From the current perspective, the electric vehicle market in the United States is about to take off, and there will be a significant increase in volume. However, a recently occurred event has become a thorn in the side, which is that General Motors and Hyundai-Kia in the United States spend $800 million and $900 million respectively to recall LG’s batteries. There are two commonalities:

Both automakers attempted to solve the problems with software updates before resorting to replacing the old batteries.

The recall aims to address historical legacy issues, establish customer confidence, and prepare for future market competition.

Addressing Historical Legacy Issues

This situation with General Motors dates back to November last year when General Motors announced a recall of all 68,000 2017-2019 Bolt EVs. This is because, prior to November 2020, a total of five Bolt EV batteries caught fire, leading to two people inhaling thick smoke and being injured. With the involvement of NHTSA, General Motors discovered that these vehicles may present a fire risk. According to preliminary investigations, all five Bolts use high-voltage batteries produced by LG Chem at its factory in Ochang, South Korea. The commonality among these five vehicles is that they caught fire while fully charged or shortly after being charged.

General Motors’ solution was to instruct vehicle owners to control the maximum state of charge (SOC) of charging to below 90% to reduce the risk of car fires. If they cannot set the SOC to 90%, General Motors recommends that car owners keep their vehicles away from garages. By April 2021, General Motors engineers had supposedly found a way to solve the battery problem and developed diagnostic software to detect battery anomalies and determine if the battery needed replacement.

Unfortunately, this approach was not entirely effective, and two more Bolt EV fires have occurred since May 2021.

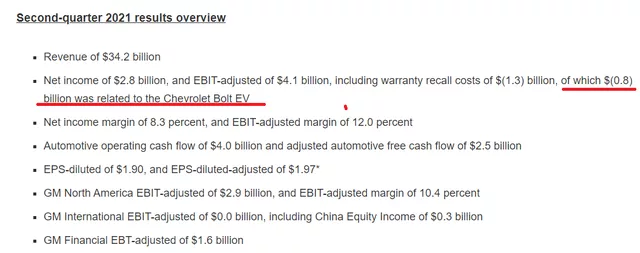

Subsequently, we saw that General Motors was much more resolute in dealing with similar issues: replacing the problematic batteries directly and setting aside $800 million for the recall of 69,000 vehicles.

The process of handling the recall of the Kona EV is similar to that of the recent recall incident, costing a total of $900 million (of which LG is responsible for the majority).

The process of handling the recall of the Kona EV is similar to that of the recent recall incident, costing a total of $900 million (of which LG is responsible for the majority).

Currently, the situation is as follows:

PHEVs prior to SDI have been recalled due to issues (BMW and Ford) and the pack has been replaced in all cases.

All LG projects in both Hyundai and General Motors have been recalled and software handling (limiting the upper limit of SOC usage) will be applied only when necessary; otherwise, all packs will be replaced.

In essence, if the battery cell encounters any issues during user operation, the ultimate result will inevitably be a recall. Software handling can only delay the process, but in the end, according to a rigorous consideration system, a recall is still the only way to go.

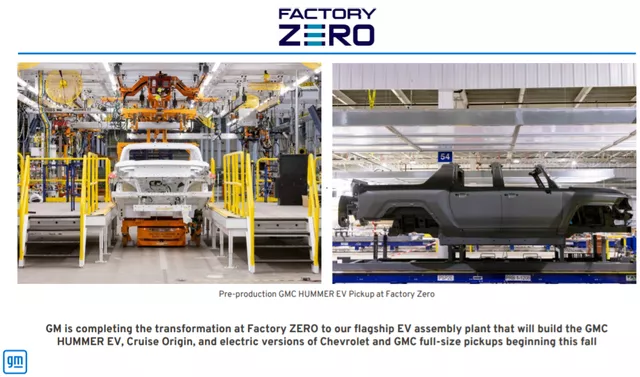

General Motors’ Next Plan

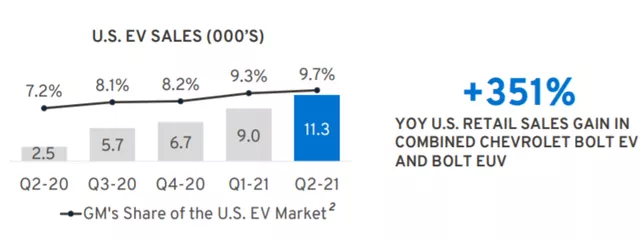

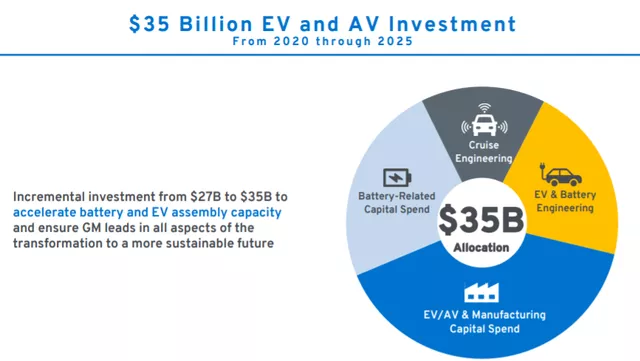

Similar to Hyundai, General Motors has issued a recall in order to handle the previous issues. Starting from 2,500 units per quarter from Q2 2020 for the Bolt EV and Bolt EUV, the number has now risen to 11,300 units by the year 2021. As its next step, General Motors plans to invest $35 billion in the development of electric vehicles.

In terms of battery factories, General Motors is planning to establish a total of four factories, each with a single 30GWh capacity, which may eventually be expanded to 120GWh.

Such a large number of batteries are mainly required for the high demand of pick-up trucks and large SUVs. With a conversion of 100-200kWh, 100,000 200kWh pick-up trucks would consume 20GWh.

In conclusion, I think the issue of the General Motors’ battery recall offers some important clues, such as the need to emphasize strict quality control during the manufacturing of electric vehicle batteries.The ultimate solution to battery problems is still to replace the battery, and this cost is mainly borne by the battery companies. If the number of vehicles in operation increases, replacement and updating will become a significant expense. Finally, if car companies want to further improve penetration and scale up, they must manage battery companies – whether it’s paying for cooperation or paying for other expenses. It’s impossible to talk about future growth if current problems are not solved.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.