Author: Dayan

On July 30, the Central Political Bureau held a meeting with the 11-worded slogan “Supporting the Accelerated Development of New Energy Vehicles,” which means that a series of policies for configuring from central to local levels will be introduced in the future. Undoubtedly, the domestic new energy vehicle stocks and the upstream and downstream industries of the industrial chain will greatly benefit. As the leading domestic electric vehicle company, BYD is favored by investors, and the surge in share price is reasonable.

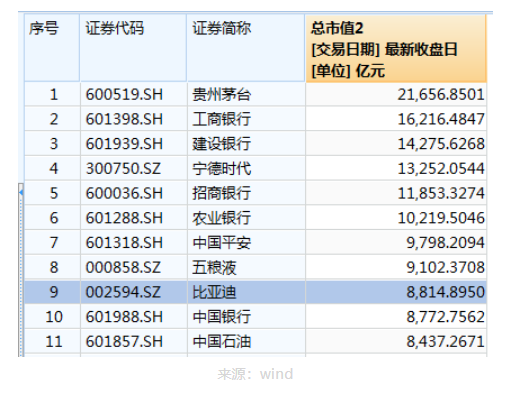

On August 4, with the stock price breaking through 300 yuan, BYD’s closing market value reached 881.5 billion yuan. It not only surpassed our impression of traditional giants China Bank and China Petroleum, ranking ninth in the A-share market value list, but also followed TESLA, Toyota, and Volkswagen, ranking fourth in the world’s major car companies in terms of market capitalization.

Today’s BYD is the gateway to the rise of the stock market, and it is expected to grow into the next TESLA, or is it already at its peak and about to rise and fall?

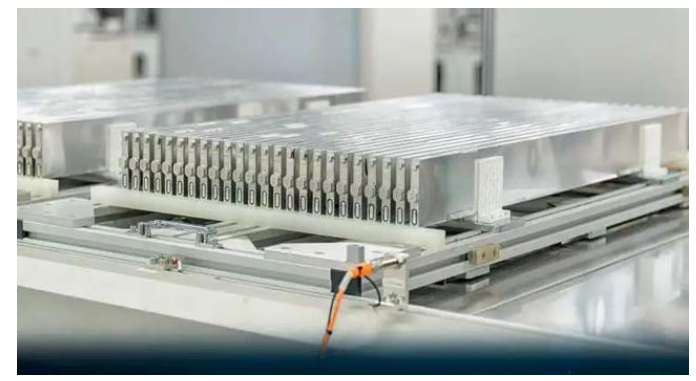

The great achievement of the blade battery

The car’s power battery accounts for about 1/3 of the cost of an electric vehicle and is the most critical component of an electric vehicle.

Just as TESLA’s infinite ear battery is the key to the success or failure of its Model 2, priced at $25,000, the blade battery is the weapon for BYD to fight the domestic electric vehicle market in the future.

Looking at car companies around the world, only a few are able to deeply master the core technology of power batteries.

