Questionable Choice

Not long ago, the news of Ai Tiecheng joining NIO spread on the internet, which also sparked discussions on NIO’s plans to launch a budget sub-brand. There have been signs that NIO will enter the budget market: in the 2020 financial report conference call, Li Bin said: “We do not rule out the possibility of entering the mass market.” Ai Tiecheng’s appointment as CEO of the brand can be regarded as confirmation of this speculation.

According to the current news, the brand will enter the market at a price range of 150,000 to 250,000 yuan, competing with new and old brands such as XPeng, WM Motor, Volkswagen, and BYD.

Gu Cheng once said: “A thoroughly honest person never faces choices. That road will always appear clearly in front of you, regardless of your aspirations, just like an apple tree that aspires to bear oranges but still honestly bears apples.”

NIO’s invitation to Ai Tiecheng to operate the new budget brand seems like asking an apple tree to bear oranges.

Ai Tiecheng’s resume on the internet is clear. He was previously the General Manager of WeWork China, and before that, he was the Vice President of Market and Management Committee Member of Shanghai Disney Resort. It must be said that both are enterprises that dare to spend money and love to spend money.

WeWork has always been presented with a free and unrestrained image. Co-Founder and CEO Adam Neumann is a typical Silicon Valley entrepreneur who walks barefoot on the street, surfs at the beach when the business is busy, has almost arrogant confidence, and pushes the company to become the darling of the capital market. It is not difficult to guess the style of the brand operated by WeWork. The brand operates shared office spaces with a style close to cafes and even bars. Unlimited supply of various beverages in public areas, fixed or mobile workstations such as well-designed cubicles, glass offices, and long tables, and a large amount of exclusive design for cultural elements in different cities and regions. In later stages, pet companionship and relaxation massage services are even provided.

Shanghai Disney’s high-end consumption emphasis speaks for itself. In the previous criticism of the high price of Beijing Universal Studios on the internet, a very important voice was, “It’s even more expensive than Shanghai Disney”. The latter is already a flagship high-end leisure and amusement park.

It is unnecessary to question Ai Tiecheng’s ability, as a high executive who has had a beautiful career at two such companies. But is he suitable to operate a budget brand from scratch?

Would Rather Give Up Oneself

Choosing Ai Tiecheng is NIO’s decision to follow their inner voice. From the beginning till now, it has always been an upscale brand.In fact, NIO has never had any genes for low-priced products. When we see Tesla flooding into the low-priced market like a huge wave, we often only see the so-called “dimensional reduction strikes” from high to low, but ignore that Tesla is leading the way to a road that matures the industry and reduces costs. To a large extent, Tesla is a low-priced brand from beginning to end, just making different choices at different times for the most favorable market. Meanwhile, NIO’s business philosophy is easy to recall the “Internet thinking” in the past, requiring products and services to not only be good, but also be explosive and make people unable to resist sharing them on social media. Thus, we see “one-click charging”, exclusive WeChat groups for services, and many gifts every year, all regardless of cost, just to provide value-added services that make users go “wow”.

At the same time, based on the company’s judgment on the pure electric industry, NIO has adopted a battery swapping + BaaS (Battery-as-a-Service) vehicle and battery separation model for the slow charging and battery life problems. The battery swapping structure itself will raise the mechanical cost, and the promised more than 3,000 swapping stations nationwide by 2025 will generate huge operating costs. This also means that NIO must be a high-end brand.

Tesla did not need to make any changes in its operating methods when it flooded into the low-priced market from the high-end market. However, when NIO wants to launch a low-priced brand, it has to face the problem of whether those means that once made them famous and the characteristics that symbolized NIO’s clear brand image can be copied from the high-end market to the low-priced market.

Even the easiest task, battery swapping, is difficult for NIO’s new low-priced brand. Will the new brand build a new swapping network or share the same one with NIO in the future? The former has too high a cost, while the latter, although there is no cost problem, raises the question of whether NIO will be dissatisfied when it sees low-end new brand users enjoying the same service while they are waiting in line. (This is a very pre-modern concern, but it is a problem that cannot be avoided in brand operations.)

Mobike-style predicament

So what makes NIO and Li Bin willing to abandon their own unique qualities and go to the low-priced market to fight against the most fierce opponents?

Because the smart electric vehicle racetrack is open.

When Ideanomics released its Q1 financial report this year, many people were surprised to see that it turned from profit to loss in Q4 of last year. The big increase in costs in the financial report is research and development expenses (140 million) and sales and general administrative expenses (about 80 million). The former is a necessary investment in new cars and the process from extended-range to pure electric, while the latter is more worth discussing, mainly the marketing investment in opening stores. Li Xiang, who values efficiency and takes things one step at a time, accelerated the pace of store construction in the first quarter – at the same time, we also began to see Ideanomics’ advertising in various media – which clearly indicates that the market has given enough enthusiastic feedback.In the same period, Xiaomi officially announced its entry into the car-making industry, while the discussion about whether Huawei will do the same reached a fever pitch. Another wave of tech giants joined the fray, causing a second boom in the industry. For companies like NIO and XPeng, their early and difficult but expected growth has made them excited, but it has also led to an unwanted consequence, as more tech giants saw the viable future of the industry and entered the competition.

When a certain industry attracts the attention of these giants, the rules of competition immediately change, shifting the focus from sustainable development and financial health to market share.

