Financial Data

This morning, NIO officially released its financial report for Q2 2021, with many indicators hitting record highs.

Delivery:

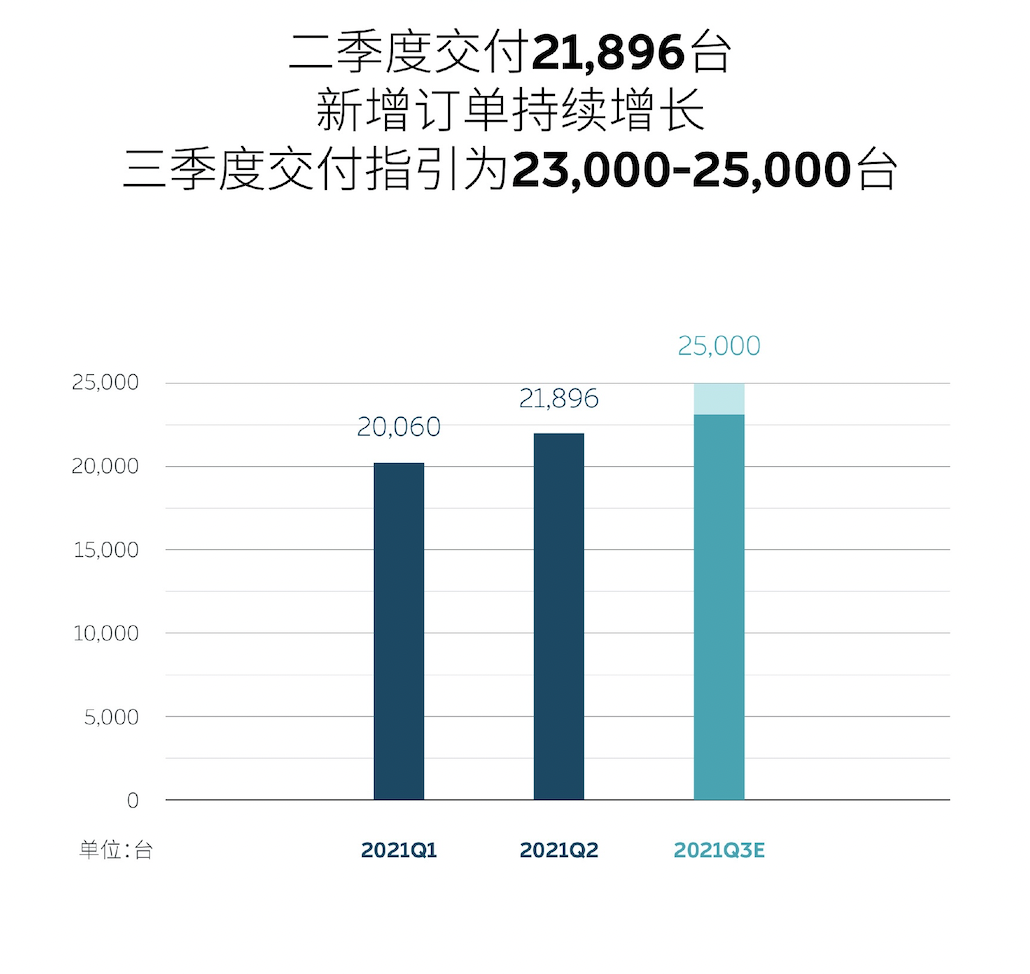

In Q2 2021, NIO delivered a total of 21,896 new cars, of which 4,433 were ES8, 9,935 were ES6, and 7,528 were EC6. This delivery volume once again refreshed NIO’s record (an increase of 9.2% MoM and 111.9% YoY), confirming Li Bin’s judgment in the Q1 financial report: “It is expected that 21,000 to 22,000 cars will be delivered in Q2 2021.”