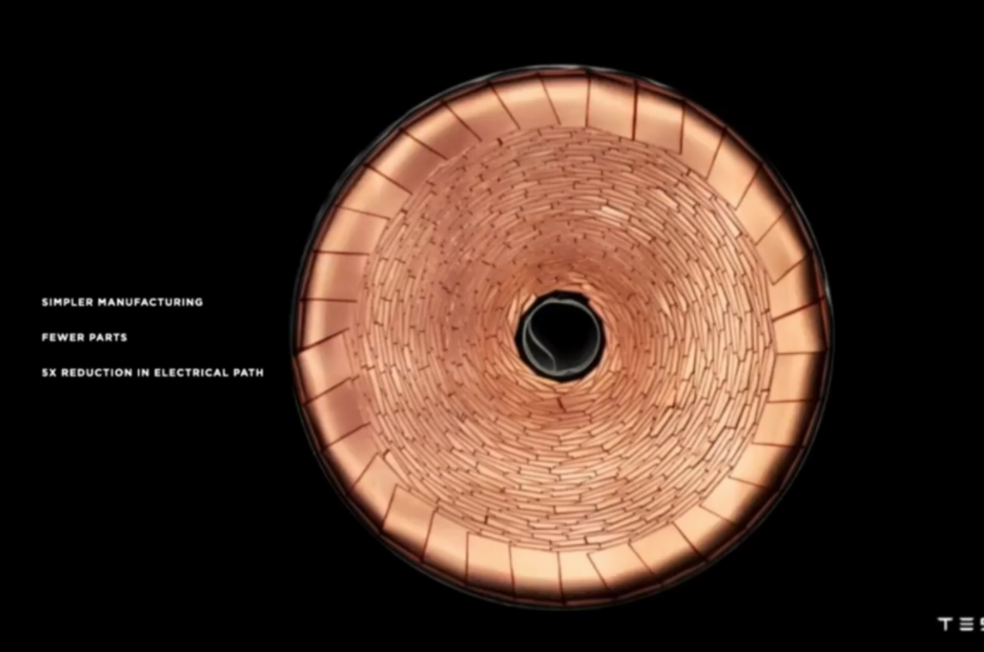

While car companies such as Volkswagen and Daimler seek to guarantee the reliability of their batteries and to deeply master the core technology of batteries worldwide by investing in battery companies or establishing joint ventures with battery suppliers, BYD, which started with a battery, has a leading position in the battery industry like TESLA thanks to its first-mover advantage.

Although many people say that the blade battery is essentially a lithium iron phosphate battery and there is no revolutionary material or technical innovation in the battery, it still allows the energy density of lithium iron phosphate batteries to be greatly improved and is currently one of the battery products that can balance safety and meet people’s needs.

Recently, TESLA successively lowered the prices of its Model Y and Model 3 vehicles in China, because it replaced the more expensive ternary lithium battery with the lithium iron phosphate battery. This has had a relatively large impact on many domestic electric vehicle companies.Additionally, with the recent trend of lithium iron phosphate batteries outselling ternary lithium batteries in China, BYD, which boasts a market cap of over one trillion yuan, has a lot of room for growth in both the vehicle and battery businesses.

What’s the deal with blade batteries catching fire?

Recently, the Chinese automotive media outlet DCDaily performed a crash test on BYD’s Han model featuring a blade battery. At the time, the test didn’t attract much attention. However, two days after being collided, another Han model with a blade battery ignited, causing a lot of concern in the industry.

BYD’s blade batteries are famous for their safety, especially after multiple “needle stabbing” demonstrations were live-streamed with ternary lithium batteries.

Therefore, it comes as a shock that blade batteries still caught fire under such circumstances.

However, the phrasing used in the news reports may have contributed to the misunderstanding. Lithium iron phosphate batteries are indeed safer than ternary lithium batteries, with fewer chances of spontaneous combustion, as this is determined by the chemical properties of the battery materials. However, we still need the manufacturer or relevant institutions to provide specific explanations for why the blade battery caught fire under these circumstances.

From our point of view, finding out the truth behind the incident and discovering any potential safety flaws in BYD’s design and giving the public a detailed explanation is far more scientific and important than just pointing out that “blade batteries caught fire.”

This is a responsibility that falls on both the manufacturer and the media. Often times, what we see with our own eyes may not necessarily be the whole truth. It is precisely due to the high sensitivity of these situations that the government-designated institutions conduct collision tests to seek a more objective and neutral result.

BYD’s strengths outside of blade batteries

In addition to their batteries, BYD has already made a technological breakthrough in the IGBT field, breaking the monopoly held by Infineon. They also have bright spots in the new energy powertrain sector.

Recently, the Ideal ONE has become the reigning champion in new energy vehicle sales for two consecutive months due to its range-extender system. Meanwhile, BYD’s DM-i dual-mode system integrates the advantages of range-extender, traditional plug-in, and gasoline-powered cars, which allows customers to enjoy the policy benefits on green license plates and road rights. Sales figures show that the Qin PLUS and Song DM are perfect examples of this integration.

