The sales data for new energy vehicles in Europe for July is not yet complete, mainly due to the lack of data from Germany and the UK. Based on the other five major countries, July returned to the level of April. It is estimated that more comprehensive data will be available around the 5th to 6th of the month. Here are the main observations.

From a month-on-month perspective, after the surge in June, July overall saw a decline, with relatively steep drops in countries like France, Sweden, and Norway. Spain and Italy were relatively stable. It is expected that Germany and the UK will also have a large month-on-month decline in July. Judging from the numbers, the level of July is approximately the same as that of April, which means that the data for Q3 is highly likely to be similar to that of Q2, and there will not be a significant year-on-year increase.

Analysis of Published Sales Data

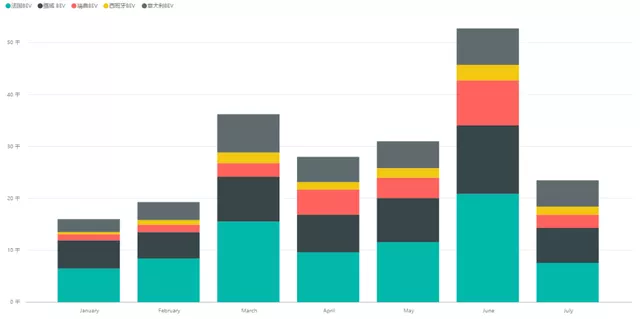

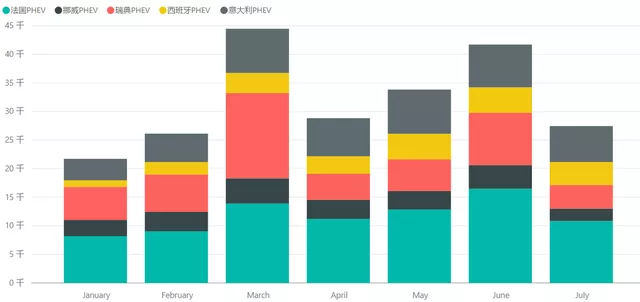

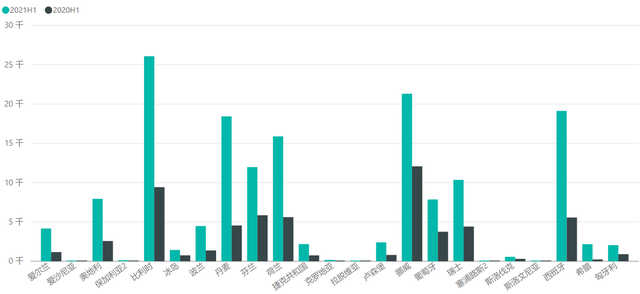

This time, I differentiated between pure electric and plug-in hybrid data, as shown in the figure below. Overall, pure electric vehicles saw a greater decline in July than hybrid ones.

In Norway, 6,731 battery electric vehicles (BEVs) were sold, down 48.95% from the previous month, while 2,166 plug-in hybrid electric vehicles (PHEVs) were sold, down 46.67% from the previous month. Norway has been relatively stable for many years.

In Sweden, BEV sales fell by 70.82% to 2,535 units, while PHEV sales fell by 54.86% to 4,126 units, due to two key factors. One was the bias in subsidies between PHEVs and BEVs that appeared on April 1, and the other was an adjustment in the tax rate for company vehicles, leading to a surge in new energy vehicles registered by companies (B2B) in June, with 74% of new energy vehicles being registered in this way. The corresponding share in July was 47%, so the decline is normal, and it is difficult to exceed this peak in September of Q3 as expected.

In France, BEV sales fell by 63.69% to 7,576 units, and PHEV sales fell by 34.27% to 10,834 units. The new energy subsidy in France has been reduced by €1,000, and there is a shortage of chips for pure electric vehicles like the ZOE, so the 7,576 units of BEV are still relatively low.

In Italy, BEV sales fell by 27.77% to 5,073 units, while PHEV sales fell by 15.86% to 6,287 units, making Italy the country with the least impact.

In Spain, BEV sales fell by 47.52% to 1,557 units, while PHEV sales fell by 9.79% to 4,034 units. Due to the relatively small base, the impact was not significant overall.

Half of the European sales are PHEVs, which are still relatively strong in supply, resulting in less withdrawal in July.

A follow-up supplement can be written when data from Germany and the UK become available. Next, let’s take a look at the overall situation in Europe in the first half of the year. I have also done some visualizations based on AECA data.