For reference, the delivery data for the previous five quarters is listed below:

- Q1 2021: 20,060 deliveries

- Q4 2020: 17,353 deliveries

- Q3 2020: 12,206 deliveries

- Q2 2020: 10,331 deliveries

- Q1 2020: 3,838 deliveries

In the financial report, Li Bin stated: “In 2022, we will launch three new products based on the NIO platform 2.0, including the flagship high-end intelligent electric sedan ET7.“

Financial Data:

In Q2 2021, NIO’s automotive sales revenue was RMB 7.9118 billion, a MoM increase of 6.8% and a YoY increase of 127.0% (total revenue was RMB 8.448 billion, a MoM increase of 5.8% and a YoY increase of 127.2%), achieving the Q1 2021 forecast goal.

NIO’s total gross margin in Q2 2021 was 18.6%, and the gross margin per vehicle was 20.3%, decreasing slightly from Q1 2021 which had a total gross margin of 19.5% and gross margin per vehicle of 21.2%. (For comparison, Tesla’s total gross margin in Q1 2021 was 24.1%, and the gross margin per vehicle was 28.4%).2021Q2 net loss was 587.2 million RMB, which decreased by 50.1% year-on-year and increased by 30.2% quarter-on-quarter.

Other data:

NIO expects total revenue in 2021Q3 to be between 8.913 billion to 9.631 billion RMB, representing a quarter-on-quarter growth of 5.5% to 14.0%.

NIO expects to deliver 23,000 to 25,000 vehicles in 2021Q3, an increase of approximately 88.4% to 104.8% year-on-year and approximately 5.0% to 14.2% quarter-on-quarter.

Total R&D expenses in 2021Q2 was 883.7 million RMB, up 62.1% year-on-year and 28.7% quarter-on-quarter.

Total sales and administrative expenses in 2021Q2 was 1.4978 billion RMB, up 59.9% year-on-year and 25.1% quarter-on-quarter.

