Author: Sun Xiaoshu

New energy vehicles account for about 20% of the total sales of new vehicles in the automobile industry.

The average power consumption of new pure electric passenger cars has been reduced to 12.0 kilowatt-hours per 100 kilometers.

Convenience of charging and swapping services has been significantly improved.

The “New Energy Vehicle Industry Development Plan (2021-2035)” issued by the General Office of the State Council has set clear goals for China’s new energy vehicle technology and market in 2025.

“The Plan” also proposes that “by 2025, China’s new energy vehicle market competitiveness will be significantly enhanced, and key technologies such as power batteries, drive motors, and vehicle operating systems will achieve major breakthroughs.”

2025 will undoubtedly be a key turning point for the development of electric vehicles. What will the powertrain of pure electric vehicles that have already achieved “major breakthroughs” look like by then?

What Electric Cars Should Look Like

“Fuel cells are fools’ errands – they are incredibly stupid,” said Elon Musk.

“Electric vehicles are being excessively hyped, and both carbon emissions from electricity generation and the costs of transitioning to electric cars are being ignored,” said Akio Toyoda, President of Toyota.

Although Tesla CEO Elon Musk and Toyota President Akio Toyoda are still exchanging verbal jabs over the powertrain itineraries, the global new energy vehicle industry has unequivocally turned towards pure electric vehicles.

Just like the power selection fog that early new energy vehicles faced, electric vehicles have also undergone various explorations in the phase of transitioning from gasoline engines to electric ones. One of the problems is how to arrange the batteries.

In early electric vehicles, power batteries were installed in the trunk, center armrest, and bottom of the chassis, among other places. The power battery of Tesla’s first electric vehicle, the Roadster, was installed in the traditional trunk position.

These strange arrangements indicate that early electric vehicles did not find the “standard answer” for battery layout, and carried obvious traces of transitioning from gasoline to electric, without a dedicated pure electric platform.

It wasn’t until 2012, when Tesla’s Model S flattens the battery on the chassis, that the “standard answer” was finally found by the automobile industry.The obvious advantage of laying the battery flat on the chassis is two-fold. First, it lowers the vehicle’s center of gravity, improving handling. Second, it frees up interior space, which is particularly important.

Looking back at the first products of the new forces in car manufacturing, such as NIO ES8, XPeng G3, WM EX5, Aiways U5, and JMEV ME7, all of them are SUVs. You could say this is due to China’s market preference for SUV models, but beneath this seemingly coincidental surface lies inevitable reality.

