first factory of Beijing Hyundai. Previously, informed sources said that the project’s production capacity is about 250,000 to 300,000 vehicles, with a total investment of about 6 billion yuan.

With a total local sales volume of 8 million, calculated based on the 20% market share, the annual sales volume will reach 1.6 million vehicles. In other words, the current capacity of Ideal, even if it is fully operating, is not enough to meet the demand of half of the annual sales volume.

As for the investment, for 5 new cars and a budget of 2.5 billion yuan for each car, the total investment is 12.5 billion yuan, plus the estimated 6 billion yuan for the Shunyi factory, a total of 18.5 billion yuan. The plan to land on the Hong Kong stock market this time is to raise 11.8 billion Hong Kong dollars, approximately 982.7 million yuan, which is just over half of the 18.5 billion yuan.

And the story has just begun.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.