Author: Tian Hui

The Hongguang MINI EV has become wildly popular in the automotive industry, with many car companies launching similar models. However, how to sell them?

Many people say to learn from the Liuzhou model, but we cannot agree.

The Liuzhou model was once a typical example of political and corporate cooperation in the early promotion stage of new energy vehicles. Through the cooperation between local government and car companies, the Baojun E100 became Liuzhou’s street car. In the early stage of the promotion of electric vehicles, the Liuzhou model was effective in the small-scale market in Liuzhou.

With the foundation of the Liuzhou model, the Hongguang MINI EV (internal code E50) launched by Wuling Motors subsequently became a popular car model of the year. At the same time, the MINI EV also stimulated the rapid development of A00-level pure electric micro cars.

If the success of the E100 is attributed to the Liuzhou model, the E50 (Hongguang MINI EV) completely broke away from it. If you still follow the Liuzhou model, it is like trying to find a sword on a ship.

For enterprises in the A00 pure electric market who want to share a pie with the Hongguang MINI EV, don’t seek government support, but focus on product strength. If it is positioned like the Hongguang MINI EV, then compete through cost-effectiveness and service, or seek differentiation. The most important thing is to learn the skills of Wuling Motors’ finding the right market, making good products, and innovating marketing behind the MINI EV.

MINI EV is selling well, and elderly mobility scooters are disappearing

Less than 30,000 RMB, no need for gasoline, can be plated, easy to park, the initial positioning of the MINI EV has been very accurate – a cheap, reliable, and low-speed mobility scooter that can be plated.

However, in terms of marketing, Wuling Motors discovered that the MINI EV also has some appeal to urban young people, so they targeted young people in their marketing. But the fact that needs to be recognized is that its main users are still in the third and fourth-tier markets.

Looking at sales, although the MINI EV has some sales in Shanghai, its main sales area is still third-tier or lower cities.

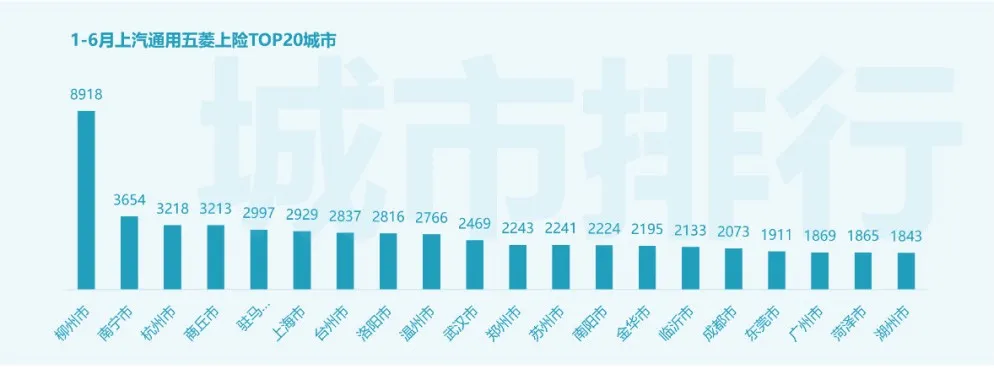

In the first half of this year, the total number of MINI EVs insured exceeded 150,000, and the sales in the central province of Henan exceeded 20,000, of which the sales of MINI EV in regions such as Shangqiu, Luoyang, Zhumadian, Zhengzhou, and Nanyang all exceeded 2,000 units.

In the central provinces of Henan, Jiangsu, Shandong, and Zhejiang, the total number of insured vehicles in the first half of this year exceeded 70,000, accounting for 46% of the total.Translate the following Chinese Markdown text into English Markdown text in a professional way, keeping the HTML tags inside Markdown and only outputting the result.

It should be noted that MINI EV is selling well in the Central Plains region without special subsidies, and even MINI EV has not received central-level new energy vehicle subsidies. Instead, the sales of MINI EV in Liuzhou, the birthplace of the Liuzhou model, are significantly behind those in the Central Plains region.

At the same time, even in areas where part of the epidemic purchase subsidy has been issued, the sales of Hongguang MINI EV are still booming after the subsidy exits, such as Qingdao and Hainan. In the first half of this year, the number of insured Hongguang MINI EVs has exceeded 1,100.

