This article is reproduced from the Autocarweekly WeChat official account.

Author: Finance Street Lao Li

In the past two years, both the industry and capital have been interested in studying Tesla’s pricing, and their research is almost always accurate.

Before writing this article, Lao Li has been thinking about how to bring some valuable information to everyone. After thinking for a while, he came up with two ways. One is to discuss views on price cuts from a macro perspective, and the other is to share with everyone the Tesla supply chain and pricing from a micro perspective.

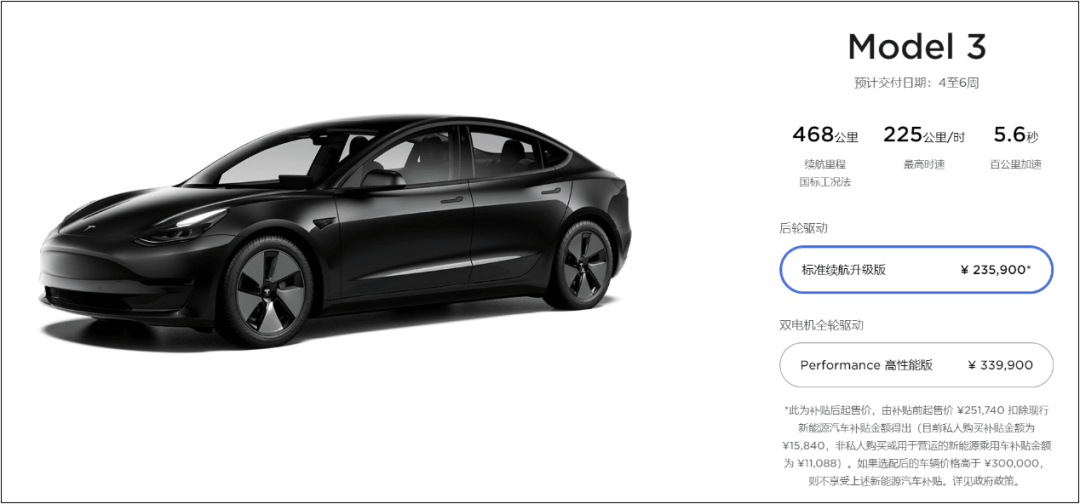

On July 8th, Tesla officially released the Model Y Standard Range version, priced at 276,000 yuan, which was reduced by about 70,000 yuan in one go. On July 30th, Tesla again lowered the price of the Model 3 Standard Range Plus by 15,000 yuan. After the subsidy, the price of the car was reduced to 235,900 yuan. Many friends wondered if Tesla would lower the price to less than 200,000 yuan.

Today, Lao Li and everyone will talk about why Tesla can always lower their prices. What is the cost of the Model 3 and Model Y? How much can it decrease in the future?

Price cuts are not just slogans, but real actions

At the end of last year, many researchers have been dismantling Tesla’s costs, and some benchmarking teams and marketing teams of other car manufacturers have also studied Tesla’s pricing. Lao Li has also had exchanges with many experts. Everyone believed that by the end of 2021 or early 2022, it is likely that Model 3 will be priced below 220,000 yuan and Model Y will be priced below 250,000 yuan. Just half a year later, Tesla’s two official price cuts seemed to have strengthened everyone’s confidence in their predictions.

Car companies have a fixed financial model, which is similar among different companies. The rule of the model is that as sales increase and suppliers are updated, the unit cost will become lower and lower, and the unit profit will become higher and higher. Every car company is working hard to reduce costs. For example, during the launch of a new car or when upgrading, they will use various methods (such as changing suppliers, reducing configurations, etc.) to reduce costs. Lao Li has been responsible for cost reduction of car models in the past, with a reduction range of up to 5% or even 10%. And excellent companies will reduce three major expenses, which will make the unit profit higher and higher.

Car companies work hard to reduce costs, but rarely reduce prices. For so many years, we have hardly seen a car company officially reducing their guidance price, at most, giving some end-terminal discounts to dealers. It is indeed a fact that the automotive industry has made “huge profits” in the past, but the emergence of Tesla has changed the industry’s rules.

