Author: Li Xu

On August 2nd, the 2021 Fortune Global 500 rankings were announced.

As with last year, there are still 6 Chinese car companies on the Global 500 list this year: SAIC, FAW, Dongfeng, BAIC, GAC, and Geely. Among these 6 companies, except for SAIC dropping 8 places, the other 5 have all moved up in the rankings. GAC moved up the most with 30 places to 176th, making it the fastest-rising automaker in the world this year.

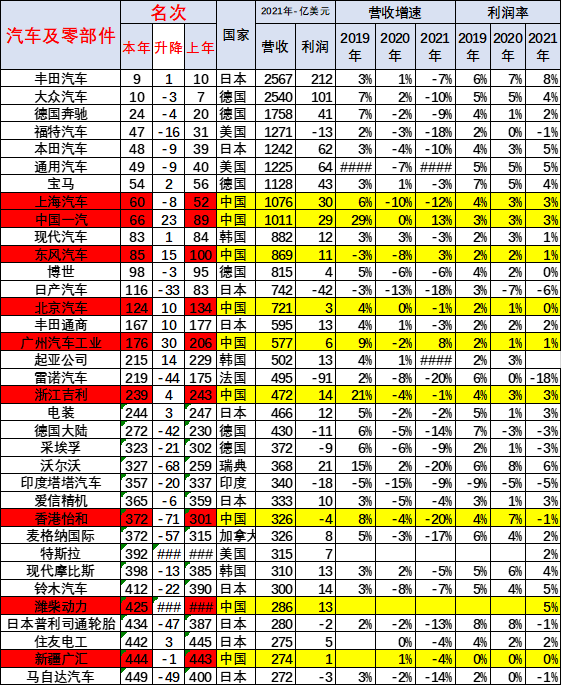

Global 500 Auto Industry Company List

Note: Red represents Chinese companies.

Source of information: Cui Dongshu, Secretary General of the China Passenger Car Association

Looking at the position of the entire automotive industry on the ranking list, decline is a common phenomenon. In the top ten, only Toyota, BMW, FAW and Hyundai moved up, and the ranking increased by only 1 place, 2 places, and 1 place respectively. The impact of the epidemic is evident.

However, it may not necessarily mean much to talk about who is on the list and how their rankings have changed. After all, Fortune Global 500 is called “Global 500”, but this is actually the “Big 500”, and the only standard for ranking is revenue. It can prove the present, and it can only prove the present.

Toyota: How much investment is there in transformation with so much profit?

Toyota surpassed Volkswagen to take the first place in the automotive industry this year.

However, due to the impact of the epidemic, Toyota’s revenue also declined by 7 percentage points in 2020, which is within a reasonable range, while its profit reached a staggering 21.2 billion US dollars, more than twice the second-ranked Volkswagen. If the range is expanded to the entire Japanese automakers, among all automakers whose profit margin reaches 5%, Japanese automakers have occupied three seats (Toyota, Honda, and Suzuki). In this respect, Japanese car companies are definitely the paradigm of the global automotive industry.

However, as we all know, the automotive industry is currently undergoing a period of transformation. There is no car company with ambition that does not increase investment to shift towards electrification and intelligence, even at the expense of financial performance. In this environment, the good financial performance of Toyota and other Japanese car companies represented may seem out of sync.

Using Toyota as an example, its revenue declined by 7% in the past year, while its profit margin increased by 1 percentage point to 8% compared to the previous year, and the financial report showed that the net profit for the 2020 fiscal year (April 2020-March 2021) even achieved an increase of more than 10%. Although its market and operational conditions are worthy of praise, it also makes people think: Is Toyota investing too little in the transformation of new energy and intelligence?According to the “2020 Global Major Automotive Group R&D Investment Trends and Enlightenment” report by the Korea Automobile Industry Association, from the perspective of R&D investment, the top 5 ranked auto companies in the Fortune 500 list, Toyota, Volkswagen, Mercedes-Benz (Daimler), Ford, and Honda, have invested 8.62 billion euros, 13.885 billion euros, 8.614 billion euros, 6.324 billion euros, and 6.167 billion euros in R&D, respectively.

Compared to Toyota’s net profit of over 21.2 billion US dollars, which is more than twice that of Volkswagen, Toyota’s level of R&D investment appears to be too conservative.

This is also directly reflected in Toyota’s slow transformation process. Currently, Toyota Group, including Lexus, only has three EV models on sale (C-HR EV, Yize E-drive, and UX new energy). As for the e-TNGA pure electric platform that was finally released at the end of last year, it looks like an oil-to-electric version of the TNGA architecture from its naming method. The first model of this platform, the BZ4X (BZ may be a brand new pure electronic brand), has already been called an oil-to-electric version of the RAV4 by many.

Even if Toyota calls it the real future hydrogen fuel cell car, after nearly 30 years of technology development since 1992, only one Mirai has been developed, which cannot show their enthusiasm for the future.