Why is it selling well in the Central Plains?

Perhaps the answer can be found in the vehicle needs of the Central Plains region.

As we all know, the Central Plains region is a hot spot for senior mobility scooters and has given rise to many well-known senior mobility scooter companies.

At the same time, the Central Plains region is also an area where local protectionism is severe. Local governments give local protection to the senior mobility scooters within their jurisdictions, giving the green light in sales and usage. Local people have a strong demand for cheap and low-cost senior mobility scooter products.

However, with the nationwide unified action of the Ministry of Public Security, various places have begun to regulate the management of senior mobility scooters. In the first half of this year, the public security and quality supervision departments cracked down on enterprises producing illegal low-speed vehicles in Shangqiu, Henan.

Senior mobility scooters have been hit, but consumer travel needs will not change because of this. Whoever can launch a substitute for senior mobility scooters will have an advantage.

The appearance of Hongguang MINI EV just meets this need. This shows the precision of Wuling Motors in grasping user needs.

Stronger than senior mobility scooters, weaker than traditional cars

Finding the right demand is not difficult. The difficulty for senior mobility scooter companies is to find the product positioning, and the products produced always tend to lean toward regular cars, leading to high prices and ending in limited success.

The product strength of Hongguang MINI EV is just in between being stronger than senior mobility scooters and weaker than regular cars.

The strengths of Hongguang MINI EV over senior mobility scooters are:

Firstly, MINI EV uses a large capacity lithium battery, which has a real range longer than that of a lead-acid battery car and supports air conditioning.

Secondly, MINI EV uses a pure electric platform, has a large interior space, and has an original design in appearance.The third advantage of MINI EV is inheriting the solid and durable quality reputation of Wuling Motors.

MINI EV is strong in all aspects where traditional elderly scooters are weak.

Due to the fact that the products are in the low-price market, elderly scooters mostly use lead-acid batteries or lithium batteries introduced by small factories, which have poor safety and lifespan. In terms of appearance, elderly scooters mostly copy automobile products and the product quality is even so poor that they break down when bought home.

Another advantage of Hongguang MINI EV that cannot be ignored is the cost control ability of Wuling Motors behind it, which is unparalleled by elderly scooter companies.

At the same time, Hongguang MINI EV is weaker in terms of product strength compared to traditional electric vehicles.

For example, in terms of driving range, MINI EV can only reach up to 170 kilometers, which is obviously lower than the common level of electric vehicles which is over 300 kilometers. Another example, the maximum speed of MINI EV is only 100 km/h. During daily driving, the driving sensation decreases significantly when the vehicle speed is over 80 km/h. In terms of space, MINI EV adopts a two-door four-seat design, which is smaller than the standard four-door five-seat automobile.

The weakest point compared to electric vehicles is that Hongguang MINI EV is not eligible for obtaining the national new energy vehicle subsidy.

However, Hongguang MINI EV actively gave up the national subsidy, and targeted the issues of unrealistic driving range, lack of air conditioning, small space, and poor quality of elderly scooters for improvement. Utilizing the advantages of low purchasing cost, low use cost, and convenient and flexible use of elderly scooters, it has formed a unique product category which is the key to MINI EV’s superior product strength.

Most importantly, Hongguang MINI EV maintains an absolute advantage in price compared to both elderly scooters and electric vehicles while maintaining a strong position in the elderly scooter market and a weak position in the electric vehicle market.

The lowest configuration is only 28,800 yuan, and the highest configuration is only 38,800 yuan, achieving higher quality at the same price compared to elderly scooters and the same quality at a lower price compared to electric vehicles.

Innovative Marketing

The hot sales of Hongguang MINI EV cannot be separated from bold marketing methods.

A disregarded phenomenon is that Hongguang MINI EV has never taken the initiative to appear at major auto shows, but it has always been the most attention-grabbing model at major auto shows.

To some extent, Wuling Motors abandons traditional auto marketing methods such as participating in auto shows, hosting roadshow events, sponsoring TV programs, and finding celebrity endorsement.

During the marketing process of Hongguang MINI EV, it is good at creating hot topic events and attentive to the dissemination of short video social platforms. Through events such as the modification competition, MINI EV has received rapid dissemination on short video social platforms such as Douyin.# MINI EV Modification Competition

The modification of cars is a novelty that is only experienced by consumers in first and second-tier cities. In third-tier and below cities, it is still a fresh concept.