Although many friends believe that Tesla “harvests retail investors” or had a bad impact at the Shanghai Auto Show, in terms of the issue itself, Lao Li has a positive attitude towards Tesla’s official price cuts. Whether Tesla is striving for more sales through price cuts or for strategic expansion, the official price cuts are giving real benefits to users.Recently, Mr. Li mentioned in his article “Capital still prefers Tesla” that Tesla’s positioning issue in the “7-layer pyramid” positioning model. Tesla’s ultimate goal is to become a high-volume enterprise like Toyota and Volkswagen. Three years ago, there were disagreements about this, but now the industry and capital have formed a consensus on this. If Tesla wants to make high-volume products, it must have an economical price.

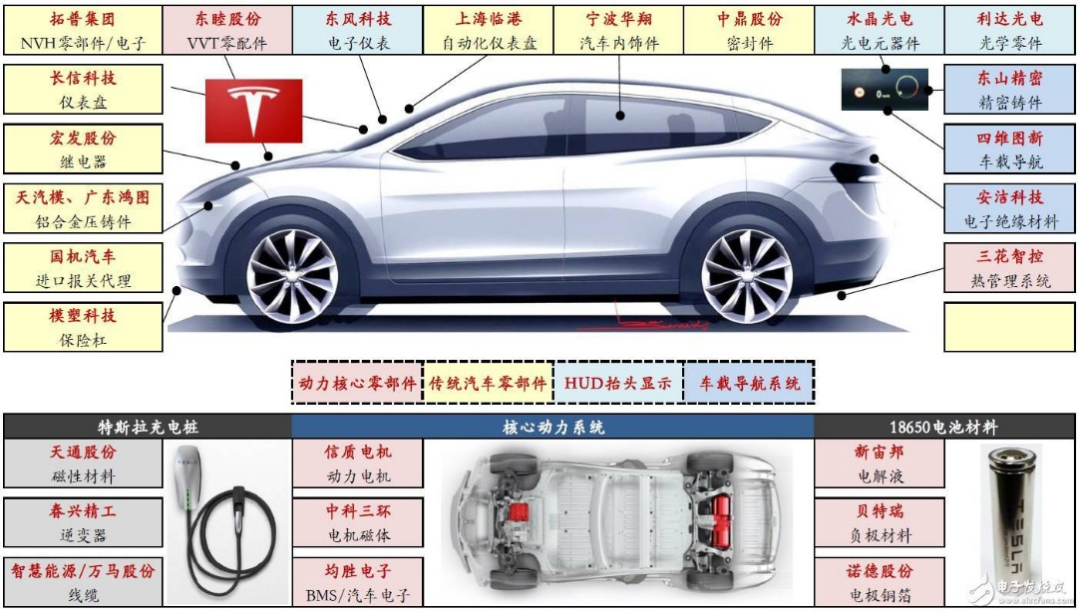

Mr. Li once interviewed an expert responsible for Tesla’s Chinese supply chain, who developed a batch of Tesla industry chain companies such as New Spring Shares and Sanhua Intelligent Control. The expert described Tesla’s cost-cutting strategy as: “Wherever the cost is high, cut it. If it can’t be cut, replace it. If it can’t be replaced, do it yourself.” The first time Mr. Li heard this strategy, he found it very novel. Now he gradually understands that from the perspective of the bicycle BOM (bill of materials), Tesla has chosen the Chinese supply system to the greatest extent possible in the process of localization, and many suppliers are not well-known, which greatly reduces the cost. On the other hand, the Tesla industry chain, which was once hot in the capital market, was pulled up so crudely.

After reaching a lower limit of the BOM, Tesla began to focus on production capacity and price. Because Tesla has been reducing prices, terminal demand has been constantly released, and Tesla’s production volume is its sales volume. Even if the Shanghai Auto Show caused a stir, the sales volume was affected for only a month, and it quickly went up after June. By comparison, the sales volume of new energy vehicles from emerging automakers is difficult to reach 10,000 units, not because of supply chain reasons, but because of insufficient terminal demand.

In the process of researching Tesla, many researchers have found the “production capacity-price” law. Every time Tesla reduces the price, it creates a new demand and releases production capacity. When the production capacity is released to a certain extent, the price will be reduced again to create another batch of demand and release another wave of production capacity. This year, Tesla’s production target in China is expected to be around 400,000-450,000, of which Model 3 is 250,000 units and Model Y is 150,000-200,000 units. However, Tesla’s maximum production capacity in China is 500,000 units/year. The Shanghai factory must achieve 100% capacity utilization, and Tesla still needs to reduce prices.