In 2016, Mobike, which was first introduced in the cities, enjoyed nearly a year of praise and competitive advantage. Afterwards, OFO, which had previously conducted trial operations on university campuses, joined in, quickly entering the burn-money mode by utilizing capital support to place more vehicles on the market at a rate far exceeding demand, with no limit on funds for subsidies. Facing such unreasonable competition, Mobike had no choice but to follow their lead. This was how the “Mobike Dilemma” came about, more commonly known as the “Prisoner’s Dilemma.”

This type of competition is devoid of any technical content, with only the goal of quickly increasing market share. There are two possible methods: one is to engage in subsidy wars like with shared bicycles and shared travel; the second is to engage in advertising wars like in the C2C second-hand car market, 58 City, and similar advertising activities.

This is why we see Ideal investing more in marketing, with the pre-launch promotion of the XPeng P5 far exceeding that of their previous vehicle models (Google search volume was even close to that of the P7). Even Tesla has accelerated its pace of price reductions and intensity (although there are also controversies regarding being flooded out [by the competition]). Everyone knows that the Chinese EV market is entering a critical period, and the more market share one can grab now, the higher their position in the future will be. Today’s underdog may be tomorrow’s eliminated competitor.

Back then, Mobike was caught up in OFO’s unreasonable competition, and now NIO cannot escape the fierce competition either. For NIO, the first challenge is that their high-end strategy will inevitably result in a smaller market size than that of XPeng, Ideal, Volkswagen ID, BYD Han, and other competitors (although Ideal ONE, which sells for over 300,000 RMB, has features like the extended range mode, which can penetrate the fuel market).

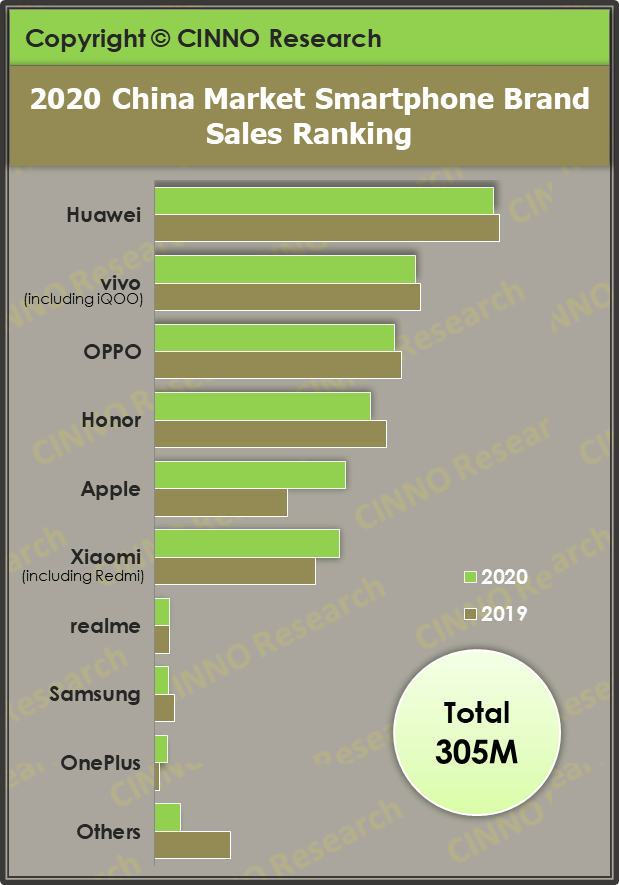

Currently, NIO, XPeng, and Ideal have similar sales volumes, but in the July sales statistics, NIO, positioned as high-end, was surpassed by the latter two. Looking at the long-term development of the EV market, as demand gradually increases, the potential and expansion rate of the high-end market where NIO is located will be much lower than that of the affordable market. Thus, the sales gap between NIO and XPeng, Ideal, and others will only widen over time.Using the example of the domestic smartphone market, according to CINNO Research, in 2020, iPhone (high-end) sold 38.7 million units, which is only 60% of Huawei’s (affordable) sales volume of 68.8 million.

Take the fuel car market as another example. In 2020, the domestic sales champion of the high-end market, Beijing Benz, sold over 610,000 units. The affordable market champion, North and South Volkswagen, had a cumulative sales volume of over 3.5 million, with the former accounting for about one-sixth of the latter.

Originally, Li Bin’s three companies had the same starting point. If NIO’s sales and market share were left behind by the other two, it would naturally create a feeling of being “left behind” in publicity.

Undoubtedly, NIO always says that it wants to become the BBA of the EV market, and its price is also benchmarked against BBA’s fuel cars. But no one can be sure what the EV market will be like in the future, or even whether the BBA level will still be needed then. Moreover, it cannot be ignored that the price of Model Y, which is also a mid-size SUV like ES6, is already 100,000 yuan lower than the former. Assuming that NIO frees up its hands to lower the prices of Model S and X in the future, what will the outcome be?

NIO must do something. Establishing a new brand may be more expensive. Directly reducing the price of the NIO brand may not be the most direct option, but it is at least a possible choice.

In any case, just like Mobike’s meager exit from the stage of history before, NIO has also been caught up in it. We thought that the threshold for making cars is high and there will be no replay of the farce of shared bicycles and shared trips. In fact, in the eyes of capital monsters, there is not much difference in all of this as long as a particular track has formed, they dare to rush in.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.