Through the MINI EV Modification Competition, the distance between consumers in third-tier and below cities and those in first-tier cities has been shortened, enhancing the brand effect of MINI EV.

Short videos of Hongguang MINI EV are precisely targeted to female consumers through social media platforms.

According to Zhou Jian, the brand and marketing director of SAIC-GM-Wuling Automobile, nearly 60% of Hongguang MINI EV customers are female, and 70% of them are born in the 1985s and later.

After establishing the brand effect of MINI EV, it has been accepted by consumers in third-tier and below cities, thoroughly differentiating it from old-age scooters.

MINI EV’s another marketing strategy is its service.

Purchasing an old-age scooter is usually a one-off deal. After buying a vehicle, the manufacturer no longer provides any services, and even if a failure occurs, the consumer cannot obtain a manufacturer warranty. Hongguang MINI EV, on the other hand, provides automobile-level after-sales services such as on-site rapid repair and 24-hour road rescue, which old-age scooter manufacturers cannot provide.

The cost of services is uncontrollable, but Wuling Automobile is brave enough to introduce the solution to this consumer pain point, proving its boldness in marketing.

Searching for Differentiated Product Strategies

The success of Hongguang MINI EV is a combination of finding the right market, producing excellent products, and innovative marketing, which is not a continuation of the Liuzhou model.

The Liuzhou model was only a special promotion method in the early stage of the development of new energy vehicles. With the increasingly strong development of the new energy vehicle market and the insufficient resources of local governments under the epidemic, the Liuzhou model cannot be replicated again, nor is there any need to do so.

No car manufacturer, no old-age scooter enterprise should expect to replicate the Liuzhou model.

A00 micro-cars’ market share in the electric vehicle market has exceeded 30%. The micro EV market will be the most fiercely competitive niche market in the future.

Currently, we see three types of players in this field: traditional car companies such as Chery, Changan, and Great Wall, which are similar to SAIC-GM-Wuling Automobile.## Third Type: New Players in the Electric Vehicle Market:

LingPao, XINRI, QIDIAN, and new brands still in the rumour stage.

For the constantly-raging storm of A00 pure electric vehicles, our suggestions are:

Firstly, from an optimistic view, Reading cars shout out the call for 6 hundred million nationals in short distance commuting demand which accommodates 20% to be transformed into A00 pure electric vehicles creating a potential user bandwidth of 100 million. Therefore, this market has much potential.

Secondly, if you truly want to produce A00 pure electric vehicles, please do so. Blindly following the trend will not have lasting returns. In the short term, you may lose your competitiveness due to impure intentions or inadequate preparation- simply re-modifying traditional A00 car models into electrically powered ones without promoting new brand images or car types would be better unpursued.

Thirdly, what products can be made? We believe that product definition is a trend that is advancing towards “users + scenarios”. This allows more accuracy and clarification towards target users while this trend is able to capture predictive demand, giving priority to the user than the scenario at hand. This logic applies to the three types of players mentioned above, where they can make use of a particular market gap in the micro-electric vehicle sector.

For traditional automotive companies, produce “small civilians + short distance commuting” car models. The Hong Guang MINI EV represents the “town residents + short distance commuting” car type, but it tends to lean towards low-end markets. Other traditional car companies in the city still have opportunities but price ranges may have to hit at around 40 to 50 thousand. Is there still any room for time-sharing car models? Although the last round of time-sharing leasing exploration generally failed, the trend towards sharing remains.

For upgrading and old-age mobility companies, produce “town + rural residents + segmented short distance commuting” car models. Although Hong Guang MINI EV is very powerful, it is still not able to dominate the city and rural market. If the car model of Hong Guang MINI EV is similar, front product capability and cost challenges may have to be attended to. However, town residents can still be divided into the middle aged to the elderly, small town youth, short trips with family, business trips, tool cars, farming trips, etc. There are still many opportunities.

For new car players, produce “urban high-end people + short distance commuting” car models. Although Ideal cars’ first SEV model failed, the manner in which the car was defined in user + scenario is a classic example.

In summary, after Hong Guang MINI EV, finding a differentiated product market distinct from MINI EV would be more realistic than trying to copy the “Liuzhou Model”.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.