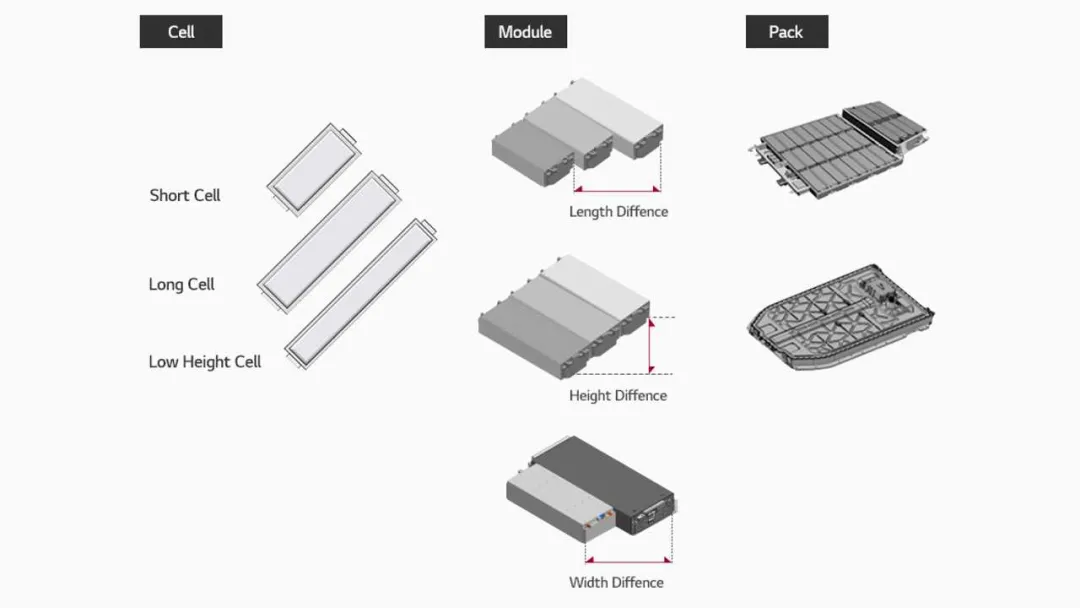

In the early days, power battery specifications were mainly in accordance with the reference dimensions of electric vehicle power battery products specified in the Ministry of Industry and Information Technology’s GB/T 34013-2017, which in turn referred to the Verband Der Automobilindustrie (VDA), the German Association of the Automotive Industry’s standard sizes for automotive power batteries. The height of the battery was “locked” at 140mm in the VDA 355 and MEB 590 standard modules.

However, the problem is that a battery height of 140mm is seriously oversized for sedans with limited space. Therefore, SUVs with relatively spacious interiors became the standard for early electric cars.

Even so, the high platform of the electric car remained one of the early drivers’ biggest complaints, and forcing a lower chassis height would sacrifice off-road capability. BYD e6, with a ground clearance of only 138mm, is the best early representative of the battery layout dilemma.

The first to break this pattern was Tesla. When we look at Tesla’s product lineup, we find that the sedan Model S was introduced earlier than the SUV Model X.

The primary reason Tesla could choose to produce sedans in the early days of electric cars was that it broke free from the restrictions of the German VDA module standard and followed the cylindrical battery inherited from Roadster as its standard, limiting the height of the battery pack to 120mm.

Among the leading new automakers in China, XPeng was the first to introduce a sedan, the XPeng P7.

When XPeng began designing the P7 at the end of 2017, founder He XPeng proposed, “Everyone is doing SUVs, which is already a crowded market. Shouldn’t we take a different approach and make a sedan?” To solve the layout problem of the car’s interior space, XPeng Automobile and its power battery supplier jointly customized the battery pack to a height as low as 110mm.

In addition to optimizing the layout and size of power batteries, “Space Magic” also plays an important role. Tesla uses very thin sports seats throughout the series, which brings some space advantages. In addition, today’s Tesla has been fully equipped with an unopenable panoramic sunroof.

The panoramic sunroof brings three benefits: first, the panoramic sunroof is thinner than traditional car roofs, which can “steal” more space; secondly, the transparent view can give people a sense of openness, alleviating the pressure caused by insufficient space; the last point is not related to the sense of space, but panoramic sunroof can add design and future sense to electric vehicles.

In fact, panoramic sunroofs are becoming standard on electric vehicles. Early Geely Geometry A, BYD Song Max, and recently launched NIO EC6, as well as upcoming Voyah FREE, Chery Xiaomayi, etc., are all equipped with panoramic sunroofs. “Battery size” + “Space Magic” allows electric vehicles to be closer to what cars should look like.

Next Generation Battery Cell Layout

The importance of battery layout, in addition to improving the interior space, also has an impact on range.

As we all know, the current power battery is first composed of cells to form a module, and then the modules are combined to form a battery pack, which is finally fixed to the chassis for installation.