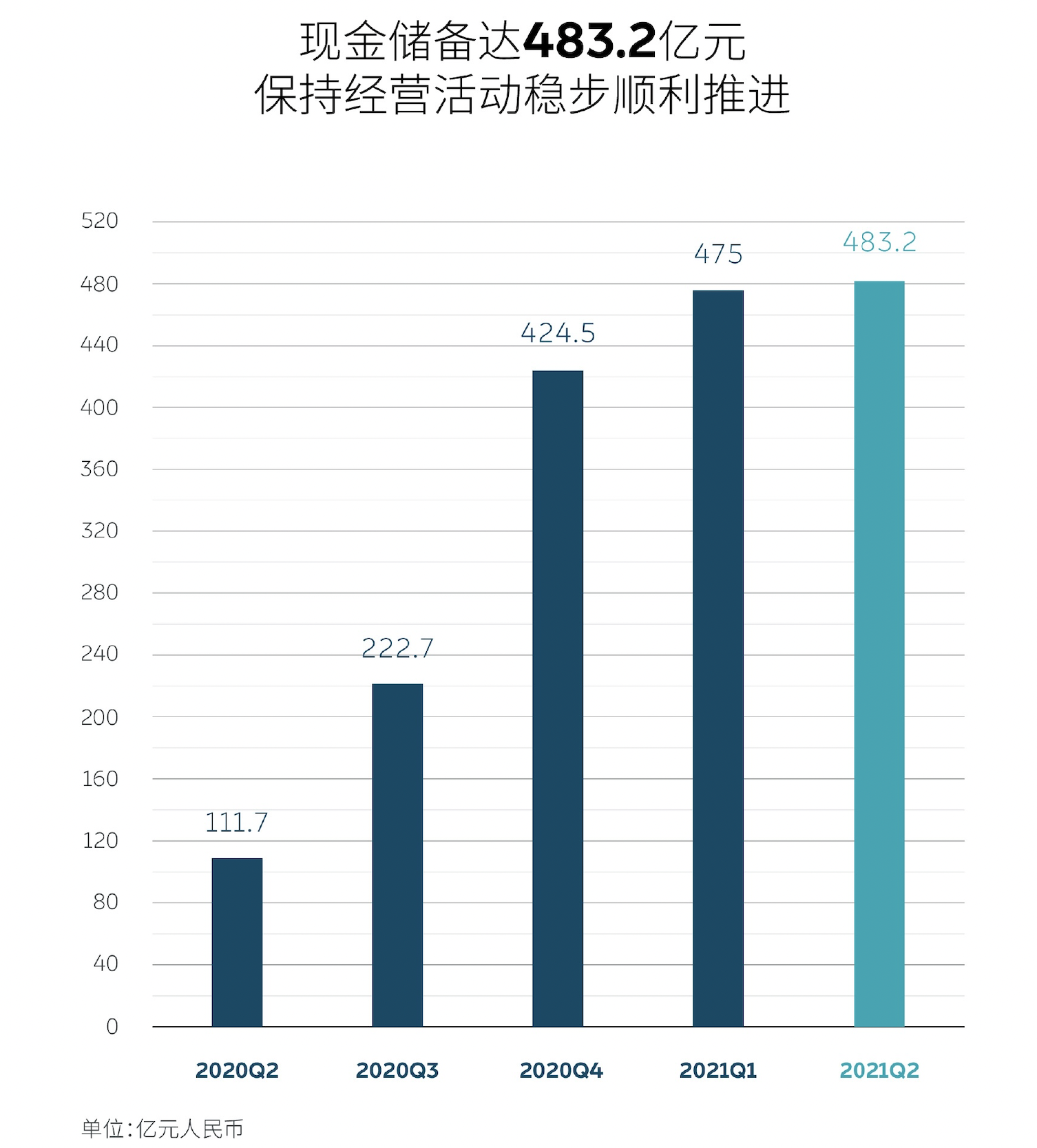

NIO’s cash and cash equivalents reached 48.3 billion RMB.

Others

In May 2021, NIO renewed its manufacturing agreement with JAC Motors. From May 2021 to May 2024, JAC Motors will continue to produce ES8, ES6, EC6, ET7, and potential other NIO models. In addition, JAC Motors will expand its annual production capacity to 240,000 vehicles (based on 4,000 working hours per year) to meet the growing demand from NIO.

On July 12, 2021, Ms. Long Yu was appointed as NIO’s new independent director, effective immediately. Meanwhile, NIO’s founder, Chairman and CEO, Mr. William Bin Li, resigned from the nomination committee and corporate governance committee of the board of directors.

Conference call

About entering the mass market

At the beginning of the conference call, William Bin Li confirmed that NIO’s entry into the mass market would accelerate and a new brand would be used.

Q1: Specific information on two new models in 2022? What changes are there in the battery strategy?

William Bin Li: The ET7 is the first model to use NT2.0, but we are confident that we can deliver on time. As for the two new models next year, I am not at liberty to disclose too much information. However, in terms of price, due to the decrease in battery costs, they will be cheaper than all NIO models currently available, but not too cheap.The demand for batteries will significantly increase in the future, and CATL remains the main partner.

Q2: What is the impact of the epidemic on production? How many deliveries are expected to Norway in Q3? What are the plans for overseas markets?

Li Bin: The epidemic does have an impact. However, since last year, NIO and its supplier partners have been “trained.” The impact of the rebound of the epidemic in China has now emerged, with one partner located in a high-risk area in Nanjing. Delivery is mainly affected by the supply chain. The upper limit of delivery expectations in Q3 is mainly restricted by the supply chain.

The epidemic in Malaysia caused chip factories to stop production, but the impact is controllable. In addition, the supply chain in Germany was affected by flooding, but we are negotiating with partners to resolve it, and the impact is controllable.

There will not be a large number of deliveries in Norway in Q3. The Norwegian market mainly aims to establish the brand’s image and satisfaction. We hope that investors can be patient. NIO has received great support from the early UAB (User Advisory Board). From the feedback from the Norwegian UAB, everyone is more recognized and looking forward to the BaaS service model and battery swapping.

Q3: Can you share more about Q2’s profit data and NIO’s cash reserve strategy?

Qu Yu: The sales volume of ES6 in the second quarter exceeded that of the first quarter. The gross profit of this model is relatively low, so the vehicle gross profit figures have changed. Next, in 2022, three new models will be launched, and the product line will be updated, and the depreciation period of existing products will be shortened. NIO will continue to invest in R&D, which is one of the main strategic focuses.

Q4: What is the development of NIO PILOT? What is the market share target for 2025? Can you share more information about entering the mass market in 2023?

