In April 2020, Renault Group transferred its 50% stake in Dongfeng Renault to Dongfeng Motor, officially ending its partnership with Dongfeng and leaving only Jinbei from Huachen Renault in the Chinese automotive market for light commercial vehicles, and Jiangling New Energy and Easycare New Energy in the electric vehicle market.

Just when the outside world thought that Renault had become a thing of the past in the Chinese passenger car market, Renault chose to return. On August 9th, French automaker Renault (hereinafter referred to as Renault) and Chinese company Geely Holding Group (hereinafter referred to as Geely) announced the establishment of an innovative partnership, having signed a memorandum of understanding (MoU).

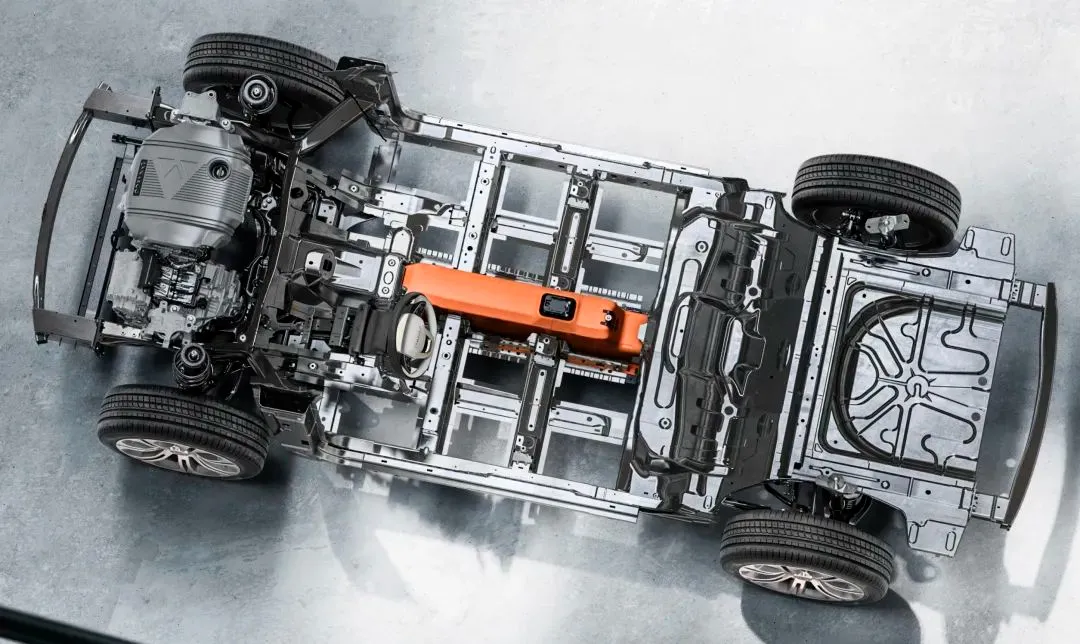

It is understood that the innovative cooperation between Renault and Geely will accelerate the implementation of Renault’s “Renaulution Plan” in China and South Korea. In China, the two parties will jointly develop Renault branded hybrid models based on Geely’s advanced platform technology. In South Korea, the two parties will collaborate on developing models for the South Korean market based on Lynk & Co’s energy-saving platform.

In other words, in the partnership, Geely is responsible for providing platform technology, while Renault’s role is to provide the brand, design, and “fully leverage its advantages in brand strategy, content and channels, ecological services development, and optimized user journeys to create value for consumers”.

At the same time, insiders say that this partnership is Renault’s first step in returning to the Chinese market quickly through innovation, and there are more plans and arrangements to come.

In fact, before partnering with Geely, Renault had been laying out its business in the Chinese automotive market for many years and had collaborated with multiple Chinese car brands, covering passenger cars, commercial vehicles, and electric cars.

Looking back on Renault’s history with the Chinese market, it can be traced back to 1993, when the Chinese automotive market began to rise and mainstream multinational automotive groups started entering the Chinese market. However, unlike most multinational automotive groups, Renault chose to establish Sanjiang Renault with Sanjiang Aerospace as a joint venture to enter the Chinese market with commercial vehicles. Due to choosing the wrong entry point and high costs, Renault’s first entry into China ended in failure.