What is the cost of Model 3 and Model Y?

Many friends have also noticed that Tesla’s price reduction follows a pattern.# Tesla’s Model 3 and Model Y Cost Analysis

Model 3 had a “surprise giveaway for every festival,” on May 31, 2019, the first domestic Model 3 Standard Range Plus was released with an initial price of 328,000 yuan. Through subsidies, downgrades and other means, the entry-level price dropped all the way to 235,900 yuan. Model Y dropped from a pre-sale price of 488,000 yuan to a formal sale price of 339,900 yuan, down by 148,100 yuan. This time, the price dropped to 276,000 yuan, down by 63,900 yuan. Prices for the Model Y may be adjusted every 3 to 6 months.

To discuss how much Tesla can reduce costs, the cost of the single car needs to be determined first. The cost of Tesla’s bill of materials (BOM) has always been the most concerned issue for everyone. To be frank, except for Tesla headquarters, no one knows the full BOM price of Tesla Model 3 and Model Y now. Generally, there are two ways people research their costs: capital’s friends basically do cross-checking interviews with internal experts or supply chain experts, but the problem with this method is that it’s hard to get the full BOM; industry friends generally do benchmarking through teardowns, finding supplier quotes to determine the price, but the problem with this method is that suppliers wouldn’t provide the same quote to another OEM as they would for Tesla.

The most ideal research method combines the two, but it’s not necessary. From the research point of view, what we need is not the exact price, but just the range.

In the past two years, the industry has conducted a lot of disassemblies on the Model 3. Starting this year, there have been many disassemblies on the Model Y too. The research team that Li (老李) belongs to has also done relevant estimations and the results are shared below:

-

The entry-level version of Model 3 (235,900 yuan version) has a BOM cost of 150,000 to 160,000 yuan according to a certain carmaker’s benchmarking team, while Li’s team’s judgement is 170,000 to 180,000 yuan.

-

The entry-level version of Model Y (276,000 yuan version) has a BOM cost of 190,000 to 200,000 yuan according to a certain carmaker’s benchmarking team, while Li’s team’s judgement is 220,000 to 230,000 yuan.

Many friends may ask, how can Tesla’s cost be so low? Actually, the answer is not difficult to find. Nearly 80% of the parts for the Model 3 are domestically produced, except for the intelligent networking system and a few key components. The parts for the Model 3 are similar to those of 100,000 to 150,000 yuan model car suppliers on the market, except for the intelligent networking system and a few key components.“`

Roughly 40% of the parts in Model Y are fully reused from Model 3, and 35% of the parts are adjusted based on the specifications of Model 3, but the supplier base is basically the same. Core suppliers include:

- CATL (60,000 yuan/vehicle, power battery)

- Top Gestamp (8,000 yuan/vehicle, front and rear sub-frame, carpet, thermal management system, etc.)

- Sanhua Intelligent Control (1,500 yuan/vehicle, thermal management valve body, etc.)

- Oukejia (2,000 yuan/vehicle, heat pump air conditioning system)

- Huayu Automotive (9,000 yuan/vehicle, interior, battery tray)

- Lingyun Stock (5,000 yuan/vehicle, body structural parts, pipelines, etc.)

- Xinquan Stock (2,500 yuan/vehicle, interior parts)

- Xusheng Stock (2,500 yuan/vehicle, structural parts)

Careful readers will find that these companies are among the most rapidly rising within the Tesla supply chain in the past two years. Li believes that this is the value of industry research – industry research itself will not create productivity, create value, but it can discover where the value lies.

Tesla’s parts level is almost at two extremes compared with luxury brands and new forces such as NIO: Tesla belongs to the maximum cost reduction, and domestic suppliers are pressed very low. It will try to make the unlocalized parts independently, such as chassis electronics, sensors, power devices, high-voltage electrical parts, etc.

The principle of traditional luxury brands and NIO is to use expensive parts. Li once consulted NIO’s classmate. With almost zero accumulation in the chassis, how can NIO ensure the durability and reliability of the chassis? The answer given by the classmate is that all suppliers use expensive parts. Some researchers in the team have done some interviews. It is true that NIO’s BOM cost is the highest among new forces, without exception.

From the perspective of product development, high cost does not necessarily mean good. Many domestic independent brands also have very sincere materials stacking, but in terms of design level and user experience, they may not be as good as low-end Toyota and Volkswagen.