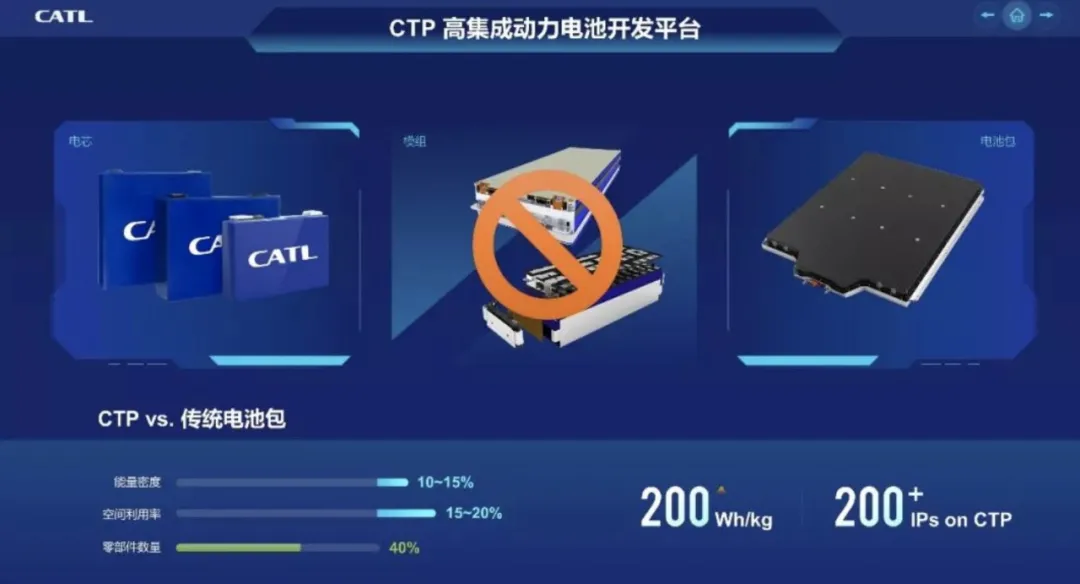

At the 2019 Frankfurt International Auto Show in Germany, CATL released the CTP (Cell To Pack) high-integration power battery development platform. As the name suggests, the biggest technical feature of the CTP platform is that the cells are directly integrated into the battery pack, eliminating the module between the cells and the battery pack.

The direct benefit of CTP is that while improving energy density, it also reduces costs: the utilization rate of battery pack space is increased by 15%-20%, the number of components is reduced by 40%, and production efficiency is improved by 50%.

Another giant of domestic battery supply, BYD, launched its self-developed new generation of lithium iron phosphate batteries-“Blade Battery” on March 29, 2020.The blade battery has a height of 118 mm and a thickness of only 13.5 mm, but a length of up to 435-2200 mm. This allows electric vehicles to bypass module restrictions, integrate more battery cells, and have a longer range.

In terms of data, compared to traditional battery packs, the volumetric utilization ratio of the “blade battery” has increased by more than 50%, which means that ignoring the weight of the battery cells themselves, the range can be increased by more than 50%. This explains why the BYD Han EV, which is equipped with lower energy density lithium iron phosphate batteries, can achieve a range of 600 km in the NEDC.