Li Bin: Subscription fees will be included in other gross profit margins. The gross profit of NT2 will be better than the current, and other gross profits will be better in the long term. Battery upgrades, carbon emissions, and NIO LIFE are all gross income.

The market share of ES8 in the mid-to-large SUV market and ES6 in the mid-size SUV market has been increasing. NIO’s goal is to become the most satisfying brand for users. Talking about data needs to be compared with prices. It is meaningless to compare with Wuling Hongguang Mini EV. Compared with Tesla Model S/X, BMW, Audi, and Mercedes-Benz, NIO occupies more than the average market share and will further expand in the high-end SUV market.

NIO adopted a proxy model in the second half of 2018 and the first half of 2019, which played a significant role in NIO’s rapid development but also brought challenges. Starting from Q3, NIO uses a direct-operated model. The vast majority of the 100 NIO Space partners have reached an agreement with NIO and will turn into direct operations in the future. The newly opened NIO SPACE will also all be direct-operated.

As for products entering the mass market, NIO has launched products quickly, so the specific launch time needs to be re-discussed.### Q5: What are NIO’s advantages in attracting talents regarding R&D team? What is the current team size? What is the penetration rate of Baas and NP?

Li Bin: AD is our important direction of R&D investment, involving hardware, system, integration and operation, and not restricted to one department. There are 500 employees related to AD, and we will add 300-800 people at the end of the year. NIO has a great commitment to invest in AD. In 2016, NIO began to carry AD, and produced the first batch with Mobileye Q4, so the competitiveness of the entire AD team is very strong.

In terms of R&D expenses, Q2 began to accelerate R&D, and we will deliver two models in addition to ET7 next year. This year, many new projects have been launched, and R&D expenses and team size will increase from Q3. This year, R&D expenses will be around 5 billion yuan, and we will try to spend as much as possible. The number of relevant R&D personnel will double by the end of the year.

BaaS has a selection rate of 60% in July, and NP has a selection rate of 80%.

Q6: What are the different strategies in the Norwegian market compared to the domestic market?

At present, NIO already has a team of 40 people in Norway, which is our first step into the international market. We will go to other European markets next, and the number of personnel will also increase.

NIO appointed a European CEO in Q2 and is building a European team. Including Germany, the second-generation platform will be used. In addition to ES8 sold in Norway, products in overseas markets will be based on the NT2.0 platform.

User support and participation is an important component, and we will stick to it as a principle. Adjustments will be made according to different regional cultures. The principle of putting user experience and user interest first is effective in every market. When recruiting 200 user advisers in Norway, 7-800 people applied. Therefore, we can see that such user community participation is the same all over the world.

Q7: Will the first-generation models be gradually phased out? Will the products entering the mass market be like Mercedes-Benz Smart? You mentioned MINI EV before, do you have ideas to benchmark against it?

Li Bin:

Generally, NIO’s understanding of cars is to give users a little more choice, not to push two or three models, or too many models. We will provide users with a limited but rich selection, without having too many models. Compared with BMW and Audi, NT1.0 and NT2.0 still have strong competitiveness, and compared with fossil fuel cars, NT1.0 has a generational gap, but we will continue to sell NT1.0 next year.New brand, such as the relationship between Leichi and Toyota in the traditional fuel vehicle market. It is expected to offer models cheaper than Tesla, without competing in the Wuling market. (Li Bin reminded the translator to translate “to have much better services compared with Tesla,” which was met with laughter in the background.)

Q8: What is the target gross margin for the ET7? What is the gross profit situation for exports? What is the impact of a 3% increase in unit cost on financial data regarding research and development?

Li Bin:

NIO expects to achieve a gross margin of 25% in the NT2.0 period, which can be achieved by next year’s ET7, but the specific amount will still need to be determined after mass production. As the scale effects of NAD, NIO Space, battery swapping, and other services become apparent, the gross margin will further increase. The price for exports is unified, but it depends on local subsidies and taxes.

🔗Source: NIO Inc. Reports Unaudited Second Quarter 2021 Financial Results

🔗Open a U.S. and Hong Kong stock trading account (Get 1 share of NIO stock and 90 days commission-free trading for U.S. stocks)

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.