An overview of new energy situation in Europe in the first half of the year

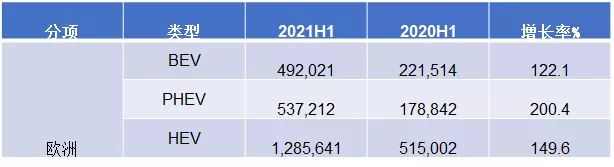

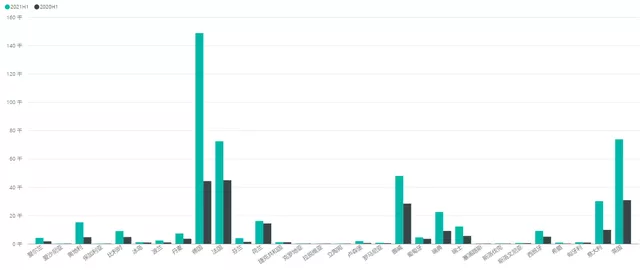

As shown in the following graph, new energy vehicle sales in Europe in the first half of the year reached a high point. In the first half of the year, pure electric vehicles sold 492,000 units, a year-on-year increase of 122.1%; PHEV plug-in hybrid vehicles sold 537,200 units, a year-on-year increase of 200.4%; and hybrid vehicles also increased by 149.6% to reach 1.285 million units.

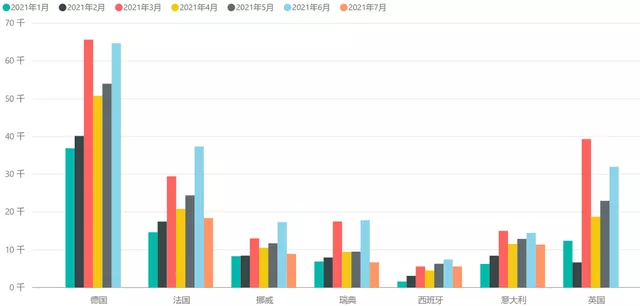

If the pure electric vehicle data in the European region is pulled out, it can be seen that the highest sales are mainly in Germany, France, the UK, Norway, Sweden, and Italy.

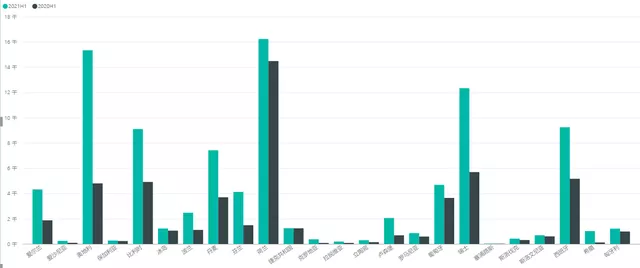

If we exclude these high-sales countries, we can see that the previously less noticeable markets in Austria and Switzerland are catching up with the already-saturated Dutch market, and Belgium and Denmark are also slowly rising, while the pure electric market in Spain still needs time to develop.

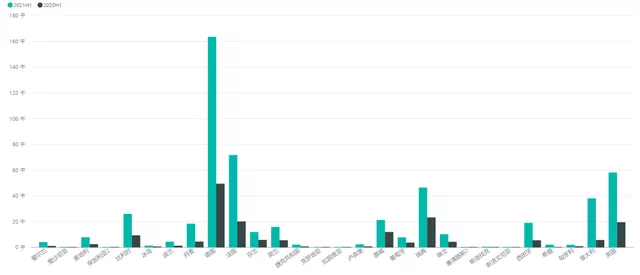

PHEVs performed better than BEVs overall in the first half of 2021, with significant growth in many countries. It is estimated that the transformation in Europe will also take some time for PHEVs. The leading markets mainly include Germany, France, the UK, Sweden, and Italy.

After removing these major markets, we can see that there is a significant increase in plug-in hybrid electric vehicles (PHEV) in small markets. I estimate that PHEVs will have a broader coverage in Europe this year.

After removing these major markets, we can see that there is a significant increase in plug-in hybrid electric vehicles (PHEV) in small markets. I estimate that PHEVs will have a broader coverage in Europe this year.

In conclusion, regarding the decline in July, I don’t think we need to be overly pessimistic as the global market was weak in July. However, the unexpected wave of deliveries from new Chinese players in July was remarkable. Europe may not have a particularly good July-August period, and we’ll have to wait until Q3 September to draw some meaningful data for reference.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.