How much more can Tesla reduce the cost?

By now, you should understand that the reason why Tesla can endlessly reduce prices is mainly due to the low BOM cost. If the gross margin is set at a low level, Model 3 may be priced at less than 200,000 yuan.

“`Generally, there are two pricing reference methods for car companies. The first one is the reference pricing method based on competitor’s market price. In other words, car companies will refer to their competitors to set their own pricing, such as BBA. A former colleague of Mr. Li worked at Audi and their pricing principle was very simple: reference the same-level competitors of BMW and Mercedes-Benz, and set the price slightly lower. The second one is the financial analysis method, which is commonly used by the financial department. Based on the BOM cost, various expenses such as research and development, manufacturing, sales, and profits are added to obtain a cost price. With the increase in sales volume, various expenses will be diluted, and unit profit will increase.

Taking the second method as an example, we will reverse engineer the pricing structure of the entry-level Model 3. This is also a common financial calculation formula used by many researchers. The result may not be accurate, but it can be used as a reference:

- Unit pricing = (BOM cost + direct labor cost + amortized R&D cost + other costs) * (1 + gross margin)

The midpoint of the BOM cost of the entry-level Model 3 predicted by car companies and research institutions is about RMB 165,000. The sum of direct labor costs, R&D costs and other costs predicted by Mr. Li’s team at a production capacity of 500,000 units (Model 3 + Model Y) is about RMB 20,000. With a gross margin of 20%, the starting price of Model 3 is RMB 222,000.

Model Y can also be priced using this method, and the result is about RMB 275,000. However, many researchers prefer to use the first method to reverse engineer the price of Model Y. The reason is that in the second method, the data for Model Y’s various costs are not as credible as that of Model 3, and the initial value error is large, which will also cause the result to be less accurate.

Since Model 3’s pricing and Model Y’s pricing have a synergistic relationship, many people like to use Model 3’s pricing as a benchmark to predict Model Y’s pricing.

In Tesla’s past pricing system, Model Y, defined as an SUV, is 5-10% more expensive than the sedan Model 3. Among them, the overseas price difference between Model 3 and Model Y is only 6%-9%, while in China, it is about 10%. The price difference for domestic models will also shrink in the future. Using 10% as a reference standard, the starting price of Model Y in China is RMB 244,200.This is where Tesla shines. Generally speaking, SUVs are priced 20%-30% higher than sedans at the same level for gasoline-powered vehicles of the same level. But Tesla has broken this pattern because the Model Y is based on the Model 3 design, rather than being a completely new model developed from scratch. However, this does not affect sales. At present, the market competitiveness of pure electric SUVs is higher than that of pure electric sedans. As long as production allows, the sales of Model Y are easily expected to exceed those of Model 3.

Speaking of the lowest price, the question arises: when will Tesla lower the price to this level? Many analysts predict it will happen at the end of this year or early next year, based on the “production capacity-price” rule: generally, Tesla adjusts its prices every 3-6 months, as well as its production capacity. Earlier this year, demand for the Model Y had already been partially released. After this price adjustment, the price of the entry-level Model 3 dropped to 235,900 yuan, and the entry-level Model Y dropped to 276,000 yuan, which will bring a new wave of demand. The production capacity brought by this wave of demand will most likely be released by the end of this year. If the market demand in Q4 exceeds that of previous years, production capacity will most likely be released in early next year as well.

Following this pace, if Tesla fully maximizes its production capacity, the Model 3 is likely to be adjusted to around 220,000 yuan by the end of this year or early next year, while the Model Y may be adjusted to around 240,000-250,000 yuan.

Some friends asked if Tesla could adjust the entry-level price of the Model 3 to below 200,000 yuan. Personally, I hold a pessimistic attitude towards this. There are two reasons: firstly, the cost and profit margin of the Model 3 are currently very low, and it is difficult to lower the price to below 200,000 yuan without changing the supply chain. Secondly, Tesla is developing derived models of the Model 3 and Model Y (not the rumored Model 2) with a pre-sale price below 200,000 yuan, and it needs to reserve price space for these derived models.

Many people asked if it is worth buying a Tesla after the price drop. My response is definitely yes, and I recommend buying early, rather than letting the so-called “official price reduction” affect your emotions. Buying early may not necessarily result in a loss, as the auto industry is always “you get what you pay for”.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.