In contrast, Volkswagen, BMW, and Ford, which are also at the forefront of the Fortune 500 list and have a more determined electrification transformation, have already had mass-produced products in electrification, intelligence, and sharing, although their profit margins are far from Toyota’s.

Tesla becomes a new force

Compared with traditional automakers in the list, Tesla, which debuted on the list for the first time, obviously represents the rise of emerging forces.

After ultra-high-speed construction and rapid expansion of the Shanghai factory, Tesla finally became a member of the Fortune 500 in 2021, with a revenue of 31.5 billion US dollars in the 2020 fiscal year, ranking 392nd. 2020 was the 14th year of Tesla’s establishment. It is indisputably the leader in the global pure electric vehicle field, with an annual revenue of 31.5 billion US dollars…

Even with such achievements, Tesla only achieved full-year profitability for the first time in 2020, with a profit of only 721 million US dollars and a profit margin of only 2%. Moreover, Tesla’s profit did not come from selling cars. Its revenue from selling carbon emission credits was 1.58 billion US dollars last year. In other words, if it were not for this part of the revenue, Tesla would still be in the red.

Is Tesla’s efficiency too low?## Efficiency fanatic Musk will definitely not agree

The important reason is that Tesla still invests a lot of funds in research and development to maintain its leading position in intelligent, electric, and energy fields.

Similarly, according to the report “2020 R&D Investment Trends and Revelation of Major Automotive Groups Around the World”, only Tesla’s R&D investment increased by 11% from the previous year in 2020. The rest decreased. Toyota reduced by 1.8%; Volkswagen reduced by 2.9%, Daimler even reduced by 10.6%, and Ford, BMW, and Honda reduced by 4.1%, 2.2%, and 5.0% respectively.

Like Tesla, Chinese new car forces such as WM Motor are also investing heavily in research and development. In 2020, the amount of WM Motor’s R&D investment was only 2.487 billion yuan, 1.725 billion yuan, and 1.099 billion yuan respectively. But the R&D to revenue ratios reached 15.3%, 29.5%, and 11.60% respectively.

Currently, globally, if Tesla is leading the way in intelligent electric vehicles, then the followers following closely behind are WM Motors. The reason why WM Motors is able to be in this position is closely related to their R&D investment.

The picture shows that XPeng Motors will invest approximately 45% of the funds raised from its Hong Kong listing in enriching its product portfolio and developing new technologies.

No need to celebrate for Chinese automakers on the list

Looking back at the Chinese automakers on this year’s list, based on the list alone, their performance in the past year has been outstanding, with only Dongfeng and BAIC’s profit margins falling, and SAIC, FAW, and Geely’s profit margins all reaching an acceptable 3%.

Moreover, they have all made postures towards the transformation to pure electric and intelligent vehicles (SAIC has launched two new brands, IM and R, and Dongfeng has LanTu. BAIC has JiHu, GAC has AiAn, and Geely has Geometry and JiKe). At first glance, it seems that they have a bright future.

However, this prosperity may not withstand careful observation. SAIC’s two new brands are progressing slowly and have a confusing positioning. JiHu and LanTu have become the only bright spots for BAIC and Dongfeng. AiAn’s sales are mainly supported by the B-side market. Geely’s “Blue Action Plan” had to be launched for the second season due to its failure. FAW has not taken substantive action yet.

If we further investigate their R&D investment, except for GAC’s heavy investment, with an R&D to revenue ratio of 8.1%, and Geely’s ratio of 5.25%, other automakers’ R&D proportions are as low as two to three percent.

And among the Chinese automakers not on the list, Great Wall Motors and BYD Auto both have lower revenues compared to the aforementioned automakers. But regarding competitiveness, how many of the Chinese automakers among the Fortune Global 500 can be compared with Great Wall and BYD? Who has a brighter future?

So, what about the R&D investment of these two companies? In 2020, BYD Auto and Great Wall Motors invested 8.556 billion and 5.15 billion yuan respectively, ranking second and third respectively in the ranking of listed Chinese automakers. R&D to revenue ratios are both around 5%.Their future is much brighter than that of the top 500 automakers. As of the closing price on August 3rd, the stock market valuations of Great Wall Motors and BYD are 544.07 billion yuan and 801.34 billion yuan respectively, which are respectively 2.5 and 3.6 times the market value of SAIC Motor, the champion of the top 500 Chinese automakers.

The stock market is a barometer for future expectations. In the eyes of the capital markets, who has a future? No need to say more.

As mentioned earlier, the top 500 are just the largest. The current task for the Chinese auto industry is to move from “big” to “strong”. Only “strong” has a future, not just “big”.

Therefore, there is not much for Chinese automakers on the list to celebrate. It’s better to think about whether they will still be on the top 500 list in five or ten years.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.