Of course, BYD’s pure electric vehicle platform also has certain competitiveness.

Previously, Toyota officially announced its partnership with BYD to develop the next-generation pure electric SUV based on the BYD e-platform with Toyota’s logo for the suspension. Skoda also once released a pure electric vehicle model that will also use BYD’s platform when it debuts in China. Setting aside Skoda, which has not announced anything yet, the joint venture between Toyota and BYD for developing the next-generation electric vehicles not only addresses Toyota’s previous mistakes in the electric vehicle strategy resulting in the suspension of the electric vehicle but also recognizes BYD’s R&D strength in electric vehicles and hopes to learn from BYD’s electric vehicle operating experience to quickly enter into the market of electric vehicles and satisfy the double-integral objectives. From this perspective, BYD has a lot of pride to deserve.

Actively cooperate with others to make up for the shortcomings of intelligent cars

However, is BYD’s position as the fourth largest global market capitalization stable? The answer is probably not.

General Motors and Ford with a higher market capitalization than BYD have Cruise and Argo AI under them, respectively, which have already started road testing of L4 level autonomous driving vehicles. BYD does not have many bright spots in autonomous driving technology, especially in higher-level autonomous driving technology, and the progress is relatively flat.

Autonomous driving, as the most shining pearl of intelligent connected vehicle technology, has attracted major automakers and many powerful technology giants worldwide. BYD still has a significant gap with technology giants in software or car networking ecology.

Another thing worth mentioning is that BYD does not have many cases of external cooperation compared to other car makers. Apart from the joint venture company with Toyota mentioned earlier, the joint venture between BYD and Didi Chuxing, Didi D1, which only has a single additional case.

However, Didi is facing significant difficulties nowadays, and even if it can survive the network security review, it is likely to be seriously injured. Even if Didi has no current troubles, BYD’s cooperation with Didi provides more of a whole-vehicle platform, which does not have too direct help for BYD’s own technical improvement in areas including autonomous driving.

Therefore, in order for BYD to make progress in the field of intelligent connected vehicles, while relying on its own technological accumulation, it also needs to go out more and cooperate with other enterprises. Although it may lose its soul if it uses the products of Huawei or other autonomous driving technology companies entirely, it is always better than having an outdated appearance compared to competitor’s models.If BYD can raise enough funds for its self-driving development through a significant increase in market value, it would be the best scenario. If BYD’s focus is on the energy sector, an in-depth collaboration with other leading automakers or technology companies is urgently needed in the field of intelligent connected vehicles.

For electric vehicles, it is the best of times, but also the worst of times.

With the backdrop of carbon peak and neutrality, policy support is increasing, and consumers’ acceptance is growing, BYD has ushered in an excellent opportunity for development.

But from another perspective, the current electric vehicle market can be described as a red ocean market, with fierce competition even exceeding that of the fossil fuel vehicle market. BYD not only faces challenges from new players such as Tesla and WM Motor but also traditional automakers and internet technology giants that have entered the industry. This has heated up the competition for intelligent electric vehicles, not only domestically but also globally.

The topic that concerns investors the most is whether BYD can surpass Volkswagen and Toyota, forming a situation where two dominate competing with Tesla.

Currently, BYD mainly has three business segments: vehicle manufacturing, electronics, and energy storage. Among them, the vehicle manufacturing sector is highly competitive, the profit margin of the electronics segment is low, and there is little room for imagination. Therefore, persistently cultivating the energy storage sector is the key to BYD’s future growth. This sector not only includes the blade batteries with high demand from automakers but also energy storage services with broader business prospects.

As for the intelligent connected vehicle sector, BYD also needs to take a collaborative approach, actively cooperating with other companies with relevant technologies to address its own weaknesses. Only through this, BYD has the hope of making further progress.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.