After learning from its mistakes, Renault started focusing on the Chinese passenger car market. In 2013, Renault and Dongfeng Motor Group established Dongfeng Renault as a joint venture. In 2016, Dongfeng Renault officially launched its first domestically produced model, Koleos. At that time, due to the rapid development of the Chinese auto market, Dongfeng Renault also achieved good results.Due to insufficient product layout and the continuous efforts of competitors, Dongfeng Renault began to decline after delivering 72,000 vehicles in 2017. In 2018, Dongfeng Renault set a target of 90,000 vehicles for annual sales, but only sold 50,000 new cars in the end. In 2019, Dongfeng Renault’s sales continued to decline, with sales of only 17,000 vehicles that year. In the first quarter of 2020, Dongfeng Renault’s sales were only 672 vehicles, less than the daily sales of mainstream joint venture brands such as Nissan, Volkswagen, Toyota, etc.

The industry believes that Dongfeng Renault’s failure is due to the unreasonable number and timing of its new car launches. Specifically, in the seven years from its establishment to dissolution, Renault had only four models in the Chinese market, namely, Koleos, Kadjar, Koleos AIR, and the electric model Renault e-NUO.

Compared with the small number of products, the timing of Dongfeng Renault’s model launches was also quite unreasonable. Publicly available information shows that after launching Kadjar and Koleos AIR in 2016, Dongfeng Renault did not launch Renault e-NUO and Koleos until 2019. These three years of product gap happened to be the period of rapid expansion for mainstream joint venture brands and independent brands.

Due to the lack of new cars, failure to grasp growth opportunities, and weak product competitiveness, Dongfeng Motors Group and Renault Group finally parted ways in April 2020.

In terms of commercial vehicles and new energy vehicles, Renault established Huachen Renault Jinbei with Huachen in 2017, which mainly produces light commercial vehicles. Also in 2017, Renault established EGT New Energy with Dongfeng and Nissan, covering new energy engineering research and development and sales. In 2019, Renault invested 1 billion yuan to hold 50% stake in Jiangling Motors New Energy, focusing on new energy vehicles. And such business layout is also the reason why Renault announced that it will shift its focus to electric vehicles and light commercial vehicles after withdrawing its business from Dongfeng Renault.

Although Renault regards electric vehicles and light commercial vehicles as the focus of its business in China, the market feedback is far from expected. For light commercial vehicles, Huachen Renault’s sales were 43,000 vehicles in 2018, down nearly 30% year-on-year, 40,200 vehicles in 2019, down 6.5% year-on-year, and 23,000 vehicles in 2020, down 42.8% year-on-year.

As for new energy vehicles, the specific production and sales data of Jiangling Motors New Energy, in which Renault invested 1 billion yuan, are difficult to find in public channels. For EGT New Energy, the total production in the past two years exceeded the total sales, with sales of only 6,673 vehicles in 2020.

It is worth mentioning that, despite suffering setbacks, Renault does not want to give up the world’s largest automobile market – China. On January 14th this year, Renault released its Renaulution strategic plan. The plan indicates that the Renault brand will transform towards electrification in the future, with 24 products expected to be launched by 2025, including at least 10 pure electric vehicles. In the Chinese market, Renault will reshape its business model, concentrate on electric vehicles and light commercial vehicles, and make use of its assets in China. The cooperation with Geely Holdings is an attempt by Renault to reshape its business model in China.

In the view of industry professionals, the cooperation with Geely Holdings will accelerate Renault’s localization of models that are more suitable for the Chinese market, save costs and research and development time, and accelerate the implementation of Renault’s “Renaulution Plan”.

However, Renault’s collaboration with Geely on hybrid vehicles is not without variables. Firstly, in terms of electrification transformation, Geely has already encountered obstacles. Although it proposed the “Blue Geely Action 2.0” plan earlier this year, the actual effect remains to be seen. From the current situation, Renault’s layout in the Chinese automobile market’s electrification is not going well either. Whether the two companies, both of which have no successful experience in the new energy automobile market, will perform well in the future is an unknown.

Secondly, currently, China’s hybrid vehicle market is on the eve of an explosion. At least 6 automobile groups have announced their own hybrid systems this year. Among them, BYD’s DM-i hybrid system and Great Wall Motors’ Lemon hybrid DHT have taken the lead. As for Geely’s GHS2.0 hybrid system, whether it can catch up in the intense competition remains to be seen.

In addition, in recent years, Geely Holding Group has frequently expanded its cooperation overseas, or invested in and exported technology to other companies, including Baidu, Foxconn, and FF in the first half of this year alone. In other words, for Geely Holdings, Renault is just one more partner. It is difficult to judge the effect of this non-exclusive partnership on Renault’s business performance.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.