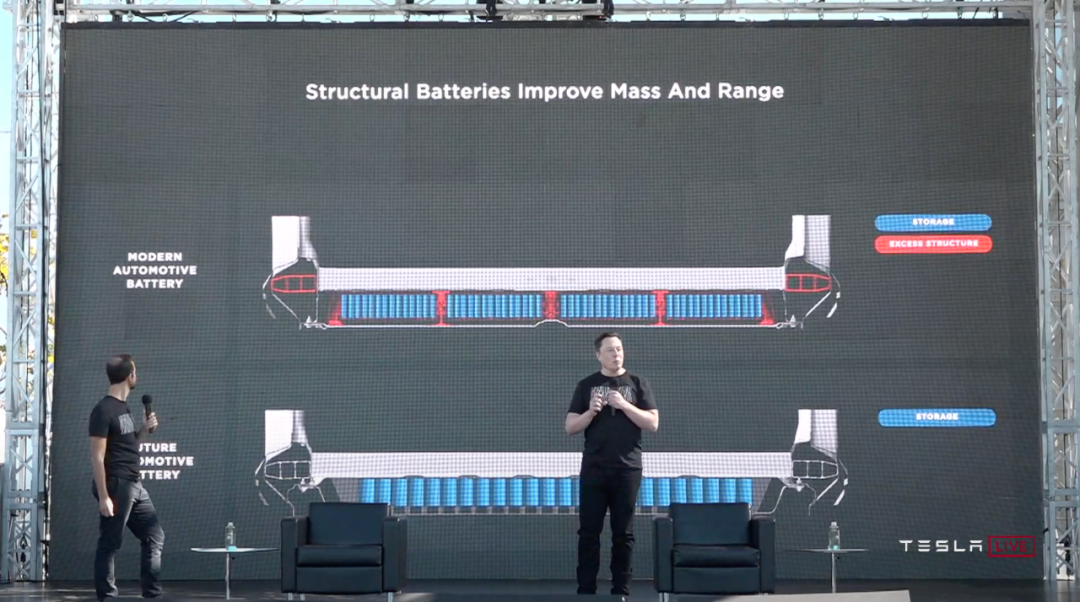

In fact, both CATL’s “CTP” and BYD’s “blade battery” are innovations in the physical level of battery cells, and both aim to eliminate the “module” and improve the integration efficiency of batteries. Their ultimate goal is CTC (Cell to Chassis).

“We are studying a new battery integration technology that can directly install batteries on the chassis of electric vehicles,” said Zeng Yuqun, Chairman of CATL, at the 2020 China Auto Bluebook Forum. By adopting this new technology, the range of electric vehicles may exceed 800 km.

Xiang Yanhuo, President of the Passenger Vehicle Solutions Department of CATL China, revealed that CATL will officially launch CTC battery technology around 2025.

This technology, which directly integrates battery cells onto the chassis, is called “Structural Battery” by Tesla. Elon Musk commented, “The battery is both an energy device and a structural component. This is absolutely the right direction.”

Tesla plans to use the 4860 battery cell with Structural Battery first in the Berlin super factory, and in the two years after proving the reliability of the new technology, it will be used in the Fremont and Shanghai factories.

The recognition of CTC actually also includes the public. Volkswagen announced at the first Power Day in March of this year that it would launch a standard unified cell and evolve from the current CTM to CTP, and eventually to CTC for the form of power battery. In fact, CTC is a technology that abandons battery swapping, much like the integrated design of the battery in the first generation of Apple’s iPhone. The development history of power batteries will inevitably leave a colorful process of integration among the four components: battery cells, modules, battery packs, and chassis.

The recognition of CTC actually also includes the public. Volkswagen announced at the first Power Day in March of this year that it would launch a standard unified cell and evolve from the current CTM to CTP, and eventually to CTC for the form of power battery. In fact, CTC is a technology that abandons battery swapping, much like the integrated design of the battery in the first generation of Apple’s iPhone. The development history of power batteries will inevitably leave a colorful process of integration among the four components: battery cells, modules, battery packs, and chassis.

However, blade batteries, CTP and CTC also pose new challenges to manufacturing processes. High integration inevitably leads to difficulty in maintenance, as a small problem could affect the entire system. “Of course, this requires a re-evaluation of the steel materials used in the shell of the battery cells and the consideration of fixing the cells to the chassis to ensure that the cells can perform the role of structural components,” according to Elon’s statement. Tesla will use a multifunctional glue that takes into account structure and fire resistance to fix the battery cells to the chassis to withstand severe shear forces.

CATL’s response is to propose an intelligent manufacturing strategy, advocate lean management, and use a large number of automated equipment and information systems to increase the automation level to 95%, increase the number of real-time quality control points to more than 3,600, and improve the yield rate to reduce the defect rate.

