The article aims to make a preliminary analysis of the registration status of Shanghai’s new energy vehicles in July and the data of new energy vehicles in various dimensions in July.

Since 2021, new energy vehicles have reached a very strong state, with many points worthy of attention.

Registration Status of Shanghai’s New Energy Vehicles

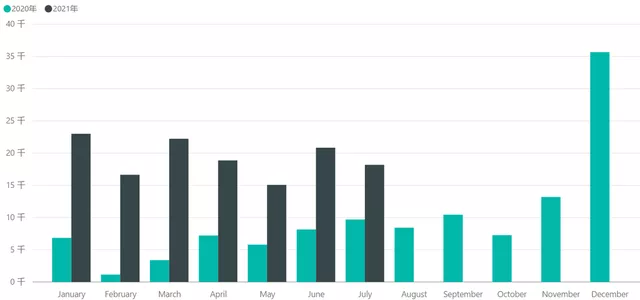

As shown in the following figure, the number of newly registered new energy vehicles in July was 18,181, an increase of 81% year-on-year, which continued to maintain a high level. Although the number of registrations in the previous month was 20,833 and decreased month-on-month, the overall demand for new energy vehicles is still at a high level. From January to July 2021, the total number of registered new energy vehicles in Shanghai reached a historical record of 135,400, completely surpassing the 117,000 vehicles in the entire year of 2020. According to this demand trend, the total number of new energy vehicles in Shanghai can reach 200,000+ in 2021.

Compared with the overall registration data, the number of newly registered vehicles in Shanghai in July was 49,116, a month-on-month decrease of 12.66% and a year-on-year decrease of 15.17%. We can see that the registration of new energy vehicles and traditional vehicles showed a divergence on a year-on-year basis, which objectively reflects that Shanghai’s consumers often failed in bidding for license plates several times, and then accepted new energy vehicles as their regular cars. This shift in attitude towards no longer wholeheartedly purchasing traditional cars is more pronounced in Shanghai.

Overview of Data from China Passenger Car Association and Certification of Conformity

- Data from China Passenger Car Association

Here we can summarize the data from the China Passenger Car Association: the wholesale sales volume was 246,000 units, the retail sales volume was 222,000 units, and the export data is the difference between these two data at 24,000 units. However, among the detailed items, there were Tesla exports of 24,347 vehicles and SAIC passenger cars exports of 4,407 vehicles, totaling 29,754 vehicles, which seems to not match the data.

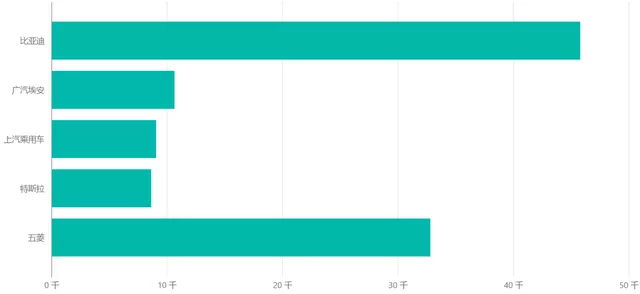

According to the wholesale data of car companies, the top players are BYD with 50,387 units, Tesla China with 32,968 units, SAIC-GM-Wuling with 27,347 units, SAIC passenger cars with 13,454 units, and GAC Aion with 10,506 units. Accordingly, the top players in retail sales are BYD with 45,782 units, SAIC-GM-Wuling with 32,800 units, and GAC Aion with 10,604 units. Here, we can roughly infer that Tesla’s retail sales in July were only 8,621 units, no wonder they had to lower the price without hesitation.

- Certificate Data

The data provided by the China Association of Automobile Manufacturers is 265,000, which should include all production. The domestic certificate data shows that there were 220,800 new energy passenger cars, including 44,000 BYD (22,400 pure electric and 21,000 hybrid), 31,900 Wuling, and 12,400 Changan. Compared with the above data, the wholesale of BYD is higher than its production in July, and the retail is also higher than the actual production in July. Changan’s cars may gradually catch up later.

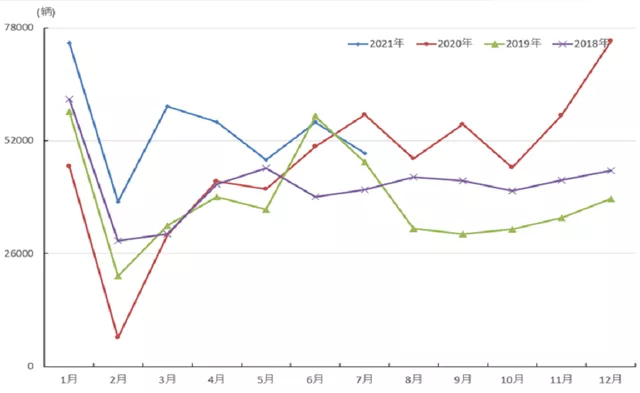

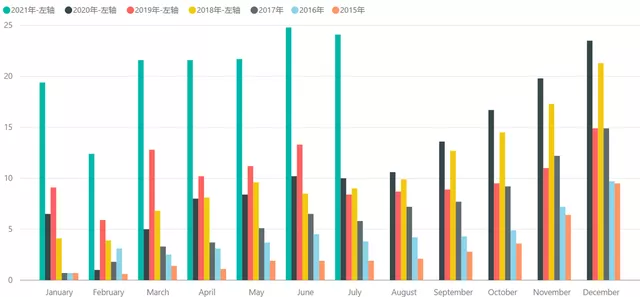

As shown below, 2021 is indeed different from previous years, relying on subsidies and various restraints. The total output of new energy vehicles in 2021 was 1.456 million. Estimating based on 250,000 units per month in the future, it will be a conservative estimate of 2.7 million units for the year. If we are optimistic (currently, batteries are still in short supply), it could be higher.

Conclusion: I think the key focus for the future is, with so many cars produced, where are they being sold? What is driving their purchases? Can these sales continue to stay stable?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.