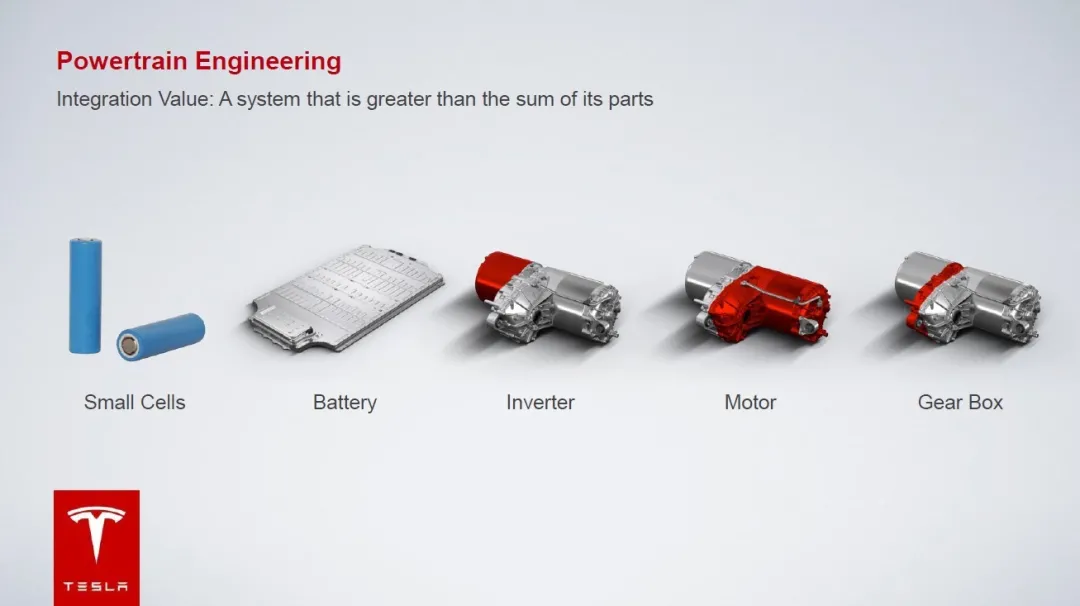

A more integrated and efficient electric powertrain system is the trend of electrification, with high integration and miniaturization of the electric drive, the application and popularization of high-performance new materials such as silicon carbide (SiC), and more reasonable electric control layout.

The most immediate benefit of the miniaturization and integration of electric drive is the release of space in the car. Tesla has always done well in this regard, as evidenced by the user experience that the front trunk of the 250,000-yuan Model 3 can hold a 20-inch carry-on suitcase, which XPeng and NIO are unable to achieve.

Integration of the motor, reducer, and inverter to form an integrated electric drive system is the general trend of electric drive integration. The first “3” in the core “33111” of BYD’s pure electric e-platform represents the integration of the three. Tesla’s early reducer was centrally located, and the motor and inverter were on both sides, which was also a classic layout of the three-in-one electric drive system.

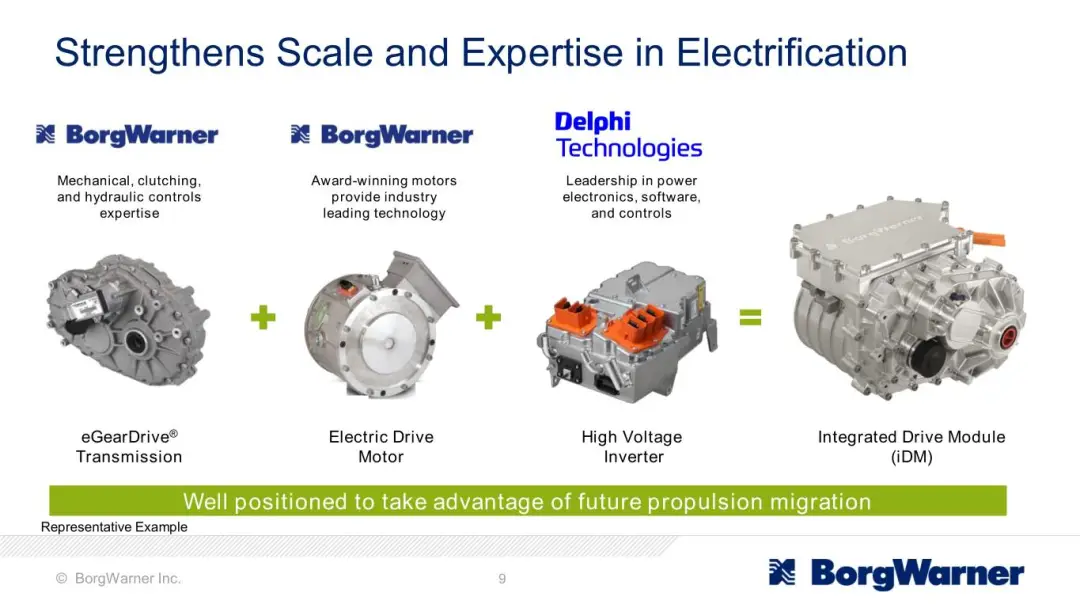

This technology route, initially promoted by OEMs, is also being followed by suppliers such as Bosch, Continental, Magna, and ZF, through independent research and development or through mergers and acquisitions. BorgWarner, for example, acquired Remy International and Sevcon, obtaining research and development and production capabilities for motors and controllers and announcing in June 2020 that it would provide Hyundai with iDM (Integrated Drive Module).

The “three-in-one” layout can simplify the equipment process, improve production efficiency, and reduce manufacturing costs, but highly integrated systems also place higher demands on the thermal management capabilities of the entire system, which may be one of the reasons for replacing water cooling with oil cooling.

Another reason for the prevalence of high-performance thermal management systems may be to meet the cooling needs of sustained high-power scenarios, such as 200kW fast charging or frequent braking and acceleration during long periods of high-speed driving.

In 2016, with the emergence of the Model 3, silicon carbide (SiC) also entered the public eye. Compared to IGBT devices, silicon carbide MOS devices are not only more efficient but also more stable and safe, making them a popular choice in the electric vehicle industry, but their high cost has always been a hindrance to the mass production of silicon carbide.

We cannot help but wonder why Tesla Model 3, BYD Han EV, and Porsche Taycan were the first three electric vehicles to achieve mass production and installation of silicon carbide. How did they solve the cost problem of silicon carbide?

The logic behind Porsche Taycan’s solution to the cost problem of silicon carbide is simple; Porsche’s high brand premium can easily cover the installation cost of silicon carbide.

As a popular brand, BYD’s confidence in mass-producing and installing silicon carbide comes from “independent research and development.” As early as 2017, BYD’s Microelectronics team independently developed two silicon carbide power MOS devices suitable for new energy vehicles: BF930N120SNU (1200V/30A) and BF960N120SNU (1200V/60A), and developed in parallel with 1200V/200A and 1200V/400A all-silicon carbide MOS modules.

Regarding Tesla, it neither has independent R&D to control costs nor does it have a super high premium to cover costs. How can Model 3 offset the cost of silicon carbide? The answer is to spread the fixed costs through mass production.

When Model 3 was first launched in 2017, Elon Musk firmly believed that Model 3 would be a huge success worldwide, and the high cost of silicon carbide could be spread out by the scale effect of the global market. But even if Model 3 sales do reach unprecedented levels, only the long-range version uses silicon carbide in its powertrain. The standard range version mixes silicon carbide with IGBT, and Tesla is still trying to balance costs.

The overall silicon carbide technology is still maturing. Other vehicles like the NIO ET7, Mercedes-Benz EQS, and BMW iX will also gradually adopt silicon carbide components, in a virtuous cycle of scale, technology maturation, and cost reduction.

However, Tesla and BYD will still have an advantage as long as this cutting-edge technology is still under development and iteration, and their position as leaders will continue.

## Conclusion

Looking back on the process of electrifying automobiles, standardization and size reduction of battery layouts, structural innovation of the fixation methods between battery cells and chassis, high integration of electric drives and the application of cutting-edge technologies such as silicon carbide are all important drivers for upgrading and iteration of electric vehicles.

In the foreseeable future, the ultimate form of electric vehicle powertrain will depend on how far we are willing to push the limits in these areas.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.